Upstox Originals

How have budgets redefined key sectors?

8 min read | Updated on January 23, 2026, 18:11 IST

SUMMARY

The Union Budget increased capital investment from ₹3.4 trillion in FY20 to ₹11.1 trillion in FY25, bringing India closer to a capital expenditure-led economy. This has encouraged structural growth in critical areas like infrastructure, defense, and EMS (Electronic Manufacturing Sector). By focusing on long-term asset creation, will the FY26 budget further continue this trend?

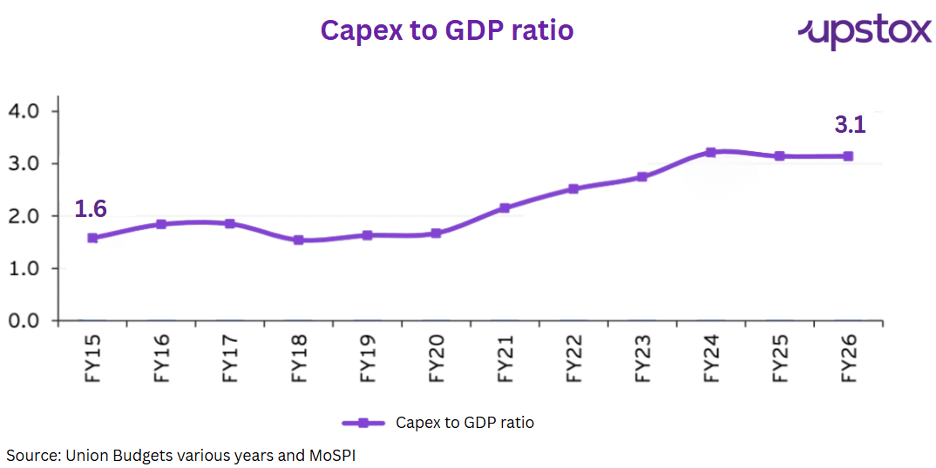

Capex to GDP ratio has increased from 1.6x in FY15 to 3.1x in FY25

The main growth engine of any economy is capital expenditure (Capex). The last few years have seen India also follow this template to bolster the economy. The emphasis on long-term projects like highways, high-speed rail, and digital grids is evident in the increase in capex from ₹3.4 trillion in FY20 to a staggering ₹11.1 trillion in FY25. The chart below shows the rise in the capex to GDP ratio over time from 1.6 to 3.1x

Why does this matter?

Think "Multiplier Effect." For every rupee invested in infrastructure, economic development amounts to approximately ₹2.5 to ₹3. It starts a domino effect that creates jobs right away, increasing demand for resources.

Sectors that were highly impacted by the budget spending and are redefining India's global standing:

- Infrastructure

- Defence

- EMS (Electronics)

1. India’s infrastructure focus

In recent years, the budget has shifted its focus from short-term spending toward a more asset-heavy, Capex-driven model. This change moved the priority from immediate operational expenses to long-term physical and digital infrastructure.

Why was this Budget the turning point?

The government identified Infrastructure as the primary driver for a $5 trillion economy. Instead of focusing on short-term subsidies, it prioritised long-term asset creation.

-

The 35% capex jump: The budget hiked planned capital spending from ₹5.5 trillion to ₹7.5 trillion with a focus on infrastructure. However, while the government has set the stage, the private sector has been slower to join in than many anticipated.

-

PM Gati Shakti master plan: This became the "key highlight," integrating seven engines of growth: Roads, Railways, Airports, Ports, Mass Transport, Waterways, and Logistics. Below is a list of select actions taken by the government and their impact on driving growth.

| Announcement | Details | Sector impact |

|---|---|---|

| National Logistics Policy (Sept 2022) | Launched to reduce logistics costs from 14% to 8% of GDP. | Boost for Logistics & Warehousing companies. |

| 5G Rollout (Oct 2022) | Rapid deployment of 5G across 779+ districts by late 2024. | India moved from 118th to the top 20 in global mobile speeds; triggered over ₹1.5 trillion in cumulative telecom infrastructure investment. |

| Vande Bharat expansion | Induction of 17 new pairs of trains and production of 900+ coaches by 2024. | Helped push the total railway capex to ₹2.40 trillion, creating a record ₹1.2 trillion order book for domestic wagon and engineering giants. |

| National highway pace | The network expanded by 25,000 km in a single year (FY23). | Doubled construction speed from the 2014 baseline; ensured a steady ₹2.7 trillion annual order pipeline for EPC and construction players. |

Source: Beat the street research, Indian Survey Data

2.The defence push

India’s defence sector has undergone a profound transformation, evolving from one of the world's largest importers into a manufacturing hub with rising global export footprints.

The capex multiplier

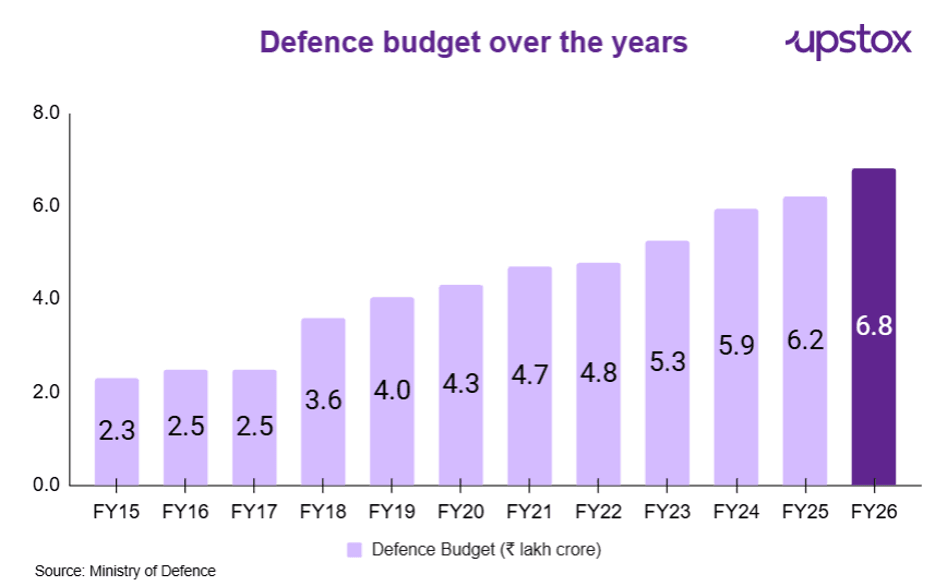

In order to fulfill the demands of modern combat, the financial commitment to the defense sector has increased dramatically. From ₹2.5 trillion in FY14 to ₹6.81 trillion in FY26, the whole defense budget has almost tripled.

In the FY26 budget, a record 75% of the modernisation outlay is specifically earmarked for domestic procurement, ensuring that the majority of taxpayer money stays within the Indian ecosystem. DRDO’s latest allocation of ₹26,816.82 crore is focused on high-tech domains like AI and hypersonics, bridging the gap with global superpowers.

Policy evolution & impact timeline

The following table highlights how specific policy interventions served as critical catalysts for the sector’s exponential growth trajectory. While these may not necessarily have been announced in the budget, they have played a critical role in supporting the initiatives.

| Year | Details | Strategic Impact & Results |

|---|---|---|

| 2014 | "Make in India" initiative | Foundational shift; production surged by 174% since inception. |

| 2018 | iDEX launch | Over 430 contracts signed with startups/MSMEs for niche tech. |

| 2020 | Positive indigenisation lists | Import embargo on 5,500+ items; 3,000+ items already indigenised. |

| 2020 | FDI liberalisation (74%) | Cumulative FDI in defence reached ₹5,516 crore. |

| 2025 | Procurement manual 2025 | Replaced imports with domestic manufacturing for 65% of all equipment. |

| 2025 | Multi-domain operations (MDO) | Integrated land, sea, air, and cyber domains for "Viksit Bharat@2047". |

Source: News articles, government documents

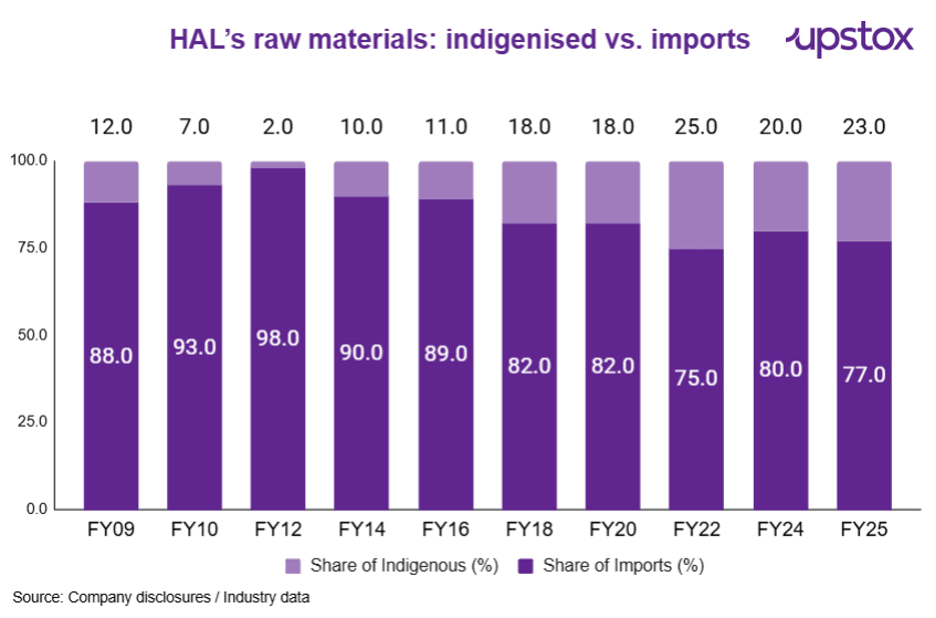

Indigenisation: The HAL story

The shift toward Aatmanirbharta (Self-Reliance) is best exemplified by the transformation of Defence Public Sector Undertakings (DPSUs).

With its successful transition from license-based assembly to domestic platforms like the LCA Tejas and Prachand Light Combat Helicopter, Hindustan Aeronautics Limited (HAL) has emerged as a key player in Indian aerospace, contributing to a record ₹1.27 trillion total domestic production value in FY24. Currently, it is witnessing a shift with the share of indigenous increasing from 2% in FY12 to 23% in FY25.

While the company has definitely witnessed some major bumps, it is has made meaningful strides in localsing its production.

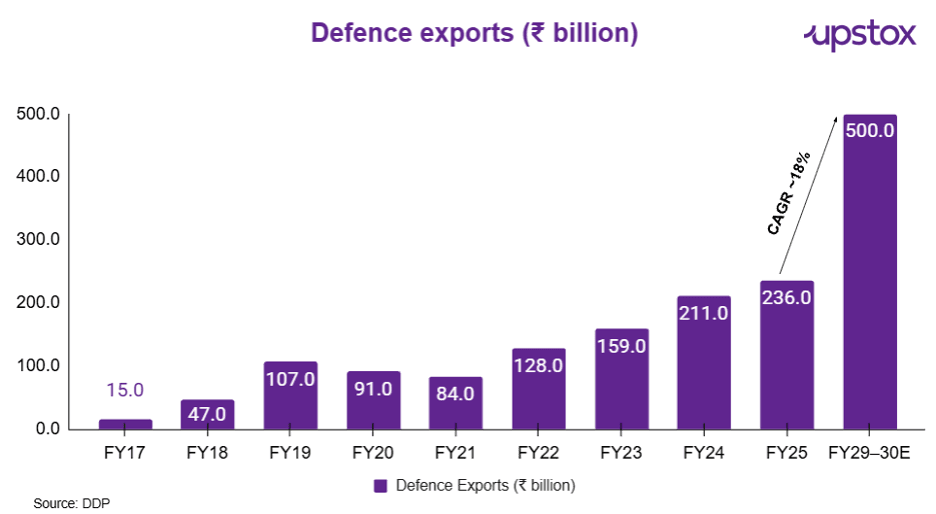

The export surge: India as a global provider

Perhaps the most significant "AI-like" leap in the sector is the 23x growth in exports over the last decade. Exports surged from a mere ₹15 billion in FY15 to a record ₹236 Billion in FY25, which are further expected to double by FY30.

3. The EMS sector: Powering India’s high-tech future

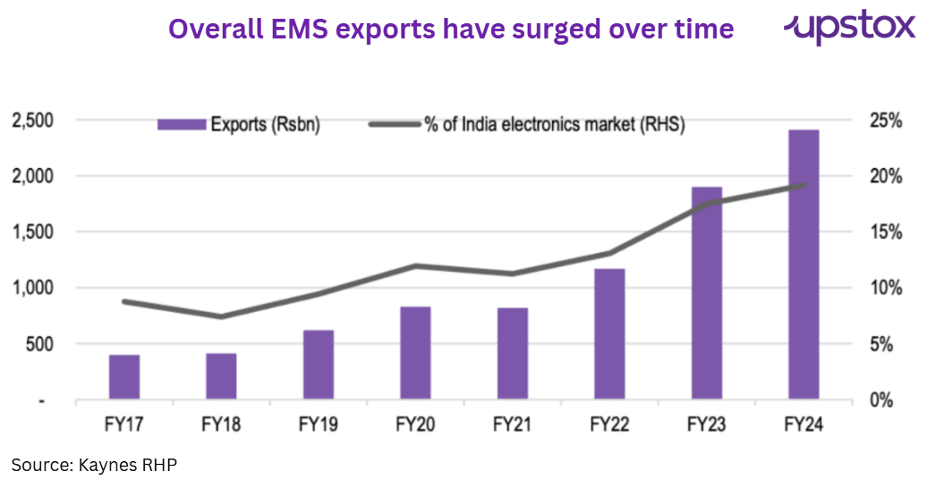

The Electronics Manufacturing Services (EMS) sector has transitioned from simple assembly to complex, high-value manufacturing, becoming a central pillar of India's "Viksit Bharat" and "Atmanirbhar Bharat" goals. This shift is driven by a massive surge in Capex and a strategic series of Production Linked Incentive (PLI) schemes.

The capex surge: Scaling production capacity

Total investment in electronics (including EMS) crossed ₹1.6 trillion by late 2024. For FY26, the budgetary allocation for Electronics and IT Hardware was hiked to ₹9,000 crore, a sharp rise from ₹5,777 crore in the previous year.

Policy evolution: The PLI catalyst timeline

The government has implemented PLI schemes in targeted phases to build a "level playing field" and attract global value chains.

| Year | Strategic Announcement | Impact on EMS Sector |

|---|---|---|

| 2020 | PLI for large-scale electronics | 6x production surge: Electronics production jumped from $21.8 billion (FY15) to $129.9 billion (FY25) |

| 2021 | PLI for IT hardware | While the 2021 IT hardware scheme specifically had a slow start, where OEM’s were finding the Incentives not enough. |

| 2023 | PLI 2.0 for IT hardware | Doubled the capex from PLI for hardware. Both schemes together contributed to the broader success of electronics manufacturing in India, which saw a 146% surge in production, rising from ₹2.13 trillion in FY21 to ₹5.45 trillion in FY25, and making India a major exporter. |

| 2024-25 | ECMS (component scheme) | Approved 22 proposals with a projected investment of ₹ 41,863 crore, projected production of ₹ 2,58,152 crore. These approvals are expected to generate 33,791 direct employment opportunities. |

| 2025 | Passive components PLI | Targeting a massive production value of ₹4.6 trillion and creating over 91,000 direct jobs. |

Source: News articles, government documents

Structural margin evolution

-

Thin margins, high scale: Traditionally, EMS is a low-margin business (2-4%). However, PLI incentives have helped improve margins by 0.6% to 1.2%.

-

Backward integration: Companies like Dixon are guiding for a 100-120 bps margin expansion by FY27 by moving into higher-value components like display and camera modules.

-

Value addition: Indigenous value addition in mobile phones has improved from practically zero to 18-20%, with targets of reaching 35-40% through the new component-focused PLI schemes.

Companies like Dixon Technologies and Foxconn are utilising these to scale mobile production from 5.8 crore units in 2014 to over 33 crore units in 2024.

Final word: The road to 2047

It is evident that India's economic narrative has progressed from temporary solutions to a significant structural change as we look to 2026. A key monitorable for investors will be the sectors in focus this time around. AI, data centers, and rural tech are in the news. Besides that, the government is expected to improve efficiency and reduce hurdles from some traditional sectors as well.

That said, while a sectoral push is always welcome, investors should be aware the impact is not always immediate. Besides that, independent research of your potential investment is crucial for a successful investment.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story