Upstox Originals

How green hydrogen is powering India's low-carbon leap

.png)

6 min read | Updated on July 04, 2025, 16:03 IST

SUMMARY

What if we could power industries and transport without adding to carbon emissions? Green hydrogen offers a cleaner alternative that’s beginning to find global interest. While the technology is still evolving, it holds potential for long-term impact. India is laying early groundwork too. With a ₹19,744 crore Green Hydrogen Mission, it’s taking steady steps toward a cleaner energy future.

Stock list

With a ₹19,744 crore Green Hydrogen Mission, India is taking steady steps toward a cleaner energy future.

The world is facing a climate crisis that demands immediate action. Fossil fuels, the primary source of carbon emissions, must be phased out across industries that are essential to our economies, including steel, cement, refining, and transportation.

Enter green hydrogen, a clean, sustainable fuel that can replace fossil fuels in these hard-to-decarbonise sectors. For India, the third-largest emitter of CO2 globally, green hydrogen offers a dual opportunity: to drastically reduce emissions and decrease dependence on imported fossil fuels, thereby making the country more energy-secure.

Green vs. Grey hydrogen

Green hydrogen is hydrogen gas (H₂) produced by splitting water (H₂O) using electricity from renewable sources like solar or wind - a process called electrolysis. Since no carbon is emitted, it’s considered 100% clean. In contrast, normal hydrogen - called grey (from natural gas) or brown (from coal) - is made through steam methane reforming or coal gasification, both of which emit significant CO₂.

While grey hydrogen remains cheaper, costing around $1 to $2 per kg, green hydrogen is currently more expensive, at $4 to $8 per kg (2024 estimates).

Applications of green hydrogen

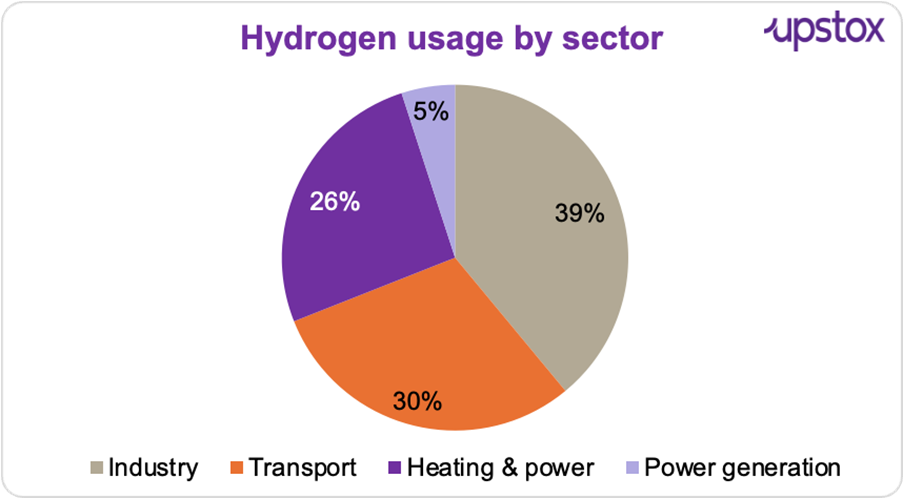

Green hydrogen has the potential to revolutionise several sectors. According to the European Hydrogen Roadmap, 39% of hydrogen is used in the industry sector, 30% in transport, 26% in heating and power for buildings and 5% in power generation. For industrialised countries, the EU breakdown is likely to be a good proxy to estimate the sector breakdowns.

Source: PwC

Key applications:

-

Energy storage: Helps store excess energy and can be used when weather conditions are less favorable. It generates electricity through fuel cells, with water as the only by-product.

-

Sustainable transport: Powers fuel cell electric vehicles, which are a growing alternative to conventional fuels. Companies like Hyundai plan to manufacture 500,000 hydrogen vehicles by 2030. Hydrogen-powered vehicles are already used in European waste collection.

-

Industrial uses: Primarily used in the chemical industry for ammonia production, in the petrochemical sector for petroleum products, and in steel manufacturing to reduce emissions.

-

Domestic use: Projects are underway to replace natural gas with green hydrogen in household energy networks, providing electricity and heat without producing pollutant emissions.

-

India’s strategic approach to green hydrogen

India’s National Green Hydrogen Mission, launched in 2023 with a budget of ₹19,744 crore, targets 5 MMT of green hydrogen annually by 2030. The aim: cut 50 MMT of CO₂ emissions per year and reduce fossil fuel imports.

As of mid-2024, 19 companies have been awarded 0.86 MMT/year of green hydrogen capacity and 3 GW/year of electrolyser manufacturing under the SIGHT scheme - the mission’s core incentive program.

Currently, India produces about 6 MMT/year of grey hydrogen, while actual green hydrogen output remains limited, with most projects still in pilot or early development stages.

The opportunity

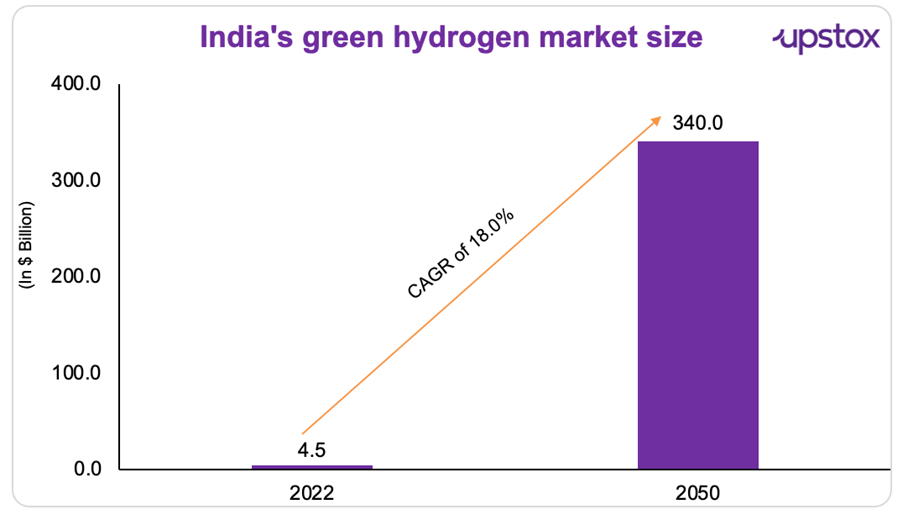

India’s green hydrogen market is on a steep growth curve - from $4.53 billion in 2022 to $8 billion by 2030, and a massive $340 billion by 2050. A big driver? The electrolyzer market, set to hit $5 billion by 2030, powering the tech that splits water into hydrogen and oxygen using electricity.

Backed by a $2.4 billion government push, including $2.1 billion for the SIGHT program, India aims to meet 46% of its hydrogen demand with green hydrogen by 2030.

Source: Market Research Future

Positioning in global markets

India is developing strategic partnerships to position itself as a green hydrogen exporter. Engagements with markets in Europe, Japan, and South Korea are progressing, with plans to develop green ammonia production facilities linked to these demand centers.

These efforts are supported by initiatives to establish green hydrogen hubs near industrial clusters and ports, enabling efficient production and export logistics. However, achieving scale will depend on continued policy support and infrastructure development.

Policy instruments supporting growth

India’s approach includes several policy measures designed to improve the competitiveness of green hydrogen:

-

Waiver of inter-state transmission charges for up to 25 years.

-

Priority access to the interstate transmission system for green hydrogen projects.

-

Permitting renewable energy banking for up to 30 days to balance supply.

-

Commitment to streamlined open access approvals within 15 days.

These provisions, combined with India’s competitive renewable energy tariffs, are expected to reduce the levelised cost of hydrogen production. Current estimates suggest a potential 40% reduction in the cost of green hydrogen over the next decade, improving its competitiveness relative to grey hydrogen, particularly for export markets.

Companies leading the charge

India’s industrial giants are at the forefront of green hydrogen adoption, driving both production and innovation. Here’s a look at the key players:

-

Reliance Industries: With a commitment to become one of the lowest-cost producers of green hydrogen globally, Reliance is investing heavily in electrolyzer technology and green hydrogen production. Their target is to bring the cost of green hydrogen down to $1/kg by 2030.

-

Adani New Industries (ANIL): ANIL is building a fully integrated green hydrogen ecosystem, encompassing solar and wind power generation, electrolyser manufacturing, and downstream products like green ammonia. The company plans to invest $50 billion over the next decade.

-

Larsen & Toubro: L&T is collaborating with HydrogenPro (Norway) and developing India’s first green hydrogen plant for its manufacturing operations. It focuses on scaling production for industries like refining and steel.

-

ACME Group: ACME is developing a 1.2 MTPA green ammonia project in Odisha and already exports small quantities of green ammonia. The company plans to scale up significantly with investments of over ₹50,000 crore.

-

Greenko: Greenko is building integrated green hydrogen hubs with renewable energy, electrolyser, and storage capacities. It is also exploring export opportunities for green ammonia.

Challenges

India’s green hydrogen push is gaining ground, but hurdles remain. Electrolyser capacity needs rapid scaling, while water shortages in renewable-rich areas threaten project viability. Patchy demand, unclear sectoral mandates, and gaps in safety and transport infrastructure are slowing momentum.

Incentives are in place, but global subsidy competition is tough, and financing remains tricky - credit risks and integration challenges still echo those of traditional thermal power.

Looking ahead

India’s Green Hydrogen Mission outlines a roadmap to decarbonize heavy industry and transport through clean energy alternatives. Its success depends on strong alignment between policy, investment, and market development.

Though the sector is still in early stages, momentum is growing. With steady implementation and stakeholder support, green hydrogen could play a major role in India’s energy mix in the coming decade.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story