Upstox Originals

Half the wait, double the trade: India’s maritime leap

7 min read | Updated on October 16, 2025, 17:50 IST

SUMMARY

Ships used to wait days at Indian ports. Now? Almost half the time. Costs down. Cargo faster. With 7,500 km of coastline, 14,500 km of waterways, and a $20 billion roadmap, India’s maritime sector is finally moving at speed. Policy, tech, and private investment are turning potential into progress you can actually see. Here’s a look at how India’s maritime story is finally setting sail.

For April 2024-25, India’s 12 major ports handled 853.56 million tonnes (MMT) of cargo.

Picture this: a massive cargo ship drifting off the coast, waiting… and waiting… and waiting. Ten years ago, it would have spent almost four full days just idling at an Indian port. Now? That same ship barely spends two days, and it’s already back on the move, goods cleared, costs down, and schedules back on track.

India’s maritime sector has always had the stage: 7,500 km of coastline, 14,500 km of navigable waterways, and a prime spot on global trade routes. Geography? Check. Potential? Massive. Execution? Well, that’s where things used to lag. Until now.

Thanks to policy nudges, tech-driven efficiency, and private sector investments, ports are no longer just docks, they’re evolving into speed machines for cargo and trade. And the effects are tangible: more jobs, better regional economies, and a stronger strategic footprint for India globally.

So, what’s the real progress in India’s maritime sector? Let’s dive in.

Major ports: Cargo on the rise

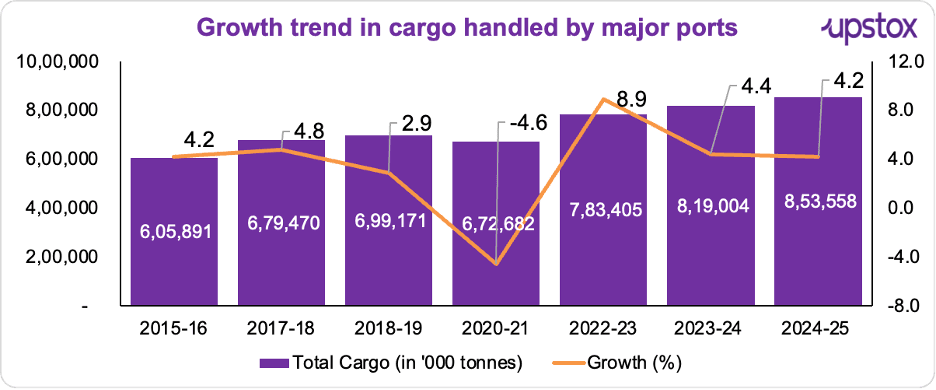

Let’s start with the basics. For April 2024-25, India’s 12 major ports handled 853.56 million tonnes (MMT) of cargo. That’s up from 819 MMT the year before. We’re talking both overseas and coastal cargo under the Ministry of Ports, Shipping, and Waterways.

If you look back over the last decade, it hasn’t been a straight climb. Growth was modest in 2015-16 (4.2%) and 2017-18 (4.8%), plunged in 2020-21 (-4.6%) thanks to global shocks, and bounced back sharply to 8.9% in 2022-23. The last couple of years? Steady growth of 4–4.5%, which is kind of like saying, “We’re not booming, but we’re not crashing either.”

Source: PIB

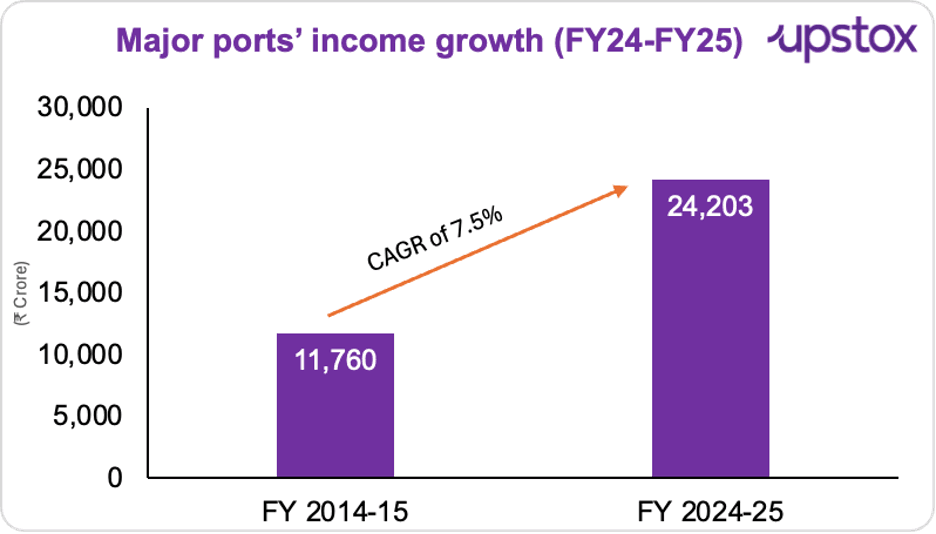

Income for ports has however, risen faster than that of growth in cargo, implying higher value growth.

Source: PIB

Efficiency revolution: Ships don’t sleep anymore

Cargo isn’t just about volume, it’s about speed. A decade ago, ships spent nearly 96 hours waiting at major ports. Today? That’s almost halved to 49.5 hours.

Other wins: output per Ship Berth Day jumped from 12,458 tonnes to 18,304 tonnes. Idle time fell from 23% to 16%, and pre-berthing detention went down from 5 hours to 3.8 hours. In simple terms: ships move faster, cargo clears quicker, costs shrink.

Faster ports also mean more cargo. Traffic at major ports grew from 545.83 million tonnes in 2012-13 to 817.98 million tonnes in 2023-24. Jawaharlal Nehru Port stands out here, clocking the fastest turnaround at 26.88 hours in April–November 2024-25.

How? They built an extended yard (centralised parking), sped up customs, streamlined berthing, added tugs, and optimised tractor trailer movements, cutting around 7.5 km of road distance per truck. The result? Faster cargo, lower fuel use, less pollution, and better cost efficiency.

Infrastructure push: Sagarmala in action

The next phase is ambitious. It’s not just about adding a port, it’s about building a whole maritime ecosystem. By FY28, India plans to add 500–550 MTPA of capacity, almost doubling what exists today. The plan is backed by 962 acres of land, private investments from APSEZ, JSW Infra, and DP World, and policy incentives worth ₹69,725 crore for maritime and shipbuilding.

Shipbuilding: Small now, big soon

India’s shipbuilding is growing at a strong pace. From $90 million in 2022 to $1.12 billion in 2024, projections see it hitting $8 billion by 2033, a 60% CAGR.

Tech startups

India is quietly building a maritime tech ecosystem. There are 122 startups now, EyeROV, Sagar Defence Engineering, ShipsKart, PierSight, MariApps. Out of these, 31 have already raised funding, and 5 have scaled to Series A+.

And they’re not just for show. EyeROV landed a ₹47 crore contract with the Indian Navy, while Sagar Defence Engineering teamed up with Boeing’s Liquid Robotics to build autonomous vessels. Slowly, the sector is moving from labs and pitches to the real sea.

That’s roughly 8 new players entering every year. Many are led by IIT and IIM alumni, which explains the expertise and credibility popping up in the sector.

What can India learn from the maritime big leagues?

As India seeks to become a “maritime power”, what can it learn from the big maritime players? Plenty. Major economies show how smart rules, gov support, tax perks, and green moves can turn ships into serious global muscle.

China, South Korea, Japan

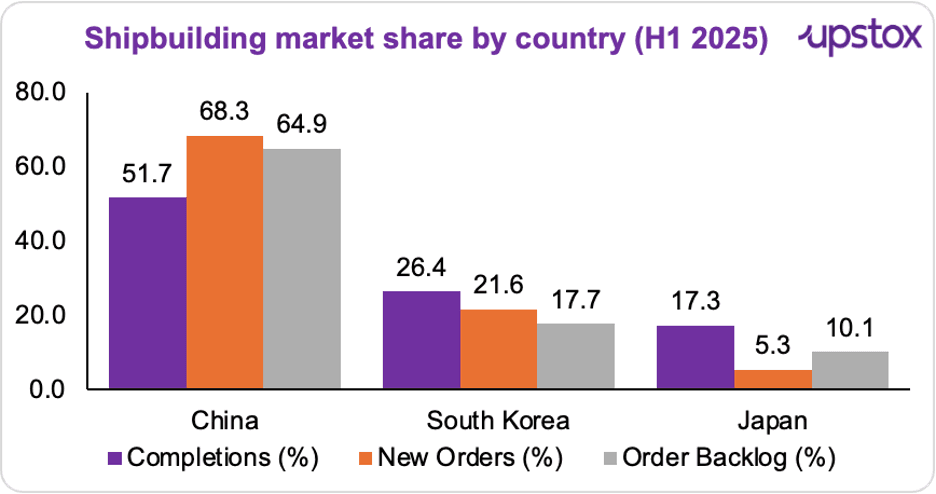

China, South Korea, and Japan dominate 94% of the global shipbuilding market. Leading the pack in global shipbuilding, China accounted for 51.7% of global completions, 68.3% of new orders, and 64.9% of the order backlog in H1 2025.

The country has heavily invested in transitioning from bulk carriers to LNG-fueled, methanol-based, and hybrid vessels, capturing 76% of alternative-fuel ship orders. And…China’s shipyards run like clockwork, rework rates are below 5%, compared with over 20% in Indian yards, thanks to automation, skilling programs, and process efficiency.

India ranks 16th worldwide, it may need to match China’s financial and technological muscle to scale its maritime ambitions.

Source: Research Gate

United States

The US maritime fleet runs on the Jones Act, all domestic trade ships have to be US-built, owned, flagged, and crewed. That’s 650,000 jobs and $150 billion in economic juice every year.

Yes, it costs $12,600 extra/day to run these ships, but the fleet stays battle-ready. Throw in strict green rules, and the US is also chasing IMO 2030 goals. For India, it’s a peek at what happens when you protect coastal trade, train your sailors, play with global ship ownership, and mix smart financing with solid rules, a recipe for a self-reliant maritime vibe.

Singapore

Singapore’s maritime magic? Smooth rules and strong government backing. Streamlined regulations make it easy to do business, while tax incentives sweeten the deal, shipping companies can get 10 years of tax exemption, or start with 5 years and upgrade if they meet the conditions.

Its ship registry is one of the largest in the world, and India could think about doing something similar: simpler registration, competitive fees, and strict safety + environmental standards. On top of that, Singapore is already racing toward zero-carbon shipping by 2050, with a dedicated R&D hub to build the tech for it.

Outlook

India’s ports are running faster, but the ships are still catching up. Dock speed alone won’t cut it. The government is backing the sector with ₹69,725 crore and a $20 billion roadmap for shipping, cleaner fuels, and digital upgrades. By 2030: 3 mega ports (>300 MTPA), >75% transshipment handled locally, >85% cargo via private operators, and ships turning around in under 20 hours.

Ports like Vizhinjam are already welcoming giants like MSC Verona. With digital ports, inland waterways, and smart tech, India can learn from global leaders to make its maritime trade faster, greener, and world-ready.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story