Upstox Originals

Fuelling the future: China's deep tech startup boom

.png)

7 min read | Updated on May 08, 2025, 11:30 IST

SUMMARY

China’s startup scene is growing, with over 32 million new business entities in 2024 alone. Backed by government policies and the drive to innovate, Chinese startups are making global waves from AI to EVs, while India, though growing fast, is still catching up.

China attracted around $40.2 billion in VC funding in 2024

In 2024, China saw 32.7 million new business entities, a 12.6% increase YoY, with over 10 million new enterprises and 22.6 million individual businesses. As per experts, entrepreneurs in regions like the Yangtze River Delta are constantly looking to adapt and tweak their business models to stay competitive so that they can build lasting success.

But how did a country that used to be known for its cheap knockoffs and low-cost manufacturing manage to transform into a global powerhouse of innovation and entrepreneurship? It's fuelled by bold government bets, a hungry domestic market, and startups that aren’t just playing catch-up—they’re aiming to lead.

So, how did this transformation happen?

China has made a push towards becoming a tech leader. From AI and robotics to semiconductors and fintech, the country is investing across the board.

What are the different startups

These sectors reflect where China is placing its bets and where many startups are making their biggest moves.

| Sector | Startups/Companies | Focus Areas |

|---|---|---|

| AI & Machine Learning | Baidu, SenseTime, High-Flyer | Healthcare, robotics, smart cities, AI module |

| Semiconductors | CXMT, Unisoc | Chips, manufacturing equipment |

| Green Energy | Jinko Solar, Goldwind | Solar, wind, fusion, energy storage |

| E-Commerce & Fintech | Shein, WeBank, Alibaba | Online retail, payments, blockchain |

| Gaming & New Media | miHoYo, ByteDance | Gaming, social media, content |

| Logistics & Supply Chain | Cainiao, JD Logistics | Warehousing, delivery, digital logistics |

| Electric Vehicles | NIO, XPeng, BYD | EVs, batteries, charging |

Source: China-briefing

China’s startup ecosystem spans everything from AI and electric vehicles to gaming, with a strong presence across these industries. Backed by government policies that actively support these sectors, Chinese startups are asserting their dominance and shaping the global landscape in these fields.

How did these startups grow?

The government pushed startups forward China attracted around $40.2 billion in VC funding in 2024, compared to India’s $13.7 billion a reflection of the country’s scale and perceived potential in emerging tech sectors. Some major initiatives that have helped are:-

-

In 2015, China launched “Demonstration Bases for Mass Entrepreneurship” startup zones offering low-cost workspaces, mentors, and investor access. By 2022, 212 hubs were running nationwide to nurture small ideas into big businesses.

-

The government sweetened the deal with major tax breaks: investors in early-stage tech could deduct up to 70% of their investment, and in 2024 alone, $361 billion in tax cuts, $80.7 billion of that for R&D which boosted high-tech growth.

-

China also built a vast network of public venture funds that work both directly and through “funds of funds,” ensuring capital keeps flowing. To help startups gain traction, the government even acts as an early buyer of deep tech products.

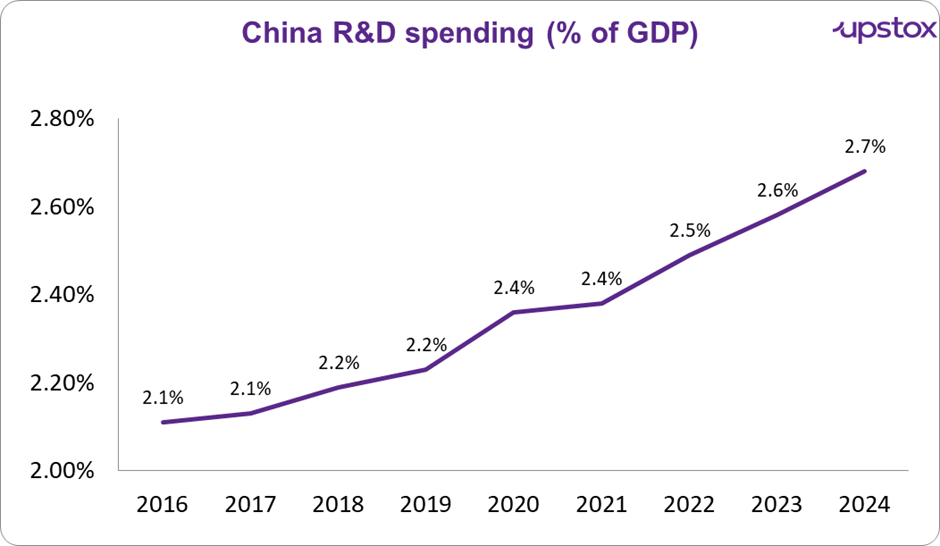

The government has played a key role when it comes to R&D research spending in China as can be seen they have been increasing their spending on R&D every year at a consistent rate of 2% every year showing their long term commitment when it comes to innovation.

Source: CGTN, Trading Economics

-

China’s government had pledged $1.4 trillion from 2015 to 2025 for tech development, a scale far beyond India’s more modest $150 billion. This includes artificial intelligence (AI), green energy, and advanced manufacturing.

-

Even during economic slowdowns, China’s R&D spending hit a whopping $496 billion in 2024 alone, which is more than 20x off India’s investment in the same year.

-

Along with R&D spending, China had also attracted around 40% of global VC funding in 2023, compared to India’s 5%, therefore showing the country’s scale and perceived potential in emerging tech sectors.

VC funding boost

China’s government actively supports entrepreneurship and innovation through policies that encourage venture capital investment and long-term funding. Beijing has set up four industry investment funds, each exceeding 10 billion yuan ($1.4 billion), focusing on AI, healthcare, robotics, and IT, while Shanghai offers startup loans of up to 5 million yuan ($712,408).

VC’s also get tax benefits where they can deduct 70% of their investment from their taxable income if held for at least two years, making early-stage investment more attractive.

Ease of doing business

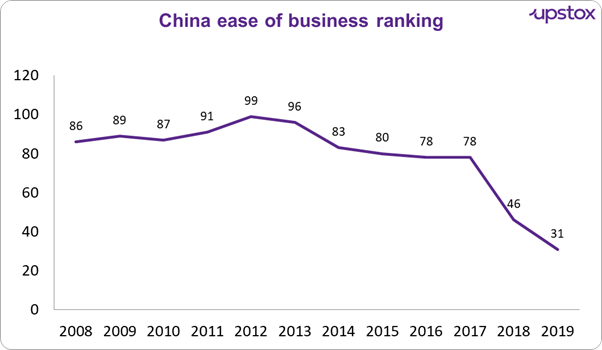

Years of policy reforms helped China improve its ease of doing business ranking, climbing from 86th in 2008 to 31st in 2019 as per World Bank data. On a more balance noted, China has been unable to improve it ranking since then.

Source: World Bank Annual Report

Comparing India and China: Same start, different paths

India and China both started with similar advantages both have huge populations, a growing internet access, and many young talents. But they both of took very different paths when it came to startups.

In India, startups focused on making everyday life easier. Craving something to eat? Zomato and Swiggy can deliver your favourite dishes in no time. Love snacking? Many new food brands are catching on and now offer snacks and desserts that are gluten-free, high in protein, or keto-friendly since health is becoming a trend. And if you love sports, fantasy apps let you build your own dream team and compete with friends for rewards.

While China may have started on similar lines, they have pivoted to focus on deep tech and making a mark globally instead of simply building consumer apps.

-

Companies like BYD aren’t just making EVs for China, they’re shipping them around the world along with helping China to cut carbon emissions and compete with global carmakers like Tesla.

-

China’s also working hard to be self-reliant in tech by building their own computer chips and developing powerful AI systems like DeepSeek, creating their own tech standards.

-

Robots, AI, and automation in factories are becoming a norm to help businesses save time and improve efficiency. Along with this, big companies like Alibaba and Shein are running massive global supply chains that ranges from making products to delivering quickly using smart tech.

-

Some startups are even working on space projects, clean energy, and building smart cities for the future, all in line with the country's long-term goals.

China’s global impact is visible: ByteDance (TikTok) has reshaped video consumption, DJI leads in commercial drones, and fintech firms like WeBank are innovating how people manage their finances.

India vs China startup snapshot 2024

| Metric | India | China |

|---|---|---|

| Startup count | 1,15,000+ | 2,50,000+ |

| Number of unicorns | 110 | 300 |

| VC funding | $13.7 Bn | $40.2 Bn |

| Well known unicorns | Ola Electric, Ather | BYD, DJI, SMIC |

Source: tice.news

What’s next?

Despite these hurdles, China’s startup ecosystem is still one of the most powerful in the world, keeping their impact strong. The country’s massive investments, tech talent, along with government support will likely keep it a major player. India is also evolving but in order to compete with China, it needs to move beyond quick apps to investing more in new technology, research, and global strategy and innovation.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story