Upstox Originals

From shelf to screen: The digital makeover of beauty

.png)

7 min read | Updated on August 26, 2025, 19:05 IST

SUMMARY

India's beauty market isn’t just growing — it’s rewiring how consumers discover, try, and buy. In H1 2025, beauty tech startups raised $102 million across 28 equity rounds, signalling investor confidence in this D2C-led surge. Nearly one in three urban shoppers now purchase directly from Instagram or influencer live streams, bypassing websites entirely. With AI shade-matching, AR try-ons, and sub-hour deliveries, beauty has shifted from a planned buy to a real-time, scroll-and-shop habit.

India’s beauty and personal care market is worth $33.1 billion in 2025

Once dominated by traditional brick-and-mortar retail, India’s beauty and personal care market is now at the forefront of a digital transformation. With 77% smartphone penetration, affordable high-speed internet, and a vibrant influencer-led beauty culture, e-commerce is capturing an ever-growing share of the beauty retail pie.

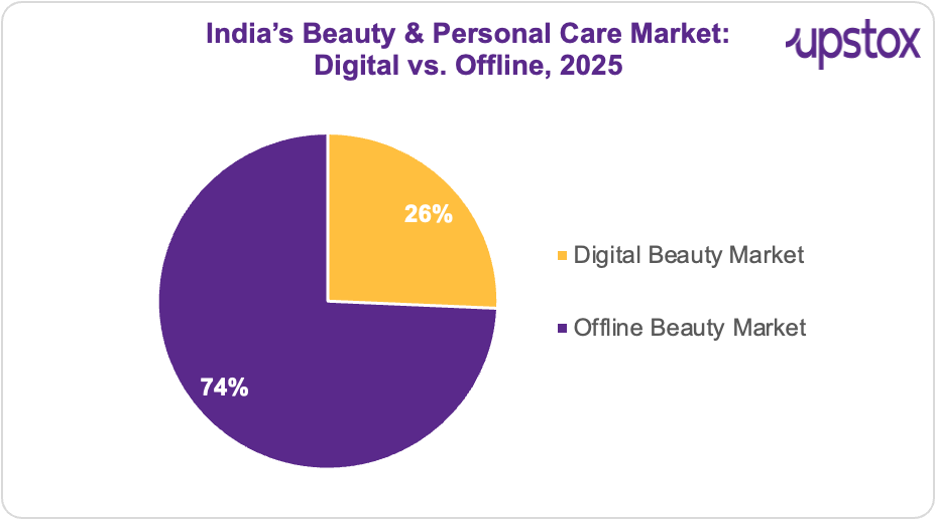

India’s beauty and personal care market is worth $33.1 billion in 2025, and about a quarter of that is already happening online. The full digital beauty ecosystem from e-commerce and quick commerce to D2C websites and social storefronts is pulling in $8–9 billion this year.

Source: Statista

This digital segment is expanding at 20%+ CAGR, projected to cross ₹12 billion by 2027, while offline retail grows in single digits.

Beyond e-commerce: The new frontiers of digital beauty

India’s beauty scene isn’t just going online, it is going fully digital. The real action now is in how people discover, try, and buy products, and it is moving faster than most shoppers or brands realise.

AR and AI are turning screens into mirrors

Think of it as a beauty counter in your pocket. Virtual try-ons now lift conversion rates by 2.5–3× compared to static photos. AI shade-match tools are being used millions of times every month, nudging up average order values by 15–20%. Even fragrance and skincare sampling is now tech-enabled, with AI-powered selection and at-home delivery cutting return rates by 20–25% in the past year.

Social commerce is making beauty a live event

Scrolling is the new window shopping and now it comes with a “buy” button. Livestreams and shoppable videos convert viewers at 8–10%, compared to just 1.5–2% on a regular product page. Limited-edition “social drops” can sell through 40–50% of stock in under 48 hours. During festive peaks, beauty consistently ranks among the top three categories in livestream commerce.

Speed is becoming the ultimate beauty perk

Beauty has shifted from “add to cart” to “need it now.” Quick-commerce delivery in under an hour is boosting repeat purchases by 30–35% and winning back 15–20% of lapsed customers. In top cities, more than 70% of online beauty orders now arrive within a day, setting a new bar for convenience.

Digital beauty is now immersive, personalised, and instant a behavioural shift as much as a channel shift.

E-commerce boom: How beauty went digital-first in India

Over 80% of beauty buyers now start their journey online, often from social media rather than search. The online beauty market’s double-digit growth is being driven by platforms that blend speed, exclusivity, and personalised discovery.

India’s Digital Beauty Leaders – 2025 Snapshot

| Platform | 2025 Growth & Highlights | Competitive Edge | Distinctive Moves |

|---|---|---|---|

| Nykaa | Beauty GMV ₹11,775 crore in FY25 (+30% YoY from ₹9,055 crore in FY24), ~25% share of India’s digital beauty market | Omnichannel leader, exclusive brand tie-ups | 70% of orders in top cities delivered in 1 day; AI/AR tools |

| Myntra | Beauty sales doubled; skincare +60% YoY; Valentine’s Day quick-commerce pilot saw perfume orders jump 6.5× in 24 hours | Fashion-beauty integration | Quick-commerce pilot delivering in under an hour |

| Purplle | ₹680 crore FY24 revenue (+43% YoY), trimmed losses significantly | Strong private-label portfolio | Expanding Tier II/III presence; boosting offline |

| Tata CLiQ Palette | 800+ premium brands | AI-driven product discovery | Omnichannel via stores + online |

| Mamaearth | ₹595 crore Q1 FY26 revenue; 7–8% from quick commerce | Natural, toxin-free positioning | Omni-channel mix with D2C + marketplaces |

| Amazon India | Expanding beauty catalogue | Competitive pricing, AI suggestions | 1–2 day delivery nationwide |

| Tira (Reliance) | Premium beauty focus | Reliance retail network leverage | Launching private-label lines |

| Sephora India | Expanding metro presence | Luxury international brand curation | Blending premium offline with online discovery |

Source: News articles, Company reports

What ties them all together? The trifecta of speed, personalisation, and discovery. Together, these platforms have turned beauty shopping into a fast-paced ritual that blends inspiration with instant gratification..

Big cosmetics business & billionaire backing

India’s beauty market is now a high-stakes battleground where billionaire-backed giants and legacy FMCG leaders are going head-to-head. Leveraging deep pockets, retail muscle, and aggressive innovation, these players are reshaping industry dynamics.

-

Reliance’s Tira is expanding into natural wellness, launching Puraveda, an Ayurvedic beauty range with 50+ products spanning skincare, haircare, and body care — tapping into a segment growing at 15.2% CAGR through 2032.

-

HUL strengthened its premium skincare portfolio by acquiring a 90.5% stake in Minimalist for ₹2,955 crore, bringing in a profitable D2C brand with ₹500+ crore annual sales and a strong digital-first growth model.

-

Tata CLiQ Palette is elevating experiential retail by pairing 800+ global beauty brands with AR try-ons and AI-powered Beauty ID recommendations, integrating offline luxury stores with online discovery.

-

Birla Cosmetics, launched in 2025 by Ananya Birla, targets young, social-media-driven consumers with high-glam makeup collections, leveraging the Birla Group’s retail network for rapid scale.

With billions in capital chasing a market growing at 20%+ CAGR, the next few years will decide not just who sells more but who owns the mindshare of India’s next 100 million beauty consumers.

Meet the shoppers: What’s driving the digital beauty wave

Scroll through any beauty hashtag on Instagram, and you’ll see who’s running the show - Millennials and Gen Z now account for over 60% of India’s online beauty purchases. They’re not just buying products; they’re buying experiences, values, and speed and they expect it all in one click.

- Millennials love the idea of affordable luxury that “premium feel” without the premium price.

- Gen Z is willing to pay more for sustainability, cruelty-free products, and transparent sourcing, over half research a brand’s ethics before buying.

- Tier II & III cities are the surprise growth engines contributing over 40%+ of new online beauty consumers , driven by better delivery networks, higher incomes, and influencer-led trends that once started in metros.

Marketing is being sliced and diced , one TikTok for Gen Z’s clean-beauty obsession and one Instagram Reel for Millennials hunting the perfect workday lipstick. It’s a beauty battlefield and the winners will be the brands that can speak everyone’s language, literally and figuratively.

Quick commerce: Instant beauty is here

If e-commerce made beauty shopping easier, quick commerce has made it almost instant. Today, the gap between “I want that lipstick” and “It’s at my door” can be as little as 10 minutes, faster than it takes to finish a coffee.

Q-commerce now makes up ~20% of India’s e-commerce and is growing nearly 50% annually. Beauty is 8–10% of Q-commerce GMV, growing 1.5× faster than the segment overall. Between FY22–FY25, Q-commerce revenue jumped at 142% CAGR to ₹64,000 crore; projected to triple to ₹2 lakh crore by FY28. Platforms like Blinkit, Zepto, and Dunzo have transformed beauty into an impulse-friendly category, delivering everything from sheet masks to premium fragrances in minutes.

This shift has reshaped e-beauty in three ways:

- Higher purchase frequency

- Faster discovery-to-purchase cycle

- Elevated customer expectations

In short, quick commerce isn’t replacing e-commerce, it's supercharging it, making speed, convenience, and immediacy the new cornerstones of India’s digital beauty boom.

From shelf to screen: The new face of India's beauty retail

The transformation of India’s beauty market is already in full swing. From Nykaa’s dominance to Tira’s wellness push, from influencer-fuelled Gen Z trends to 10-minute deliveries, the industry is moving faster than ever. Shopping for beauty is no longer a monthly errand, it’s a daily ritual, blending discovery, personalisation, and instant gratification.

Over the next five years, the real winners will be those who go beyond just speed and product range. The brands that will truly own India’s next 100 million beauty consumers will be the ones that marry personalisation, sustainability, and community engagement creating experiences so seamless and meaningful that clicking “buy now” feels as natural as picking up a lipstick in store.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story