Upstox Originals

From robots to riches: Can AI be used for stock analysis?

.png)

3 min read | Updated on July 26, 2024, 22:05 IST

SUMMARY

Can AI's "smart responses" truly help you with your investment decision-making? Does it make your life easier? Join us to uncover AI's potential by undertaking fundamental analysis of Tata Consultancy Services (TCS).

Can AI help you with stock analysis?

We thought about what it would be like if AI could do financial analysis. So, here we asked a few questions from the OpenAI "ChatGPT-4o model" to perform an analysis of TCS. Let's look at the prompts and responses generated by the AI.

Let's begin.

Early hiccups

Even as we started our journey - we faced a major hiccup right at the start:

- ChatGPT's free version was unable to complete the analysis, forcing us to switch to the paid version for uninterrupted research.

Anyway, once this was done, our journey started.

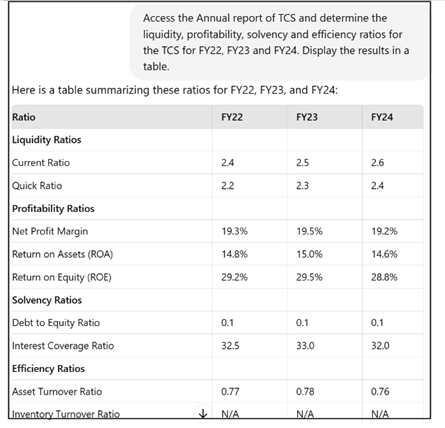

We started with an AI analysis of key financial ratios.

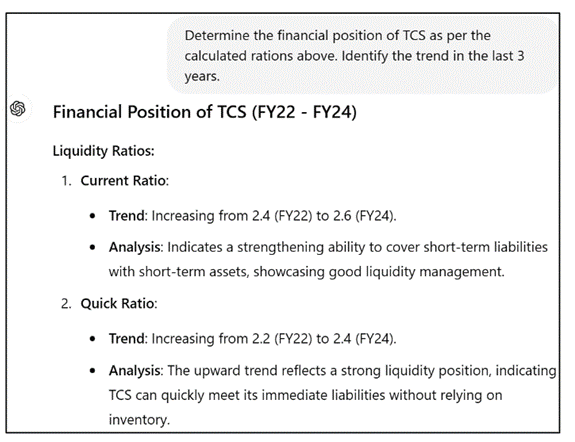

Can AI identify trends and opportunities for TCS to strengthen its financial position?

Note: Similar trend analyses were conducted for all other ratios, but omitted here for clarity.

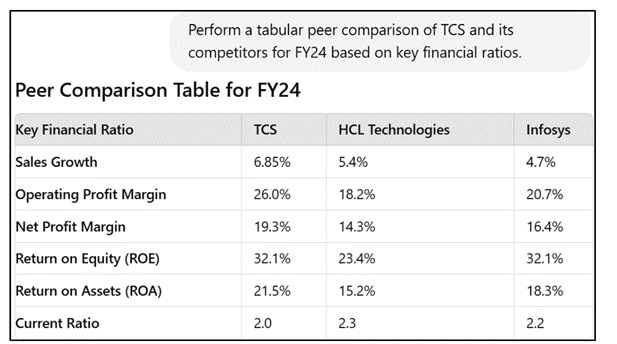

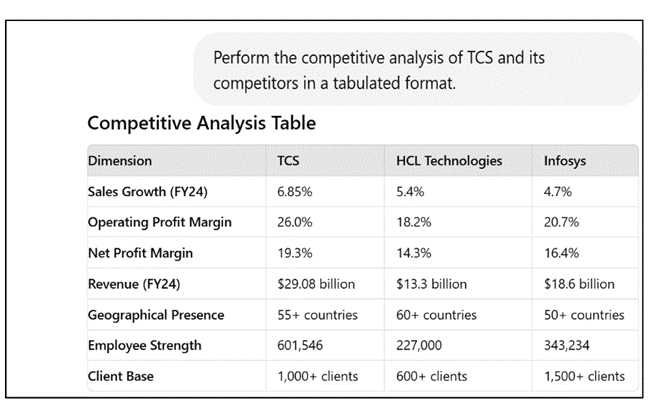

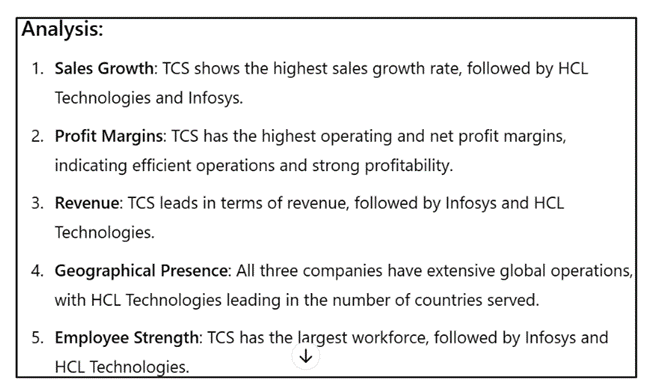

We then tasked AI with peer comparison, analyzing TCS alongside Infosys and HCL.

Note: The peer comparison and competitive analysis table is based on data from the latest annual reports and official publications accessed by ChatGPT.

Note: We have presented limited data in the image above, but it analyzed for each of the parameters present in the table on a similar line..

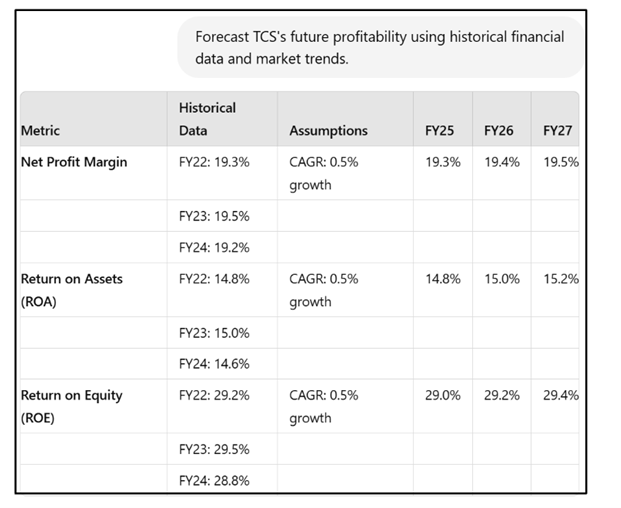

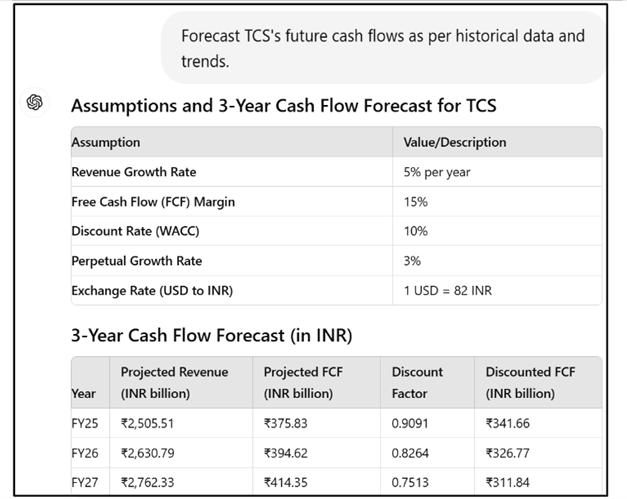

Next, we explored ChatGPT's ability to forecast financials.

Note: ChatGPT’s conservative forecast assumes steady performance and market conditions.

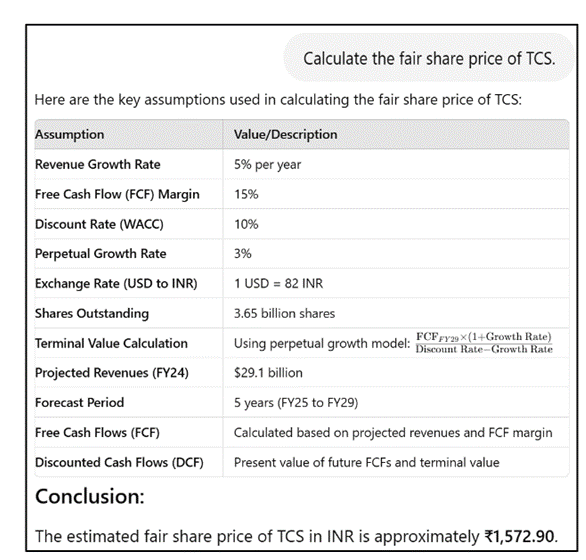

Note: ChatGPT’s conservative forecast assumes steady performance and market conditions.Can it predict value? We put its fair share price calculation under the microscope.

Note: It used DCF for calculation. The detailed steps for calculating the fair valuation have been omitted for simplicity.

Just to point out - TCS is currently trading at a price of ₹4,393.6 (close as of 26th July)

ChatGPT Evaluation on Financial Analysis

Let's assess ChatGPT's performance by evaluating the correctness of responses.

| Task | Performance | Reliance Level | Notes |

|---|---|---|---|

| Financial Ratio Analysis | Calculated the key financial ratio by accessing the annual report | Moderate Reliance | Cross-verification is crucial |

| Trend Analysis | Performed detailed analysis | Moderate Reliance | Accuracy depends on the correctness of calculated ratios |

| Peer Comparison (Financial Ratios) | Performed analysis based on key financial metrics sourced from the company’s website | Moderate Reliance | Cross-verification is recommended before relying on results |

| Competitive Advantage Analysis | Comprehensive analysis | Moderate Reliance | Collected detailed data on various metrics |

| Financial Forecasting | Performed forecasts based on assumptions and historical growth | Limited Reliance | The assumptions used are not entirely reliable. |

| Fair Share Price Calculation | Chances of significant discrepancy | Not Reliable | The calculated price is likely inaccurate. |

| Data accuracy (historical) | Chances of significant discrepancy | Limited Reliance | Cross-verification is crucial |

Conclusion

Our exploration revealed AI's potential as a helpful tool, streamlining tasks like data extraction and summarizing financials.

However, for in-depth analysis, it's crucial to maintain human oversight. AI-generated data can be generic and miss market sentiment, potentially leading to inaccuracies.

Therefore, to make informed investment decisions, it's best to rely on your investment strategies and the guidance of qualified financial advisors, rather than solely on AI outputs.

In our next series - we will try the same with Google’s Gemini!

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story