Upstox Originals

From packed theatres to quiet screens - what’s happening to Bollywood?

6 min read | Updated on October 20, 2025, 14:35 IST

SUMMARY

Bollywood movie tickets used to feel like a treat. Today, catching a film in a multiplex can make you wince, not just at the price, but at what’s playing. The buzz is missing. Box office collections are sliding, footfalls are down, and Hindi cinema is clinging to a few big blockbusters to keep theatres ticking. Meanwhile, films from the South are quietly booming. Can Bollywood find a way to get it back?

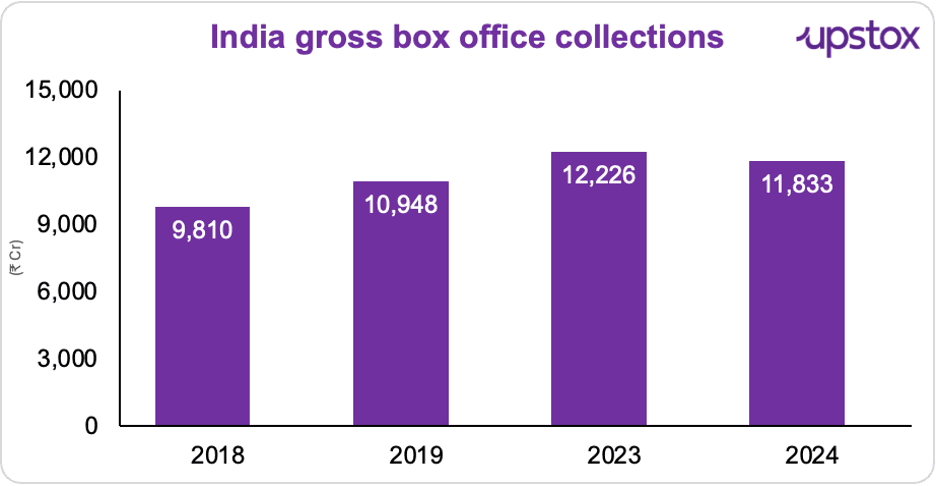

India’s gross box office collections dipped to ₹11,833 crore in 2024, down 3.3% from ₹12,226 crore in 2023

From chasing the thrill of Friday’s “first day, first show,” I’ve somehow graduated to waiting for Tuesday’s last-show discounts and “Buy 1, Get 1” deals to catch a Bollywood movie. And that’s… telling.

This, at a time when OTT is increasingly gaining traction among viewers and at least in Bollywood, viewers are complaining about the quality of the content. The numbers tell the story: India’s gross box office collections dipped to ₹11,833 crore in 2024, down 3.3% from ₹12,226 crore in 2023.

Source: ET

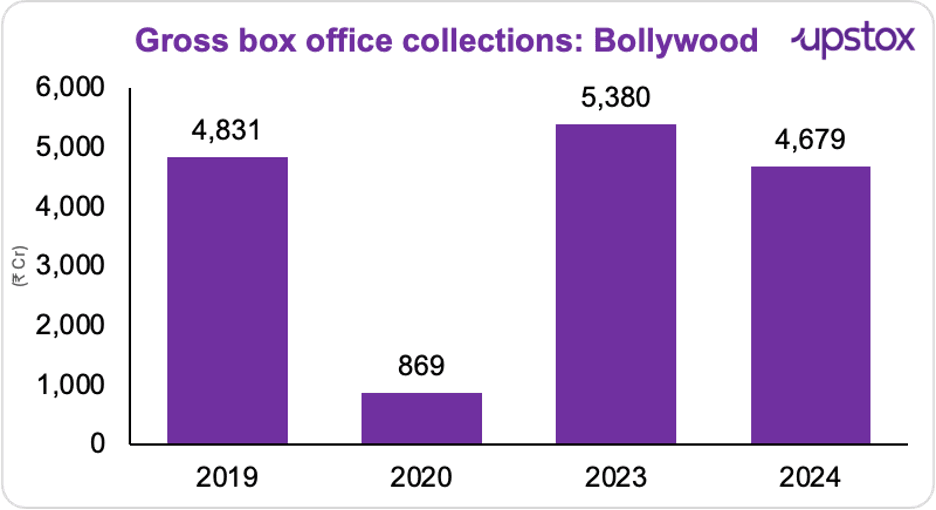

The main reason? Bollywood. Gross box office collections slipped from ₹5,380 crore to ₹4,679 crore. Even with blockbuster releases, theatres are struggling to fill seats.

Source: ET

The decline is sharper when we exclude dubbed South Indian films. Roughly 31% of Hindi collections in 2024 came from dubbed versions of South Indian films like Pushpa 2: The Rule or RRR. Strip out these titles, and original Hindi films are down a staggering 37% in collections.

Regional cinema, meanwhile, is thriving. Malayalam films recorded more than 100% growth in 2024, while Gujarati cinema grew by 66%. Telugu cinema also posted a modest increase, rising from ₹2,265 crores in 2023 to ₹2,348 crores in 2024.

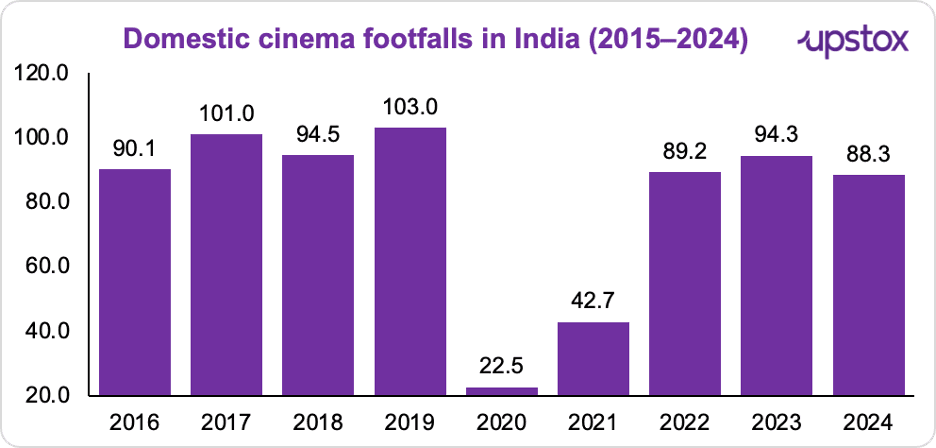

Footfalls, a key measure of cinema attendance, tell the same story. In 2024, footfalls dropped to 88.3 crore from 94.3 crore the previous year.

Source: ET

Why is this happening?

The OTT effect

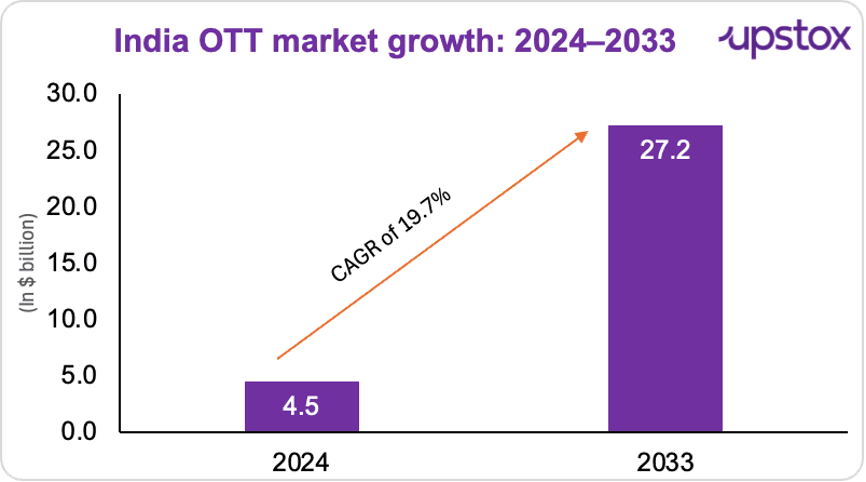

Bollywood is shortening the wait. Many Hindi films now hit OTT in 4 weeks, while big-budget releases stretch to 8 weeks if box office numbers hold up. At just ₹199 a month, streaming is cheaper and comfier than the theatre, and Hindi cinema is following viewers home. A quick glance at the booming OTT market:

####### Source: Research Gate

####### Source: Research GateThe reliance on tentpole films

Hindi cinema is increasingly dependent on tentpole releases. Pushpa 2: The Rule (Hindi) and Stree 2 together contributed ₹1,587 crores, 34% of Hindi cinema’s total collections. Only six original Hindi films crossed the ₹100 crore mark in 2024, compared to 16 in 2023.

This concentration on big-budget films has a side effect: smaller, content-driven movies struggle to get screens or attention. The Hindi audience is slowly migrating to OTT platforms or pirated content, leaving the multiplexes filled only by blockbuster spectacles.

Ticket prices vs audience

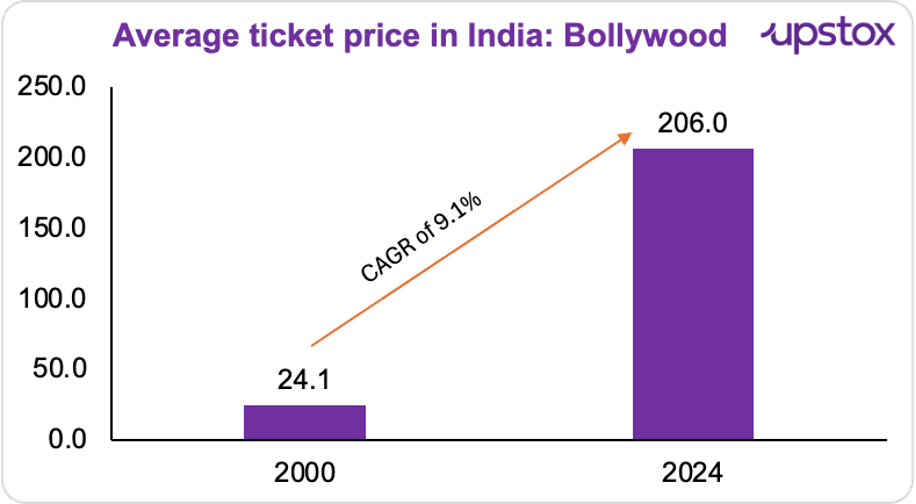

Watching a Bollywood blockbuster in theatres is getting pricey. Add food and drinks for a family of four, and the outing can easily cross ₹3,500–4,500. For many viewers, it’s less about whether the film is worth it and more about whether the outing is. And.. Average ticket prices for Hindi films have jumped from ₹24.1 to ₹206 in India.

Source: News articles

While the average Bollywood ticket costs ₹206, South Indian cinemas keep prices lower, without compromising on spectacle.

Take Chennai, for instance. Tickets for Rajnikant’s latest movie, Coolie, were officially priced between ₹57 and ₹190. Why? Movie ticket prices in Tamil Nadu are always capped, the maximum usually hovers around ₹200. Movies are a big deal in Tamil culture, so successive governments have kept them affordable. Muthukrishnan on X notes: a ticket in Mumbai might burn a hole in your pocket, but the same movie in the same chain in Chennai starts at just ₹55-₹60.

Then there’s Karnataka making steps too. The state is capping movie tickets at ₹200, following the trends of Tamilnadu.

Big screens are losing their charm

Hindi cinema is stuck in multiplexes, with one big screen chopped into 3–4. Md Hulia sums it up: “How many 70-mm screens are left? Re-releases like Tumbhaad and Laila Majnu are working in the South because prices are low.” And did you know? Half of India’s theatres are down South; the rest of the country is thinly covered. No wonder Hindi films struggle to turn profits.

Now, what needs to change?

To bring audiences back to Bollywood, the industry must fix what’s broken - access, affordability, and timing.

More screens, beyond big cities. SRK points to China: massive theatre expansion there has driven an exponential rise in viewership. “If we want to showcase Indian films in every language to a larger audience, we need to think beyond big cities,” he says.

Aamir Khan echoed the same concern at the WAVES Summit, noting that only about 2% of India’s population, roughly 3 crore people, watch even the biggest hits in theatres.

The solution? Simpler, cheaper theatres in smaller towns and cities. Right now, India has roughly 10,000 screens. Compare that to 40,000 in the US and 80,000 in China. More screens + thoughtful pricing + content that connects = lively bollywood again.

Keeping ticket prices accessible. Many families can’t afford multiplex tickets today. Subhash Ghai notes that as theaters have grown more luxurious, they’ve also grown less inclusive, pricing out the everyday moviegoer. Take Mukta Art Cinemas, a chain owned by the filmmaker. It aims to change that with budget-friendly pricing so families can enjoy both their popcorn and the picture.

Reevaluating OTT timing. Aamir Khan tested a new release model with Sitaare Zameen Par, which hit theatres on June 20, 2025. He reportedly turned down a ₹150 crore OTT deal, a massive sum, to protect the long-term health of theatres. His rule is simple: keep at least six months between a film’s theatrical and streaming release.

The reason? Word-of-mouth takes time, and if a movie lands online too soon, it kills the motivation to buy a ticket. As Aamir puts it, “If you haven’t watched it in six months, chances are you won’t watch it in theatres at all.”

Summary

Bollywood’s challenge isn’t just making big films, it’s making them matter. Affordable pricing, relatable stories, and wider access could bring audiences back. Regional cinema and OTT are showing what works: convenience, value, and connection. Theatres still have magic, but only if Bollywood remembers who it’s really entertaining. The question now: will it adapt before audiences move on for good?

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story