Upstox Originals

From NSE to NYSE: One portfolio, two time zones

.png)

5 min read | Updated on August 05, 2025, 18:41 IST

SUMMARY

As Indian investors evolve, so should their portfolios. This article explores why the US market is a strategic starting point for global investing, thanks to dollar-based returns, worldwide exposure, and long-term diversification benefits that extend beyond borders.

INR depreciates ~3-4% versus the dollar annually

Think of your investment portfolio like your Spotify playlist.

If it’s filled with only one genre, say Bollywood, it gets repetitive, right? Sure, it’s comfortable, but you miss out on other beats: lo-fi, jazz, maybe even a bit of K-pop.

Just like your playlist needs variety, your investments thrive on it too. A portfolio that’s 100% Indian stocks might be familiar, but it’s also limiting. Global markets, especially the US, offer entirely new rhythms for your wealth to grow to.

US companies, global reach

When you're investing in US markets, you're not only investing in America. You're investing in businesses that are in charge of the world's economy.

Think:

-

Apple, which derives about 57% of its revenues outside the US.

-

Microsoft, which powers offices from Bengaluru to Berlin.

-

Nvidia, at the forefront of the global AI revolution.

These businesses function far beyond US shores, exposing you to world trends in one marketplace.

Some might wonder, can’t Indian exporters give me similar exposure to global growth? In part, yes. But India's foreign market exposure is relatively limited compared to that of their American counterparts. Besides, with America, you get multiple sectors and a much wider geographical exposure.

Rupee vs Dollar: A long-term hedge

But here’s what’s been happening behind the scenes. While markets go up and down, the rupee has quietly been losing ground to the dollar, year after year.

| Year | Avg USD/INR | Annual depreciation (%) |

|---|---|---|

| 2010 | 46 | - |

| 2011 | 47 | 3% |

| 2012 | 53 | 14% |

| 2013 | 59 | 10% |

| 2014 | 61 | 4% |

| 2015 | 64 | 5% |

| 2016 | 67 | 5% |

| 2017 | 65 | -3% |

| 2018 | 68 | 5% |

| 2019 | 70 | 3% |

| 2020 | 74 | 5% |

| 2021 | 74 | 0% |

| 2022 | 79 | 7% |

| 2023 | 83 | 5% |

| 2024 | 84 | 1% |

| 2025 | 86 | 3% |

Source: Investing.com, Internal research

Over the 15 years if you see the Indian rupee has shown a consistent tendency to weaken against the US dollar, depreciating by an average of 3-4% annually.

This long-term depreciation might not seem dramatic year to year, but over time, it quietly chips away at your global purchasing power.

That’s why, by investing in dollar-denominated assets:

-

Your portfolio becomes more valuable as the rupee depreciates.

-

It acts as a natural hedge if you plan to study, travel, or even retire abroad.

-

Your global purchasing power stays stronger.

Why the US is your ideal first global step

Here’s why starting with the US makes global investing feel less intimidating and more intuitive:

-

Trust and transparency: The US has some of the world's best financial regulations and corporate disclosures. You're not flying blind; earnings, filings, and governance standards are sound.

-

Liquidity: It's the most liquid, deepest market in the world. Whether you're buying a piece of Apple or a piece of Google, it's easy to get in and out of positions.

-

Brand recognition: You already use products created by Apple, Google, Netflix, and Microsoft. Why not own them?

In short, the US market has a combination of familiarity and international diversification without being foreign.

Beyond borders: what diversification does for you

It’s not just about checking the ‘diversification’ box—it’s about giving your portfolio real-world advantages, which are:

-

Multiple engines of growth: You're not just counting on India's economic cycle anymore. If your domestic markets are slow, your US investments may still improve.

-

Currency cushion: Dollar-denominated assets are worth more in INR terms if the rupee falls. That's an actual hedge if your future plans involve education, travel, or retirement overseas.

-

Smoother returns: When Indian and US markets diverge, it balances your portfolio. Less volatility, more consistency.

-

More long-term wealth: Diversified portfolios build wealth more quickly in the long term by avoiding concentrated risk.

You’re not turning your back on India, you’re simply making your portfolio future-ready.

Getting started: S&P 500 and Nasdaq

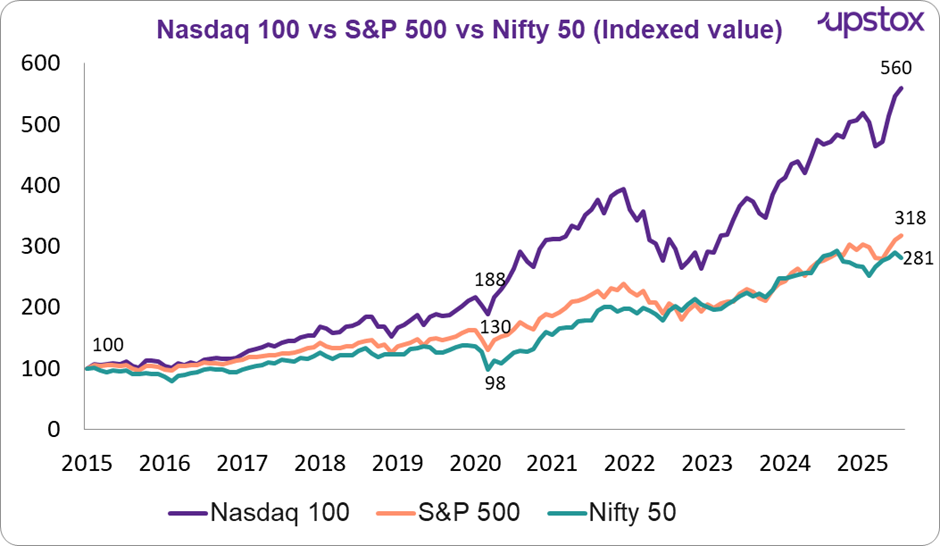

One of the simplest ways to start investing in US markets is through the S&P 500 and the Nasdaq-100 indices. The S&P 500 follows 500 of the biggest US-listed firms across industries like Apple, Coca-Cola, and JPMorgan, and the Nasdaq-100 is weighted more heavily in technology, with Microsoft, Nvidia, and Amazon.

Source: Investing.com

Over the past decade, the Nasdaq-100 has surged nearly sixfold, while the S&P 500 and Nifty 50 have roughly tripled in value. That translates to a CAGR of 19% for the S&P 500, 12% for the Nasdaq-100, and 11% for India’s Nifty 50.

Outlook

So, why are we even talking about US stocks and global investing?

Because the investing world is changing, and so are Indian investors. The old idea of keeping everything local worked when the world was less connected. But today, your career, your lifestyle, even your shopping habits are global. Shouldn’t your portfolio be too?

As markets around the world move at different speeds, having exposure to just one economy feels a bit narrow. This isn’t about abandoning India, it’s about giving your money more room to grow.

Starting with the US is simple, accessible, and increasingly relevant. And if you’re planning to invest for the long haul, now’s the time to start thinking globally.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story