Upstox Originals

From apps to wallets: The rise of embedded finance in India

5 min read | Updated on September 11, 2025, 17:59 IST

SUMMARY

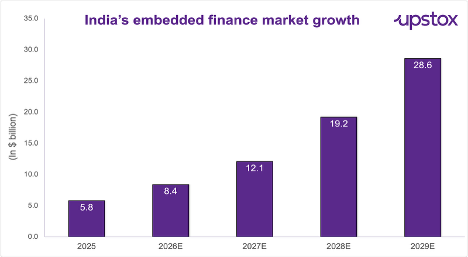

Imagine buying something online, booking a ride, or signing up for a course — and the credit, payments, or insurance you need just appear automatically, no separate apps, no long forms. This is embedded finance at work. By 2029, the market is expected to leap from $5.8 bn to $28.6 bn, growing at a 45% CAGR. Yet convenience has a flip side, fraud, mis-selling, and privacy risks are rising, making trust just as important as technology in driving adoption.

The embedded finance market is expected to leap from $5.8 bn to $28.6 bn by 2029, growing at a 45% CAGR.

Embedded finance puts financial services right where you need them. No hopping between apps or banks for a loan, payment, or insurance. Imagine adding something to your cart on a shopping app and instantly seeing a “Pay Later” option, or booking a ride and getting in-app insurance for the trip, all without leaving the app. It makes managing money effortless, turning everyday apps into your personal financial assistant.

Source: researchandmarkets

That’s not just numbers; it shows how payments, lending, insurance, and investments are integrating into everyday apps and platforms. The market itself reflects this momentum, projected to grow at a CAGR of 45%, highlighting the rapid adoption of embedded finance across India.

Making a difference: Where finance meets life

Imagine your favorite apps could handle more than just rides, shopping, or learning - they could manage your money too. That’s what embedded finance is doing in India. Credit, insurance, payments, and savings are now woven seamlessly into the platforms people use every day. Embedded finance goes beyond convenience, reaching everyday needs from credit to savings.

Financial inclusion (Rural and underbanked)

-

200 million underbanked Indians access credit, savings, and insurance through apps.

-

35% of UPI transactions in 2025 come from Tier 2–4 towns, showing rural penetration.

-

Micro-savings and small loans on Paytm, PhonePe, and BharatPe help households manage daily needs and emergencies.

Small Businesses & Merchants

-

30–35% of MSMEs use instant digital lending.

-

₹65,000+ crore loans disbursed in 2025 by Razorpay Capital and Paytm Business.

-

Real-time approvals give small firms faster access to working capital.

Agriculture

-

5 million+ farmers covered by embedded crop insurance.

-

₹15,000+ crore agri-loans disbursed in 2025 for seeds, fertilizers, and irrigation.

-

Loan approvals cut from weeks to under 48 hours.

Gig Economy

-

14 million gig workers could benefit from in-app loans and insurance.

-

₹9,000 crore lending reached gig workers in 2025.

-

Insurance penetration doubled to ~30%.

Banks & NBFCs

-

Customer acquisition costs are down to 20–25%.

-

30% of new retail loans for NBFCs are via digital channels.

-

40% of approvals are AI-automated.

Why India is catching up so fast

India’s embedded finance market is expanding rapidly, powered by structural shifts and digital adoption:

-

Digital adoption: By 2025, India will have nearly 900 million internet users (55% penetration), with rural growth fueling direct access through apps.

-

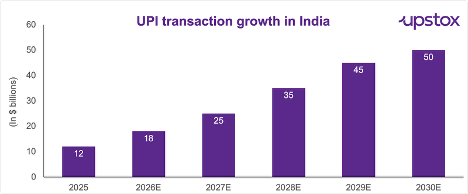

Payments infrastructure: UPI transactions are set to cross 12 billion monthly in 2025, and could hit 50 billion annually by 2030, showing comfort with digital payments.

Source: ibef, pwc

-

Regulatory support: India Stack, the Account Aggregator framework, and RBI lending guidelines provide a secure base for innovation.

-

E-commerce & platforms: Retailers and apps are embedding BNPL, wallets, and instant lending, simplifying access for users and merchants.

-

Strategic collaborations: Bank–fintech partnerships, M&A, and new launches are expanding choice, boosting market share, and accelerating adoption.

In short, India’s high internet penetration, strong digital payments adoption, regulatory support, and platform innovation combine to make it one of the fastest-growing markets for embedded finance globally.

Challenges to keep in mind

While embedded finance offers immense opportunities, it also comes with risks that need careful management:

-

Cybersecurity: Multi-party platforms increase exposure to fraud and breaches. India saw a 40% YoY rise in digital financial frauds, with losses topping ₹1,500 crore, underscoring the need for stronger safeguards.

-

Regulatory oversight: Compliance demands are rising, with the RBI and others issuing 15+ guidelines (2023–25) on privacy, digital lending caps, and KYC.

-

Brand & trust risk: Mis-selling or unclear terms erode confidence — surveys show 30% of users face issues like hidden charges, creating reputational risks for platforms.

-

Integration complexity: Embedding finance at scale remains tough, with 25% of fintech partnerships facing delays or glitches that hurt user experience.

-

Financial literacy: Despite adoption, 45% of users lack a clear understanding of digital products, raising risks of misuse, over-indebtedness, and disengagement.

Global overview: Embedded finance around the world

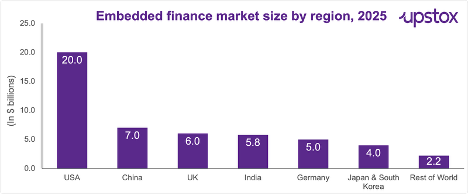

Embedded finance is expanding globally, transforming how financial services reach people. The global embedded finance market is projected to reach $230 billion by 2027, expanding at a CAGR of 30%, fuelled by e-commerce growth, fintech innovation, and rising consumer demand for seamless, integrated financial experiences.

Source: marketsandmarkets

The trend of embedding financial products directly into apps whether for consumers or businesses is quickly becoming the global standard. The US and China lead in 4absolute market size, while countries like India, Brazil, and Indonesia are accelerating adoption thanks to robust digital infrastructure, growing smartphone penetration, and supportive regulatory frameworks.

Across regions, embedded lending, insurance, and payments are converging to make finance a seamless part of daily life from shopping and travel to agriculture and healthcare laying the groundwork for next-generation financial inclusion worldwide.

Outlook: Invisible, Inevitable, Inclusive

By 2029, India’s embedded finance market will be near $29 billion, fueled by lending, payments, and insurance integrated into apps people use every day. Consumers might not even realize they’re using a loan or insurance policy, it just works. For banks, NBFCs, fintechs, and platforms, the choice is clear: embed services where customers are. For users, it’s seamless access, financial security, and convenience. The story isn’t about technology - it’s about bringing finance to life where people live it, digitally, in real time.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story