Upstox Originals

Financial crashes that shook the world: Lessons learned and reforms made

.png)

9 min read | Updated on February 26, 2025, 19:00 IST

SUMMARY

Financial crashes shake economies, causing instability, job losses, and downturns. History’s major crises—like the Great Depression, Black Monday, and the 2008 crash—highlight the dangers of speculation, weak regulations, and excessive risk-taking. While reforms have strengthened oversight and banking rules, markets remain vulnerable. The lesson? Stay vigilant—as financial stability can be influenced by various factors.

Analysing some of the biggest market crashes and lessons learnt from them

Throughout history, financial crashes have wreaked havoc on economies, wiping out wealth, and leaving millions unemployed. These crises, often fuelled by excessive speculation, weak regulatory oversight, and macroeconomic imbalances, have provided important lessons that have shaped financial reforms and policies worldwide.

Here, we explore some of the most significant financial crashes in history, the lessons learned, and the reforms implemented to prevent future crises.

The Great Depression (1929)

The 1929 stock market crash, fueled by rampant speculation and excessive margin trading, led to the Great Depression. Overvalued stocks, declining consumer spending, and industrial overproduction caused economic instability.

Unregulated banks made risky investments and collapsed after the crash, deepening the crisis. The absence of financial regulations permitted reckless trading practices, triggering panic selling, market collapse, and the onset of the Great Depression.

Economic impact

Between 1929 and 1932, the Dow Jones Industrial Average (DJIA) plummeted by nearly 89%, dropping from 381 to 41 points, wiping out over $25 billion in stock market value within weeks. This financial collapse led to a severe economic downturn, with US GDP contracting by almost 30% and unemployment soaring to 25%.

The banking sector was devastated, with over 9,000 banks failing by 1933, erasing life savings and hurting financial stability. The crisis disrupted global trade, deepened economic distress, and forced governments to rethink financial regulations and market oversight to prevent future collapses.

Lessons learned

The 1929 crash was a wake-up call for economic responsibility. Like a house of cards, unregulated markets collapsed under reckless speculation. The Great Depression proved that government intervention, financial safeguards, and oversight were essential for stability.

Reforms made

-

Glass-Steagall Act (1933): Separated commercial and investment banking to curb risk-taking and protect depositors.

-

Securities and Exchange Commission (SEC) (1934): Regulated stock markets, enforcing laws against fraud and insider trading.

-

Social Security Act (1935): Established unemployment insurance, pensions, and aid for the disabled.

-

Public Works Programs: Created jobs through infrastructure projects, aiding economic recovery.

Impact on India:

The Great Depression severely impacted India's economy. Between 1928 and 1934, exports and imports halved, and wheat prices fell by 50%. Rural areas suffered due to declining agricultural exports.

The decline in agricultural exports: Indian agricultural exports, particularly jute and cotton, plummeted, leading to a rural economic downturn.

-

Increase in unemployment: The decline in demand for Indian goods caused widespread unemployment.

-

Reduced industrial growth: The crisis severely impacted Indian industries reliant on foreign trade.

Black Monday (1987)

On October 19, 1987, global stock markets experienced a massive collapse, with the DJIA (the Dow Jones Industrial Average - a benchmark index tracking 30 of America's largest, most influential companies) plummeting by over 22% in a single day.

The crash was triggered by a combination of factors, including computerised trading strategies, excessive market speculation, and liquidity issues. Program trading, an early form of algorithmic trading, led to rapid, automated sell-offs, while investors' overreliance on portfolio insurance strategies exacerbated the downturn.

Additionally, rising interest rates and geopolitical tensions had already created an unstable market environment, making it more susceptible to a sudden collapse.

Market loss

The financial impact of Black Monday was severe. The DJIA lost $500 billion in market value in a single day, marking a historic 22% decline. Globally, stock markets saw a staggering loss of over $1.7 trillion within a week, highlighting the systemic vulnerabilities caused by algorithmic trading and market illiquidity.

Lessons learned

The 1987 Black Monday crash exposed the risks of program trading and automated sell orders, which intensified market volatility by triggering large-scale sell-offs. It demonstrated the need for circuit breakers—mechanisms that temporarily halt trading—to prevent panic-driven collapses.

The crash also emphasised the importance of enhanced risk management and better coordination among financial institutions to maintain market stability.

Reforms made

In response to Black Monday, regulators introduced circuit breakers to halt trading during extreme market drops, preventing uncontrolled sell-offs. Stricter margin requirements and enhanced risk management reduced excessive leverage and improved market stability.

Financial institutions adopted stress-testing protocols to withstand extreme volatility. Additionally, global regulatory coordination improved, ensuring a more unified response to financial crises.

The Asian Financial Crisis (1997)

The 1997 Asian Financial Crisis began in Thailand when the government was forced to devalue the Thai baht by ~30% in July. They shifted it from a fixed to a floating exchange rate after depleting its foreign currency reserves to defend the currency.

This triggered a broader financial meltdown across Asia, which quickly spread across Asia, causing currency devaluations, corporate bankruptcies, and economic collapses. Weak financial regulations, excessive foreign debt, and over-reliance on short-term capital inflows led to instability.

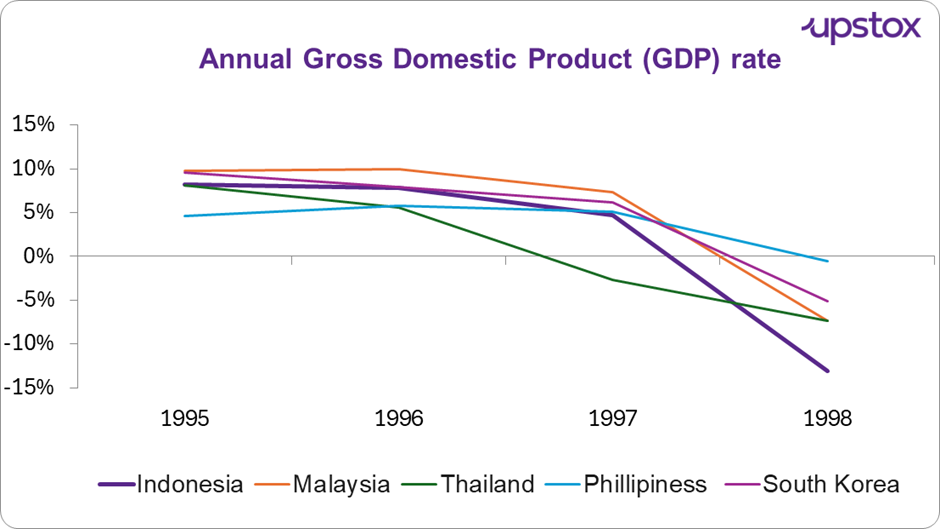

Fixed exchange rates made economies vulnerable to speculative attacks, while a lack of transparency eroded investor confidence. GDP growth plummeted across Indonesia, Thailand, South Korea, Malaysia, and the Philippines.

Source: World Integrated Trade Solution (WITS)

Thailand and Indonesia were hit the hardest, while Malaysia and South Korea also struggled but managed to recover through reforms. The Philippines experienced a smaller economic decline, demonstrating some resilience amid the turmoil.

Market loss

- Asian stock markets lost over $600 Bn in value.

- The Thai baht lost more than 50% of its value against the U.S. dollar.

Impact on India

India’s relatively closed-off economy at the time and limited exposure to these currencies prevented the contagion from spreading to India. While the INR did experience fluctuations, research by the Department of Economics, Delhi School of Economics suggests that India was relatively unaffected by this crisis.

Lessons learned

One key lesson learned is that relying too much on short-term foreign capital can create serious financial instability. To build a more resilient economy, it’s crucial to prioritize financial transparency and strong risk management practices.

Reforms made

-

Strengthened Banking Regulations: Improved oversight and governance to ensure financial stability.

-

Financial Stabilisation Funds: Established to prevent future currency crises and enhance economic resilience.

The Dot-Com bubble (2000)

The Dot-Com Bubble was fueled by excessive speculation in internet-based companies during the late 1990s. Investors poured money into technology startups, driving stock prices to unsustainable levels.

However, many of these companies had little to no profitability, and when market confidence waned, the bubble burst, leading to a dramatic decline in stock values.

Market loss

The Dot-Com Bubble led to a severe market downturn, with the NASDAQ Composite Index plummeting by ~78% from its peak in March 2000 to October 2002. Trillions of dollars in market capitalization were erased as numerous tech companies went bankrupt. Many investors suffered substantial financial losses, contributing to an economic slowdown and a decline in investor confidence.

Lessons learned

The crash highlighted the dangers of excessive speculation in unproven business models, emphasizing the need for thorough risk assessments before investing in emerging industries. It underscored the importance of balancing market enthusiasm with fundamental financial analysis to prevent unsustainable asset bubbles.

Reforms made

Following the Dot-Com crash, stricter IPO regulations were implemented to ensure financial stability before companies went public. Corporate governance and financial reporting standards were strengthened, leading to greater transparency and accountability.

The Sarbanes-Oxley Act (2002) introduced stringent financial regulations to prevent fraud. Additionally, investors adopted more rigorous valuation methods, focusing on profitability and long-term growth over speculation, helping to create a more stable financial system.

Impact on India

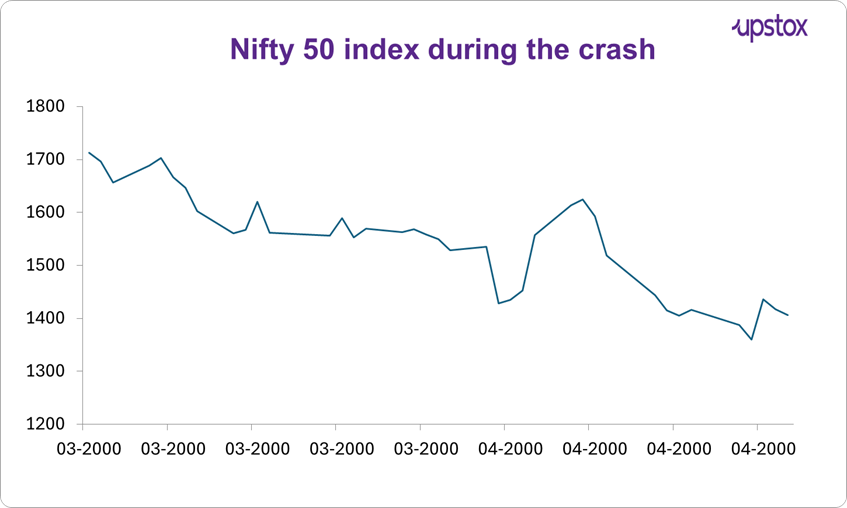

While the Dot-Com crash primarily affected the U.S. and global financial markets, its repercussions were also felt in India. The Indian IT sector, which had been experiencing rapid growth due to increased outsourcing from Western companies, saw a slowdown as U.S.-based tech firms cut costs and reduced outsourcing contracts.

The stock markets in India, particularly the technology-heavy indices, faced significant corrections. Venture capital funding for Indian startups declined as global investors became more risk-averse.

Source: NSE

The Global Financial Crisis (2008)

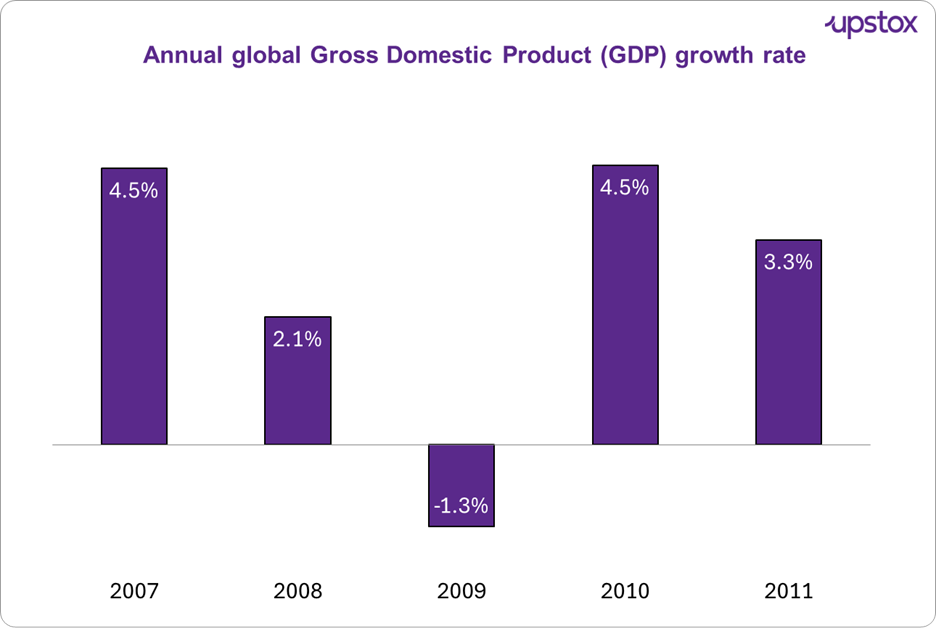

The 2008 financial crisis, triggered by the collapse of Lehman Brothers, was fuelled by subprime mortgage lending, excessive leverage, and financial deregulation. The crisis led to a deep global recession and necessitated unprecedented government interventions.

Market loss

-

Global stock markets lost over $30 trillion in market capitalisation.

-

The S&P 500 dropped 57%, wiping out $11 trillion in U.S. household wealth.

-

The U.S. unemployment rate peaked at 10% in 2009.

Impact on India

Global financial crises slow India's economic growth by reducing investments, weakening exports, and increasing financial market volatility. The stock market experiences sharp declines, and the rupee depreciates due to capital outflows. Export-driven industries like IT and textiles suffer, leading to job losses.

Banking and credit availability tighten, causing a rise in Non-Performing Assets (NPAs). However, the Indian government and RBI responded with policy measures such as interest rate cuts, liquidity support, and fiscal stimulus to stabilize the economy. While India remains vulnerable to global downturns, its strong domestic demand and regulated financial sector provide resilience.

Lessons learned

When financial innovations run wild and risk-taking spirals out of control, the consequences can shake the entire world—making strict oversight essential to prevent economic disaster.

Reforms made

-

Stronger Financial Regulations: The Dodd-Frank Act (2010) imposed stricter rules on banks and financial institutions.

-

Bank Resilience Checks: Regular stress testing was introduced to ensure banks could withstand economic crises.

-

Consumer Safeguards: New measures were implemented to prevent predatory lending and protect borrowers.

Source: Statista

A quick comparison

| Crash | Year | loss | Key causes | Major reforms |

|---|---|---|---|---|

| Great Depression | 1929 | DJIA fell 89% | Speculation, margin trading | Glass-Steagall Act, SEC, Social Security |

| Black Monday | 1987 | DJIA fell 22% in one day | Program trading, illiquidity | Circuit breakers, risk management |

| Asian Crisis | 1997 | $600 Bn lost | Currency devaluation, debt crisis | Strengthened banking regulations |

| Dot-Com Bubble | 2000 | NASDAQ fell 78% | Overvaluation of tech stocks | Stricter IPO rules, risk assessment |

| Global Crisis | 2008 | $30 Tn lost globally | Subprime lending, financial deregulation | Dodd-Frank Act, stress tests |

In summary

Financial crashes have consistently exposed vulnerabilities in the global financial system. While reforms have been implemented to mitigate future risks, financial markets remain susceptible to new and evolving threats. The key to preventing future crises lies in continuous regulatory vigilance, prudent financial management, and global cooperation.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story