Upstox Originals

Fewer deals, bigger bets: Is India’s M&A market leveling up?

6 min read | Updated on September 19, 2025, 15:17 IST

SUMMARY

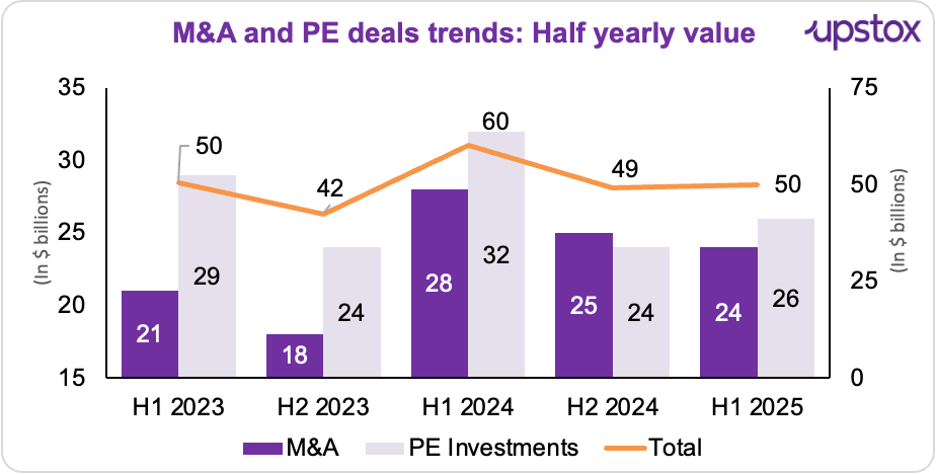

Bigger, not busier, that’s the story of India’s M&A market in H1 2025. Deal value hit $50 billion, up 2% from the previous half, even though the number of transactions dropped 12%. Average deal sizes are up nearly 20%, and power and renewables are leading the charge. Add tech, consumer, and finance to the mix, and you get a picture of India Inc. making fewer, bigger, bolder bets.

EY’s latest M&A report says $50 billion worth of deals were signed in the first half of 2025

India’s dealmaking scene is buzzing again, just not in the way you’d think. EY’s latest M&A report says $50 billion worth of deals were signed in the first half of 2025, 2% higher than the previous half, which is pretty solid given all the noise around interest rates and policy and global uncertainty.

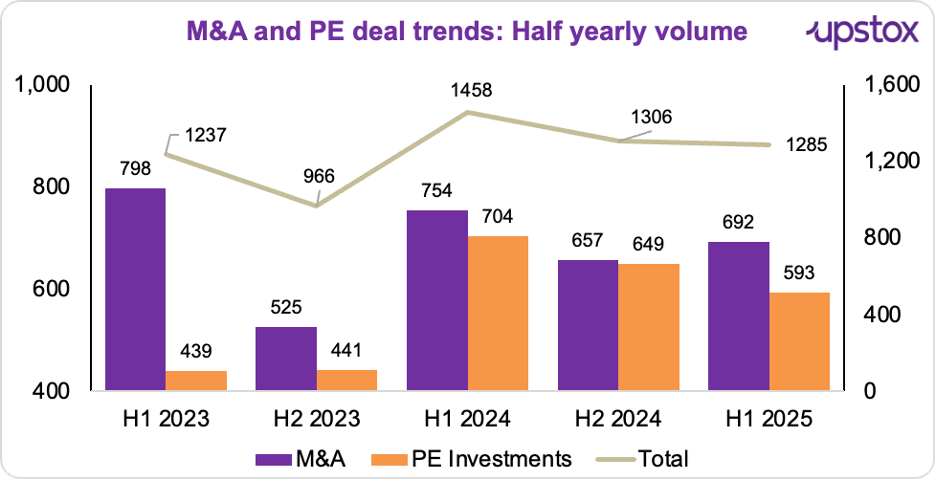

But here’s the twist, dealmakers are cutting fewer cheques, but they’re making them bigger. Only 1,285 transactions were signed in H1 2025, down 12% from last year, yet the average deal size jumped nearly 20% year-on-year.

June 2025 was the perfect example. It was the biggest month by value ($8.4 billion — more than double May), but also saw just 136 deals, the lowest monthly count in the half and 46% fewer than a year ago. PE deals added more fuel to India’s M&A momentum. Volumes stayed flat, but the cheques got bigger, keeping overall deal value steady.

Source: BS

Source: BS

Top 5 M&A deals (H1 2025)

| Month | Target | Acquirer | Sector | Value ($ million) | Stake |

|---|---|---|---|---|---|

| Jun | J B Chemicals | Torrent Pharma | Pharma | 3,001 | NA |

| Feb | Ayana Renewable Power | ONGC NTPC Green | Power/Renewables | 2,247 | 100% |

| May | Yes Bank | Sumitomo Mitsui | Banking | 1,590 | 20% |

| Jun | Akzo Nobel India | JSW Paints | Building products | 1,098 | 75% |

| Feb | Owens Corning unit | Praana Group et al | Industrials | 755 | 100% |

Source: EY

Top 5 PE deals (H1 2025)

| Month | Target | Investor(s) | Sector | Value (US$m) | Type |

|---|---|---|---|---|---|

| Mar | Haldiram Snacks | Temasek, Alpha Wave, IHC | FMCG | 1,500 | Growth capital |

| Jan | Access Healthcare | New Mountain Capital | Tech/Healthcare | 1,400 | Buyout |

| Mar | Manappuram Finance | Bain Capital | NBFC | 923 | PIPE |

| Mar | Siemens Gamesa (India & SL wind) | TPG & MAVCO | Industrials | 500 | Buyout |

| Jan | Dhoot Transmissions | Bain Capital | Automotive | 400 | Growth capital |

Source: EY

So, where is the money flowing?

Source: FT

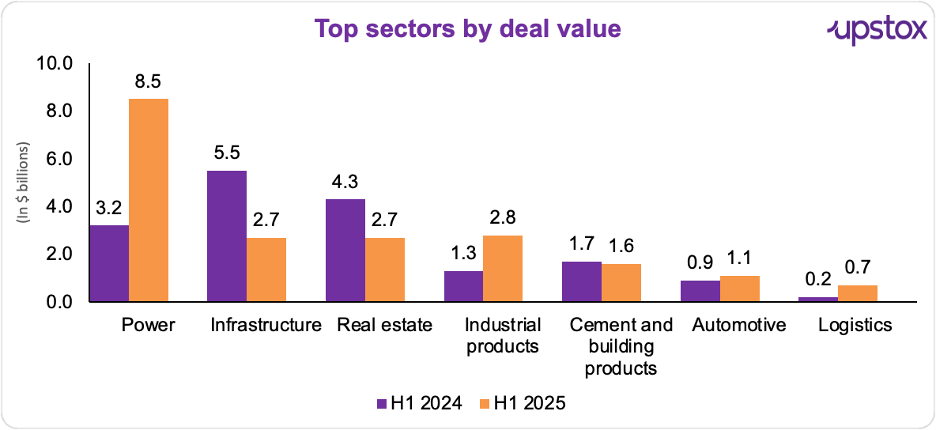

Power & Renewables: The Scene-Stealer

The sector was the clear MVP, pulling in $8.5 billion worth of deals, the highest across sectors. And nearly three-fourths of that came from renewables alone.

This is where some of India’s biggest strategic bets are playing out.

ONGC and NTPC bought Ayana Renewable Power for $2.25 billion — one of Asia’s largest clean-energy deals this year.

Macquarie-backed Blueleaf Energy picked up 1 GW of Jakson Green projects for $400 million.

And this isn’t a one-off trend. With India auctioning 50 GW of renewable capacity annually, global utilities, sovereign wealth funds, and private equity are all lining up to grab a slice of the market.

Consumer products & retail: Small but many

This sector led the charts in deal count with 205 transactions in just six months. Most of these were small-ticket D2C plays, brand consolidations, or distribution deals.

But there was one deal that made everyone take notice — Haldiram’s $1.5-billion PE fundraise, showing that even homegrown legacy brands are becoming hot picks for investors looking at India’s consumption story.

Tech: Capability is king

Tech deals were fewer, but big when they happened.

The showstopper? New Mountain Capital’s $1.4 billion buyout of Access

Healthcare, a massive health-tech deal. SLK Software and Impetus Tech also changed hands — a sign that acquisitions are being used to buy capabilities (digital engineering, SaaS, healthcare tech) rather than just scale.

Financial services: Quiet consolidation

Finance also had its fair share of headline deals. Yes Bank sold a 20% stake to Sumitomo Mitsui for $1.5 billion, shoring up its balance sheet.

Bain Capital invested $923 million in Manappuram Finance, betting on NBFC growth.

Patanjali-led consortium acquired 98% of Magma General Insurance for $507 million, marking its foray into general insurance.

What is drawing this new wave of investors?

First, the exits look great.

Global investors have been able to cash out with healthy profits, whether by selling entire platforms, individual assets, or going public through IPOs and Infrastructure Investment Trusts (InvITs). That kind of track record makes fresh capital easier to justify.

Second, valuations are on the rise.

Transaction multiples have gone up by 0.5–1x of EBITDA, thanks to lower perceived risk and stable yield profiles. And if you’ve been following the action, you’ll know that bidding wars are heating up, a sure sign that we’re in a seller’s market.

Third, tech is changing the game.

Of the 42 GW capacity auctioned in FY25, nearly 60% had battery storage linked to it, a massive shift toward Firm Dispatchable Renewable Energy (FDRE). This isn’t just good for reliability, it’s also great for returns. And with India projected to account for 35% of global battery deployments by 2040, it’s fast becoming a key player in the global energy supply chain.

Finally, capital itself is evolving.

Private equity now accounts for over 55% of deal value, and it’s no longer just about minority growth capital. We’re seeing control buyouts (like Access Healthcare and Impetus) and large platform plays. And here’s the stat that ties it all together. H1 2025 saw 10 billion-dollar-plus deals, double the count from each half of 2024.

But there are headwinds

Not everything is rosy. August’s export tariff changes have reintroduced trade uncertainty, which could slow cross-border flows. Global interest rates are still elevated, making leveraged buyouts costlier.

And according to Deloitte, about 40% of large Indian M&As fail to deliver planned synergies, meaning the integration challenge is real. Supply-chain gaps in solar modules and batteries remain another risk that could delay execution.

Outlook

Analysts expect another $60–65 billion worth of deals in the next six months, taking India’s full-year M&A tally past $110 billion.

And the themes aren’t changing much.

-

Power & Renewables will stay in the spotlight, but with new flavours. Think battery storage, green hydrogen, and EV infrastructure platforms all coming into play.

-

Finance is likely to see more consolidation, especially NBFC-bank tie-ups as lenders clean up balance sheets and chase scale.

-

Tech deals could tilt toward AI, cybersecurity, and product IP as companies look to buy capabilities for the next phase of digital growth.

And here’s the kicker, dealmaking could actually get cheaper. The RBI cut the repo rate to 6.25% in February and Fitch expects it to drop further to 5.75% by December 2025. Lower borrowing costs = more appetite for leveraged buyouts and big-ticket M&A.

But (there’s always a but)… the world isn’t risk-free. Geopolitical tensions, US reciprocal tariffs, and India-EU trade deal negotiations could still throw a spanner in the works. Still, if H1 was any indicator, India’s M&A story is now about fewer, bigger, and bolder deals, a clear sign that the market is maturing.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story