Upstox Originals

Factor Investing: Can it help you outperform the market?

.png)

5 min read | Updated on July 18, 2024, 14:59 IST

SUMMARY

Factor investing AUM has grown almost 2x since September 2023 to ~₹14,000 crore. The strategy has also performed superior returns compared to overall markets. Find out what factor investing is all about and how can you participate in this ongoing “momentum”

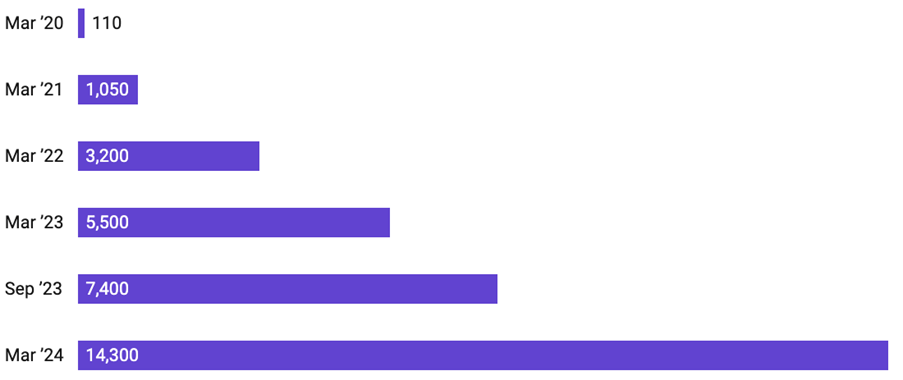

Factor investing AUM has grown 2x since September 2023

Factor investing involves selecting stocks based on various characteristics or "factors" that influence their performance. These factors can include size, value, momentum, growth, low volatility, and quality. By focusing on these attributes, investors can aim to achieve better risk-adjusted returns compared to traditional market-cap-weighted strategies.

How Factor Investing Evolved in India?

Factor investing has recently gained traction in India - with overall AUM increasing by 2x from September 2023 to March 2024. The growth was driven by an increase in the number of factor indices managed by BSE/NSE from 13 in 2017 to 45 in March 2024 and also an increase in the number of funds to 59 as of March 24 from 35 as of November 22 as per ACE MF.

Rise of factor investing AUM in India (₹ crore)

Source: Bloomberg, NSE, Edelweiss MF; Note: Factor Investing AUM is calculated based on funds / ETCs managed funds by NSE and BSE

Key factors explained

| Investment style | Index | Brief description | Metrics |

|---|---|---|---|

| Quality | S&P BSE QualityTRI | Sound balance sheet stocks | High ROE, ROCE, Lower Debt to Equity |

| Growth | Nifty Growth Sectors 15 Index | High growth with future potential | Revenue, EBITDA, and PAT with a high growth rate |

| Value | S&P BSE Enhanced Value TRI | Relatively inexpensive stocks | Low valuations like P/E, P/B |

| Momentum | Nifty 200 Momentum 30 TRI | Rising stocks | Higher returns in the recent period (1M-12M period) |

| Low Volatility | S&P BSE Low Volatility TRI | Lower variability of returns | Low standard deviation of price returns |

Source: NSE

Which factor to choose?

Going by the historical performance, the top performer factor changes every year with market conditions and there has been no consistent winner across the factors. Investors would therefore be wise to diversify across various factors.

We also compare the performance of each of these factors to the overall BSE 250 index. In comparison, we note that almost all the factors have outperformed the index over the past 10 years, with momentum and value coming out as the most consistent performers, compared to the benchmark

Factor performance by year

| Factors performance (%) | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Momentum | 49.6 | 10.8 | 9.6 | 57.5 | -1.7 | 10.6 | 20.0 | 53.8 | -5.4 | 41.7 | 12.9 |

| Quality | 44.9 | 13.2 | 7.4 | 39.7 | -3.9 | 3.9 | 26.0 | 19.4 | 13.0 | 34.4 | 8.2 |

| Low Volatility | 42.9 | 13.5 | 4.4 | 30.2 | 8.7 | 5.3 | 26.8 | 19.3 | 4.5 | 30.8 | 7.8 |

| Growth | 52.1 | 10.6 | -1.2 | 63.6 | -21.0 | -4.8 | 7.6 | 60.7 | -1.4 | 32.8 | 6.2 |

| Value | 40.0 | -15.8 | 16.6 | 46.0 | -26.9 | -7.3 | 12.8 | 56.9 | 26.3 | 62.2 | 14.8 |

| S&P BSE 250 Large Midcap Index | 37.2 | 0.1 | 5.1 | 36.9 | 0.8 | 10.1 | 18.5 | 30.5 | 5.6 | 25.2 | 15.3 |

Source: NSE, Bloomberg. Note the above performance is based on the factor index of NSE on each factor. 2024 data as of 31st March-24.

How can you invest?

Below is a list of select mutual funds and ETF:

| Name of MF/ETF | Factor | 1 Year Returns (%)* |

|---|---|---|

| Edelweiss Nifty Midcap150 Momentum 50 Index Fund | Momentum | 78.3 |

| Tata Nifty Midcap 150 Momentum 50 Index Fund | Momentum | 76.4 |

| UTI Nifty200 Momentum 30 Index Fund Direct-Growth | Momentum | 72.4 |

| Motilal Oswal Nifty 200 Momentum 30 ETF | Momentum | 70.3 |

| Quant Momentum Fund | Momentum | 59.3 |

| Nippon India Nifty Alpha Low Volatility 30 Index Fund | Low Volatility | 50.2 |

| LIC MF Value Fund | Value | 44.2 |

| UTI Nifty Midcap 150 Quality 50 Index Fund | Quality | 43.8 |

| SBI Nifty 200 Quality 30 ETF | Quality | 39.0 |

| DSP Value Fund | Value | 38.8 |

| UTI BSE Low Volatility Index Fund | Low Volatility | 38.6 |

| Edelweiss Nifty 100 Quality 30 Index Fund | Quality | 36.3 |

| ICICI Prudential Nifty 100 Low Volatility 30 | Low Volatility | 33.6 |

| HDFC Nifty 100 Index Fund | Low Volatility | 32.4 |

Source: NSE, Value Research; data is as of 13th July 2024

Conclusion

Factor investing represents a sophisticated approach to portfolio management, emphasising specific stock characteristics that drive performance. By adhering to a disciplined, rule-based investment process, factor investing aims to deliver enhanced returns and reduce risks, making it an appealing option for investors seeking personalised and resilient investment strategies.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story