Upstox Originals

Do you really need crores to invest in real estate?

8 min read | Updated on October 08, 2025, 18:04 IST

SUMMARY

Ever dreamed of owning a piece of Bandra or Koramangala? For years, that dream was out of reach; sky-high prices, endless paperwork, and zero liquidity kept real estate an exclusive club. But that’s changing. Digital platforms are transforming the way India purchases real estate. Entry points have dropped from lakhs to just thousands, liquidity is improving, and a whole new generation of investors, from millennials to global institutions, is getting a seat at the table.

Fractional ownership enables you to purchase a part of real estate at an affordable ticket size

On a busy Saturday morning in Mumbai, a group of friends were scrolling through property listings on their phones. One pointed at a compact studio in Andheri and laughed: “₹75 lakh for this tiny flat? That’s insane.” Another shrugged, “Guess we’ll just keep renting.”

Even a modest metro apartment? ₹50 lakh and up. Paperwork? Endless. Legal checks? A maze. Middlemen? Everywhere. Selling it? That could take months, even a year.

But do you know that things are shifting? Digital real estate platforms like Alt DRX and Property Share are experimenting with fractional ownership and tokenisation, letting people buy tiny portions of properties. Suddenly, what used to require lakhs can be approached with just a few thousand rupees, making the market more liquid and accessible.

And all this comes at a time when India’s real estate sector is projected to grow to $5.8 trillion by 2047, potentially contributing 15.5% to the GDP, up from 7.3% today.

Fractional Ownership

In simple terms, fractional ownership lets you co-own a commercial property with others. You put in a fraction of the money, get a fraction of the rent, and when the property is sold, you get a fraction of the profits.

So, where does this idea come from? Sharing real estate isn’t new. Ancient civilisations pooled resources and shared living spaces. The modern concept took shape in the US Rockies, where vacationers wanted ski homes without buying the entire place. Europe followed, with France, Spain, Portugal, and the Canary Islands experimenting with “co-ownership” or “co-propriété”—multiple owners, one property, shared costs.

For years, fractional ownership in India ran in a regulatory grey zone, exciting but messy. That changed in March 2024. SEBI rolled out the Small and Medium REIT (SM-REIT) framework, bringing fractional ownership platforms under formal rules. Think of it as “fractional ownership 2.0”: same idea, now with disclosures, trustees, and quarterly payouts that protect investors.

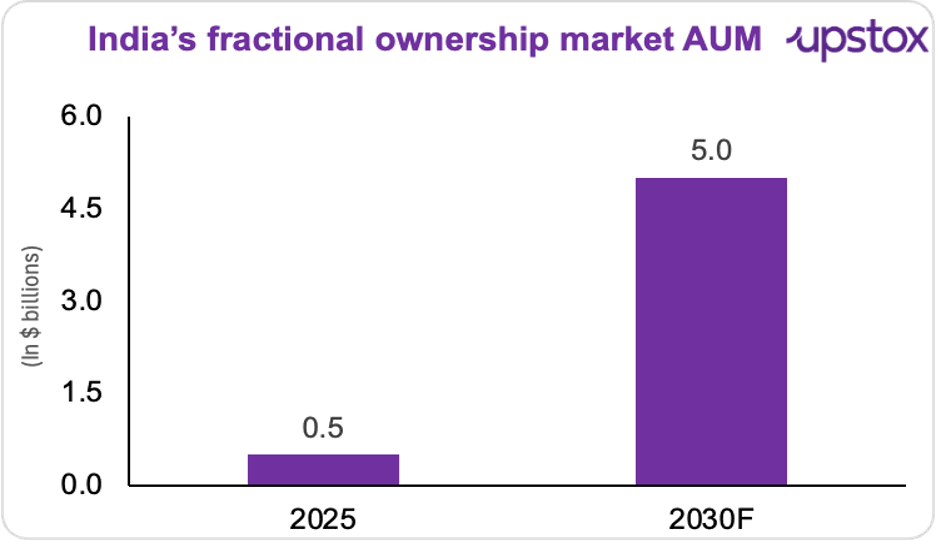

Today, India’s fractional ownership market is tiny, around $500 million in assets under management, a still niche market. But, investors are waking up. A study by Anarock Property Consultants shows interest in fractional ownership platforms has shot up 40% post-COVID-19. By pooling investors’ money to buy premium office spaces and renting them out, these platforms are turning an exclusive, illiquid asset class into something regular investors can access with as little as ₹5,000–₹50,000.

The result?

- More liquidity (you can sell your share faster than selling a flat)

- More transparency (most platforms offer dashboards tracking rent payouts)

- Potentially steady yields (7–9% in many cases)

It’s early days, but the model is maturing fast. Analysts believe that as trust builds and more institutional-grade assets are listed, this market could grow 10x and cross $5 billion in AUM by 2030.

Source: JLL

How does it work?

With fractional ownership, you don’t directly buy the property. Instead, you buy a share in a company (called a Special Purpose Vehicle, or SPV) that owns it. The property could be under construction, leased out, or ready to use. Your returns, whether from rent or price appreciation, depend on how well that property performs, after expenses are deducted.

Typical FOP structure:

- A platform manager sets up an SPV to hold and manage the property.

- Investors buy securities in the SPV, giving them a proportional stake in the asset.

- The SPV uses the pooled funds to acquire the property, whether under construction, developed, or leased.

- Rental income is passed on to investors as interest or dividends.

- Capital gains are realised when SPV securities are sold.

| Platform | Asset Focus | Secondary Trading |

|---|---|---|

| Property Share | Offices, malls | Yes |

| Claravest | Residential, co-living | Yes |

| BRIKitt | Residential | Yes |

Source: News articles

Asset classes under FOPs

With FOPs, one can own a slice of offices, warehouses, retail spaces, or even holiday homes, without burning a hole in pocket. Each asset class brings its own opportunity to earn, rent, or grow your capital:

- Gurgaon: 2,000 sq. ft. shop ≈ ₹10 crore

- Lower Parel, Mumbai: 500–600 sq. ft. shop ≈ ₹6–7 crore

Most retail investors can’t buy these alone. That’s where FOPs come in, they let you pool investments and own a slice of income-generating retail property. Rental returns via the FOP route? Around 8–9%.

Case study of a successful exit

One of India’s fractional ownership platforms delivered a 100% exit for investors from an 88,000 sq. ft. warehousing asset in Jaipur, Rajasthan.

Investors had entered in 2021 with a total transaction value of ₹20.9 crore. By 2023, the platform facilitated an exit at ₹23.25 crore, translating to gross returns of 11–12% over two years, roughly a CAGR of 5.72%.

This example highlights how fractional ownership can provide:

- Structured, digital-first access to real estate assets

- Liquid returns, even from a single property

- A hassle-free exit, without the complexities of managing the asset directly

How does fractional ownership compare with traditional property?

| Feature | Traditional Property | Fractional Ownership |

|---|---|---|

| Minimum Investment | Atleast ₹50 lakh (metro housing) | ₹10–25 lakh (asset/platform dependent; (Some platforms may allow entry as low as ₹20,000 for asset-backed fractional ownership, but commercial properties generally start from ₹10 lakh onward) |

| Liquidity | Very Low (6–12 months to sell) | Moderate (secondary platform P2P trades, exit window ~3–6 months) |

| Transparency | Low (title risk, opaque pricing) | High (platform due diligence, dashboards, valuations) |

| Risk | High (illiquidity, market cycles, legal disputes) | Medium (platform risk, property-specific risk) |

| Expected Returns | ~8–12% (rental + appreciation, but highly illiquid) | ~10–16% IRR in select assets |

Source: News articles

Hurdles

Sure, fractional ownership sounds exciting. But there are speed bumps. For starters, regulations are still catching up. Rules around tokenisation, KYC, and taxation are evolving, leaving some uncertainty for investors.

Fractional platforms face another challenge: many are venture-backed start-ups. If a platform shuts down or mismanages assets, investors could be stuck.

And liquidity? Secondary markets for fractional shares are still thin, so getting a full exit can take longer than expected.

Finally, awareness is still low. Many investors are still learning the ropes, understanding fees, exit mechanisms, and governance can be tricky.

Global landscape

Fractional property ownership isn’t just an India thing, it’s going worldwide. The market is led by the US, UK, UAE (Dubai), Singapore, and parts of Europe.

In the US, platforms like Pacaso, Arrived, and RealT let anyone in from $100–$1,000, with tokenized platforms making trading and management smooth. Singapore’s Fraxtor starts at S$25,000 (≈US$19,500), though awareness is low.

Europe (France/UK) sees luxury apartments split into fractions, legal frameworks and minimum buy-ins in place. Dubai is growing residential, luxury, and commercial segments through fractionals, tying them to Golden Visa perks, with tickets from AED 5,000–20,000 (US$1,300–5,400). Meanwhile, India is just warming up, formalising under SEBI’s Small & Medium REIT framework.

Takeaway

India’s real estate market is quietly changing gears. Fractional ownership platforms are pulling more retail investors into premium real estate , what used to need lakhs now sometimes needs just thousands.

But these models are still small compared to India’s $477-billion property market. Secondary markets are thin, awareness is low, and trust will take time to build.

Policy moves are helping though. The GST cut on construction materials (cement GST down from 28% to 18%) could lower project costs by 5–7%, which should improve project viability. So, while it’s not a free-for-all yet, the direction of travel is clear, real estate is getting more transparent, more liquid, and more digital than ever before.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story