Upstox Originals

Could FII inflows see a resurgence in India?

.png)

3 min read | Updated on May 29, 2024, 18:23 IST

SUMMARY

FII holding in NSE’s cash segment is near its all-time lows and their allocation to India remains below emerging market average. In this article, we look at trends in FII holding and why India remains an attractive destination for FIIs.

Indian market halts the losing streak, Nifty reclaims 22,000 mark, Broader markets outperform

During FY22-FY23, FII cumulatively sold stocks worth nearly ₹1.8 lakh crore, ~3-4 times that of what was seen during the Global Financial Crisis. Given this all-time high selling, FII holding is now near decadal lows.

That said, India remains an under-owned market for FIIs. Given India’s promising macroeconomic scenario (economic growth prospects, political stability, etc.), FII flows could see a resurgence.

Let’s first look at what is happening

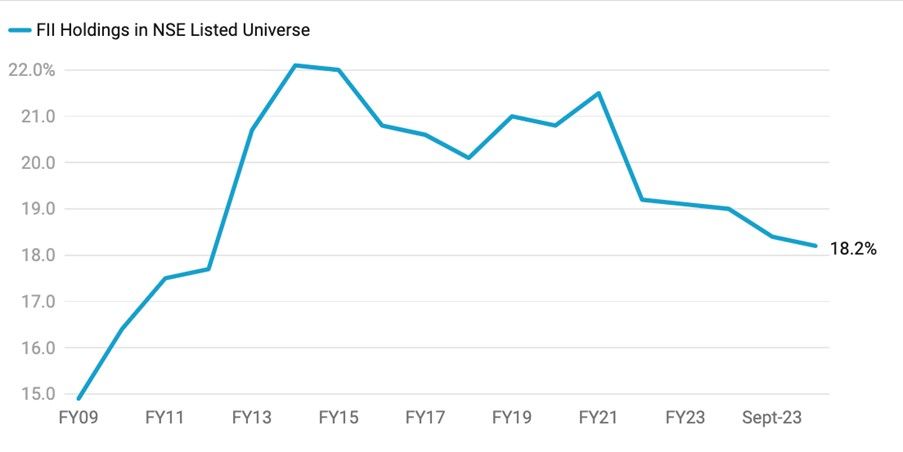

FII holdings in NSE’s Cash segment, have constantly been declining. They hit a decadal low of 16.6% in November 2023. Per NSE’s latest Ownership Tracker, their holding is 18.2% as of December 2023%, still lower than the 20% levels in March 2021.

FII holding trend

Source: NSE

What caused this?

The primary reasons for this are:

- Rapid global monetary tightening

- Uncertainty around the Fed monetary policy

- Ongoing global skirmishes leading to a volatile global environment

- Valuation concerns in domestic markets

The positive news is that these are transitory concerns. What do we mean? They are temporary and are not questioning India’s stability, its appeal as an investment destination or its larger growth story.

With that, we look at the potential for FIIs in India.

Potential for FIIs in India

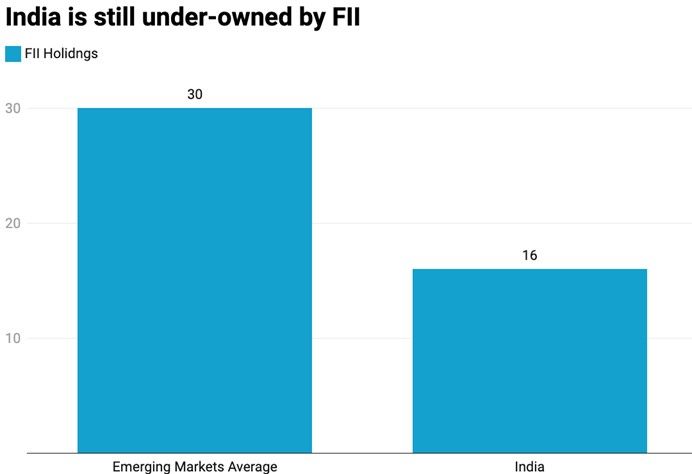

India remains under-owned by FIIs. India’s FII holdings of 16% is still below average FII holdings of 30% in emerging markets.

Source : NSE, MSCI

Their flows contribute 0.8% of India’s total market of NSE 500. This figure used to be around 2% a decade ago, suggesting that there is enough headroom for growth.

What does India offer?

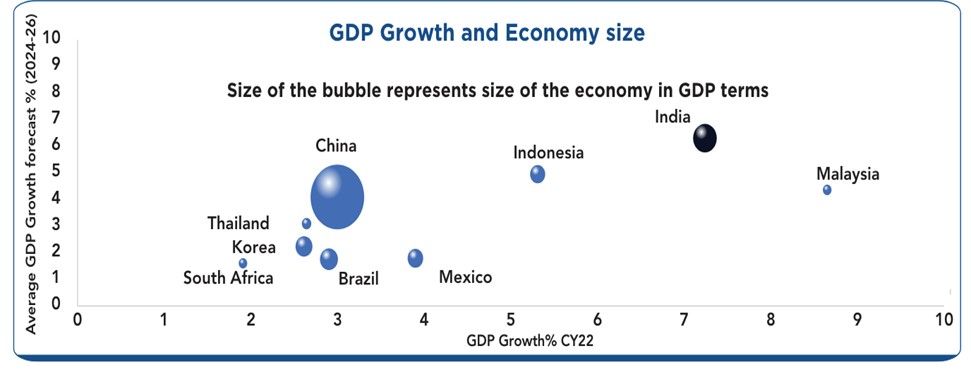

As one of the largest economies by market cap, India offers a highly investable opportunity for FIIs. Besides, as one of the fastest-growing global economies, India remains an attractive long-term potential investment destination for FIIs.

GDP growth and economy size comparison

Source: HDFC MF Chartbook

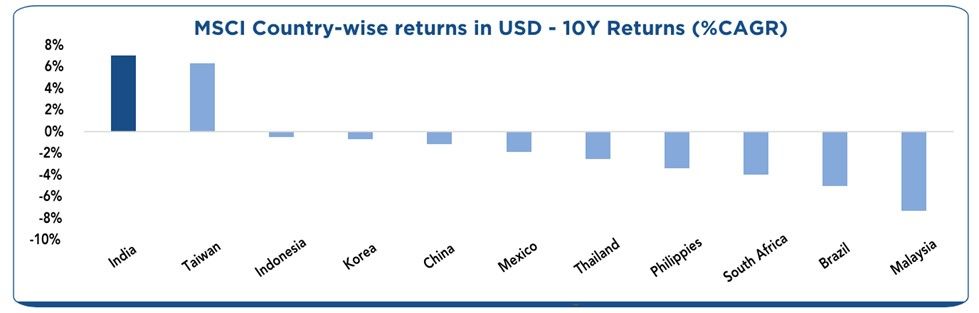

Besides this, Indian markets have generated some of the highest long-term dollar returns over the past 10 years. While we do not speculate about the future - India’s current global positioning, growth expectations, and expected political stability - all make it a very compelling case for any investor, let alone FIIs.

10-year CAGR returns by country (as of December 2023)

Source: HDFC MF Chartbook

What does this mean for investors?

From the FII standpoint, India offers one of the largest investable destinations with stable governance and strong economic prospects. This is further magnified by the current scenario in China, where slowing growth has caused FIIs to look for alternative destinations. FIIs have enough headroom to invest in India considering their decadal low holdings at a time when the economy is performing well.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story