Upstox Originals

Convenience first: How India’s home services market is evolving

.png)

7 min read | Updated on June 03, 2025, 12:57 IST

SUMMARY

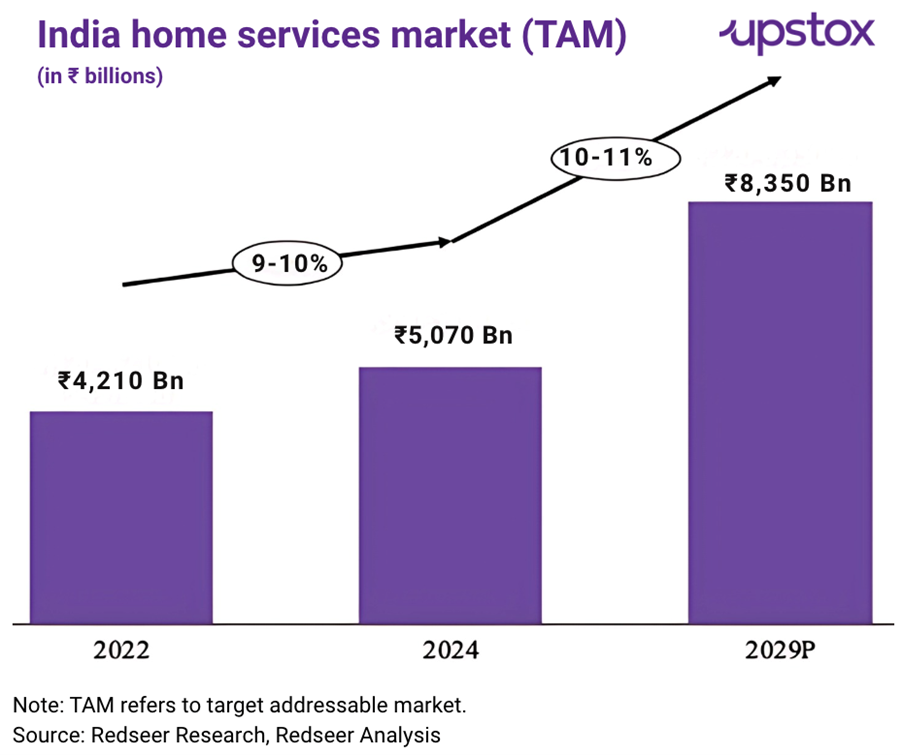

India’s home services market is undergoing a major transformation —from a fragmented, offline sector to a tech-driven, organised ecosystem. Valued at ₹5,070 billion in CY2024, it is projected to grow at a 10–11% CAGR to ₹8,350 billion by CY2029. Key drivers include rising incomes, nuclear families, urban lifestyles, and digital adoption. The article explores sector dynamics, key drivers, major trends, demand segments and risk attached to the sector.

India's housing services industry is valued at ₹5,070 billion in CY2024.

The Indian home services market is a vast and diverse sector, encompassing everything from beauty and wellness services to home repairs and renovations. The shift from unorganised local vendors to organised, digital platforms presents significant growth and innovation opportunities are some key growth drivers.

India's home services market, valued at ₹4,210 billion in CY 2022, has grown to ₹5,070 billion by CY2024. With a projected CAGR of 10-11%, the market is expected to reach ₹8,350 billion by CY2029.

The market has traditionally been fragmented and offline, with unorganised vendors struggling with inconsistent availability, pricing, quality, and post-service support, resulting in varied customer satisfaction. This gap has opened the door for tech-driven platforms to standardise services, improve demand-supply matching, and enhance earnings for service professionals.

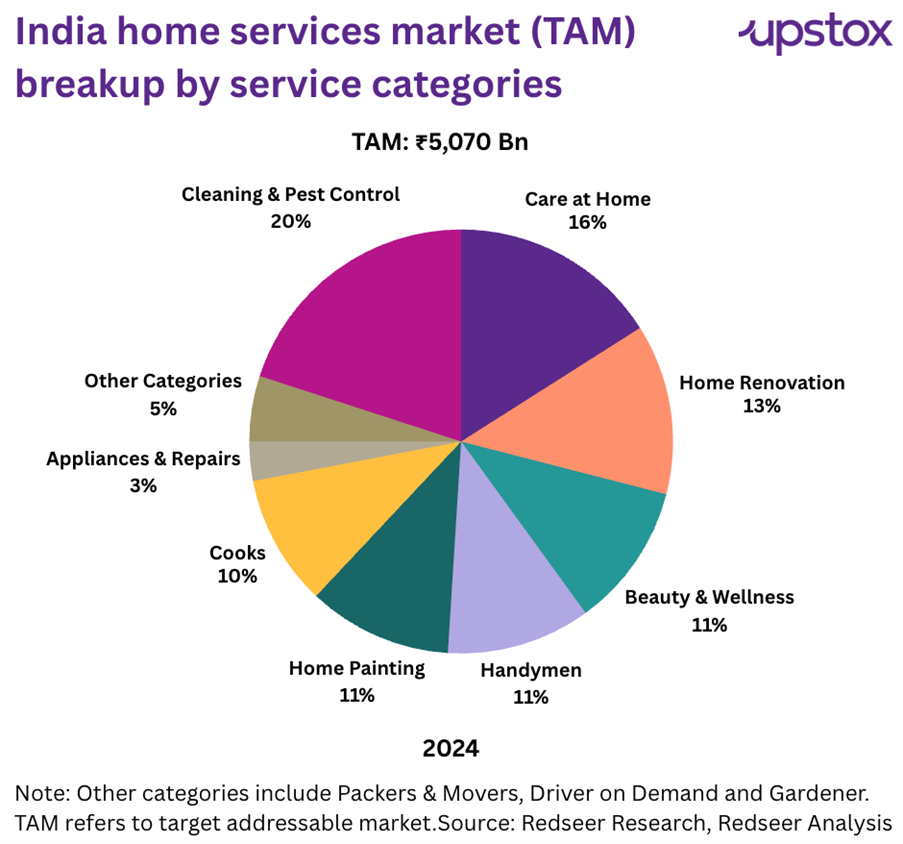

The usage of home services in India varies significantly across households, driven by differences in income levels, family structures, and lifestyle preferences. Here is a breakup of the India Home Services Market by service categories as of CY 2024.

Growth of online full-stack service providers

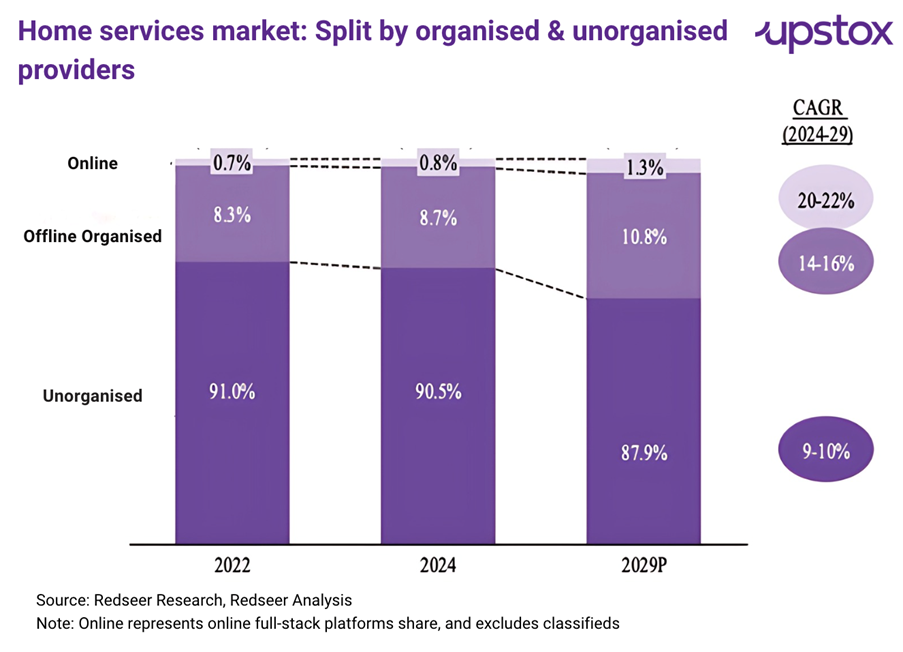

On a more encouraging note, the overall organised home services sector is set to outpace the broader industry. As seen in the chart below, online full-stack service providers, currently valued at ₹40-42 billion in 2024, is expected to grow at a 20-22% CAGR through 2029. Similarly, Offline organised markets is also expected to grow at an impressive 14-16%.

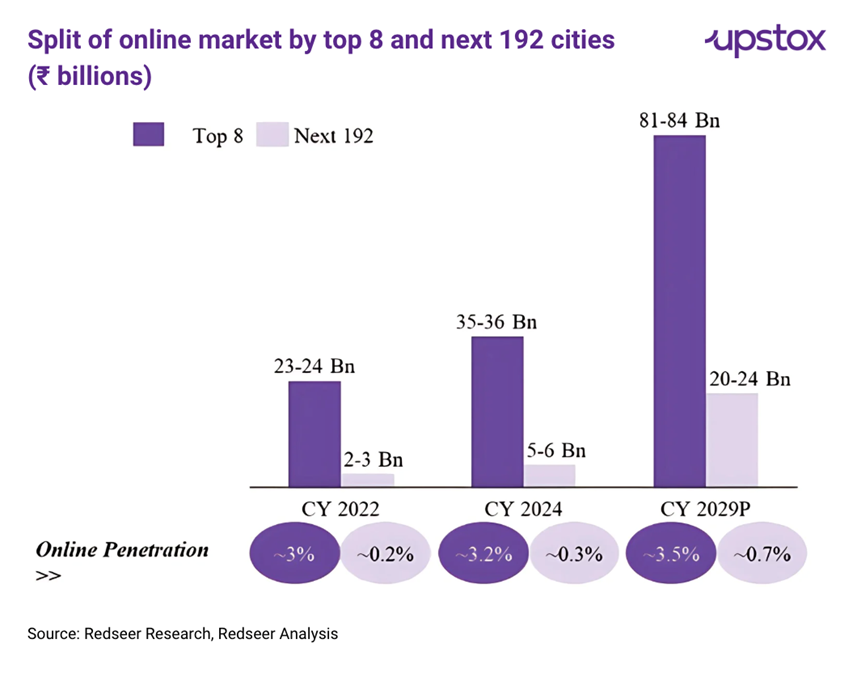

The online home services market in the top 8 cities is more developed, driven by factors like higher demand density, busier lifestyles, greater disposable incomes, and increased awareness of on-demand services. These cities see faster adoption due to a willingness to pay for quality, convenience, and reliable platforms.

India's online home services market has significant growth potential, with only 2% of households using these services in CY 2024, compared to 50% in the US and 21% in China.

Drivers of the home services market

Several key factors are contributing to the expansion of the home services market in India.

Rising incomes and a growing middle class

India's lower-middle- and middle-income households grew from ~170 million in CY 2022 to ~187 million in CY 2024. Meanwhile, upper-middle- and high-income households saw a 6% CAGR growth, while low-income households declined by 1%. By CY 2029, middle- and high-income households are expected to make up 76% of total households, up from 67% in CY 2024.

Share of households by annual income across India

| Income category | CY2022 | CY2024 | CY2029P |

|---|---|---|---|

| Total households | 326 million | 344 million | 370 million |

| ₹1.0 million+ | 41 (13%) | 45 (13%) | 64 (17%) |

| ₹0.5 - 1.0 million | 55 (17%) | 64 (19%) | 86 (23%) |

| ₹0.25 - 0.5 million | 115 (35%) | 123 (36%) | 132 (36%) |

| < ₹0.25 million | 115 (35%) | 112 (32%) | 88 (24%) |

Source: Redseer research and analysis

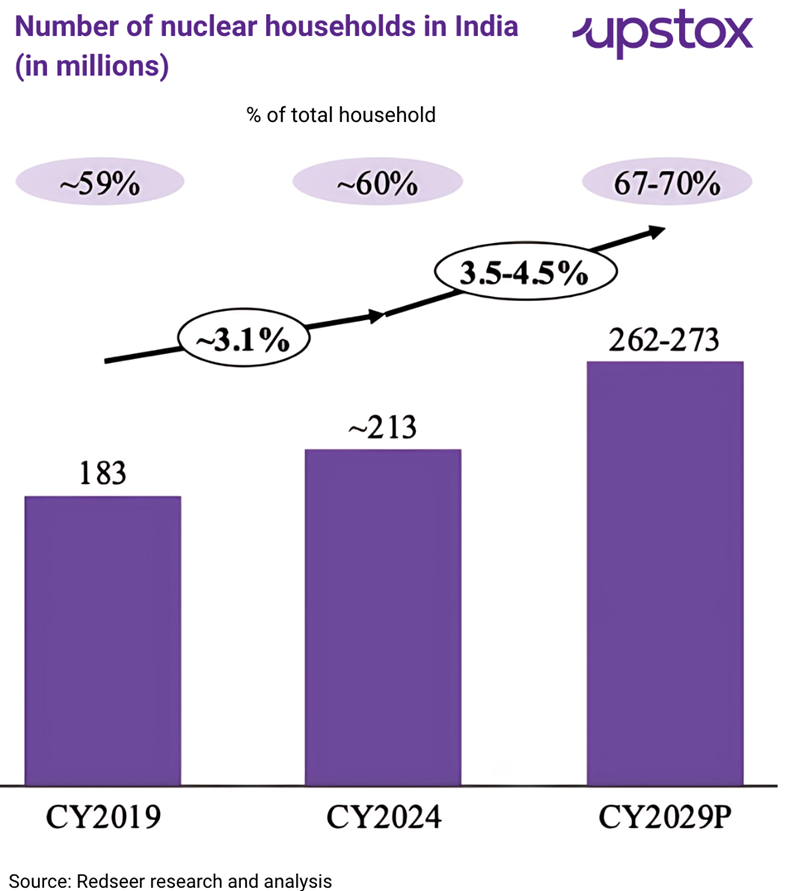

Increasing nuclear family units

The shift from joint to nuclear families is rising, particularly in urban areas. By CY 2029, nuclear households are expected to increase by 50-60 million. With both partners often working, there’s a growing demand for convenience-first solutions to ease household chores.

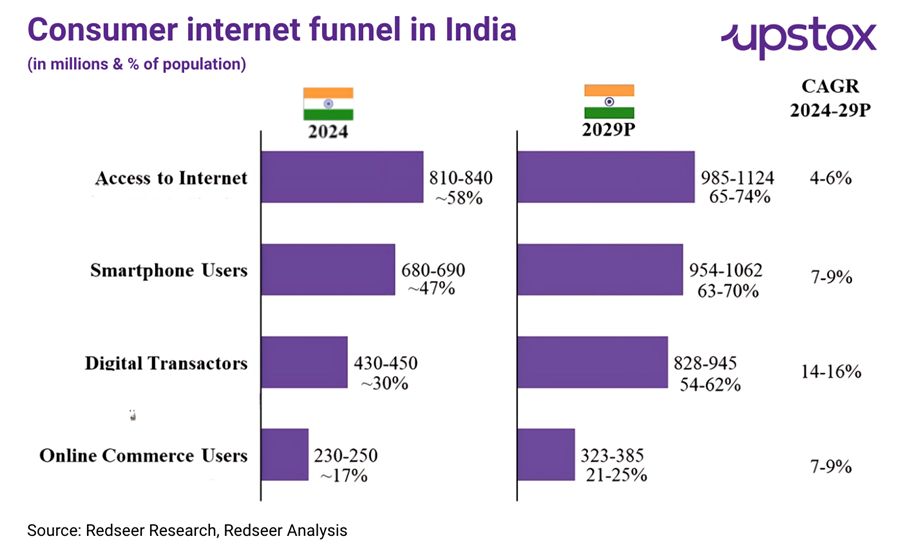

Rise of digital platforms and increased digital adoption

India's internet user base grew from 570-600 million in CY 2019 to 810-840 million in CY 2024, driven by UPI boom, 4G connectivity and initiatives like Digital India, expected to reach 985-1,124 million by CY 2029.

Demand for convenience

Busy urban lifestyles, increasing female workforce participation (from 23% in FY 2018 to 37% in FY 2023), and the rise of dual-income households are driving a strong demand for convenience. Consumers are increasingly prioritising services that save them time and effort, allowing them to focus on their careers and personal pursuits.

Synergy in home services and appliances

There is a strong potential for synergy between the home services and appliances sectors in India. Home services companies possess valuable insights into the product lifecycles and common repair patterns of appliances. This knowledge can be leveraged to inform the design and innovation of new appliances that are easier to maintain and have a lower total cost of ownership.

Global expansion for home services

Indian home service providers have a significant opportunity to expand their reach globally. The tech-based hyperlocal model successfully implemented in India has strong potential in international urban centers, particularly in countries with a substantial Indian diaspora and a "Do-it-for-me" culture.

Economies like Saudi Arabia (KSA), the United Arab Emirates (UAE), and Singapore present lucrative opportunities for expansion. The home service market in these three countries combined totals ₹1,955-2,025 billion (~$ 23.4 billion) as of CY2024 and is expected to grow at a CAGR of 9-10% until 2029.

These markets, characterised by high urbanization rates, expatriate-heavy populations, and high disposable incomes, showcase a growing demand for organized, professional home services. However, much like India, these regions often rely on fragmented service ecosystems dominated by informal providers, leading to inconsistencies in service quality, pricing, and accessibility.

| TAM (₹ billion) | CY2024 | CY2029P | CAGR |

|---|---|---|---|

| India | 5,070 | 8,350 | 10 – 11 % |

| KSA | 1,290 | 2,140 | 10 – 11 % |

| UAE | 390 | 550 | 7 – 8 % |

| Singapore | 340 | 475 | 6 – 7 % |

Source: Redseer

Threats and challenges

Despite the promising growth trajectory, the home services market in India faces several threats and challenges:

-

Macroeconomic conditions: The home services industry is sensitive to broader economic conditions, with potential negative impacts during economic slowdowns.

-

Competition: The entry of newer players and the expansion of offline organized players into the online space pose a threat, potentially leading to price wars and user/service professional churn.

-

Innovations in the industry: New innovations could potentially make existing services redundant if platforms fail to adapt.

-

Changing consumer preferences: Evolving consumer preferences, such as the demand for instant availability, require continuous adaptation, especially when expanding to Tier 2+ cities.

-

Rising labor costs and managing service professionals: Increases in labor costs can lead to higher pricing and potentially impact demand. Managing gig workers and addressing concerns about working conditions, compensation, and regulations are also challenges.

-

Maintaining service quality at scale: Ensuring consistent service quality as platforms expand is crucial for maintaining brand reputation.

-

Off-platform transactions: A decline in the value proposition for either customers or service professionals could lead to transactions bypassing the platform.

In conclusion

The home services market in India is on a strong growth path, driven by favorable demographics, increasing incomes, urbanization, and digital adoption.

While online full-stack platforms are well-positioned to capture a significant share of this growth by addressing the inefficiencies of the traditional market and offering superior convenience and reliability, they must also navigate intense competition, evolving consumer preferences, and operational challenges to realize their full potential.

The potential for synergy with the appliances sector and opportunities for global expansion further underscore the dynamic and promising future of the home services market in India

About The Author

Next Story