Upstox Originals

How consumer preferences are ‘driving’ SUV demand in India

.png)

6 min read | Updated on September 04, 2024, 16:36 IST

SUMMARY

The SUV market share has almost doubled from FY20 to FY24, reaching nearly 50%. In this article, we look at the factors driving demand and the listed players in that market segment.

As of FY24, the SUV segment accounts for 50 per cent of all passenger cars sold in India

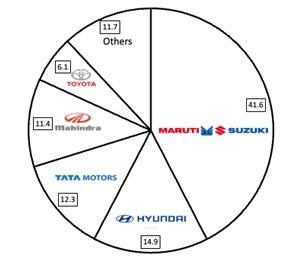

India is the third-largest automobile market in the world. From its current size of ~$100 bn in 2022, the market is projected to reach ~$220 bn by 2032, a CAGR of ~8%. This growth will be driven by factors like rising income levels, growing urbanisation, and wider product choice. The chart below presents the key players and their market share in the industry.

Market share of key players in the Indian automobile industry (%)

Source: Digit Insurance (as on sept ’23)

A key trend that has been prevalent for the past several years is the growing preference for SUVs. From the earlier days of Tata Sierra (launched in 1991) to the Tata Safari (1998) and Mahindra Scorpio (2002), the SUV market has come a long way.

Let’s have a more detailed look at that.

Growing craze for SUVs in India

SUVs, which were once seen to be expensive and niche, have grown in popularity as purchasing power has increased and smaller variants have become available. They currently dominate the Indian automotive market.

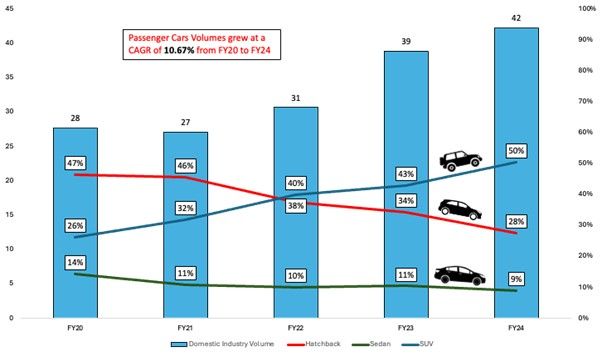

Over FY20-24, total domestic passenger vehicles (sedans, hatchbacks, SUVs and others) grew from ~28 lakh to 42 lakh units now (CAGR of ~11%). SUV sales outpaced them growing from ~9.6 lakh to ~22 lakh units (CAGR of 23%) over the same time period.

As of FY24, the SUV segment accounts for 50% of all passenger cars sold in India, exceeding hatchbacks (28%), and sedans (9%), and has been dropping in recent years.

Total domestic passenger car sales volume (in lakh units) & segment-wise market share (%)

Source: SIAM, Times of India; *rounded up numbers

Some of the key trends driving SUV demand

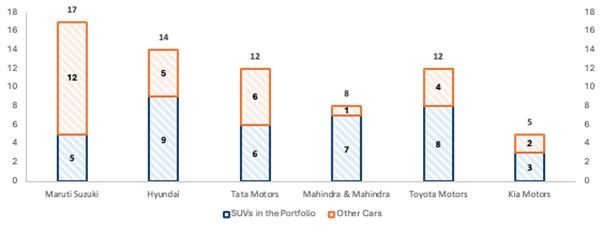

The chart below looks at the product split of key manufacturers. It indicates that for most of them, 50% or more of their portfolio consists of SUVs.

Portfolio split of key manufacturers (actuals)

Source: Carwale, Cardekho; *Note: Included compact SUVs and excluded MPVs & MUVs; latest available data

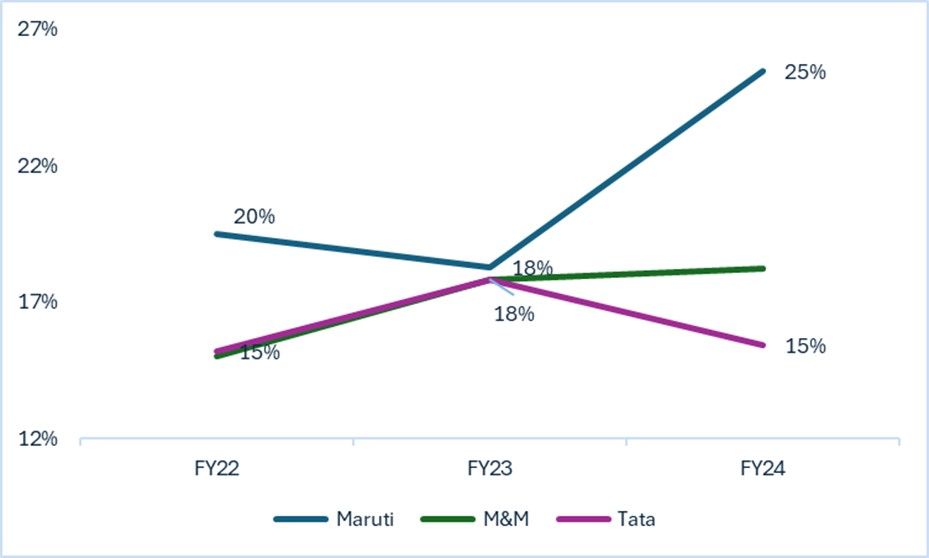

Taking it a step further, we also provide details of the trend in SUV market share of the three listed OEMs. We are restricted only to three years due to data access issues.

Market share of listed manufacturers in the UV segment (%).

Source: Company reports, Autocar, Press releases

How should investors think of this?

Market data and for that matter, a conversion among friends, will indicate that the SUV trend is still “hot”. For sure, there are more factors than SUVs that impact the price performance and profitability of companies. Factors such as safety, price-value proposition, and after-sales services are all key. That said, when it comes to buying a car, the product is one of the most superior drivers of decision-making. We also note that SUVs typically tend to be higher profit margin products for most OEMs.

As such, players with a wider and more appreciated SUV portfolio are likely to see gains in market share, which will impact their price performance as well. It will be vital for investors to recognize and be aware of these changes in consumer behaviour and keep a keen eye on how their portfolio companies will act in response to them in order to make better investment decisions.

Finally, for our readers who are car aficionados, below is a list of some of the most awaited SUVs.

| Manufacturer | Vehicle | Expected Launch* |

|---|---|---|

| Hyundai | Alcazar Facelift | Expected June 2024 |

| Hyundai | Creta EV | Expected September 2024 |

| Hyundai | New Santa Fe | Expected September 2024 |

| Hyundai | Tucson Facelift | Expected November 2024 |

| Hyundai | Palisade | Expected July 2025 |

| Tata Motors | Harrier EV | Expected September 2024 |

| Tata Motors | Nexon Fearless 1.2 CNG | Expected October 2024 |

| Tata Motors | Curvv EV | Expected October 2024 |

| Tata Motors | Curvv | Expected December 2024 |

| Tata Motors | Punch Facelift | Expected November 2024 |

| Tata Motors | Safari EV | Expected January 2025 |

| Tata Motors | Sierra EV | Expected May 2025 |

| Mahindra & Mahindra | XUV 3XO | Launched Recently |

| Mahindra & Mahindra | Five Door Thar | Expected August 2024 |

| Mahindra & Mahindra | XUV.e8 | Expected December 2024 |

| Mahindra & Mahindra | XUV.e9 | Expected April 2025 |

| Mahindra & Mahindra | BE.05 | Expected October 2025 |

| Mahindra & Mahindra | Thar.e | Expected March 2026 |

| Mahindra & Mahindra | Global Pik Up | Expected September 2026 |

| Mahindra & Mahindra | BE.07 | Expected October 2026 |

| Mahindra & Mahindra | BE.09 | Expected June 2027 |

| Toyota Motors | BZ4X | Expected April 2025 |

| Kia Motors | Clavis | Expected December 2024 |

| Kia Motors | EV9 | Expected December 2024 |

| Kia Motors | EV5 | Expected June 2025 |

Source: Press release, news articles; *Expected launch dates are subject to change

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story