Upstox Originals

China's tech powerhouse: The Tencent rise

.png)

6 min read | Updated on August 13, 2024, 20:24 IST

SUMMARY

This company is responsible for some of the most popular games played by today’s youth. From Fortnite to Clash of Clans, it owns it all. Its social media applications have millions of active users, in some cases outpacing global platforms like Telegram. We are of course speaking on Tencent - the company with a market share of ~20% in the global gaming industry.

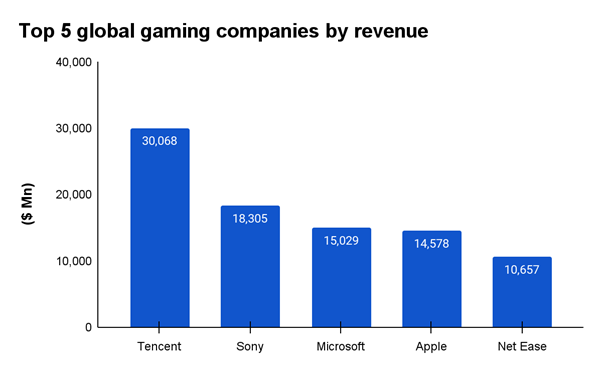

Tencent is a leader in the global gaming business

The company's roots lie in instant messaging with the launch of Quick Question(QQ) in 1999. The application currently also remains widely used with a Monthly Active User (MAU) base of ~554 million (more than Telegram). However, it was WeChat that truly catapulted Tencent into the stratosphere.

What began as a platform for simple text became a sprawling ecosystem encompassing news, social media, ride-hailing, e-commerce, and even financial services.

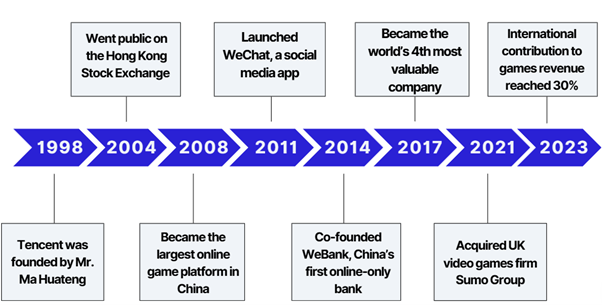

The following chart outlines Tencent's key milestones.

Source: Technology Magazine

Business segments

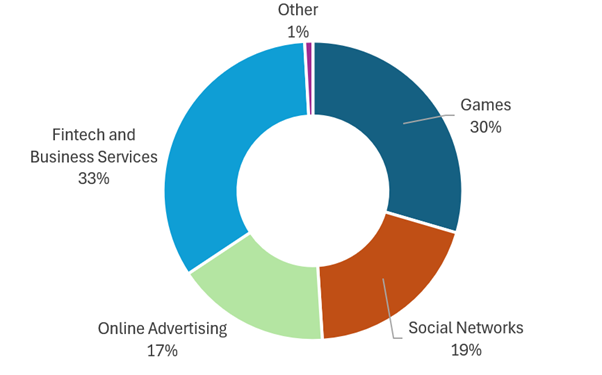

The chart below provides a revenue split for 2023. As can be seen, from a traditional gaming and social network business, it has branched to a conglomerate that operates across multiple segments.

2023 revenue split

Source: Annual report

Source: Annual reportIn this article, we dive into the gaming and social media business that has made Tencent into the major global player that it is

The gaming empire

Recognizing the potential beyond messaging, Tencent diversified into online gaming, which has reaped robust returns. As of 2023, Tencent holds ~20% market share in the list of top 25 global gaming companies, cementing its position as the world's largest gaming company by revenue. It is almost 2x its closest competitor

Source: Newzoo

Tencent's gaming division achieved remarkable growth over the past decade, expanding at a CAGR of 19%. Tencent witnessed an increase in the number of "major hit games" in China, with each title garnering an average quarterly DAU exceeding 5 million on mobile or 2 million on PC.

Summary of Tencent’s hit games

Source: Business of Apps, mobile marketing reads

Source: Business of Apps, mobile marketing readsTencent's approach to building its gaming empire has been largely through strategic acquisitions and investments. Some of the most significant moves include:

| Year | Studio | % owned | Acquisition value ($ million) | Rationale |

|---|---|---|---|---|

| 2011 | Riot games | 100% | 350 - 400 | Control of the immensely popular "League of Legends" |

| 2012 | Epic games | 40% | 330 | To gain access to the Unreal Engine and later, the global phenomenon "Fortnite” |

| 2016 | Supercell | 84.3% | 8,600 | To add mobile hits like "Clash of Clans" and "Clash Royale" to its portfolio |

| 2020 | Funcom | 100% | 148 | To acquire intellectual property |

| 2021 | Leyou | 100% | 1,500 | To acquire valuable game franchises like “Warfare” |

| 2021 | Sumo Group | 8.75% | 1,270 | Development expertise for its high-quality work on titles like "Sackboy" |

Source: Polygon

Social networks: WeChat and Beyond

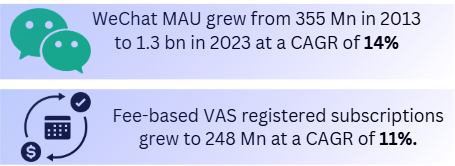

Tencent's social network segment, primarily driven by WeChat (known as Weixin in China), has been a key growth driver. WeChat has evolved from a simple messaging app to a super-app ecosystem.

WeChat Mini Programs Launched in 2017, Mini Programs allow third-party services to operate within WeChat, creating a vast ecosystem of apps within the app. By 2023, over 1 million mini-programs were covering various services from e-commerce to government services.

WeChat Pay Integrated seamlessly into WeChat, this payment service has become one of China's dominant mobile payment platforms, processing over 1 billion daily commercial transactions.

Impressive social network reach

Source: Business of Apps, mobile marketing reads

Management profile

Tencent's ascent to a global tech giant is undeniably linked to the vision and leadership of its key executives.

| Key executives | Position |

|---|---|

| Ma Huateng | Co-founder, chairman and CEO |

| Martin Lau | President and Executive director |

| James Mitchell | CSO and Senior Executive Vice President |

| Ren Yuxin | COO and Executive Vice President |

| Zhang Xiaolong | President of Weixin Group |

Source: Company reports

Financial and market performance

The company has delivered an impressive revenue CAGR of ~26% over the past 10 years. What makes this noteworthy is the fact this growth has been driven by each of its key segments.

Tencent's financial performance over the past decade

| Business Segment | 2013 (RMB million) | 2023 (RMB million) | CAGR (%) |

|---|---|---|---|

| VAS (Value Added Service) | 44,985 | 2,98,375 | 20.8 |

| -Games | 31,966 | 179,860 | 18.9 |

| -Social Networks | 13,019 | 118,515 | 24.7 |

| Online Advertising | 5,034 | 1,01,482 | 35.0 |

| Fintech and Business Services | 9,796 | 203,763 | 35.5 |

| Other | 622 | 5,395 | 24.1 |

| Total | 60,437 | 6,09,015 | 25.9 |

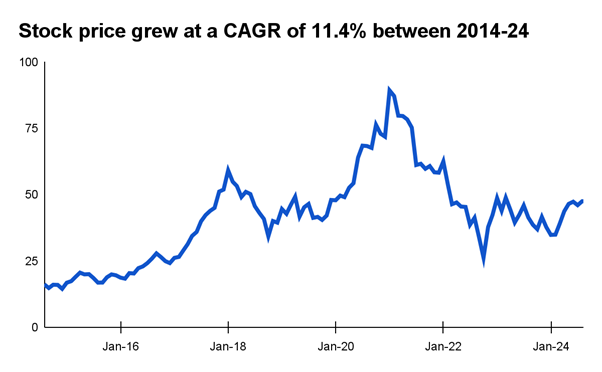

Market performance

Source: Yahoo Finance

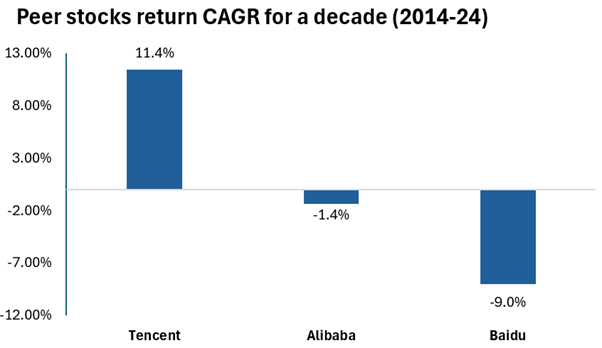

Looking at the peers of Tencent, it is visible that Tencent has outperformed its competitors. In the last 10 years, a substantial rise in its stock price can be seen.

When compared to its peers, it has delivered a staggering outperformance, as seen below. Please note, that the companies below are not their exact peers/competitors. These companies however are Chinese conglomerates that have made a global impact.

Source: Trading View

Recent challenges

Let’s examine the headwinds it’s facing now and the strategies it's implementing to weather the storm.

| Recent challenges | Strategies |

|---|---|

| In 2021 the Chinese government started tightening regulations on the tech industry, which led to a freeze on new game approvals. | Emphasized streamlining operations, cost reduction, and strategic divestments by focusing more on core business They closed non-core businesses like online education, e-commerce, and game live-streaming |

| Increasing competition in gaming | Focus on integrating AI model into business operations |

| Falling short with new game launches | Emphasizing efficiency over rapid AI product development |

| WeChat platform aging | Exploring new growth opportunities within WeChat |

Source: US News

Conclusion

Tencent's meteoric rise, propelled by gaming hits like League of Legends, Fortnite, and Honor of Kings, offers invaluable lessons for investors. Central to its success are three key strategies:

-

Diversification: Expanding beyond its core competency into gaming, fintech, and other sectors has fortified Tencent's resilience and fuelled growth.

-

Strategic investments: The company's astute investments in promising startups have yielded significant returns, demonstrating the power of strategic capital allocation.

-

Ecosystem integration: By creating a tightly integrated ecosystem of services, Tencent has maximized user engagement and monetization opportunities.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story