Upstox Originals

Chai still rules, but could Matcha be India’s next big sip?

7 min read | Updated on September 23, 2025, 12:42 IST

SUMMARY

What is tea in India, if not a ritual, a livelihood, and part of daily life? While masala and black teas still rule kitchens and streets, a new green contender, matcha, is quietly making its mark in cafés and online stores. Is it here to replace chai? Not at all. It’s a premium twist, adding a fresh layer to India’s timeless tea story.

Tea exports have inched up from $852 million in FY24 to nearly $900 million in FY25

If there’s one thing that binds most Indians, it’s a hot cup of chai. And it’s not just about taste or habit, it’s also big business.

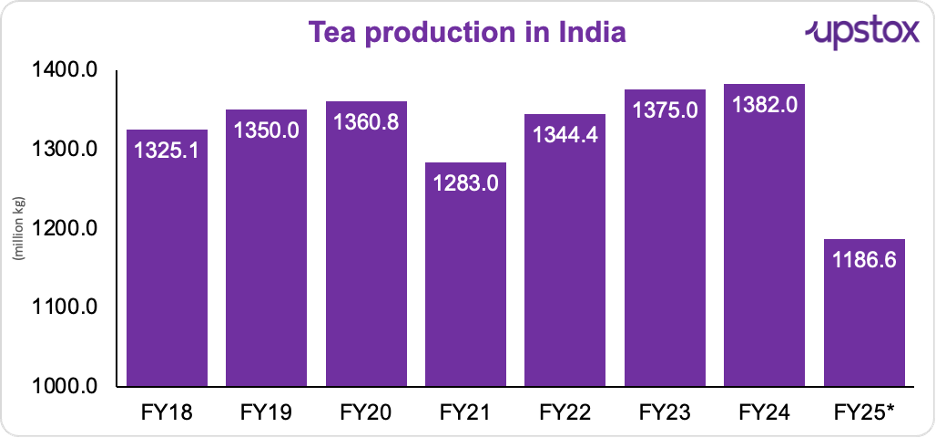

India is the second-largest producer of tea in the world, cultivating over 6.2 lakh hectares of land for it. In FY24 alone, the country produced 1,382 million kilograms of tea, a slight uptick from the year before. And by December FY25, we’d already clocked 1,186 million kgs.

What’s more? Indians love their own brew. Nearly 80% of the tea grown here never leaves the country; it’s consumed domestically.

As for where it all comes from, the Assam Valley and Cachar dominate the map up north, while Dooars, Terai, and Darjeeling keep West Bengal’s legacy alive. Down south, states like Tamil Nadu, Kerala, and Karnataka pitch in too, accounting for about 17% of the country’s total production. So yeah, whether it’s your ₹10 cutting chai or a fancy Darjeeling blend, India’s tea story is as much about scale as it is about tradition.

Source: IBEF *Data until Dec 2024

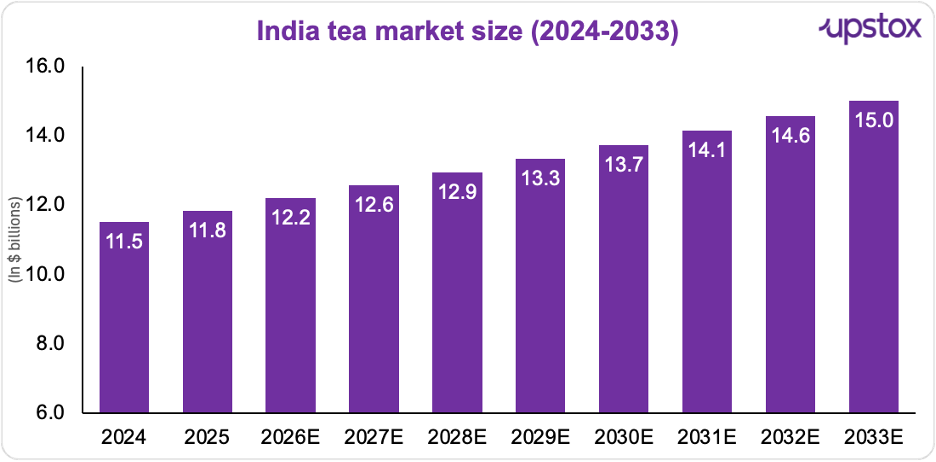

Now, let’s talk about the market size:

Source: IBEF *Data until Dec 2024

Here’s the interesting bit: India is one of the world’s largest producers, and exports have inched up from $852 million in FY24 to nearly $900 million in FY25, supported by the country’s reputation for high-quality leaves.

That said, tea producers aren’t without challenges. The greenfly infestation in Assam and West Bengal has hurt yields, sometimes cutting output by as much as 11–55% in affected gardens. Add to that the fact that labour makes up nearly 70% of production costs, and you’ll see why estates often operate on thin margins.

Still, tea continues to be India’s comfort drink, deeply woven into culture, daily habits, and even our export story.

Why tea has stayed undisputed

Now, you must be wondering why tea has stayed undisputed? Because other drinks too, have tried to claim a spot in India’s beverage story.

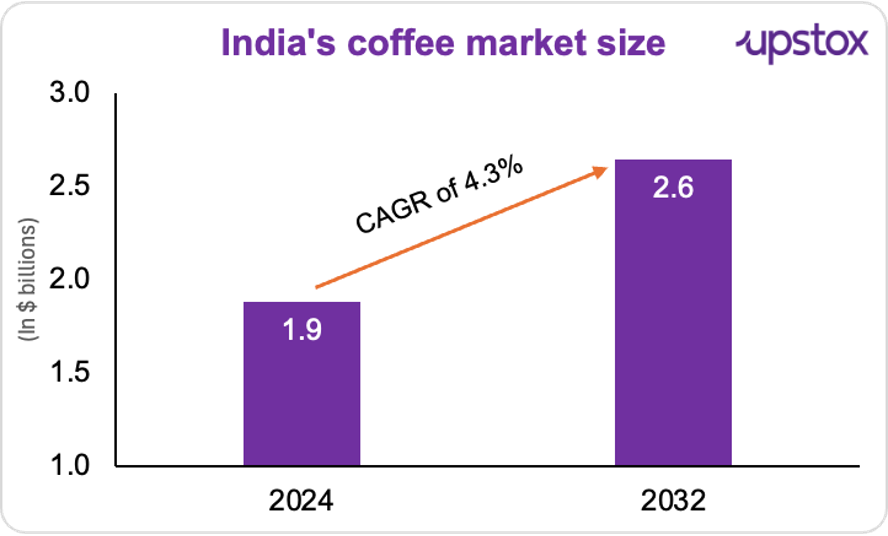

Let’s talk Coffee. Arrived with colonial plantations in the 17th century and has grown steadily since. Today, India even ranks among the top 10 coffee producers worldwide, with thriving estates in Karnataka, Kerala, and Tamil Nadu.

Source: Zion market research

But India’s coffee market still trails tea.

Sure, cafés are everywhere and cold brews look great on Instagram. But coffee never beats chai.

And the numbers prove it, India’s tea market stood at $11.5 billion in 2024, nearly 6x bigger than coffee’s $1.8 billion. We also drink over 1.1 billion kg of tea every year, compared to roughly 135,000 tonnes of coffee. Coffee is aspirational. Tea is habitual. And that’s why it still dominates our cups.

While chai holds its fort, another green powder is starting to catch attention in Indian cafes and e-commerce shelves alike, Matcha.

The Matcha moment

Matcha’s story begins in Japan over 900 years ago, when a Buddhist monk brought powdered tea from China. Ever since, it’s been central to Zen philosophy and tea ceremonies, celebrated for its health benefits that exceed regular green tea.

But what exactly is matcha?

It’s a finely ground powder made from shade-grown green tea leaves. Unlike regular green tea, where you steep the leaves and toss them, with matcha you consume the whole leaf, which is why it’s packed with antioxidants, caffeine, and that bright green color. In India, the journey is much newer; the first homegrown matcha came from an Upper Assam tea garden in 2016. While it still trails the finesse of Japanese matcha, it marked the first step toward local adoption.

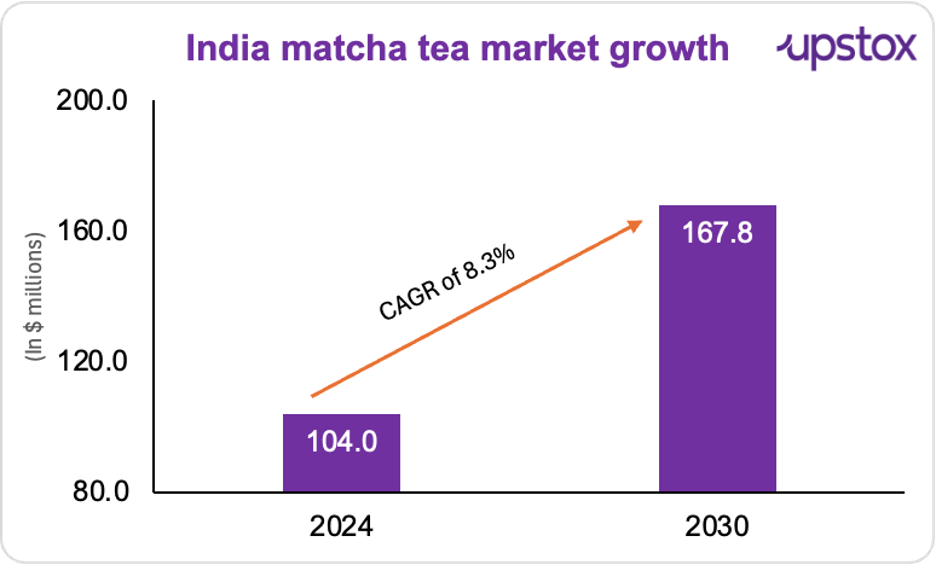

Source: IMAARC group

So, what’s driving matcha’s surge in India today?

Café culture: the new aspirational sip

Walk into Starbucks, Third Wave Coffee, or Blue Tokai, and you’ll spot matcha lattes on the menu. Priced at ₹250–400 a cup, they’ve turned into premium indulgences. Much like cappuccinos in the 2000s, they now double up as a social signal of global taste.

Digital buzz: online-first adoption

Matcha is riding on India’s D2C wave. In 2024, 41% of its sales came from online channels, driven by brands like Kimino, Matcha Maiden, and Tea Trunk. Add to that Instagram reels, influencer shoutouts, and 15M+ global #matcha posts, and you’ve got a digital-first beverage trend.

Global push: Japan’s green gold

Between 2014 and 2024, matcha production in Japan shot up by 185%. Nearly half of it is now exported, with the US, China, and India emerging as major growth markets.

Product expansion: beyond tea

In India, the powdered form already accounts for 53.75% of matcha’s revenue share (2024). But it isn’t just about lattes anymore, think ice creams, cookies, smoothies, protein bars, and even health supplements. The instant premix segment is expanding the fastest, thanks to its appeal among convenience seekers and first-time buyers.

Comparison at a glance..

| Metric | Indian Tea | Matcha |

|---|---|---|

| CAGR (2024 - 2030) | ~3.0% | ~8.3% , small but growing fast |

| Consumption | 80% of Indian households drink it daily | Mostly urban Gen Z & millennials; café-goers & health-conscious buyers |

| Price point | ₹10–₹30 for roadside chai; ₹100+ for premium blends | ₹250–₹400 per café latte; ₹500–₹1,200 per 30g pack online |

| Employment | 1.2 million+ workers directly in India | Limited local jobs; mostly retail & D2C activity |

| Exports | $900 mn in FY25, led by Assam & Darjeeling teas | Japan exports nearly 50% of its matcha; India a small but growing buyer |

| Production | 1,382 mn kgs in FY24; Assam, WB, South India dominate | India’s first local matcha in 2016 (Upper Assam); still niche |

| Opportunities | Room to grow per capita use; premium exports | Rising café culture, D2C push, local cultivation potential |

But here’s the real question: will matcha be different?

Other premium drinks, from bubble tea to Ceylon tea to imported cold brews, tried entering India. They created buzz in metros but stayed niche, unable to cut through India’s price sensitivity and chai-first culture.

Take bubble tea from Taiwan. It entered India in 2016–17 with brands like Dr. Bubbles, Gong Cha, Tea Trails, and Chatime. It’s grown in metros like Mumbai, Delhi, and Bangalore, popular with Gen Z for its colourful drinks and chewy tapioca pearls. But with prices of ₹200–400 per cup and a sugary profile, a 500 ml serving packs 250–400 calories, it remains café-centric, not mainstream.

So what makes matcha different? Two things:

It’s still tea. Unlike kombucha or kefir, matcha has a natural bridge to India’s tea culture, even if premium and powdered. Wellness + status. Matcha has 137x more EGCG antioxidants than regular green tea, giving it stronger health appeal. Add its global lifestyle pull, and it looks more like a premium upgrade than a fad.

The takeaway

So, is matcha going to replace Indian tea? Not really. Think of it more like an upgrade, urban consumers get a healthy twist, while masala and black tea continue to rule the teacup.

India is already testing the waters. The Tea Research Association (TRA) has a decaf green tea powder from Assam’s elite clones TV 9, 11, and 12. It has 75% less caffeine and plenty of antioxidants, a product that can compete in the global matcha scene without threatening traditional Indian tea.

Here’s the catch: China spends ₹110 crores on tea research every year. India? Just ₹30 crores. More investment could help India improve quality, tap into high-value segments like matcha, and push exports. Essentially, matcha is a growth opportunity, not a replacement.

Matcha adds a new layer to India’s tea story. With some smart moves, India can capture new markets, boost exports, and reinforce its spot as a global tea powerhouse.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story