Upstox Originals

Can India become a global leader in electronics manufacturing?

11 min read | Updated on July 23, 2025, 13:18 IST

SUMMARY

India’s electronics production is estimated to reach $282-500 billion by 2030. But how exactly does India plan to reach this ambitious number? And, does it have the required ecosystem to get there? Are there any obstacles in this journey? Let’s get into the exciting story of what’s brewing in India’s electronics manufacturing sector!

Electronics is a $4.3 trillion global market

From the smartphone in our hands to the smartwatch on our wrists, from the car we drive to the appliances in our homes, electronics power almost everything in our daily lives. Without them, it would be practically impossible to get through our day!

That is how much we are dependent on electronics.

No wonder, it is a $4.3 trillion global market.

But do you know how much India’s share is in the global electronics market?

According to the Economic Survey 2025, India's share in the global electronics market is just about 4%. The market is dominated by China, the US, Taiwan, South Korea, Vietnam, and Malaysia.

The reason? Until now, India has largely focused on assembling electronic components instead of designing and manufacturing them.

But that does not mean India’s electronics market is doomed. On the contrary, India’s electronics market is showing remarkable growth. And it is now focusing even on domestic production and exports.

India’s electronics market (value in ₹ lakh crore)

| FY21-22 | FY22-23 | FY23-24 | FY24-25 | |

|---|---|---|---|---|

| Production | 6.41 | 8.25 | 9.52 | 11.00 |

| Exports | 1.17 | 1.90 | 2.41 | 3.25 |

| Imports | 5.50 | 6.21 | 7.28 | ~8.18 |

Source: MeitY Annual Report and PIB

The domestic production of electronic goods has nearly doubled from ₹6.41 lakh crore in FY21-22 to ₹11 lakh crore in FY24-25, at a 20% CAGR. Similarly, exports have almost tripled from ₹1.17 lakh crore in FY21-22 to ₹3.25 lakh crore in FY24-25, at a 41% CAGR. Further, imports have increased from ₹5.50 lakh crore in FY21-22 to ₹7.28 lakh crore in FY23-24, at a 15% CAGR.

This is a tremendous achievement because until 2016, India imported more electronics than it produced. But now the story has flipped. According to the FY23-24 numbers, the local production is about 24% higher than imports.

India is not only witnessing strong growth but is also becoming a top choice for global electronics manufacturing and exports. In FY24-25, electronics moved up from the fifth-largest to the third-largest export category.

Top 10 export categories from India in FY24-25

| Category | % of total exports |

|---|---|

| Mineral fuels, oils, distillation products | 31% |

| Pearls, precious stones, metals, coins | 13% |

| Electrical, electronic equipment | 12% |

| Machinery, nuclear reactors, boilers | 8.7% |

| Organic chemicals | 3.7% |

| Plastics | 3.1% |

| Iron and steel | 2.5% |

| Animal, vegetable fats and oils, cleavage products | 2.4% |

| Optical, photo, technical, medical apparatus | 1.9% |

Source: Comtrade

According to an Axis Capital report, value addition in electronics manufacturing has significantly increased from 30% to around 70%, and is projected to reach 90% by FY26-27.

And that’s not all.

Research reports and government projections further indicate huge growth in domestic production. According to a PwC report, India’s electronics production will surge to $282-500 billion by 2030. As per a MeitY report, India’s electronics production is expected to reach $300 billion by 2026. To better understand India’s electronics landscape, let us deep dive into individual segments.

Current market position and growth trajectory

Smartphones

The smartphone segment leads India's electronics manufacturing achievements. India is now the world’s 2nd largest mobile manufacturing / assembling country. According to official estimates, 99.2% of mobile phones sold in India are now made within the country.

This reflects India’s expertise in intricate assembly processes and sets the stage for more advanced manufacturing. The country is already manufacturing critical mobile components like chargers, battery packs, camera modules, display assemblies, microphones and speakers.

A few years ago, India imported ₹300 billion worth of mobile PCBAs (printed circuit board assemblies), but in FY23-24, that number dropped to zero.

Exports tell a similar story.

India is not just showing a strong focus on reducing reliance on imports and boosting domestic manufacturing; it is also doubling down on exports. Today, smartphones are among the top exported goods out of India.

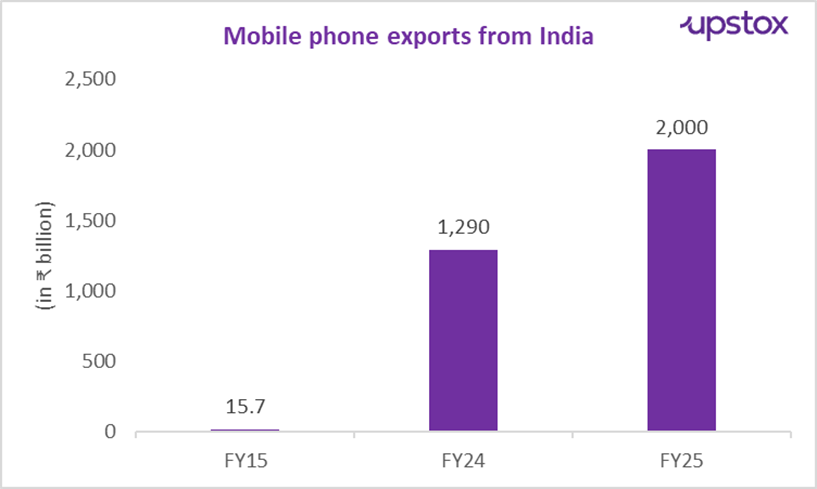

The numbers are even more impressive—mobile phone exports from India, which were a mere ₹15.7 billion in FY14-15, have now crossed an all-time high of ₹2,000 billion in FY24-25. That’s a 128x growth in a decade.

Source: PIB and MoneyControl

But here’s the real kicker.

India is on the path to becoming a global smartphone factory, with big global players like Apple and Samsung increasingly showing trust in India’s electronics manufacturing capabilities and moving their factories to India.

Today, India manufactures approximately 25% of Samsung’s global smartphones and around 15% of Apple’s iPhones. In fact, Apple plans to double this number in the near future.

Semiconductors

Semiconductors are an integral part of modern electronics. The semiconductor industry in India is rapidly growing. According to the India Electronics and Semiconductor Association (IESA), India's semiconductor market is projected to grow 13% annually, from $52 billion in 2024 to $103.4 billion by 2030.

And by the end of 2025, India will also have its first ‘Made in India’ semiconductor chip rolled out.

India is positioning itself as a key player in this critical sector by developing its semiconductor ecosystem, from chip design to fabrication, research and partnerships with global semiconductor giants.

The government has also approved six semiconductor manufacturing projects under the Semicon India Program with a combined investment of around ₹1.56 lakh crore.

Also read: Chipping in: India's journey to Semiconductor self-reliance

White goods

The white goods industry in India (comprising large household appliances) is also progressing. With the government’s PLI scheme, the domestic value addition in the industry is expected to grow from 15-20% to 75-80% in the next 5 years.

If you look at the Air Conditioner market, India has significantly cut down its import of fully built air conditioners to 5% in FY24-25 from 35% in FY18-19. India is now manufacturing key components like compressors, copper tubes and aluminium coils.

In FY23-24, India imported around 8.5 million RAC compressors, but within the next 2-3 years, we can expect them to be manufactured locally.

Automotive electronics

India’s automotive electronics market (comprising electronic systems used in vehicles) is also experiencing strong growth, driven by rising demand for electric vehicles (EVs) and advanced automotive systems.

The automotive electronics market is currently valued at around $11.2 billion and is projected to grow to $74 billion by FY31-32.

What is driving growth in India’s electronics manufacturing?

Global supply-chain shift

The global electronics industry is undergoing supply chain realignment. This has positioned India as a major global manufacturing hub. Many big international electronics manufacturers are moving their outsourced manufacturing operations from China to India to achieve greater supply chain diversification.

Besides, India also finds itself in a beneficial spot amid the US-China tariff war. Several US companies are now turning towards India because of its low-cost advantage and developed ecosystem.

Supportive government policies

A major catalyst behind the growth of the electronics sector is the government’s proactive policy framework. Initiatives such as Production Linked Incentive (PLI) Scheme, Electronics Manufacturing Cluster (EMC) Scheme, Electronics Component Manufacturing Scheme (ECMS), Phased Manufacturing Program (PMP), and Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) have attracted both domestic and foreign investments for manufacturers of smartphones, semiconductors, and other electronic components.

Under the PLI scheme alone, the budget allocated to electronics went up from ₹5,747 crore in FY24-25 to ₹8,885 crore in FY25-26.

Additionally, under the ECMS, the government has allocated ₹22,919 crore to broaden the electronics manufacturing ecosystem in India.

These policy initiatives offset the cost disadvantage and promote domestic manufacturing of key components such as PCBAs, displays, batteries and enclosures.

Infrastructure development

Another reason for India gaining a strong foothold in the electronics sector is its strategic approach to developing manufacturing infrastructure. The establishment of EMCs and Special Economic Zones in states like Karnataka, Tamil Nadu and Uttar Pradesh has provided stellar infrastructure that facilitates electronics manufacturing and ensures operational efficiency and scalability.

What further complements these manufacturing zones is the development of a comprehensive logistical network, which includes road network expansion, port modernisation, and the establishment of designated freight corridors.

These infrastructure developments strengthen India’s domestic production and distribution capabilities and improve export capacity.

Talent development

The electronics industry is well-supported by a strong technical talent pool that comprises over 2.14 million STEM graduates annually. Not only that, India also has premium educational institutions that develop the country’s diverse talent ecosystem.

Besides, initiatives like the establishment of the Electronics Sector Skills Council of India (ESSCI) help impart industry-specific knowledge that aligns with industry needs and improve workforce readiness for high-tech roles, especially in engineering and advanced manufacturing sectors.

So, if India is on a promising growth trajectory, what’s the problem, you ask?

While India is well on its way to becoming an electronics manufacturing and export hub, there are some challenges along the journey.

Challenges that could hinder the growth

Limited R&D investment

The biggest reason why India lags in advanced manufacturing capabilities is due to limited R&D investment. India spends a mere 0.64% of its GDP on R&D — far behind China’s 2.6%, Germany’s 3.1% and South Korea’s 4.9%.

Weak technological foundation

Another issue is India’s weak technological foundation. Let’s accept it—at the moment, India neither has high-end R&D facilities, nor does it have an indigenous innovation culture required for state-of-the-art electronics.

While it is working on building the research, infrastructure and the deep tech ecosystem required for advanced manufacturing, it will take some time.

Engineering complexity

Components are the DNA of electronics. But India largely sources them from China, Taiwan and Korea. Surprisingly, 85-90% of the electronic component value is still imported.

Buy why? Simply because manufacturing components is a complex business. It requires advanced materials science capabilities, precision control at the nanometer scale and highly specialised machinery. And, India still does not have the required capabilities.

Just to give you a perspective, a single smartphone requires putting together around 500 components to make it a fully functional device. Each of these 500 components is like a mini system in itself that further has multiple components within it. That is the level of engineering India needs to work on!

Cost deficit

Another problem is the high cost of domestically manufacturing critical components like PCBs, advanced displays and sensors. The manufacturing cost in India is 10-20% higher compared to countries like China, Vietnam and Mexico. For context, there is a 10-14% cost deficit for assembly and 14-18% for components compared to China.

Having said that, government policy initiatives are working towards offsetting these cost disadvantages and promoting domestic manufacturing.

China’s rare-earth magnet export curbs

Recently, there has been another major challenge looming over India’s electronics industry. Amid the ongoing trade war, China has restricted the export of rare earth magnets to India, among other nations. The magnets are a key input in consumer electronics and automotive products.

For context, an electric vehicle needs 1–2 kgs of these magnets. Overall, rare-earth magnets account for up to 40% of the total manufacturing cost of electronic goods.

China controls 92% of global rare-earth magnet production, making it a major player in the supply chain. And India imports nearly 100% of its magnet requirement from China.

Now with the restricted supply, even if India looks at alternate sources like Japan, the European Union and the US, they are 2-3 times more expensive and fail to meet India's rising demand.

But is India doing something to tackle this issue? That’s for our next story!

Will India’s electronics industry power its economic growth? India's electronics manufacturing sector is well-positioned to capture global opportunities. With a robust policy backing, significant technology investments, strategic infrastructure development and comprehensive skill development programmes, India’s electronics manufacturing industry is set to thrive as a cornerstone of India's economic growth.

For now, all we can say is that India has successfully run the first lap of the 4x400 relay race, but there’s more ground to cover before it can emerge as a global electronics manufacturing hub.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story