Upstox Originals

Can FD-backed cards help lower credit stress?

7 min read | Updated on October 07, 2025, 17:35 IST

SUMMARY

Swipe, tap, repeat - that’s India’s credit card story, with ₹2.91 lakh crore in outstanding dues and 11.2 crore cards in circulation as of July 2025. Banks and fintechs are scrambling to manage risk while still expanding access. The solution? FD-backed credit cards, low-limit, secured credit cards that let first-time borrowers build a credit score safely. Could they be India’s “credit passport” for millions of credit-invisible citizens?

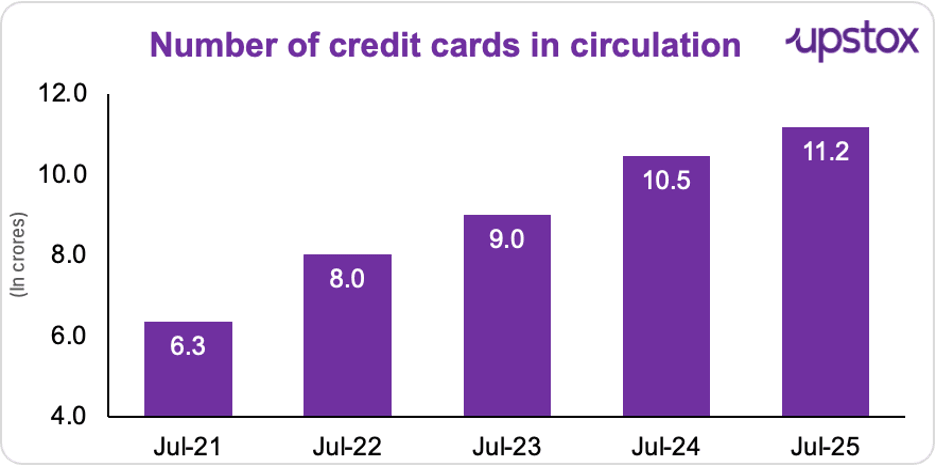

Active credit cards have skyrocketed to 11.2 crore, up from 6.3 crore in July 2021

India is swiping like never before. Outstanding dues are climbing, NPAs are rising, and the fix? FD-backed credit cards, growing faster than ever. Let us understand the story in numbers. Active credit cards have skyrocketed to 11.2 crore, up from 6.3 crore in July 2021, a 76% jump in just four years. And it’s not just about owning more plastic: people are spending more on them too. Average dues per card have climbed from ₹20,900 to ₹26,100, a 25% increase over the same period.

Source: RBI

Sounds interesting, right?

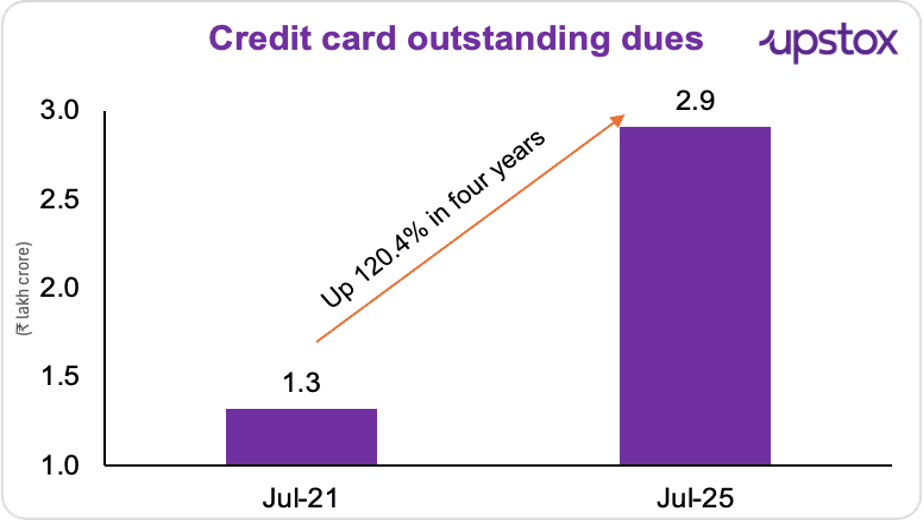

But here’s the catch, people aren’t paying back fast enough. Most of the stress is building up in the 91–180 day overdue bucket, and that alone is nearly ₹30,000 crore. Simply put, Indians are swiping more than ever, but repayments are falling behind. And if you look at the numbers, the story gets clearer, credit card outstanding dues have shot up by 120% in just four years, touching ₹2.9 lakh crore by July 2025.

Source: RBI

Now here’s why banks are getting the jitters.

In just one year, between December 2023 and December 2024, gross NPAs on credit cards shot up by ₹1,500 crore, from ₹5,250 crore to ₹6,742 crore. Why? People are swiping more, but repaying lesser, whether it’s because of job losses, overspending, or those killer interest rates that can top 40% a year.

And the share of bad loans is creeping up too. NPAs now make up 2.3% of all credit card loans (₹2.92 lakh crore outstanding as of December 2024), compared to 2.06% a year earlier.

And that’s exactly why banks and fintechs are looking for safer ways to lend. They don’t want credit card NPAs to balloon further. So what’s the fix on the table?

FD-backed credit cards.

This one needs a safety net. You park some money (like in a fixed deposit), and the bank gives you a card with a limit linked to that amount.

And FD-backed credit cards? You simply open a small FD, get a credit card against it, and start spending. For new-to-credit users, this is often their very first swipe, a safe, low-risk way to enter the formal credit system.

What’s in it for everyone?

For you, the appeal is simple.

You don’t need a credit history or a fancy salary slip to get started. Even a tiny fixed deposit, as low as ₹2,000, can get you a card. Some banks even set limits as small as ₹90, just enough to help you make your first digital payment and start building a credit trail. And your FD doesn’t sit idle, it keeps earning interest while you spend.

Every on-time payment quietly polishes your credit score, preparing you for bigger loans down the road, whether that’s a personal loan, a car, or even a home someday.

For banks, it’s a no-brainer... Let us understand:

-

Risk? What risk? Since the credit line is secured by the fixed deposit, the chance of loss is almost zero. If someone defaults, the bank simply recovers the amount from the FD.

-

The perfect customer funnel A customer who starts with a ₹2,000 FD card today could be taking a home loan in five years. Banks get to build trust, track repayment behaviour, and cross-sell more products. FD-Backed Card → Regular Card → Personal Loan → Home Loan.

-

Boosting CASA & margins Even though FDs don’t count as CASA directly, these cards still help banks:

-

Customers open savings accounts for repayments

-

Salaries and transactions stay with the bank, improving stickiness

-

CASA ratio rises, and here’s the fun fact: across Indian banks it’s around 37%, and anything above 40% is considered healthy.

With RuPay credit cards now UPI-enabled, these cards are not just for swiping in malls, users can pay local kirana stores, scan QR codes, and shop online too.

The shift: Why does it matter?

The bank gives you a credit card with a limit equal to 70–100% of that deposit. You start building your credit history without risking debt spirals. And this market is steadily moving. Out of the 1–1.1 million new credit cards issued every month, nearly 10% are FD-backed, according to insiders.

Top 5 FD-backed credit cards of 2025

| Bank & Card | Min. FD Amount | Annual / Joining Fee | Credit Limit | Rewards | Unique Perks |

|---|---|---|---|---|---|

| SBM Bank – Step UP | ₹2,000 | Nil (Lifetime Free) | Up to 90% of FD | 1 point per ₹100 spent | No savings account required, FD earns 6.50% p.a., 50-day interest-free period |

| SBI – Unnati | ₹25,000 | Nil for first 4 years | 80–90% of FD | 1 point per ₹100 spent | ₹500 cashback on ₹50,000 annual spend, 1% fuel surcharge waiver, offers on Amazon, Cleartrip, Ajio |

| ICICI – Instant Platinum | ₹50,000 | Nil | 85–90% of FD | Points redeemable for shopping, travel | 25% off on BookMyShow (max ₹100), dining discounts via Culinary Treats |

| Kotak 811 – #DreamDifferent | ₹5,555 (811 acct) ₹5,000 (non-811) | Nil (Lifetime Free) | 90% of FD | 500 bonus points on ₹5,000 spend in 45 days | Milestone benefit: ₹750 cashback or 4 PVR tickets, 1% fuel surcharge waiver |

| IDFC FIRST – WOW! | ₹10,000 (₹25,000 for NRIs) | Nil | 100% of FD | No rewards program but 5% cashback on first EMI txn | FD earns 7.5% p.a., ₹2 lakh personal accident cover, 4 free roadside assistance calls |

Source: Paisabazaar

These cards aren’t just safer for banks, they’re more inclusive, allowing gig workers, students, and people without income proof to get access to credit.

The flip side: Are these cards risk-free?

Not quite. Sure, the FD collateral shields banks from direct losses. But there’re risks:

-

Credit utilisation impact → Low limits can also backfire on your credit score. For instance, if you block ₹5,000 in an FD and get a ₹5,000 card limit, spending even ₹2,000 pushes your utilization to 40% — above the recommended 30% threshold. That can hurt the very score you’re trying to build.

-

Cash up front → You need to lock in money before you can borrow. For someone already strapped for cash, even arranging ₹2,000–₹10,000 for an FD can be a hurdle. And this can limit liquidity in emergencies.

In short, FD-backed cards lower default risk for banks but don’t automatically eliminate India’s larger debt stress challenge.

So, could FD-backed cards formalise credit for millions?

For millions with no credit history — gig workers, freelancers, first-time earners — access to formal credit is tough. Many fall back on India’s $100 billion informal market.

The gap is huge: over 50% of urban poor households still borrow from moneylenders; 40% of low-income households lack income proof or ID cards; and 63 million Indians have thin or no credit files.

Schemes haven’t closed it either. Of 56 crore Jan Dhan accounts, 23% remain inactive — including 2.75 crore in Uttar Pradesh, 1.39 crore in Bihar, and 1.07 crore in Madhya Pradesh. Debt stress is rising among the young too: one-third of millennials and 40% of Gen Z are juggling loans and credit cards (FT). With informal rates at 36–120%, the trap is clear.

FD-backed cards offer a safer path — helping credit-invisible Indians build scores while protecting banks with FD collateral. If scaled well, they could be the gateway to formal credit for millions, turning India’s swelling appetite for credit into a more sustainable culture.

About The Author

Next Story