Upstox Originals

Can Budget 2026 simplify India’s customs maze?

7 min read | Updated on January 16, 2026, 16:28 IST

SUMMARY

Budget 2026 is around the corner, and India’s complex customs maze is in focus! Complex duty slabs, thousands of exemptions, and years-long disputes are tying up ₹24,000+ crore, hitting SMEs and exporters in electronics, textiles, and chemicals the hardest. Could simpler duties, a GST-style amnesty, full digitisation, and smoother SEZ integration change the game?

Today, India has eight customs duty slabs; 0%, 5%, 10%, 15%, 20%, 25%, 30%, and 40%+

Customs is meant to be procedural. Predictable. Boring, even.

But for many businesses, it’s anything but.

Disputes over classification drag on for years. Refunds get stuck between mismatched portals. And compliance often means dealing with multiple authorities, instead of one system that talks to itself.

India didn’t set out to make customs complicated. It just… happened.

Over time, layers were added. Today, India has eight customs duty slabs; 0%, 5%, 10%, 15%, 20%, 25%, 30%, and 40%+.

That’s already more than most trading nations.

But the real complexity sits on top of this structure; over 1,000 exemptions and special notifications, many tailored to a specific product, sector, or even a single year. Even the government acknowledges the problem. In a recent speech, Finance Minister Nirmala Sitharaman said that simplifying customs procedures is next on her reform to-do list.

So that brings us to the obvious question…

..Why is India's customs regime holding trade back?

Classification-driven complexity

As we just saw above, India’s customs regime isn’t just layered; it’s fragmented. Over time, overlapping slabs, exemptions, and product-specific notifications have made classification the real fault line, where the same good can attract very different duties.

Take electronics. Import a component and the duty can be 20%. Import the finished mobile phone and it drops to 10%. The result? Assembling in India can cost more than importing it fully built, undercutting local manufacturing.

Compare that with Singapore (4 tariff slabs) and Vietnam (5). India’s 8 slabs add complexity; and make trade far less predictable.

Then you have disputes locking up money

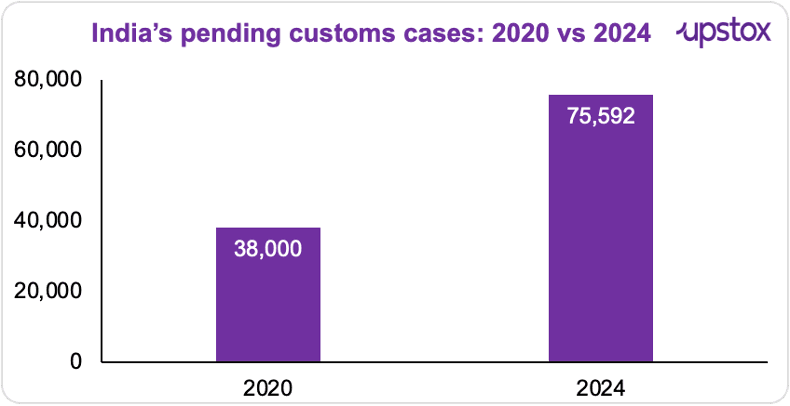

Tariff complexity directly feeds litigation. As of December 2024, India had 75,592 pending customs cases, nearly double the 38,000 cases recorded in 2020. These disputes involve ₹24,016 crore in locked-up dues, equivalent to roughly 8% of annual customs revenue.

Source: Business Line

The burden falls disproportionately on smaller firms. Around 65% of cases involve SMEs, many of which pay 18% interest on disputed duties while waiting two to five years for resolution. For exporters operating on thin margins, this becomes a working-capital shock rather than a legal inconvenience. Sector-wise, disputes are concentrated in priority export areas:

- Electronics: 28% of cases, ₹6,800 crore

- Textiles: 22%, ₹5,300 crore

- Chemicals: 18%, ₹4,300 crore

- Engineering goods: 15%, ₹3,600 crore

The process still needs hand-holding

Despite progress on digitisation, 98% of bills of entry are now filed electronically through ICEGATE, customs processes remain fragmented. Appeals, refunds, and assessments still involve manual intervention, and data does not flow seamlessly between GST and customs systems.

The SEZ–domestic disconnect

Another Customs friction point? The SEZ–domestic disconnect.

India’s Special Economic Zones account for over one-third of the country’s merchandise exports. But doing business between SEZ units and domestic manufacturers remains messy.

Under current rules, goods sold from an SEZ to the Domestic Tariff Area are treated as imports, even though they never leave India. This means domestic firms using SEZ-sourced inputs often face customs duties and import-like taxes, even when most of the value addition happens locally.

Oh, and let’s not forget delays

Customs delays in India often stretch far beyond the promised timelines, locking up inventory and working capital in the process.

Take a recent case at Chennai port. In August, a 40-foot container of battery-powered body massagers worth about $23,000 arrived and was expected to clear in two days. Instead, it remained stuck for over 45 days. By October, the importer, Wintrack Inc., announced it was shutting down its import-export operations in India altogether, blaming prolonged customs delays.

Budget 2026 expectations - how far can customs reform really go?

Rationalising tariff slabs

As per CII, the proposal is to rationalise duties into three clear tiers:

- Raw materials: 0–5%

- Intermediate goods: 2.5–15%

- Finished goods: 25–35%

Some big-ticket inputs could become duty-free, including rutile, coking coal, magnesium, manganese, ferro niobium, met coke, pyroxenite, and industrial essentials like refractory bricks, graphite electrodes, steel mill rolls. Even electronics manufacturing could get a boost: camera modules and displays from 10% → 5%, flexible printed circuits and audio components from 15% → 10%.

The idea isn’t to cut government revenue. Instead, blanket exemptions would be replaced by targeted schemes like PLI, keeping the books balanced while making domestic manufacturing more competitive.

If this happens, more companies might choose to set up factories in India instead of importing finished goods. That’s a big deal for exports, jobs, and the “Make in India” push.

A GST-style customs amnesty

One idea gaining traction ahead of Budget 2026? A Customs amnesty scheme. The idea is simple. Let companies close long-pending Customs disputes by paying only the principal duty. Interest and penalties could be waived.

The scale of the problem is hard to ignore. Parliamentary data shows that ₹24,016 crore of Customs duty was stuck in pending cases as of December 2024. Look beyond active cases, and total Customs arrears, including litigation and stays, stand at about ₹1.36 trillion.

As per FICCI (Federation of Indian Chambers of Commerce & Industry), Assocham (The Associated Chambers of Commerce and Industry of India), and other industry bodies; an amnesty could help on two fronts. It could free up working capital for businesses. And it could ease the litigation burden on the Customs system.

Less money in court. More money back in the economy.

Making customs operationally easy

One fix that could matter quickly? Making customs operationally easy.

If you’ve ever tried clearing goods through customs, you know it’s a maze of websites and registrations; DGFT, BIS, FSSAI, ICEGATE… hopping between portals takes forever. Budget 2026 is expected to change that. The plan? end-to-end digitisation. Full digitisation of appeals to make disputes faster and more transparent.

GST–customs portal integration for real-time refunds, so businesses aren’t left waiting.

At the heart of this is National Customs Single Window 2.0. With a Universal Entity Number, businesses would need just one ID to interact with all agencies; no more juggling multiple sites.

The potential impact? Huge. CII estimates it could cut transaction time by up to 70%. And for low-risk shipments? AI could approve them within an hour of arrival.

SEZ reform and domestic supply chain integration

SEZs were originally designed to boost exports. But Deloitte notes that they could play a larger role in the domestic economy as well. That would involve allowing SEZ units to sell into India without being taxed like imports, easing permission-heavy subcontracting rules, and limiting customs duty to only the imported inputs, rather than the value added within India.

The idea is to improve competitiveness and reduce disputes, while better integrating SEZs with domestic supply chains.

Summing it up

GST made domestic trade frictionless. Customs reform has the potential to do the same for global trade. With $170 billion in SEZ exports, PLI factories running at full tilt, 14 FTAs, and a $451 billion export base, the pieces are already in place. Budget 2026’s real measure won’t be in headlines; it will be in how it simplifies, speeds up, and stabilises India’s borders. Get that right, and customs reform could quietly reshape India’s global competitiveness for years to come.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story