Upstox Originals

Budget buzz: What is in store for the infrastructure sector

.png)

4 min read | Updated on July 19, 2024, 15:22 IST

SUMMARY

India's ambitious goal of becoming a $30 trillion economy hinges on significant infrastructure investments. What did the interim budget announce for this sector and what can we expect from the upcoming budget?

Infrastructure sector will be a key focus in the budget

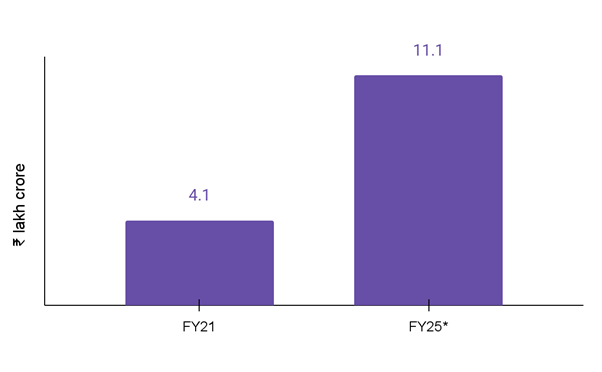

Infrastructure is the foundation of a country's economy, encompassing roads, bridges, power grids, and communication networks, among others. With the ambitious goal of becoming a $30 trillion economy by 2047, India is heavily investing in infrastructure. The budgetary allocation for infrastructure has grown at ~28% CAGR from FY21 to FY24.

Infrastructure investments surge at a 28.3% CAGR.

Source: Press Release, *Interim budget

Source: Press Release, *Interim budgetGiven the continuation of existing policies expected in the final budget, investors can gain valuable insights by analyzing historical trends. Let's examine how infrastructure funding flowed during the interim budget.

| Sector | Industry | Budget allocation (₹ Lakh crore) | Initiative taken / announcement in interim budget | |

|---|---|---|---|---|

| Transportation | Railways | 2,55,300 | 5.8% increased budget from last budget, Manufacturing of 10,000 Non-AC coaches, Induction of rail corridor worth ₹ 11 trillion | |

| Roadways | 2,78,000 | Increased allocation of 2.8% from the previous year's budget | ||

| Ports | 2,345 | Assistance for shipbuilding, funds of ₹ 1 billion for Sagarmala programme | ||

| Renewable energy sector | Solar | 10,000 | 110% increased allocation from the previous budget, Announced rooftop solarisation | |

| Hydrogen | 600 | 102% higher allocation than the last budget for the National Green Hydrogen Mission | ||

| Housing Sector | Housing | 77,523 | Allocation of ₹ 10,400 crore for smart cities mission |

Source: press releases, budget documents

As the full budget comes nearby, here are some expectations for these sectors.

| Sector | Expecations |

|---|---|

| Railways | The budgetary allocation could potentially reach ₹ 3 lakh crore with increased focus on expanding railway capacity and alleviating congestion issues. |

| Renewable Energy | To achieve a clean energy goal of 35-40% by 2029, estimates suggest an investment of ₹ 6.5-7 trillion will be made towards grid augmentation and stability between 2025-29. |

| Sustainable Infrastructure | Green hydrogen initiatives and sustainable infrastructure projects, financial incentives for battery storage |

| Housing | Increased incentive for rental housing, relaxation through tax credits |

Source: Mint

Budgetary impact on infrastructure

Infrastructure encompasses a vast array of industries. Let's explore some key stocks from leading sectors. These companies represent the top 3 by market capitalization within their respective industries. It's important to remember that this is not an exhaustive list, and further due diligence is crucial before making any investment decisions.

| Industries | Companies | Market Cap (₹ Crore) | ROE % | D/E | EV/EBITDA | Stock price 5-year CAGR % |

|---|---|---|---|---|---|---|

| Construction and Infrastructure | Larsen and Toubro | 4,98,925 | 14.7 | 1.4 | 17.9 | 21 |

| Rail Vikas | 1,29,709 | 20.4 | 0.8 | 35.5 | 89 | |

| IRB Infra | 40,667 | 4.5 | 1.4 | 15.2 | 50 | |

| Renewable Energy | NTPC | 3,55,189 | 13.5 | 1.5 | 10.5 | 24 |

| Power Grid | 3,10,222 | 18.3 | 1.4 | 10.6 | 24 | |

| Adani Green | 2,74,038 | 17.1 | 8.7 | 37.3 | 107 | |

| Transport | Adani Ports | 3,19,668 | 12.9 | 0.9 | 21.2 | 30 |

| JSW Infra | 66,675 | 19.0 | 0.6 | 28.6 | - | |

| Gujarat Pipavav Port | 10,278 | 16.4 | 0.0 | 14.3 | 22 | |

| Cement | UltraTech Cement | 3,29,176 | 12.3 | 0.2 | 25.1 | 21 |

| Ambuja Cement | 1,66,864 | 10.3 | 0.0 | 21.1 | 26 | |

| Shree Cement | 99,725 | 12.2 | 0.1 | 19.7 | 6 | |

| Steel | JSW Steel | 2,18,465 | 11.8 | 1.1 | 10.1 | 29 |

| Tata Steel | 1,97,864 | 6.6 | 0.1 | 12.3 | 29 | |

| Jindal Steel | 96,704 | 13.3 | 0.4 | 10.6 | 48 |

Source: Screener; data as on 19th Jul 2024, JSW Infra got listed on October 2023

What should investors do?

In the infrastructure sector, any significant policy changes can trigger ripple effects across various industries.

- As an investor, it's crucial to focus on sectors you understand and identify potential opportunities within your expertise.

- Pay close attention to any infrastructure-related announcements. Analyzing the announced policies, impacted sectors, and potential beneficiary stocks will help in making smart investment decisions and a well-balanced portfolio.

- Before making any investments, it's essential to identify potential risks and conduct thorough due diligence. Avoid impulsive decisions driven by the fear of missing out.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story