Upstox Originals

Exploring India's real estate landscape with REITs

.png)

5 min read | Updated on June 04, 2024, 14:35 IST

SUMMARY

What if investors could participate in fast-growing Indian real estate, with minimal capital investment, transparency and in a very liquid transaction? Sounds interesting? We explore this theme, highlighting the Real Estate Investment Trusts (REITs) opportunity in India.

One of the major deterrents of real estate investing for most retail investors is the huge ticket size

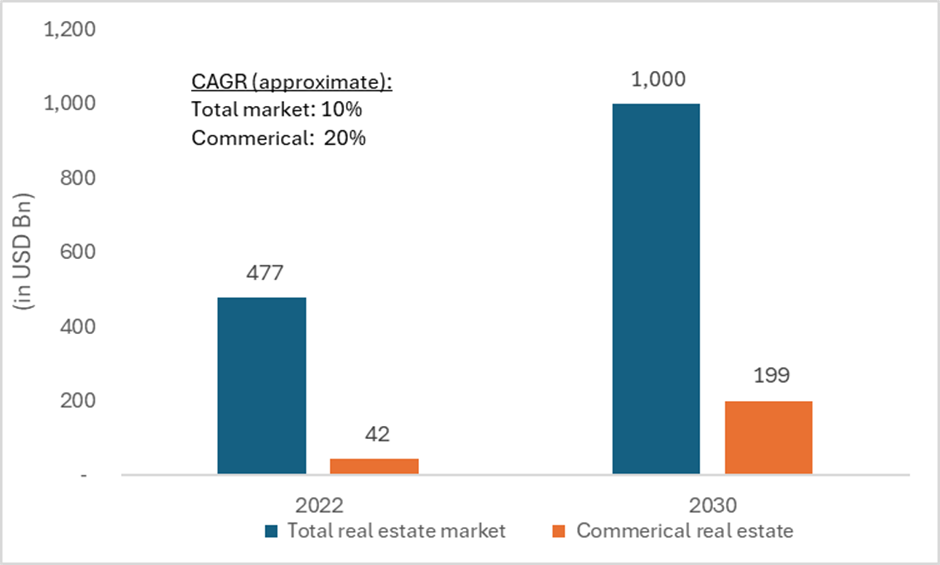

India’s real estate market is poised to grow at a CAGR of 10% over 2022-2030 to reach $10 billion in market size. Key growth drivers include a growing population, increasing urbanisation, and supportive regulations. Commercial real estate is however expected to surpass this growth, growing at 2x the pace, driven by an increasing need for office space (driven by growth in IT, finance, and e-commerce among others).

Market size of India’s real estate markets

Source: IBEF, Marketsearch, Upstox

Current challenges to participate in this growth?

One of the major deterrents of real estate investing for most retail investors is the huge ticket size. An Anarock report states that average housing prices have increased between 13-33% across 7 major cities over the last 3 years. On the other hand, in commercial real estate markets, prices have increased by around 15%.

What is the way around this?

Real Estate Investment Trusts (or REITs) offer a solution, allowing investments in real estate with minimal capital. They operate similarly to mutual funds, pooling funds from multiple investors to invest in diverse properties and are managed by experienced professionals.

In the past five years, India's REIT asset values have risen from $3.6 billion to $15.6 billion (~3% of the overall real estate market). They operate in the commercial space and the market potential remains vast. Currently, only about 10% of India’s total Grade A office stock in the commercial space falls under the REIT umbrella.

Benefits of REIT investing

For an investor, choosing between REITs and direct real estate ownership can be a complex decision. Here are some key differentiators (and benefits) to help make it easier.

| REITs | Real Estate | |

|---|---|---|

| Liquidity | Highly liquid | Illiquid |

| Diversification | Diversified among various property types | Concentration risk |

| Lower Initial Investment | Minimal investment | Requires a High capital amount |

| Professional Management | Managed by professionals | Self-manage or hire property services |

| Steady Income | Legally liable to distribute ≥90% of taxable income to shareholders as dividends | Income can be inconsistent due to vacancy periods, tenant defaults, and maintenance costs, among others |

| Market Exposure | Exposure without the complexities of direct ownership | Exposure through direct ownership |

How should investors value REITs?

Traditional metrics like P/E and ROE can be misleading for REITs. High depreciation and irregular property sale gains distort net income, making the P/E ratio unreliable.

REITs are asset-heavy, leveraged (high debt) structures that render ROE less meaningful, as it may reflect high leverage rather than operational efficiency.

Instead, below are a few key metrics to focus on. They measure profitability or operational efficiency, so the higher the better!

| Measure | What is it? |

|---|---|

| Funds from operations (FFO) | Measures the cash generated from core operations by adding back non cash charges and ignoring any gain or loss on sale |

| Net asset value (NAV) | Estimated market value of a REIT's total assets |

| Occupancy rate | Ratio of used or rented space to the total amount of available space |

| WALE or weighted average leasing expiry | Measures the average length of leases for a property or portfolio of properties |

Additionally, investors can see the track record of the investment manager, and evaluate the quality and diversification of the underlying assets.

Who are the key players and how have they performed?

In the following two tables, we list the key players (limited choice for investors as of now) and also note their recent performance

Key REIT players in India

| Description | Embassy REIT | Mindspace REIT | Brookfield REIT | Nexus REIT |

|---|---|---|---|---|

| IPO Listing Date | April’19 | April’20 | April’21 | April’23 |

| Primary Assets | Office | Office | Office | Retail Malls |

| Geographic Focus | Bangalore, Mumbai, Pune, NCR | Hyderabad, Pune Mumbai, Chennai | Gurugram, Noida, Mumbai, Kolkata | Presence across 14 cities |

| Total Portfolio Area (million square feet) | 45.4 msf | 33.1 msf | 25.4 msf | 11.2 msf |

| Completed Area | 35.8 msf | 26.2 msf | 20.7 msf | 9.9msf |

| Office assets | 12 | 10 | 5 | 17 |

Source: Avendus, Press releases

Key metrics for REITs companies

| Company name | Market cap (₹ cr) | Net asset value (NAV) (per unit in ₹) | Occupancy rate (%) | Yield (%) | WALE (in years) | 3 yr CAGR stock price growth (in%) |

|---|---|---|---|---|---|---|

| Embassy Office Parks | 32,239 | 401.6 | 85.0 | 6.7 | 6.8 | 1.0 |

| Mindspace Business Parks | 20,131 | 380.5 | 86.0 | 6.9 | 6.8 | 8.0 |

| Brookfield India | 11,372 | 333.0 | 87.0 | 7.3 | 7.6 | 1.0 |

| Nexus | 18,874 | 98.6 | 97.6 | NA | 5.1 | 19.7** |

Source: Screener; *Data as of 28/05/2024, **CAGR for 1 yr

Conclusion

REITs offer a more hassle-free investment option. The REIT industry growth and the achievements of key players indicate a promising future characterised by WALE and attractive rental yield returns. However, as the industry is still in its developmental phase, there are few potential operational challenges, such as tenant risk and regulatory hurdles, that need to be navigated. However, before investing one should consider due diligence.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story