Upstox Originals

Beyond the dip: When markets fall, ideas rise?

.png)

5 min read | Updated on November 24, 2024, 11:23 IST

SUMMARY

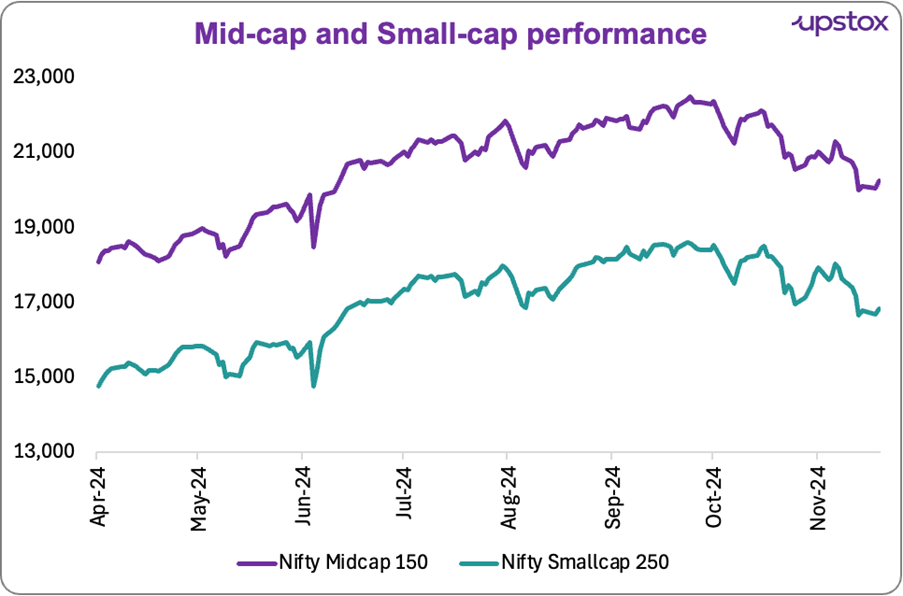

While small and mid-cap indices have corrected ~7-8% over the past month, a few fundamentally sound companies have corrected a lot more. In this article, we look at some of these companies and their current valuations.

Small and mid-cap indices have corrected ~7-8% in the past month

While easier said than done, it is a time-tested successful investment method.

That said, does this correction present a buying opportunity? While we do not speculate about the future, for anyone looking for their next investment, we hope this screener of mid and small-cap stocks helps you.

The Nifty Midcap 150 has declined by 6.9%, while the Nifty Smallcap 250 has dropped by 7.6% over the last 30 days.

Source: NSE

To cut through the noise, we screened these segments using a set of rigorous filters to identify potentially fundamentally strong companies that have corrected more than 20%.

Our screening process

For mid-caps, we focused on:

- Market Capitalisation: > ₹ 5,000 crore and < ₹ 20,000 crore

- 1-month return: < -20%, stocks that have corrected more than the markets

- ROE: > 15%, signaling efficient use of shareholder funds.

- Profit growth (3 Years): >15%, showing consistent earnings expansion.

- Debt-to-Equity Ratio: <1, ensuring manageable leverage.

- Free Cash Flow (Preceding year): Positive, indicating prudent capital management.

For small-caps, the same parameters were applied, except the market capitalisation was greater than ₹100 crore and capped at ₹5,000 crore.

Using these filters, we discovered the following 7 mid-cap and 8 small-cap companies. These are companies that not only meet strict financial benchmarks but also show resilience in their core operations.

Mid-Cap stock screener (arranged in descending order of returns)

| Name | Mar Cap (₹ Cr) | Industry | P/E (x) | Profit growth 3Yrs (%) | ROE (%) | 1 month return (%) | Share price return 3Yrs (%) |

|---|---|---|---|---|---|---|---|

| Chennai Petroleum Corporation | 8,620 | Petroleum Products | 12.6 | 125.2 | 36.5 | -36.0 | 421.5 |

| Mahanagar Gas | 11,123 | Gas | 9.7 | 27.7 | 27.8 | -28.1 | 19.0 |

| Voltamp Transformers | 9,860 | Electric Equipment | 28.7 | 48.4 | 24.3 | -26.6 | 418.2 |

| Garden Reach Sh. | 16,143 | Aerospace & Defense | 42.0 | 29.1 | 22.2 | -21.9 | 499.9 |

| C.E. Info System | 8,964 | IT - Software | 66.5 | 37.2 | 20.6 | -21.8 | 14.5 |

| Jyothy Labs | 14,863 | Household Products | 39.6 | 19.3 | 21.2 | -21.8 | 169.9 |

| Electrosteel Castings | 9,104 | Industrial Products | 10.5 | 96.6 | 15.9 | -20.1 | 330.2 |

| Average | 11,240 | NA | 29.9 | 54.8 | 24.1 | -25.2 | 267.6 |

Source: Screener, Financial Express

Small-Cap stock screener (arranged in descending order of returns)

| Name | Mar Cap (₹ Cr) | Industry | P/E | Profit growth 3Yrs (%) | ROE (%) | 1 month return (%) | Share price return 3Yrs (%) |

|---|---|---|---|---|---|---|---|

| Shri Balaji Valve Components | 140 | Industrial Manufacturing | 21.5 | 552.9 | 36.2 | -36.1 | -15.3 |

| Maan Aluminium | 800 | Non - Ferrous Metals | 34.4 | 30.3 | 22.3 | -36.1 | 384.7 |

| Taylormade Renew | 331 | Industrial Manufacturing | 49.7 | 98.3 | 30.5 | -33.3 | 1421.9 |

| Ovobel Foods | 126 | Food Products | 42.6 | 128.2 | 26.4 | -32.7 | 263.9 |

| Brady & Morris | 355 | Agricultural, Commercial & Construction Vehicles | 37.2 | 46.9 | 43.3 | -31.9 | 1,045.8 |

| Tinna Rubber | 2,025 | Industrial Products | 37.4 | 596.6 | 36.1 | -30.8 | 1,907.4 |

| Golkunda Diamond | 133 | Consumer Durables | 11.0 | 53.1 | 19.3 | -30.1 | 62.9 |

| 20 Microns | 790 | Minerals & Mining | 13.3 | 35.2 | 17.8 | -28.4 | 283.3 |

| Average | 588 | NA | 31.0 | 193 | 29.0 | -32.0 | 669.3 |

Source: Screener, Financial Express

Let's assess the current valuation trends

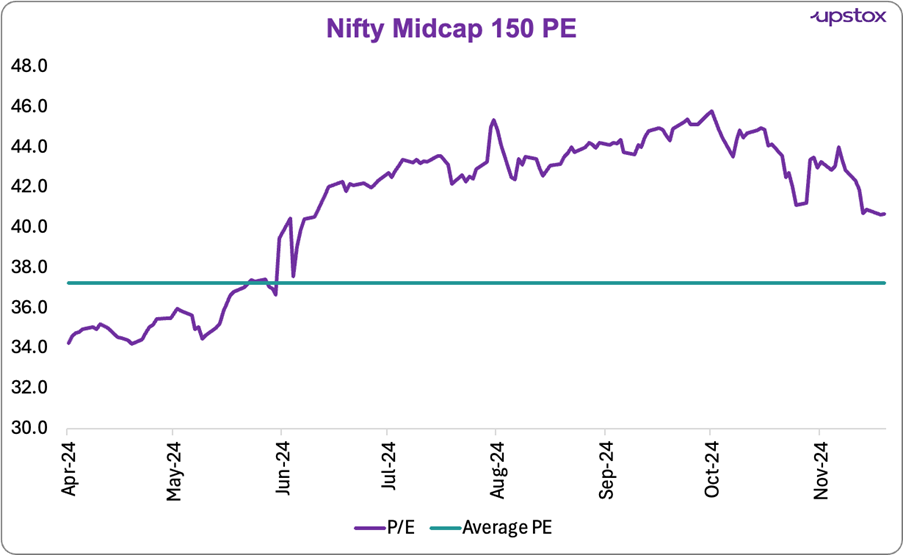

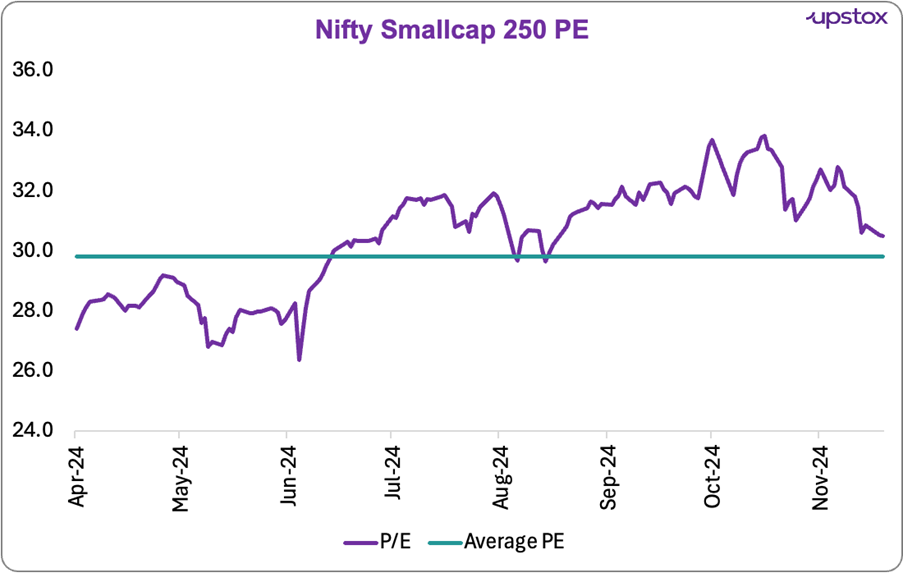

Yes, markets have been correcting for the past few months and as we have shown above, some stocks have corrected more than the market.

While this could potentially be an investment opportunity, we would be amiss to note that, despite the correction, valuations are still frothy. As we show in the charts below, both the small and mid-cap indices are still trading above their average.

Please note: It seems that the Nifty mid-cap index was rebalanced around March 2024. As such, looking at trends before that could have led to an erroneous implication, hence the charts below are from April 2024.

Source: NSE

Source: NSE

Conclusion

Market corrections can be unsettling, but they’re also a chance to revisit the fundamentals. That said, we would advise investors to carefully and methodically analyse any potential investment opportunity before deciding on the next step.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story