Upstox Originals

Behind the $19 trillion curtain: The power of BlackRock and Vanguard

.png)

6 min read | Updated on April 03, 2025, 17:50 IST

SUMMARY

BlackRock and Vanguard collectively oversee a staggering $19 trillion - roughly 10% of the world’s assets. Their investments are everywhere, giving them a unique influence over corporate governance and policy-making. While they don’t directly run these companies, their decisions have a huge impact. So, what do you think - should we be paying closer attention to their role in shaping the global economy?

BlackRock and Vanguard collectively oversee a staggering $19 trillion - roughly 10% of the world’s assets

Did you know that two financial giants, BlackRock and Vanguard, manage a massive $19 trillion in assets as of 2024? BlackRock alone handles around $11 trillion, while Vanguard oversees over $8 trillion. That’s more than the GDP of some of the world’s biggest economies!

BlackRock: The powerhouse with a tech edge

BlackRock, the world’s largest asset manager, closed 2024 with a massive $11.6 trillion in assets under management (AUM). They had a record-breaking year, pulling in $641 billion in net inflows — with $281 billion just in the fourth quarter.

They also rewarded shareholders nicely, returning $4.7 billion through dividends and share buybacks. On top of that, their revenue climbed 14%, operating income jumped 21%, and diluted EPS rose 15%, thanks to stronger markets, organic fee growth, and extra earnings from their GIP transaction.

And they’re not slowing down — BlackRock announced plans to acquire HPS Investment Partners, adding a private credit business with around $220 billion in client assets.

But what really makes BlackRock stand out is their tech — and their Aladdin platform is a game-changer. Think of it as the ultimate command center for managing investments. It combines portfolio management, trading, risk analysis, and compliance all in one place. Big institutions, asset managers, and even governments rely on Aladdin to make smarter, data-driven investment decisions — it’s basically the brain behind some of the world’s biggest portfolios.

In 2011, Aladdin handled ~$11 trillion of global assets (including ~$4 trillion of BlackRock’s assets). This was nearly 7% of the world’s financial assets. By 2020, this number had jumped to ~$20 trillion, nearly 10% of the world’s financial assets.

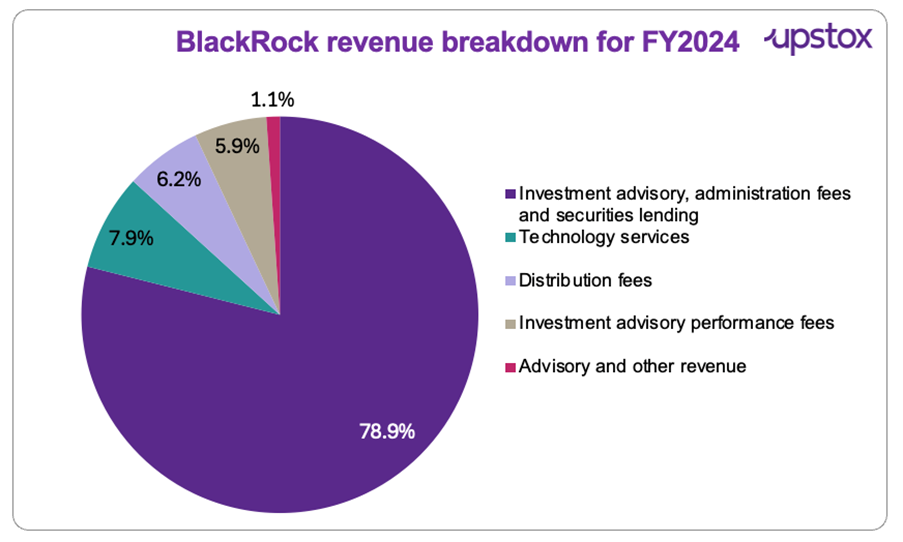

Here is BlackRock’s revenue breakdown for FY2024:

Source: BlackRock.com

Vanguard: The people’s champion of low-cost investing

Vanguard has built a reputation as the go-to choice for low-cost investing - thanks to its unique ownership structure and commitment to low fees. Founded by John C. Bogle in 1975, they’re the pioneers of index investing. Bogle’s big idea? Instead of trying to beat the market, just be the market - and that’s how the first index fund was born.

What really sets Vanguard apart is their unique ownership structure. Since the company is owned by its fund shareholders, they don’t answer to outside stockholders. That means they focus entirely on keeping fees low and putting investors first - no wall street games here.

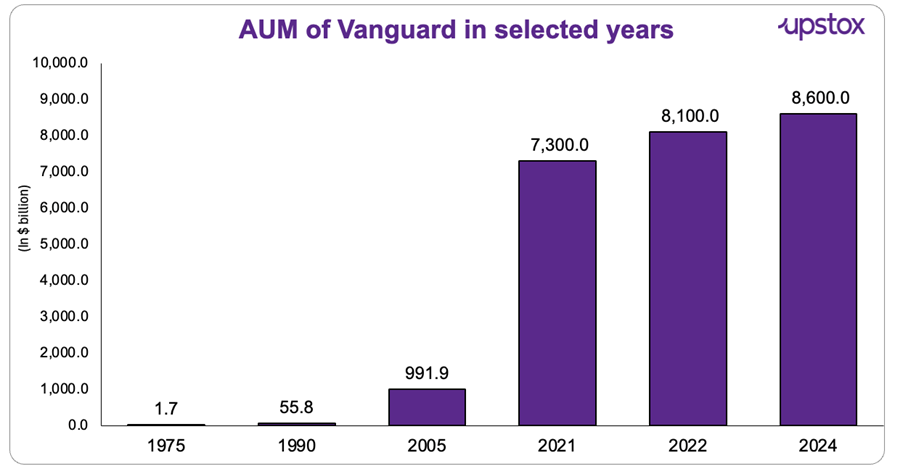

Fast forward to the end of 2024, Vanguard now manages a massive $8.6 trillion in assets. Most of that - around 82% - is in index funds, with the remaining 18% in actively managed strategies. Their investor-first approach has earned the trust of over 50 million clients worldwide.

With a strong presence across Europe, Australia, and the Americas - backed by more than 20,000 crew members - Vanguard continues to offer simple, long-term investment solutions that just make sense.

Here is the graphical representation of AUM of Vanguard from 1975 to 2024

Source-Statista

How two companies shape the world’s wealth

When you think of the biggest players in global finance, BlackRock and Vanguard are two names that dominate the conversation - and for good reason. As these investment giants manage an astonishing portion of the world’s wealth, with their combined assets reaching trillions of dollars - enough to influence markets, industries, and even economies.

Imagine this: with vast holdings across industries, they quietly shape corporate policies, voting on executive pay, environmental strategies, and mergers. Their passive investing—via index funds—automatically gives them stakes in thousands of companies. But their influence goes beyond money; they set the tone for corporate governance, sustainability, and long-term investment trends, impacting everything from job markets to climate initiatives.

BlackRock and/or Vanguard are among the three largest institutional investors for 505 out of 505 of the S&P 500. One or the other is the single largest institutional investor in 422 of these.

| Company | Industry | Market cap ($ Bn) | Largest investor | 2nd largest investor |

|---|---|---|---|---|

| Apple | Information Technology | 2,584.0 | Vanguard Group (7.6%) | BlackRock (6.2%) |

| Microsoft | Information Technology | 2,255.0 | Vanguard Group (8.1%) | BlackRock (6.7%) |

| Alphabet (Class C) | Communication Services | 1,933.0 | Vanguard Group (6.6%) | BlackRock (5.9%) |

| Alphabet (Class A) | Communication Services | 1,927.0 | Vanguard Group (7.5%) | BlackRock (6.7%) |

| Amazon | Consumer Discretionary | 1,781.0 | Vanguard Group (6.4%) | BlackRock (5.4%) |

| Communication Services | 1,076.0 | Vanguard Group (7.6%) | BlackRock (6.5%) | |

| Tesla | Consumer Discretionary | 753.7 | Vanguard Group (5.9%) | BlackRock (5.1%) |

| Berkshire Hathaway | Financials | 633.0 | Vanguard Group (10.1%) | BlackRock (8.1%) |

Source-https://blackrockvanguardwatch.com/

Is there a hidden monopoly behind every industry?

While their widespread ownership isn’t illegal, critics argue it weakens competition. With passive investment strategies holding so much sway, companies may focus more on boosting shareholder returns than fostering innovation, improving employee conditions, or embracing sustainability.

India presence of BlackRock and Vanguard

BlackRock previously had a joint venture with DSP (DSP BlackRock Mutual Fund), which ended in 2018 when DSP bought out BlackRock’s 40% stake. Now, BlackRock has expanded its presence in India through a joint venture with Jio Financial Services, forming Jio BlackRock Asset Management Pvt. Ltd. and Jio BlackRock Trustee Pvt. Ltd. in October 2024. This collaboration combines BlackRock's investment and risk management expertise with Jio’s digital reach to offer innovative investment solutions, including ETFs and mutual funds.

Vanguard, meanwhile, has gained popularity in India with its low-cost index funds, appealing to passive investors. Some well-known global funds include Vanguard S&P 500 ETF (VOO), Vanguard Total Stock Market Index Fund (VTSAX), and Vanguard FTSE Emerging Markets ETF (VWO).

In summary

So, do BlackRock and Vanguard really own everything? Not quite — but their influence is undeniably massive. As their power continues to grow, it’s likely that regulators will face mounting pressure to ensure these firms' interests align with the broader public good. One thing's for sure: their impact on the financial world isn’t going away anytime soon.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story