Upstox Originals

A diamond is forever, is it though?

.png)

5 min read | Updated on October 08, 2024, 19:02 IST

SUMMARY

Ever been to a diamond bazaar and felt its hustle and bustle? Well, in the last few years, this energy has been slowing down. India's diamond industry is facing a tough time. Both imports and exports have sharply declined, and the rise of lab-grown diamonds has added further pressure. Despite these challenges, the industry is seeking solutions to stabilize and recover, with hopes for a brighter future.

India's diamond industry as seen multiple layoffs and shutdowns in recent times

A recent interview by a couple of diamond workers really caught our attention. Read what diamond workers from Surat, Prakash Joshi, and Dipak Ghetiya have to say:

Prakash Joshi, once a skilled diamond polisher, now sells phone accessories to make ends meet. He reflects, "You will find many vendors like me who earlier worked in diamond factories. Most of them would now say, 'Enough of being a ratna-kalakar (diamond artisan).' Some have taken up jobs as delivery boys of Zomato and Swiggy. With duplicate diamonds [lab-grown diamonds] dominating the market, riding out this mandee (recession) will be difficult."

Similarly, Dipak Ghetiya, who once made a comfortable living polishing diamonds, now runs a food cart he’s named "Ratnakalakar Nasta House." He explains, "Until last Diwali, I was earning ₹40,000-50,000 a month from polishing. But my income plummeted quickly. By June, I was getting just ₹15,000. That’s simply not enough to survive in a city like Surat." In search of new opportunities, Dipak and his wife have even turned to YouTube, sharing cooking videos to supplement their income.

India’s diamond industry is navigating some tough times. A sharp increase in the demand for lab-grown diamonds is affecting conventional businesses.

India is a dominant player in the diamond market processing, with Surat processing 90% of the world's diamonds. It is the world’s largest hub for cutting and polishing diamonds. The industry provides direct employment to over 1.0 million (~800k in Gujarat) workers and millions more through indirect jobs.

Factory closures and mass layoffs have been widespread, with over 60 suicides reported in Gujarat due to financial stress. According to various reports, conservative estimates suggest that 50,000 cutting and polishing artisans have been laid off or are working fewer hours, with extended breaks.

In this article, we dive into the state of the industry and measures to restimulate it

Let’s first understand the two basic types of diamonds

Cut and polished diamonds (CPD): They are diamonds that have been transformed from rough crystals into finished gems through a process of cutting and polishing

Lab-grown diamonds (LGDs): They are grown from a mined diamond “seed” by scientists using state-of-the-art technology. Chemically and optically however they are identical to naturally mined diamonds

Now, what is going on in the diamond markets?

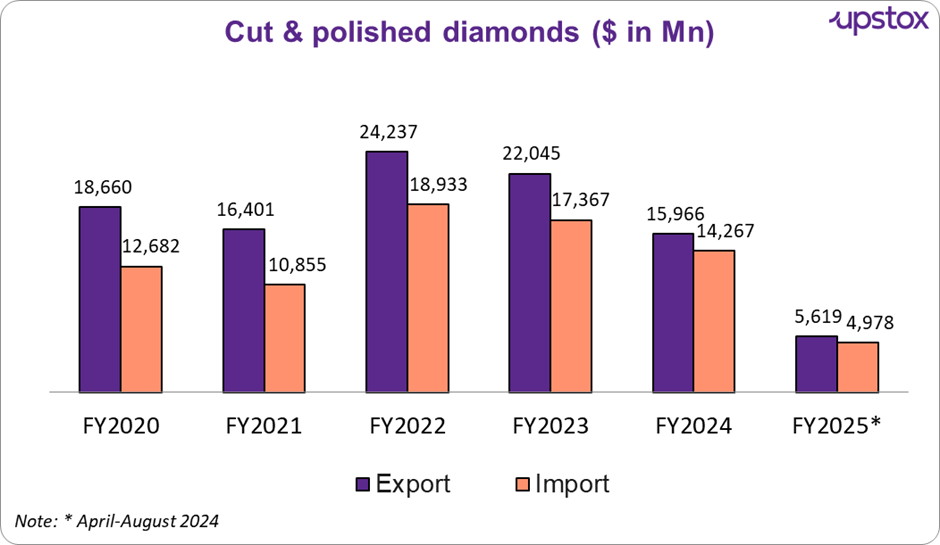

Rough diamonds are imported into India and then exported as cut and polished diamonds. As can be seen from the chart below the overall CPD business (imports + exports) in India has taken a knock, with exports falling faster than imports. This shift demonstrates a weaker global market and fewer processing orders.

Source: GJEPC India

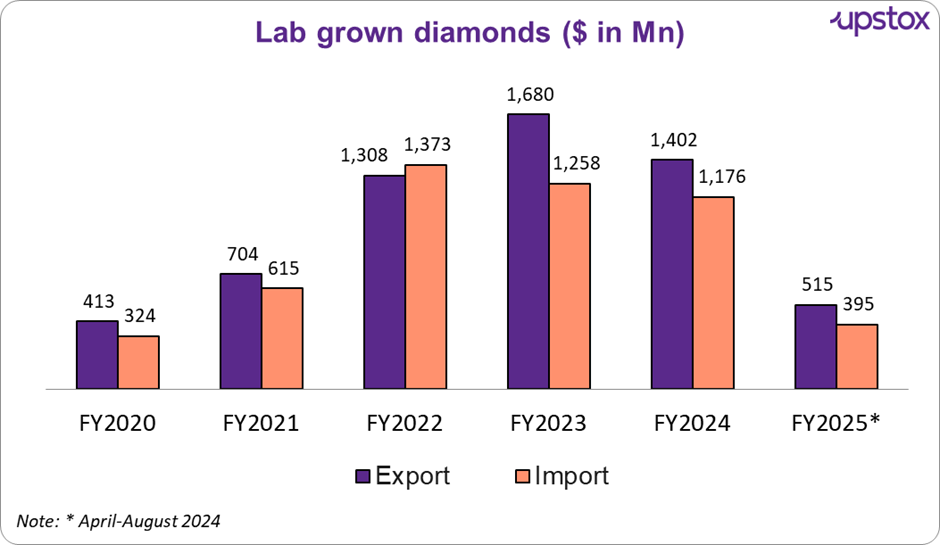

On the other hand, the chart below shows the trend of a flourishing lab-grown diamond industry.

GJEPC India

Two key reasons for the decline

-

The most obvious reason is the rise of lab-grown diamonds. Per experts, a lab diamond costs ~60%-85% less than a natural diamond with identical carat weight and grades.

-

Major markets like the USA and China, which account for most of the demand, have reduced their purchases. This has led to an overall drop in demand. To make things worse, many of the diamonds that are exported are getting returned due to unsold inventory. Reports indicate that the share of unsold diamond inventory is at an all-time high.

The result?

-

Wholesale diamond prices have corrected almost 30% YTD this year, while those of lab-grown diamonds continue to increase

-

The industry struggles at a global level as well. According to a report by Rapaport, De Beers, the world’s largest producer and distributor of diamonds, cut its production by 15%, following a 26% slide in sales during the first half of 2024

How can India tackle this situation?

While challenges in the industry are of a global nature, India can take some steps to support its local industry. Ajay Srivastava, Co-founder of the Global Trade Research Initiative (GTRI), suggests:

-

Extend export credit period: The RBI could extend the export credit period for CPD exporters from 6 to 12 months, as international buyers are now demanding longer credit terms

-

Tax exemption: To compete with the UAE, it is recommended that India exempts foreign rough diamond sellers from corporate tax when they sell through Special Notified Zones (SNZs). Instead, such sales should be treated as regular imports, subject only to import duties

-

Regulate lab-grown diamonds: There is a call for better regulation of the lab-grown diamond industry, including labeling and certification guidelines to differentiate lab-grown diamonds from natural ones in jewelry sales.

-

Reconsider zero-tariff imports from Dubai: Dubai has become a major player in supplying India with rough diamonds, boosting its share from 36.3% in 2020 to 64.5% in the first quarter of 2024. It was suggested to reconsider the zero-tariff import of CPD from Dubai under the India-UAE Comprehensive Economic Partnership Agreement, as the current system allows CPD imports at zero duty with just 6% value addition in Dubai, putting pressure on domestic manufacturers.

Conclusion

While India’s diamond industry is currently navigating through a challenging period due to declining demand and increased competition from lab-grown diamonds, the sector remains resilient. With the right interventions, such as regulatory reforms and technological innovation, there is still potential for the industry to rebound and regain its global prominence.

By signing up you agree to Upstox’s Terms & Conditions

About The Author