Upstox Originals

India’s luxury boom: How high-end living is becoming mainstream

.png)

4 min read | Updated on May 06, 2025, 14:22 IST

SUMMARY

Luxury brands in India are increasingly generating a significant portion of their revenue from tier 2 and 3 cities. As India’s luxury market is projected to grow to approximately $90 billion by 2030, 3.5x its current size, this shift in consumer behaviour is playing a pivotal role. Both Indian and global luxury brands are now focusing on establishing their presence in these markets, recognizing the immense potential of the expanding affluent consumer base.

India's luxury market is expected to grow 3.5x by 2030

Did you know that 55% of Tata CLiQ’s sales come from non-metro cities? Kalyan Jewellers operates more than 200 showrooms across India with a focus on tier 2 and 3 cities.

Luxury in India, once confined to cities like Mumbai, Delhi, and Bangalore, is now steadily making its way into tier 2 and 3 cities. This shift is being driven by several factors, including the rise of the middle class with greater disposable income, increased digital access to global luxury brands, and a growing interest in sustainability and experiential luxury.

As more consumers in smaller cities embrace these trends, luxury brands are expanding their reach beyond traditional hubs, tapping into a new, affluent audience eager to experience premium products and services.

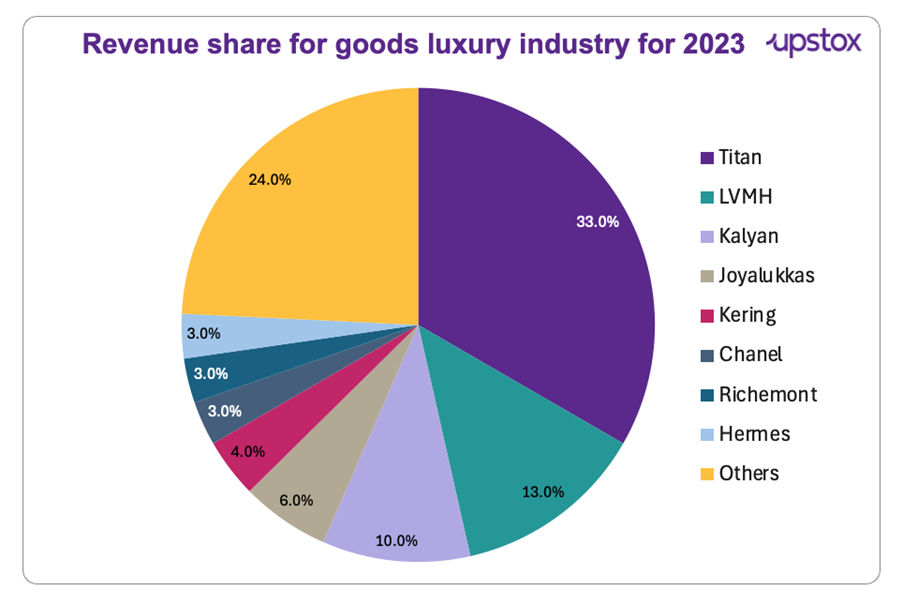

India’s overall luxury market is on a strong growth trajectory, projected to reach $85-90 billion by 2030, expanding 3.5x its current size. The current revenue of this industry is pegged at around ~$15-20 billion dollars. The snapshot below showcases the revenue share in India's luxury goods industry for 2023:

Source: Statista

In this article, we track some of the most interesting developments about increasing penetration of luxury across Indian cities.

Automobiles

As urbanisation spreads and infrastructure improves, more affluent buyers in smaller towns are turning to luxury vehicles. In fact, nearly 30% of luxury car sales in 2024 came from these markets. Mercedes-Benz India is a prime example of this trend. It achieved record sales of over 19,500 vehicles in 2024 — a 12% jump from the previous year — with a significant portion of this growth fuelled by demand from non-metro regions.

Recognising this potential, the company is set to open 20 new dealerships or service outlets in 2025, targeting cities like Kanpur and Patna, where interest in premium cars is rapidly increasing.

Hospitality

Similarly, in the luxury hospitality market, premium properties are expanding beyond major metropolitan hubs. Taj Hotels has recently announced plans to open 100+ new properties in Tier-2 and Tier-3 cities by 2030, capitalising on growing domestic travel trends.

Cities such as Udaipur, Goa, and Mahabalipuram have witnessed a surge in luxury resort openings, with occupancy rates exceeding 80% during peak seasons.

Real estate

India's luxury real estate boom is to cities like Chandigarh, Indore, and Lucknow emerging as key growth hubs. In 2024, luxury home sales increased by 53%, with these smaller cities contributing significantly to the surge. For instance, luxury property prices in Chandigarh rose by 20% YoY, while Lucknow saw a 25% increase in premium home sales.

Developers such as DLF, Prestige Group, and Godrej Properties are expanding into these regions, introducing projects with amenities like private terraces, concierge services, and wellness centers. With rising demand from affluent buyers and improved connectivity, Tier-2 and Tier-3 cities are becoming major contributors to India's growing luxury housing market.

Malls

Phoenix Citadel in Indore, spanning 1 million square feet, features brands like Coach, Diesel, and Armani Exchange. LuLu Mall in Lucknow, at 1.9 million square feet, houses Hugo Boss, Guess, and Montblanc. Forum Kochi has a dedicated luxury section with Tommy Hilfiger, Calvin Klein, and Sephora, while Taurus Zentrum in Thiruvananthapuram is set to welcome several global brands.

With rising incomes and growing demand for premium experiences, luxury malls are reshaping India’s retail scene. As global brands expand, high-end shopping is becoming easier to access.

Global luxury brands strengthen presence in India

India’s luxury market is expanding beyond big cities into Tier-2 and Tier-3 hubs, driven by evolving consumer aspirations.

- Cartier and Jaeger-LeCoultre see 40% of sales from smaller towns.

- 27 global luxury brands entered India in 2024, nearly double the previous year.

- Brands expanding into 14 Tier-2 cities: Armani Exchange, H&M, Starbucks.

Digital transformation in the luxury retail sector

Luxury brands in India are leveraging technology to enhance personalisation and engagement. From AI-driven recommendations to AR try-ons, brands like Gucci, Louis Vuitton, and Chanel are integrating innovation with exclusivity.

E-commerce is expanding access, with Chanel delivering to 27,000 pin codes, while Burberry and Gucci use AR mirrors for interactive experiences, seamlessly blending heritage with modern advancements.

Final thoughts

From high-end fashion and real estate to luxury travel and cars, premium experiences are in high demand. India’s luxury market is expanding beyond the elite, driven by rising wealth, digital innovation, and a growing appetite for premium experiences. From high-end fashion and real estate to luxury travel and cars, the industry is expected to thrive.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story