Upstox Originals

Can India reduce its $75 billion import bill by building its own ships?

9 min read | Updated on April 21, 2025, 15:10 IST

SUMMARY

India has set an ambitious target to become one of the world’s top 10 shipbuilding nations by 2030 and reach the top 5 by 2047. But how feasible is this goal? Where does it stand now, and what does it need to do to make this dream a reality? What is the government doing to energise this sector? And, will India’s shipbuilding ambitions reshape global trade? Let’s decode!

India is poised to become one of the top 10 shipbuilding nations by 2030 and top 5 by 2047.

India has a 7,500 km long coastline. And, 95% of India's international trade by volume and 70% by value takes place through sea routes.

Looking at our huge dependence on maritime trade, guess what is India’s share in the global shipbuilding market? 60%, 40%, 20%?

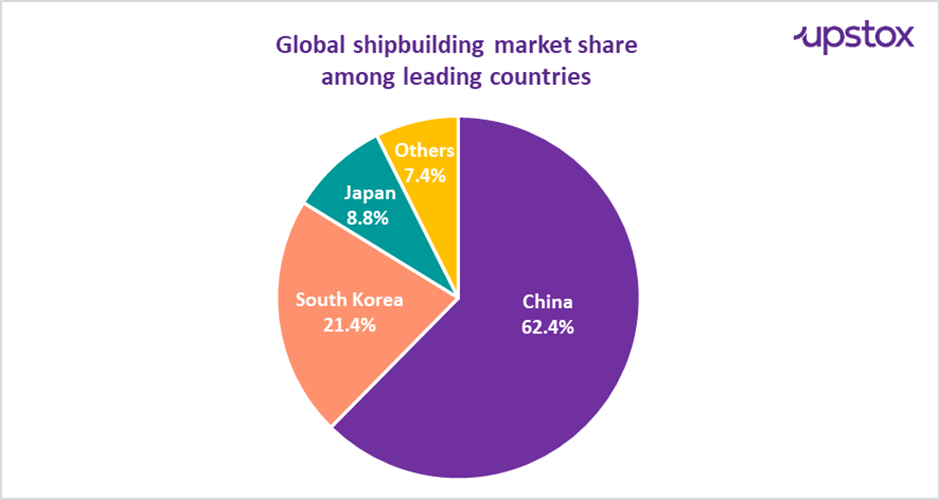

Guess which country dominates the industry? China with 62.4%, followed by South Korea with 21.4% and Japan with 8.8%.

Source: Maritime Gateway

These three nations together command 93% of the global shipbuilding market. No other nation comes even close. And, India certainly does not.

Let’s face it—India is at the bottom of the scale, ranking 22nd in the global shipbuilding industry.

What’s even worse is…

While other nations have a fleet of self-owned ships to transport their products to the global markets, India is almost entirely dependent on foreign ships to trade with the rest of the world. To be exact, 95% of India's international cargo depends on foreign ships.

The reason?

India owns about 1526 ships, which is a tiny 1.2% share in global ship ownership. Compare that to Greece, China and Japan, which together own nearly 40% of the world’s carrying capacity.

Of total 1526 vessels, only 487 vessels are used for international trade. In contrast, China owns over 6,000 ships, which fuel its international trade.

This is exactly how far India is lagging.

How is this a problem, you ask?

Well, dependence on foreign vessels doesn’t come cheap. India paid $75 billion (over ₹6 lakh crore) to foreign shipping companies for sea freight in FY23 alone. (That’s a huge foreign exchange outflow, almost equal to India's defence budget!)

The problem doesn’t end there!

Heavy reliance on foreign shipping lines gives India little to no control over its merchandise trade. It makes the country vulnerable to trade disruptions in case sanctions are applied. It also exposes India to freight price volatility and geopolitical risks, as seen during the Red Sea crisis, Russia-Ukraine war, and Israel-Gaza conflict.

Then why does India build such few ships?

Let’s look into the reasons that are holding back India’s shipbuilding industry.

A shipyard typically requires 35-40% of a ship’s construction cost as working capital. Unfortunately, Indian shipbuilders struggle to secure low-cost financing, leaving them with no option but to rely on expensive commercial bank loans, which require them to pay 9-10% interest rate, significantly higher than the 4-8% paid by leading shipbuilding nations.

While other countries have easy financing options for shipbuilders, Indian shipbuilders cannot access long-term financing from domestic or foreign sources because of the non-inclusion of ships in the harmonised list of infrastructure.

Absence of long-term shipbuilding credit facilities and a dedicated maritime financing institution limits Indian shipbuilders’ ability to scale.

For context, shipyards in leading nations enjoy up to 40% subsidy on shipbuilding costs from the government. There is no such support for the Indian shipyards, especially the private ones.

Meanwhile, China is the world’s cheapest steel manufacturer, which lowers its shipbuilding costs. The cost disadvantage makes it less competitive for Indian shipyards to build ships.

All of these issues make Indian-built ships less competitive in the global market.

Does this mean shipbuilding is doomed in India?

Well, not quite. There are a few things that work in India’s favour.

You see, India has everything it needs to be a global shipbuilding powerhouse.

India also stands to benefit from the substantial trade that takes place in the Indian Ocean. For context, 80% of the world's oil and gas shipments and nearly 9.48 billion tonnes of cargo travel through the Indian Ocean every year, amounting to nearly $7 trillion worth of global trade.

But the irony is:

Despite its economic strengths, India virtually has no presence in the global shipbuilding industry.

It’s simply because India's shipbuilding industry has been largely overlooked for decades.

But now, the dynamics are changing!

The government is seeing a huge opportunity in this industry. To give you some idea, if Indian shipyards can meet future shipping demands, it could unlock a ₹20 lakh crore market by 2047.

So, India is now mapping a course to revolutionise its shipbuilding sector, aiming to position it among the world’s top 10 shipbuilding nations by 2030 and reach the top 5 by 2047.

How is the government energising shipbuilding in India?

To revitalise the sector, the Indian government has rolled out a range of initiatives. Let’s look at them!

With this partnership, India seeks to boost its shipbuilding capacity and capabilities, tap into their technology prowess, secure a larger share of global demand and reduce dependence on foreign vessels.

This initiative has encouraged several private players to venture into shipbuilding.

For context, Adani Group is investing ₹45,000 crore for a massive shipbuilding project at Mundra Port in Gujarat. And since global shipyards are fully booked until 2028, Adani Group seeks to cash in on growing demand for eco-friendly ships, aiming for a $62 billion (₹5.2 lakh crore) market by 2047.

Additionally, Pipavav Shipyard (now Swan Defence and Heavy Industries), which India’s largest shipyard by capacity, has infused $250 million with an additional $250 million investment plan (₹4,150 crore total) for building various types of ships in India.

-

A ₹25,000 crore Maritime Development Fund has been allocated to provide long-term, low-cost finance for shipbuilding and related infrastructure.

-

Large vessels will be granted infrastructure status, enabling companies to access long-term funding.

-

Specialised shipbuilding clusters will be developed that will bring together infrastructure, skilled workers, and new technologies to promote domestic manufacturing.

-

A 10-year customs duty exemption will be given on key shipbuilding components to reduce costs and encourage local production.

-

Shipbreaking credit notes worth 40% of the value of a scrapped ship will be issued to encourage sustainable ship recycling and renewal in Indian yards.

-

Shipbuilding Financial Assistance Policy will be renewed to offer large subsidies and incentives to improve global competitiveness.

There is another interesting point here:

US tariffs on China-made ships

According to a report in ThePrint, China builds more ships in a single year than the US has in its entire history. To restrict China’s domination in shipbuilding, the US proposes charging a service fee of $1 million on China-owned vessels and $1.5 million on China-built vessels entering US ports.

This move could potentially change the global trade dynamics as most global shipping companies currently rely on China-built ships. Now, if US tariffs on China-built ships, India could largely benefit by stepping in as an alternative manufacturing hub.

Having said that, we are not just dependent on tariffs to fuel our shipbuilding ambitions. The Indian government is taking significant steps to encourage shipyards to build more ships locally, boost private sector investment, expand port infrastructure, enhance connectivity, and improve ease of doing business.

But the key questions are:

-

Are these efforts enough to revive our shipbuilding industry?

-

Will it reduce India’s foreign dependence?

-

And, will we be able to bridge the gaps and secure our own sea lanes and maritime trade?

Whether the Indian shipbuilding industry will swim or sink is something only time can tell.

But one thing is certain: If we want to break into the top 10 in the next 5 years, we need to act fast!

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story