Upstox Originals

Beyond FDs and G-Secs: Why municipal bonds should be on your radar

7 min read | Updated on September 26, 2025, 15:06 IST

SUMMARY

For just ₹10,000, you could help finance India’s next clean energy or water project. No, this isn’t through taxes. It’s an investment that can actually earn you steady, tax-free returns of up to 5-6%. We are talking about municipal bonds, a small but steadily growing corner of India’s ₹226 trillion bond market. Of course, it’s not all smooth sailing. Liquidity is thin, governance can be patchy, and repayments are sometimes delayed.

Since FY18, Indian cities have raised about $303 million

India’s urban infrastructure demands are soaring, and municipal bonds are helping cities bridge the financing gap for roads, water systems, and clean energy projects. At their core, municipal bonds are debt securities issued by Urban Local Bodies (ULBs) to finance essential projects.

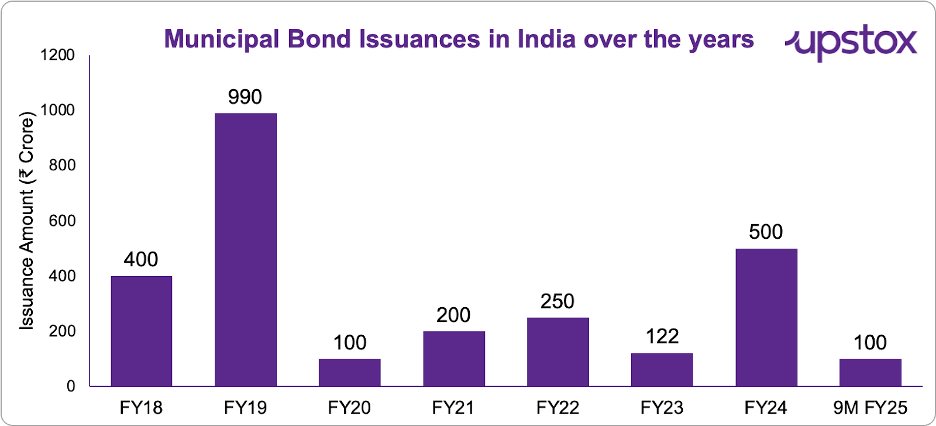

Since FY18, Indian cities have raised about $303 million (₹2,662 crore) through municipal bonds. With another $180 million (₹1,500 crore) expected in FY2025–26, the market is steadily advancing toward the $480 million (₹4,000-crore) milestone.

By tapping capital markets, cities are moving beyond dependence on government transfers and issuing bonds backed by property taxes, water charges, or project revenues. Safeguards such as escrow accounts (separate accounts where repayments are routed first) and Debt Service Reserve Accounts (emergency funds kept aside for bond payments) add confidence for investors, while SEBI’s disclosure framework has introduced much-needed financial discipline.

This shift is already visible: cities such as Pune, Ahmedabad, and Indore have raised hundreds of crores to finance water supply, waste management, and solar power. Municipalities are competing for investor trust like corporates by strengthening revenues, transparency, and governance.

Why should you look at these?

Take this example: A 6% municipal bond delivers ₹6,000 annually on ₹1 lakh, completely untaxed. In comparison, a fixed deposit at 6% yields ₹6,000 before tax, but for someone in the 30% income tax bracket, the post-tax return drops to just ₹4,200. The difference highlights the tax efficiency that makes municipal bonds attractive.

Municipal bonds in India typically carry coupons of 6–8% (ICRA), placing them at the upper end of returns for AA-rated fixed-income instruments. By comparison, AA-rated corporate bonds generally offer yields of 9–14%, though these can vary depending on the issuer’s sector, credit profile, and market conditions, with some finance and NBFC bonds yielding over 10%. Government securities of similar maturities provide yields of around 6-7%

When combined with the tax-exempt status of municipal bonds, these instruments can deliver higher effective post-tax returns than both corporate and government alternatives, making them an attractive option for investors seeking steady, risk-adjusted income.

How do municipal bonds stack up?

| Instrument | Typical Yield (10Y) | Tax Treatment | Liquidity |

|---|---|---|---|

| Government Securities (G-Secs) | ~6.5% | Fully taxable | Very High |

| State Development Loans (SDLs) | ~7.5% (≈1%+ over G-Secs) | Fully taxable | High |

| PSU Bonds | Up to 8.4% | Fully taxable | Moderate |

| Municipal Bonds | 6.5–8.0% | Tax-free under Sec 10(15) | Low (nascent secondary market) |

Source: News articles, internal research

G-Secs remain the safest choice but offer the lowest yields. SDLs and PSU bonds provide slightly higher returns but are still fully taxable. Municipal bonds, while less liquid and carrying governance risks, stand out for their tax-free status and competitive yields, making them an attractive option for investors willing to hold for the medium to long term.

Largest municipal bond issuances (FY2018–2025)

| Bond / Issuer (ULB) | Year | Amount Raised (₹ crore) | Rating | Maturity | Yield / Coupon | Subscription Status |

|---|---|---|---|---|---|---|

| Pune Municipal Corporation (PMC) 2017 Bonds | 2018 | 200 | AA+ | 10Y | 7.59% | NA |

| Ahmedabad Municipal Corporation 2019 Bonds | 2019 | 200 | AA+ | 5Y | 7.50% | NA |

| Surat Municipal Corporation 2019 Bonds | 2019 | 200 | AA | 5Y | 7.33% | NA |

| Lucknow Municipal Corporation 2021 Bonds | 2021 | 200 | AA | 10Y | 8.10% | NA |

| Pimpri-Chinchwad Municipal Corporation (PCMC) 2024 Green Bonds | 2024 | 200 | AA | 10Y | ~7.62% | Oversubscribed 5.1× |

| Greater Chennai Corporation 2025 Bonds | 2025 | 200 | AA | 10Y | 7.97% | Oversubscribed 4.2× |

Source: Government documents, press releases; Pune Municipal Corporation (PMC) and Pimpri-Chinchwad Municipal Corporation (PCMC) are two separate ULBs, though both fall within the Pune Metropolitan Region.

To date, Indian municipal bonds have not experienced defaults, thanks to strong rating standards and protective mechanisms. However, credit quality varies across ULBs, so due diligence remains important.

Liquidity is a limitation, with low secondary market activity making early exits challenging. These bonds are therefore best suited for medium- to long-term investors, though regulators and issuers are working to enhance market depth.

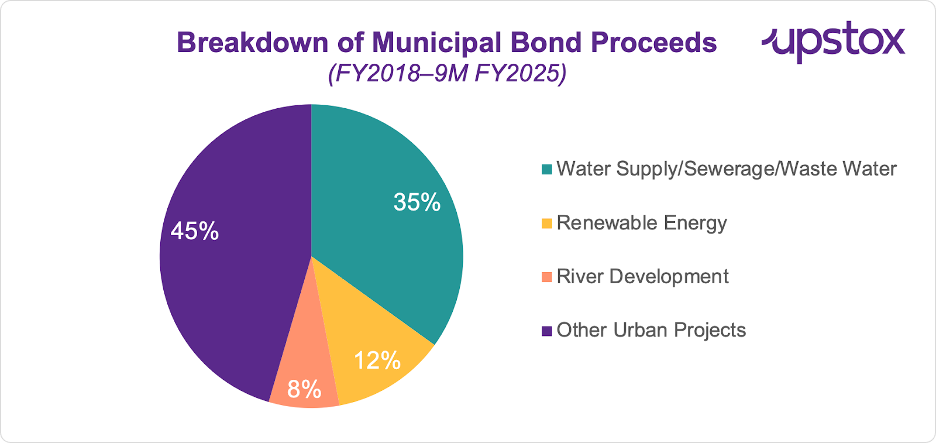

Water and sewerage projects dominate municipal bond funding, but renewable energy and other urban projects are steadily gaining share.

Source:ICRA Research, BSE/NSE; Data reflects the aggregate use of proceeds from all municipal bond issuances in India between FY2018 and 9M FY2025; not specific to any single city.

The other side of the story: Key risks in municipal bonds

Of course, no story is risk-free. Municipal bonds bring their own set of challenges:

-

Credit Risk: Repayments depend heavily on municipal revenues such as property tax and user charges. If collections weaken, repayment capacity can come under pressure. A case in point is the Nashik Municipal Corporation bond, which promised a steep 14.75% return but faced long repayment delays due to coordination issues between the state and the city.

-

Liquidity Risk: Secondary market trading in Indian municipal bonds is thin. Most issues see very limited daily volumes, making early exit difficult. With typical tenors ranging from 3 to 10 years, these bonds are better suited to investors with a medium- to long-term horizon who can hold until maturity.

-

Political and Implementation Risk: Project delays, leadership changes, or weak execution can undermine municipal finances. For instance, the Lucknow Smart City project faced cost escalations and delays after state-level leadership changes.

-

Governance Risk: Only about 11% of Indian municipalities currently meet strong financial governance standards. For investors, due diligence on the issuing city’s transparency, revenue discipline, and track record is essential.

Key drivers behind the rise: why now?

India’s municipal bond revival did not happen overnight; it reflects the convergence of policy support and growing market appetite.

Source:ICRA Research, BSE/NSE

Government support has played a key role in enabling municipal bond issuances. Under the AMRUT scheme, the central government provides a grant incentive: for every ₹100 crore that a city raises through municipal bonds, it receives an additional ₹13 crore as a grant, capped at ₹26 crore per issuance.

SEBI’s 2015 reforms provided the regulatory backbone, introducing stricter disclosure norms, lowering the minimum ticket size to ₹10,000, and mandating the role of merchant bankers - all of which made issuances more transparent and investor-friendly.

National programs such as AMRUT and the Smart Cities Mission have further built supply, encouraging ULBs to raise market capital while competing for investor trust.

A global perspective: India in context

While India’s municipal bond market is still in early stages, global municipal cbond markets offer perspective. The US municipal bond market reached over $4.2 trillion in Q1 2025 (SIFMA), highlighting the scale achieved in mature markets.

India’s total municipal bond issuances remain modest in comparison, but with policy support, regulatory frameworks, and growing ULB participation, the country is poised for steady growth.

Market outlook: A bet on India’s urban future

Looking ahead, India’s municipal green bond market could mobilise up to ₹20,000 crore ($2.5 billion) by 2030 (CEEW). This growth will be fuelled by targeted reforms, stronger financial practices, and enhanced institutional capacity, paving the way for climate-resilient urban infrastructure on a large scale.

Issuances are expected to exceed ₹1,500 crore in FY2025–26, with green bonds forming a growing share. For investors, municipal bonds combine safety, tax efficiency, and visible impact. For cities, they ease reliance on strained budgets; for citizens, they translate into cleaner water, renewable energy, and better infrastructure.

Yet scale remains limited. Municipal bonds today account for less than 0.01% of India’s ₹226 trillion bond market (ICRA). With the urban population projected to cross 600 million by 2036 (World Bank), grants alone cannot meet the trillions required. Municipal bonds will be vital in bridging that gap.

As India moves toward its $10 trillion economy goal (ijraset), these instruments will not just raise capital, they will help shape the future of India’s cities.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story