Upstox Originals

Too pricey or just right? India’s sector report card

.png)

5 min read | Updated on June 04, 2025, 18:12 IST

SUMMARY

India’s stock market might be making steady moves, but a closer look reveals some sectors sprinting ahead while others catch their breath. From auto’s turbo-charged returns to slowdown in IT and metals, here we will try to uncover who’s winning, who’s wobbling, and where the real value lies.

Nifty Auto and pharma have delivered strong earnings growth over the past 3 years

However, as the Q4FY25 earnings session comes to a close, we dive a little deeper into the fundamental performance (earnings) of the overall market and key sectors.

Halfway through 2025, the Indian financial market is holding its head high like a student who just aced an exam — despite chaos in the classroom (global markets). From tariffs tossed around like confetti to whispers of a recession, India Inc. is keeping calm and carrying on. But how’s everyone really doing behind the scenes?

In such an environment, earnings support becomes crucial to ensure market buoyancy and future growth.

Let’s take a stroll through the sectors to find out who’s thriving, who’s just surviving, and who’s eyeing the exit in this economic rollercoaster.

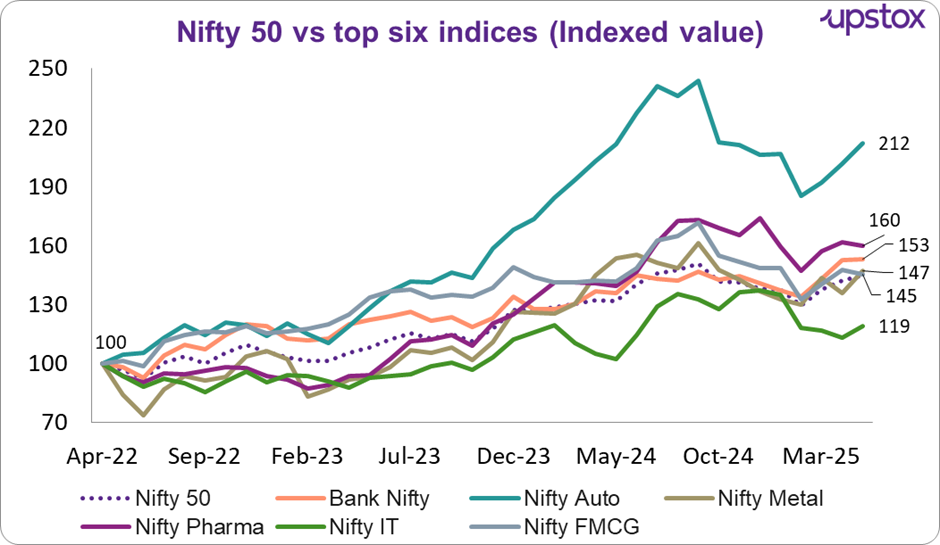

Overview of index performance

Over the past three years, most major indices have delivered a positive performance, with the Nifty Auto achieving a commanding pole position. Successful new vehicle launches (cars and 2Ws), along with an overall thriving EV market and robust financial position of most players, are some of the key contributors. Not to mention, as electrification gains momentum, it translates into more value-additive business for the ancillary businesses as well. Coming in a distant second and third are the Nifty Pharma and Bank Nifty.

A little surprising to note is the Nifty IT’s modest showing. In a world where AI has become a buzzword, the IT sector’s performance may come as a surprise to many. However, even as AI and related technologies and services still don't contribute meaningfully to revenues, they are changing the way the IT business is conducted. From massive investments in data centres to the development of new models and major cost rationalisations, the IT sector will need to adapt to a new paradigm in doing business.

Source - Investing.com

Now, let’s peek under the hood to see how earnings are shaping up.

Earnings performance

The earnings scoreboard aligns with the overall performance, with the top performers also scoring higher in earnings growth in comparison to their peers.

Net profit trend: Nifty 50 and select indices (₹ Cr)

| Nifty Pharma | Nifty Auto | Bank Nifty | Nifty FMCG | Nifty 50 | Nifty Metal | Nifty IT | |

|---|---|---|---|---|---|---|---|

| FY23 | 24,376 | 38,066 | 1,88,243 | 43,944 | 5,10,983 | 70,756 | 95,745 |

| FY24 | 36,895 | 61,776 | 2,59,170 | 46,635 | 6,14,451 | 55,203 | 1,03,635 |

| FY25 | 44,103 | 65,055 | 2,91,862 | 65,308 | 6,93,223 | 84,032 | 1,11,182 |

| CAGR | 22% | 20% | 16% | 14% | 11% | 6% | 5% |

Source - Ace Equity, internal research

Key drivers and challenges for these sectors.

Beyond the numbers, we take a look at some major challenges and opportunities for the sectors

| Sector | Key Drivers | Key Challenges |

|---|---|---|

| Auto | Strong rural growth Rising EV adoption Easing raw material prices | Some financing stress in the CV space Withdrawal of EV-related subsidies |

| Bank | Retail lending continues to be strong with home loans and SME financing growing by over 15% and 12-14% YoY Strong CET-1 ratio of above 10% | Pressure on deposit growth persists, which has raised funding costs by 50-75 basis points Rise in loan delinquency in both personal loans and credit cards by 5-7%. |

| IT | Deal wins continue to remain strong Demand from sectors like telecom, financial services, healthcare, and retail is healthy | Geopolitical challenges weigh on the overall IT spending. Demand from Europe slowed down sequentially Companies struggle with slow deal conversions, intense pricing competition |

| Pharma | Strong export growth | Persistent pricing pressure in generic drugs |

| Metal | Rise in mega projects like PM Gati Shakti, Bharatmala, and Smart Cities, which are increasing domestic demand. | Increasing import reliance, For instance, in FY25 India’s steel trade deficit hit a 10-year high of 4.5mt |

Source: Company reports, news articles

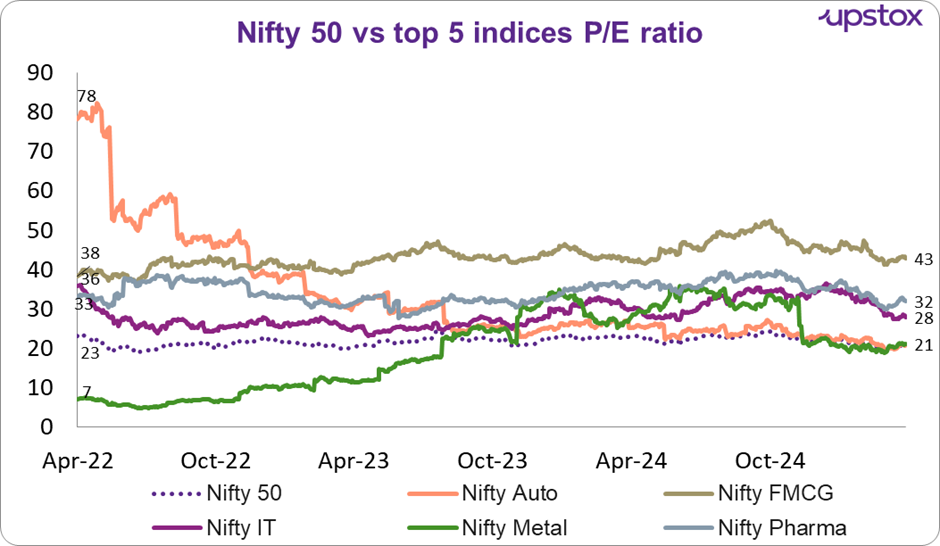

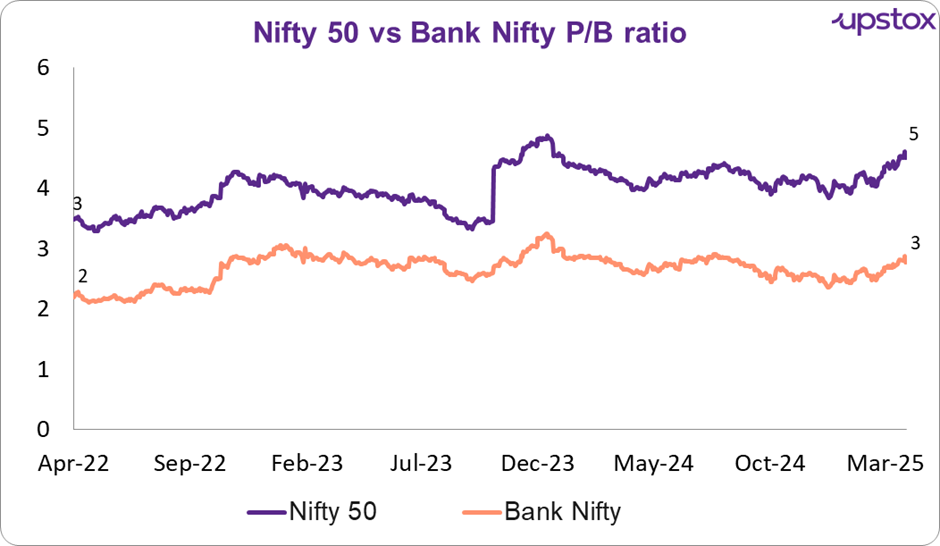

Valuation

Now, let's put those earnings in perspective, because price tags matter. Here’s where sectors look overpriced, undervalued, or just right.

Source - NSE, data as of 31st March 2025

Source - NSE, data as of 31st March 2025

-

Strong earnings growth in pharma, autos, and the banking sector should provide some support, while poor performance in IT, metals will be a key monitorable for investors.

-

That said, as highlighted in Markets calling, at current levels, valuations leave little room for error, which means earnings need to continue supporting markets. For the quarter ended Q4FY25, Nifty50 has seen an earnings growth of ~3% (as per Ace Equity), below overall expectations. With the overall outlook still challenged largely due to global uncertainties, earnings will need to keep pace with investor expectations.

Outlook

As the global economy throws curveballs, India’s sectoral split shows us more than just numbers—it reveals shifting consumer habits, evolving policy impacts, and where future growth could come from. For investors, this isn’t just a mid-year check-up; it’s a chance to reposition and rethink which sectors truly have the legs to lead in the long run.

Disclaimer: This article is for informational purposes only and must not be considered investment advice. Investors should consult with experts before making any investment decisions.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story