Personal Finance News

Budget 2026: Capital markets seek lower Securities Transaction Tax (STT). All you need to know

.png)

3 min read | Updated on November 18, 2025, 18:57 IST

SUMMARY

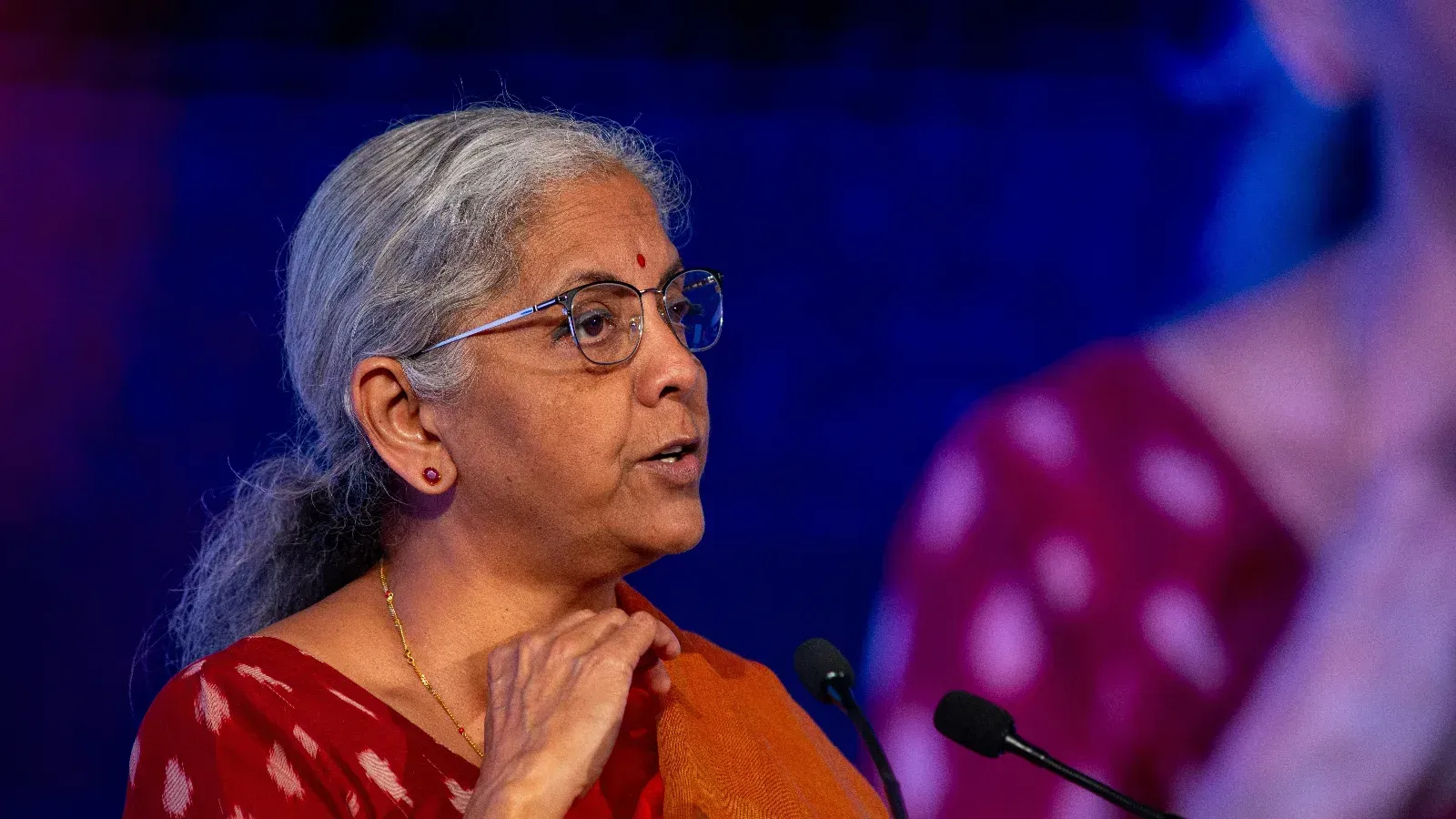

Pre-Budget meetings 2026: This was the fourth pre-Budget meeting between the finance minister and representatives of capital markets. Finance Minister Sitharaman is set to present her ninth consecutive Budget likely on February 1.

STT is a direct tax levied on every sale and purchase of listed securities. | Image source: Shutterstock

Capital market players, including BSE, Multi-Commodity Exchange (MCX), Association of Mutual Funds in India (AMFI), Association of Registered Investment Advisers, and Commodity Participants Association of India (CPAI), have reportedly requested Finance Minister Nirmala Sitharaman to reduce the Securities Transaction Tax (STT) on cash market trades in Budget 2026..

According to a PTI report, capital markets' representatives attended a pre-budget meeting with the finance minister on Tuesday, November 18, 2025, where they pitched for reductions in securities transaction tax and measures to deepen the financial sector.

They also submitted suggestions regarding improving the efficiency of capital markets and increasing capital market inclusion.

The report, quoting sources, said that representatives of capital markets sought lower STT on cash market trades as compared to derivatives.

What is STT?

STT is a direct tax levied on every sale and purchase of securities listed on stock exchanges in India. The STT is levied over and above the transaction value.

Some of the securities on which STT applies are the following:

-

Equity shares

-

Derivatives

-

Units of equity-oriented mutual funds

-

Unlisted shares sold under an offer for sale to the public and are included in the IPO, and subsequently listed on stock exchanges.

-

Securitised debt instruments

Current STT rates for stocks, mutual funds, ETFs and derivatives

-

Delivery-based purchase of equity share: Purchaser has to pay 0.1% STT on the price at which equity share is purchased.

-

Delivery-based sale of an equity share: Seller has to pay 0.1% STT on the price at which the equity share is sold

-

Delivery-based sale of equity MF units: Seller has to pay 0.001% STT on the price at which the units are sold

-

Sale of ETFs: 0.001% STT paid by the seller

-

Sale of an option in securities: 0.1% STT on Option premium to be paid by the seller

-

Sale of an option in securities where the option is exercised: 0.125% STT on the settlement price to be paid by the purchaser

-

Sale of futures in securities: 0.02% STT to be paid by the seller on the price at which futures are traded.

More from pre-budget meetings

This was the fourth pre-Budget meeting between the finance minister and representatives of capital markets.

The meeting was also attended by Union Minister of State for Finance Pankaj Chaudhary, Secretary of the Department of Economic Affairs Anuradha Thakur, Chief Economic Adviser V Anantha Nageswaran and other senior officials from the Ministry of Finance.

Last week, the finance minister had met economists, leading representatives from the agriculture sector and MSME sector players as part of the first, second, and third rounds of discussions, respectively.

Finance Minister Sitharaman is set to present her ninth consecutive Budget likely on February 1 in the backdrop of geopolitical uncertainties and the steep US tariff of 50 per cent imposed on shipments from India.

On Tuesday, the Finance Minister also held a separate meeting with startup founders representatives as part of her pre-Budget consultations.

Related News

About The Author

Next Story