Personal Finance News

Is Post Office fixed deposit interest rate better than top bank FDs in July 2025?

.png)

3 min read | Updated on July 04, 2025, 11:44 IST

SUMMARY

India Post currently offers fixed deposits (or time deposits) with a tenure of 1 year, 2 years, 3 years and 5 years and interest rates ranging from 6.9% to 7.5%. Not only do these fixed deposits come with better returns as compared to banks (for these specific tenures), they're also safer as they're government-backed.

The interest earned from post office fixed deposits is calculated quarterly, but is paid annually.

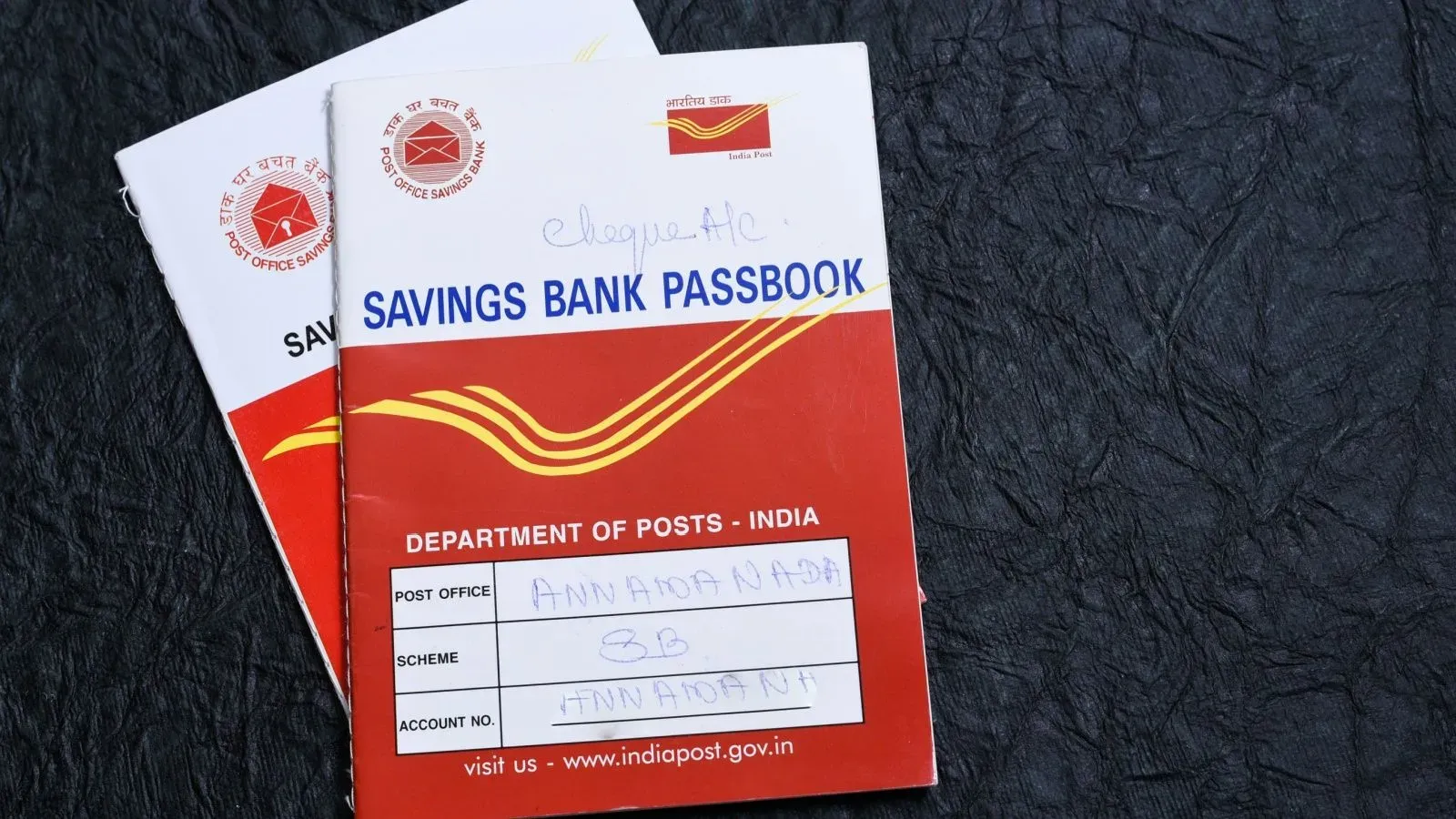

A Post Office Time Deposit (POTD), also referred to as a ‘Post Office fixed deposit’, is a popular, government-backed savings tool offered by the India Post. It is considered safer than bank FDs and is beneficial for those with limited access to banks.

While banks offer fixed deposits in several tenures, and even some special tenures (like 444 days, 555 days), the Post Office only has time deposits in four specific tenures: 1 year, 2 years, 3 years and 5 years.

FD interest rates offered by banks and other financial institutions vary on the basis of their tenures, typically ranging from 7 days to 10 years, with higher interest rates for longer durations. The interest rates are usually between 3-7% in leading banks and up to 8-9% in some small finance banks.

While India Post only offers fixed deposits for four tenures, it offers competitive interest rates along with a much safer investment option for citizens. The government reviews the interest rates on TDs every quarter. During 2014-2016, the FD rates in the post office were at their peak at 8.5% for 5-year deposits. Since then, they’ve fallen and recovered as per the market conditions and monetary policy.

For the July-September quarter of FY 2025-26, the government kept the Post Office FD interest rates as follows:

| Tenure | Interest rate |

|---|---|

| 1 Year | 6.9% |

| 2 Years | 7.0% |

| 3 Years | 7.1% |

| 5 Years | 7.5% |

Note: The interest earned from post office fixed deposits is calculated quarterly, but is paid annually. This means that compounding of interest is done quarterly, but the whole amount is paid at the end of every year.

In 2025, the Reserve Bank of India (RBI) has cut the repo rate by 100 bps (1%). This has resulted in many banks lowering their lending rates, along with the interest rates offered on FDs.

While banks have followed suit and announced multiple FD interest rate cuts in the last few months, India Post has kept rates unchanged.

| Institution | 1 Year | 2 Years | 3 Years | 5 Years |

|---|---|---|---|---|

| Post Office | 6.90% | 7.00% | 7.10% | 7.50% |

| SBI | 6.25% | 6.45% | 6.30% | 6.05% |

| HDFC | 6.25% | 6.45% | 6.45% | 6.40% |

| ICICI | 6.25% | 6.50% | 6.60% | 6.60% |

| PNB | 6.40% | 6.40% | 6.40% | 6.50% |

| Bank of Baroda | 6.50% | 6.50% | 6.50% | 6.40% |

Source: Bank websites

While banks have higher interest rates for some tenures, it is clear that the Post Office offers better interest on the most widely chosen tenures, including the 5-year fixed deposit. Before you invest your money, remember to compare all the deposits and interest rates offered by different institutions. The Post Office Time Deposit is also an attractive option if you are aiming for a safe investment with decent returns.

Related News

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story