Personal Finance News

Silver price history from 1970 to 2025: A look at Mumbai vs New York trends over 55 years

8 min read | Updated on December 05, 2025, 09:27 IST

SUMMARY

Due to currency controls that made it difficult for Indian investors to participate freely in the global silver trade and an overall low interest in silver, the white metal continued to trade at a discount in the country until 1985.

Over the years, the premium that silver built became almost structural, and it never looked back.

Silver, often referred to as gold’s undervalued cousin, is a more volatile and industrial metal with an interesting price history. While gold has been consistently rising and soaring during uncertain situations, the white metal has had a more fluctuating yet fascinating journey through the years.

In 2025, the white metal ended up making more noise in the market than its other shiny cousin, primarily due to rising industrial demand and supply shortage.

Now that silver is commonly used in several industries and is crucial for emerging sectors like EV, 5G and solar, the white metal has become more valuable in both domestic and international markets.

In 2024-25, silver was at around ₹89,000 per kg; when compared to the current price of around ₹1.9 lakh per kg, the precious metal has jumped over 110%. This remarkable increase is even more interesting when you consider that the metal was valued at ₹536.08 per kg in 1970-71.

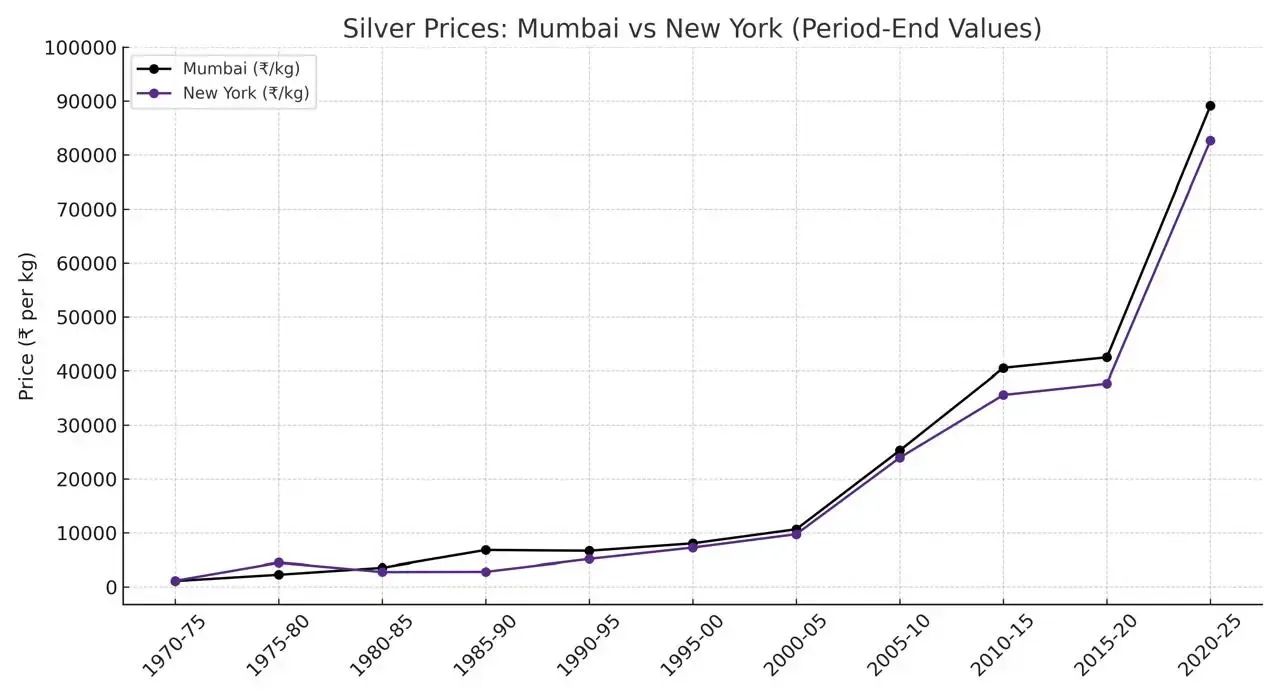

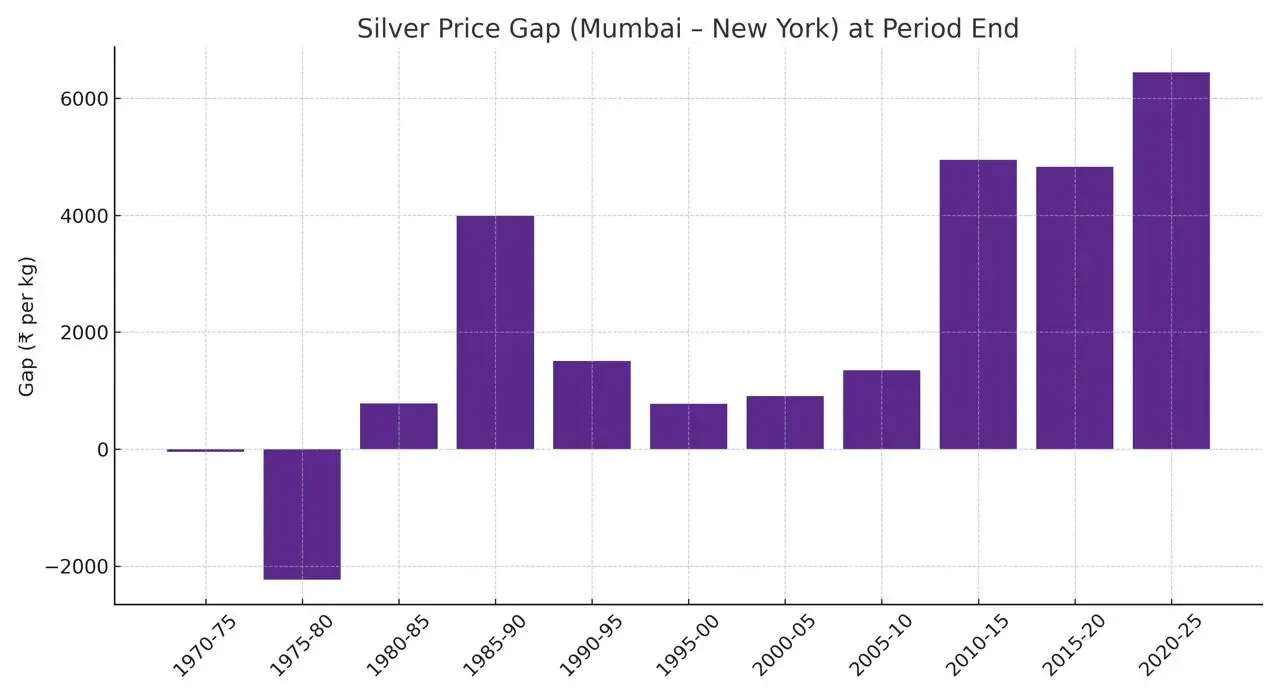

Until 1985, silver prices in Mumbai (India) mostly traded at a discount when compared to New York (US) rates, except for some years scattered in between this period. However, notably, since then, the white metal has consistently traded at a premium. This means that silver prices in India have remained above those in the US for nearly 40 years now.

Before getting into the why, let’s first look at how silver prices have changed in Mumbai and New York in the last 55 years:

Silver prices in Mumbai vs New York

| Year | Mumbai (₹/kg) | New York (₹/kg) | Gap (₹/kg) |

|---|---|---|---|

| 2024-25 | 89,130.53 | 82,685.10 | 6,445.43 |

| 2023-24 | 72,242.82 | 62,821.01 | 9,421.81 |

| 2022-23 | 61,990.56 | 55,347.95 | 6,642.61 |

| 2021-22 | 65,425.65 | 58,847.68 | 6,577.97 |

| 2020-21 | 59,283.26 | 54,499.06 | 4,784.21 |

| 2019-20 | 42,514.30 | 37,687.89 | 4,826.41 |

| 2018-19 | 38,404.23 | 34,540.20 | 3,864.04 |

| 2017-18 | 39,072.18 | 34,961.97 | 4,110.22 |

| 2016-17 | 42,748.31 | 38,360.04 | 4,388.27 |

| 2015-16 | 36,318.10 | 32,091.84 | 4,226.26 |

| 2014-15 | 40,558.48 | 35,611.18 | 4,947.30 |

| 2013-14 | 46,636.80 | 41,643.21 | 4,993.59 |

| 2012-13 | 57,602.30 | 53,329.11 | 4,273.19 |

| 2011-12 | 57,315.87 | 54,320.69 | 2,995.18 |

| 2010-11 | 37,289.54 | 35,050.93 | 2,238.61 |

| 2009-10 | 25,320.69 | 23,980.04 | 1,340.65 |

| 2008-09 | 21,247.57 | 20,059.44 | 1,188.13 |

| 2007-08 | 19,427.45 | 18,738.23 | 689.22 |

| 2006-07 | 19,056.57 | 18,133.96 | 922.62 |

| 2005-06 | 11,828.81 | 11,417.37 | 411.45 |

| 2004-05 | 10,680.82 | 9,766.58 | 914.24 |

| 2003-04 | 8,721.90 | 7,982.49 | 739.40 |

| 2002-03 | 7,990.53 | 7,268.46 | 722.07 |

| 2001-02 | 7,447.19 | 6,708.71 | 738.49 |

| 2000-01 | 7,868.39 | 7,110.18 | 758.21 |

| 1999-00 | 8,066.94 | 7,286.51 | 780.43 |

| 1998-99 | 7,855.33 | 7,143.92 | 711.42 |

| 1997-98 | 7,352.27 | 6,153.96 | 1,198.32 |

| 1996-97 | 7,165.07 | 5,762.65 | 1,402.42 |

| 1995-96 | 7,220.50 | 5,809.36 | 1,411.14 |

| 1994-95 | 6,692.31 | 5,187.33 | 1,504.98 |

| 1993-94 | 6,348.12 | 4,741.09 | 1,607.03 |

| 1992-93 | 7,078.39 | 3,749.87 | 3,328.52 |

| 1991-92 | 7,332.41 | 3,269.89 | 4,062.52 |

| 1990-91 | 6,760.79 | 2,579.21 | 4,181.58 |

| 1989-90 | 6,841.91 | 2,846.31 | 3,995.60 |

| 1988-89 | 6,366.76 | 2,971.52 | 3,395.24 |

| 1987-88 | 5,538.83 | 3,016.70 | 2,522.13 |

| 1986-87 | 4,247.10 | 2,220.03 | 2,027.07 |

| 1985-86 | 3,918.38 | 2,396.35 | 1,522.03 |

| 1984-85 | 3,593.59 | 2,810.19 | 783.40 |

| 1983-84 | 3,505.80 | 3,516.66 | -10.86 |

| 1982-83 | 2,798.34 | 2,829.46 | -31.12 |

| 1981-82 | 2,636.06 | 2,617.36 | 18.70 |

| 1980-81 | 2,617.61 | 4,020.30 | -1,402.69 |

| 1979-80 | 2,301.30 | 4,532.00 | -2,230.70 |

| 1978-79 | 1,500.94 | 1,559.13 | -58.19 |

| 1977-78 | 1,240.54 | 1,305.77 | -65.24 |

| 1976-77 | 1,247.89 | 1,291.78 | -43.90 |

| 1975-76 | 1,171.64 | 1,220.06 | -48.42 |

| 1974-75 | 1,122.40 | 1,170.86 | -48.46 |

| 1973-74 | 799.01 | 809.59 | -10.58 |

| 1972-73 | 554.24 | 458.89 | 95.35 |

| 1971-72 | 561.35 | 363.51 | 197.84 |

| 1970-71 | 536.08 | 415.02 | 121.06 |

Key insights

1970-1985: During this period, silver prices in India mostly traded at a discount when compared to the US, except for some years. This was because back then, India’s silver market was still emerging, and imports were limited. The industrial demand for the metal was also significantly less than in the West.

Now, see this:

- Silver price in New York in 1979-80: ₹4,532 per kg

- Silver price in Mumbai in 1979-90: ₹2,301.30 per kg

- Gap: ₹2,230.70 per kg

This is the largest discount India has ever had over 55 years.

Due to currency controls that made it difficult for Indian investors to participate freely in the global silver trade and an overall low interest in silver, the white metal continued to trade at a discount in the country until 1985.

Over the years, the premium that the white metal built became almost structural, and it never looked back after that.

- Silver price in New York in 1989-90: ₹2,846.31 per kg

- Silver price in Mumbai in 1989-90: ₹6,841.91 per kg

- Gap: ₹3,995.60 per kg

- Silver price in New York in 1990-91: ₹2,579.21 per kg

- Silver price in Mumbai in 1990-91: ₹6,760.79 per kg

- Gap: ₹4,181.58 per kg

The gap between Mumbai and New York prices rose sharply after the 2008 Global Financial Crisis, when Indian prices remained relatively stable due to safe-haven buying and the effects of currency depreciation.

In uncertain and volatile situations, precious metals attract major attention from investors due to their safe-haven appeal. Both gold and silver are known to do well during economic turmoil and stressful conditions.

After 2010, the silver market started expanding even further, boosting the white metal prices. From around ₹7,500 per kg (Mumbai) in 2001-02, silver prices soared to above ₹37,000 in 2010-11, and skyrocketed to above ₹57,000 in just one year during 2011-12.

In recent years, the gap between Mumbai and New York prices has expanded due to many factors:

- Inflation in India and depreciation of the rupee

- Increased silver demand with expanded solar panel manufacturing in India

- High gold prices pushed many retail Indian investors to silver, boosting its demand

- Higher import duties

Some examples of very high gaps:

- Silver price in New York in 2022-23: ₹55,347.95 per kg

- Silver price in Mumbai in 2022-23: ₹61,990.56 per kg

- Gap: ₹6,642.61 per kg

- Silver price in New York in 2023-24: ₹62,821.01 per kg

- Silver price in Mumbai in 2023-24: ₹72,242.82 per kg

- Gap: ₹9,421.81 per kg

Current silver prices

This year, silver has seen the most remarkable rally in its entire history. From around ₹89,000 per kg last year, silver prices are currently at around ₹1.9 lakh per kg in India, up 113%.

Similarly, in New York, silver prices were at around ₹82,500 last year. Compared to the current price of around ₹166,000 per kg, the white metal is up more than 100%.

- Supply-demand deficit

- High industrial demand for silver

- Geopolitical tensions and trade war concerns

- US tariffs

- Gold price rally

- Market volatility

Meanwhile, the current gap between Mumbai and New York prices seems to be at its highest. Silver prices in Mumbai are nearly ₹25,000 (14.7%) more than in New York.

This is because:

- High import duties

- Rupee depreciation

- Increased domestic demand for silver (festive and wedding season demand)

The rupee hit its all-time low on December 3, crossing the 90 mark against the US dollar for the first time ever.

Over the last 55 years, silver has shown great volatility due to fluctuations in supply and demand. Furthermore, domestic silver prices have consistently traded at a premium over global benchmark prices due to many factors, including supply-demand imbalances, high local demand, import duties and taxes.

This year, silver demand in India has risen even further, not just because of the cultural and traditional value, but because investors have participated in greater numbers due to the global rally, boosting the premium in domestic prices.

Related News

About The Author

Next Story