Personal Finance News

Diwali to Diwali: How Gold and Silver left Sensex behind over 10 years

7 min read | Updated on September 26, 2025, 15:27 IST

SUMMARY

Over the last 10 years, silver has been more volatile than gold, with double-digit losses in some years (2015, 2017 and 2022) and bumper gains in others (2020 and 2025).

Sensex was at 81,159 points on September 9, and has delivered only 1.8% returns against last year.

So far this year, gold and silver have proven to be stronger investments than even the Indian stock market. Gold has jumped over 50% this year, surpassing multiple lifetime highs just in this month.

Precious metals gold and silver are more than just investments in India, with huge cultural and traditional significance in the country. Gold jewellery is central to religious ceremonies and a key part of household wealth in India.

Festivals like Dussehra, Dhanteras and most importantly of all, Diwali, are known to boost the demand for gold and silver, fuelling their prices all across the country.

Buying gold and silver on Diwali, one of the biggest Hindu festivals that symbolises the victory of light over darkness, is considered to be auspicious. Investors believe that assets brought in this period will bring them wealth and prosperity.

As of September 9, 2025, gold and silver prices stood at ₹1,12,750 per 10 gram and ₹1,36,882 per kg, up 43.76% and 44.65%, respectively, when compared to last year on Diwali (October 31, 2024).

Sensex was at 81,159 points on September 9, and has delivered only 1.8% returns against last year, when it was at 79,724 on October 31.

Nearly 10 years ago, on Diwali (November 11, 2015), gold was at just ₹25,490 per 10 gram. This marks an increase of 342.3% over the span of a decade. Silver, ten years ago, was at ₹34,197 per kg. When compared to September 2025, it has jumped over 300%.

On the other hand, Sensex was at 25,866 points on Diwali in 2015. Compared to September 2025, when it’s at 81,159 points, it is up 213.7%.

Five years ago, on Diwali (November 14, 2020), gold prices were at ₹50,986, delivering a return of 122.9% against September’s gold rates. The Sensex in 2020 was at 40,286, which means it has delivered 101.4% returns in the last five years.

Even Silver has delivered 113.4% returns in the last five years, as it was at ₹64,120 per kg in November 2020.

This signifies that both gold and silver have outperformed the Sensex on Diwali.

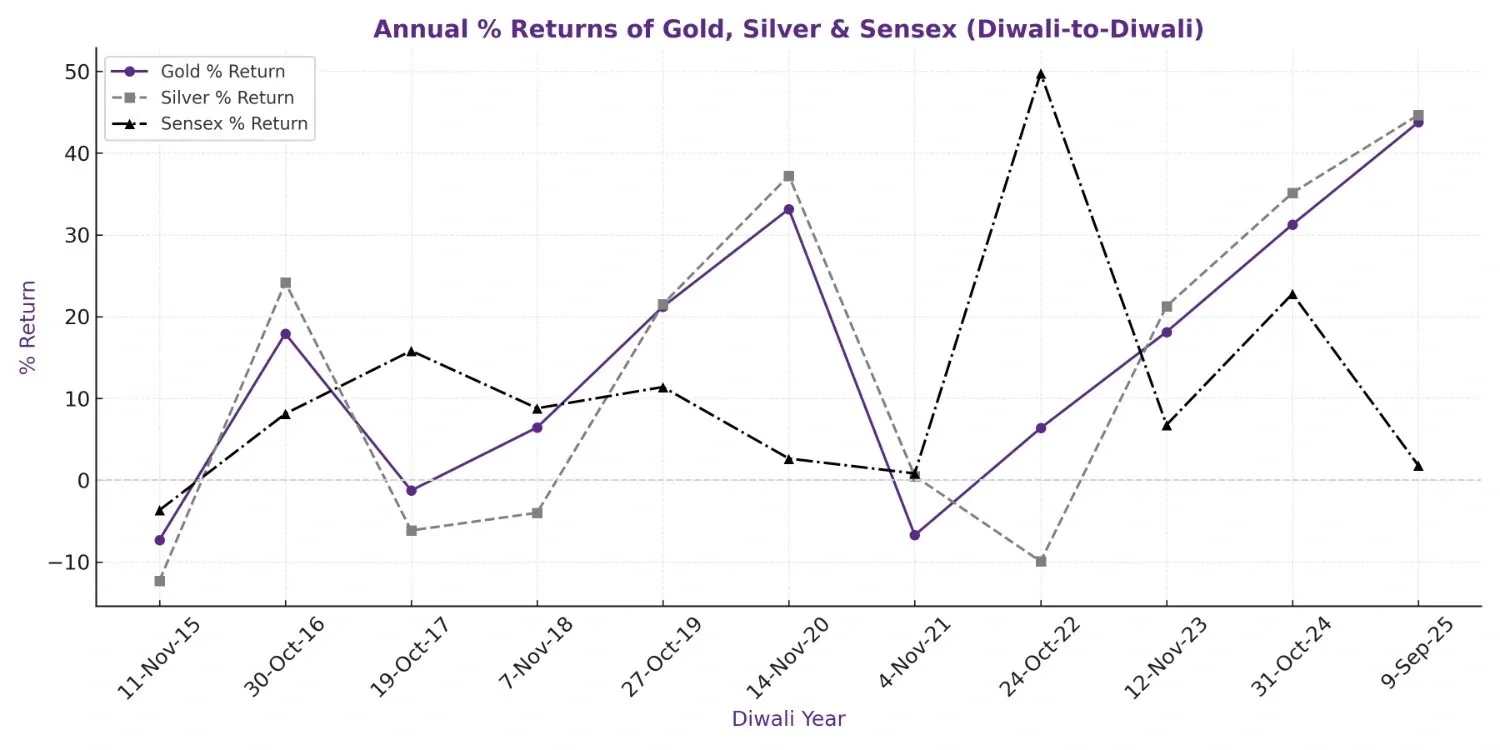

Here’s a detailed look at the performance of gold, silver and the Sensex at Diwali over the last 10 years, according to data by a leading commodity analyst:

| Diwali Date | Gold | Difference in ₹ | % Return | Silver | Difference in ₹ | % Return | Sensex | Difference | % Return |

|---|---|---|---|---|---|---|---|---|---|

| 11-Nov-15 | 25490 | -2010 | (7.31) | 34197 | -4803 | (12.32) | 25866 | -985 | (3.67) |

| 30-Oct-16 | 30057 | 4567 | 17.92 | 42459 | 8262 | 24.16 | 27966 | 2100 | 8.12 |

| 19-Oct-17 | 29679 | -378 | (1.26) | 39846 | -2613 | (6.15) | 32389 | 4423 | 15.82 |

| 7-Nov-18 | 31589 | 1910 | 6.44 | 38257 | -1589 | (3.99) | 35237 | 2848 | 8.79 |

| 27-Oct-19 | 38293 | 6704 | 21.22 | 46491 | 8234 | 21.52 | 39250 | 4013 | 11.39 |

| 14-Nov-20 | 50986 | 12693 | 33.15 | 63801 | 17310 | 37.23 | 40286 | 1036 | 2.64 |

| 4-Nov-21 | 47553 | -3433 | (6.73) | 64120 | 319 | 0.50 | 40616 | 330 | 0.82 |

| 24-Oct-22 | 50580 | 3027 | 6.37 | 57748 | -6372 | (9.94) | 60821 | 20205 | 49.75 |

| 12-Nov-23 | 59752 | 9172 | 18.13 | 70032 | 12284 | 21.27 | 64933 | 4112 | 6.76 |

| 31-Oct-24 | 78430 | 18678 | 31.26 | 94631 | 24599 | 35.13 | 79724 | 14791 | 22.78 |

| 9-Sep-25 | 112750 | 34320 | 43.76 | 136882 | 42251 | 44.65 | 81159 | 1435 | 1.80 |

Some insights

-

Over the last 10 years, silver has been more volatile than gold, with double-digit losses in some years (2015, 2017, 2022) and bumper gains in others (2020, 2025).

-

After Covid, gold and silver rose by 33% and 37%, respectively, in 2020. On the other hand, Sensex grew by just 2.6%, as investors turned to safer assets during crises.

-

Following a weak performance in 2020-21, the Sensex rebounded sharply in 2022 with nearly 50% growth. This highlights that long-term equity investors were rewarded.

Gold prices

Gold prices in Delhi, as per the All India Sarafa Association, hit a record high of ₹1,18,900 per 10 gram on Tuesday, September 23. This reflects a 50.6% jump from ₹78,950 per 10 gram recorded on December 31, 2024.

On the Multi-Commodity Exchange (MCX), gold contracts for the October delivery were at a lifetime high of ₹1,14,179 per 10 gram on September 23, up 27% from ₹89,500 per 10 gram in March 2025.

While gold has slowed down after the US Federal Reserve announced a 25 basis points (bps) rate cut, the outlook for the precious metal remains positive. Market experts forecast precious metals to rise in the near future, especially with the upcoming festive season.

Investors await the US PCE inflation report to determine gold’s trajectory in the overseas markets, as a ‘hotter-than-expected reading could increase pressure on the Fed and weigh on gold prices’, said CEO of Aspect Bullion & Refinery, Darshan Desai.

"Gold prices are on track for a sixth consecutive weekly gain globally, holding near record highs. While strong macroeconomic data has slightly reduced expectations of a US Federal Reserve rate cut in October, investor focus now shifts to today’s PCE inflation report. A hotter-than-expected reading could increase pressure on the Fed and weigh on gold prices. However, any resulting pullback may still attract renewed buying interest,” said Darshan Desai, CEO of Aspect Bullion & Refinery.

Gold, as a safe-haven metal, thrives in geopolitical tensions and market volatility. Major factors driving gold prices both domestically and internationally are market fluctuations, rising trade war tensions, central bank gold buying and weak currencies. Silver climbs with the rise in gold, and increasing industrial demand for Silver has helped the white metal give remarkable returns this year.

Related News

About The Author

Next Story