Personal Finance News

Digital gold purchases via UPI surge over 95%: Know the risks before buying digital gold this festive season

5 min read | Updated on September 24, 2025, 19:29 IST

SUMMARY

Gold’s rate in Delhi, as per the All India Sarafa Association, hit ₹1,18,900 per 10 gram on Tuesday, September 23. This is a 50.6% jump from ₹78,950 per 10 gram recorded on December 31, 2024.

Reports have shown that digital gold demand is gradually increasing, even in smaller towns across India. | Image: Shutterstock

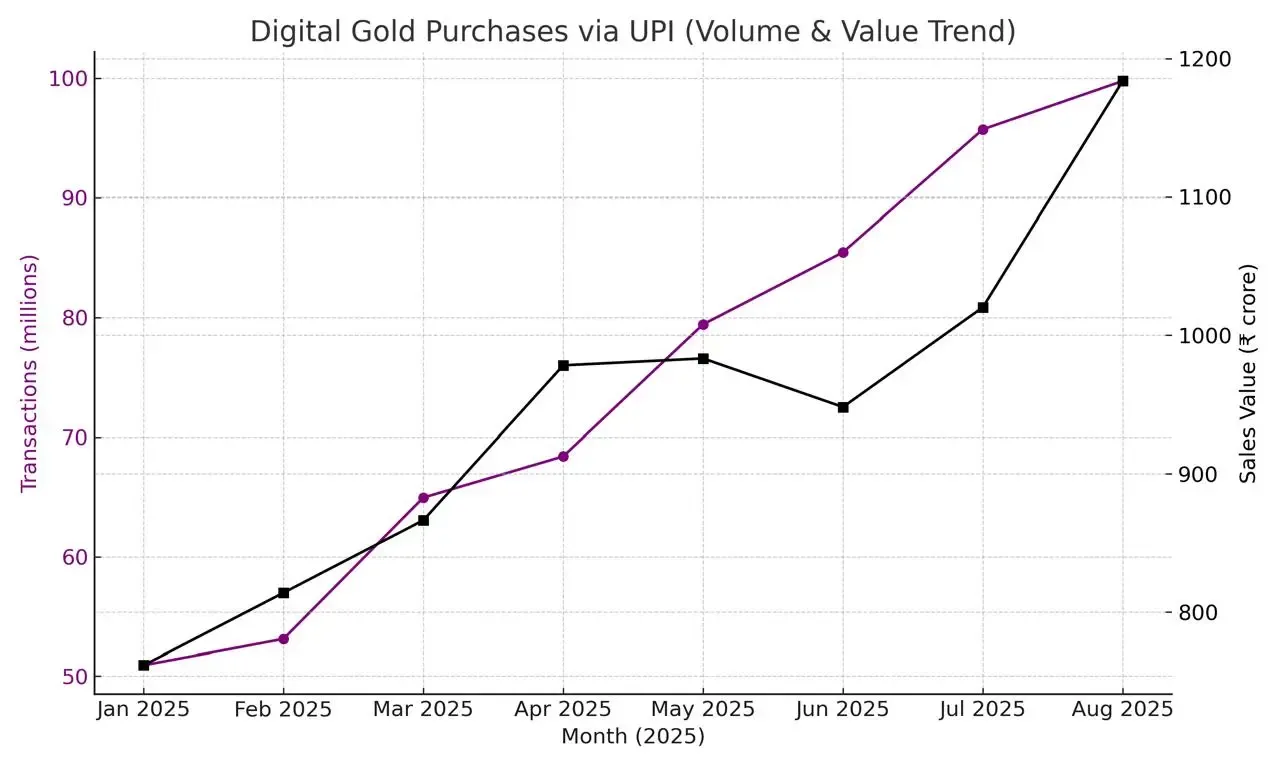

The volume of digital gold purchases through UPI (Unified Payments Interface) soared 95.89% in 2025 to 99.77 million transactions in August against 50.93 million transactions in January, as per National Payments Corporation of India (NPCI) data.

Year-to-date, the value of digital gold purchases via UPI jumped 55.4% to ₹1,184 crore in August from ₹761.60 crore in January 2025.

| Month | Transaction Volume (in tonnes) | Transaction Value (in ₹ crore) |

|---|---|---|

| Jan 2025 | 50.93 | 761.60 |

| Feb 2025 | 53.13 | 813.93 |

| Mar 2025 | 64.96 | 866.43 |

| Apr 2025 | 68.40 | 978.24 |

| May 2025 | 79.43 | 983.24 |

| Jun 2025 | 85.46 | 948.05 |

| Jul 2025 | 95.72 | 1,020.24 |

| Aug 2025 | 99.77 | 1,183.73 |

In a major cultural and structural shift, consumers used online payment platforms like PayTM, Google Pay, PhonePe and others to buy digital gold from companies like MMTC PAMP and Augmont Goldtech and jewellers like Tanishq and Senco Gold.

A cultural shift

For decades, Indians have bought gold for cultural and religious purposes, and the yellow metal has always been more than just an investment tool in the country. From Dhanteras purchases, as gold is considered to be auspicious, to traditional ceremonies where gold is significant, Indians have a special place for the precious metal in their portfolios and lockers.

Remarkably, Indian women held 11% of the world's gold, as per World Gold Council data from December 2024. According to the WGC, Indian women own 24,000 tonnes of gold, which is more than the gold reserves of the top five countries combined. For instance, the US had 8,000 tonnes of gold, followed by Germany and Italy with 3,300 tonnes and 2,450 tonnes.

With such strong roots of physical gold holding in the country, there has been a consistent rise in digital gold buying. Gold’s surprising and frequent all-time highs, coupled with the increase in digital transactions, have brought a significant shift in how Indian people buy gold.

Reports have shown that digital gold demand is gradually increasing, even in smaller towns across the country.

Risks of investing in digital gold

Investing in digital gold is easy. You can buy small amounts of digital gold from apps and platforms like MMTC-PAMP, Paytm and PhonePe. In this, gold is stored in secure vaults and can be redeemed as cash or physical gold. It is a flexible investment option with no lock-in period, usually. It also offers high liquidity.

However, digital gold comes with many risks:

What’s more, the Securities and Exchange Board of India (SEBI) has even prohibited registered investment advisors from recommending digital gold as it is susceptible to misappropriation of investor funds.

This festive season, you must aim to make safe investment choices to grow your wealth and plan your finances accordingly.

Gold’s performance

Gold’s performance over the past year has turned many heads and captured global attention. Even for investors who’ve aggressively put their money into the equity markets and stayed cautious of traditional investment tools like precious metals, it has been impossible to ignore the nearly 50% returns delivered by the yellow metal in 2025.

Surprisingly, the equity market was at its all-time high on September 27, 2024. This means it has been almost a year since the stock markets have surpassed their lifetime high.

Gold’s rate in Delhi, as per the All India Sarafa Association, hit ₹1,18,900 per 10 gram on Tuesday, September 23. This is a 50.6% jump from ₹78,950 per 10 gram recorded on December 31, 2024.

In futures trade on the Multi-Commodity Exchange (MCX), gold contracts for the October delivery were at ₹1,14,179 per 10 gram. In March 2025, these contracts were trading at around ₹89,500 per 10 gram, which marks an over 27% growth just in the last six months.

Related News

About The Author

Next Story