Personal Finance News

Bajaj Finserv Mutual Fund introduces two new funds: NFOs are open for subscription

.png)

6 min read | Updated on May 14, 2024, 18:38 IST

SUMMARY

Bajaj Finserv introduces two new schemes: Multi Asset Allocation Fund and Nifty 1D Rate Liquid ETF. The former objective is for income and capital appreciation, while the second one seeks low-risk, liquid investments. Both offer diverse opportunities for investors.

Bajaj Finserv Mutual Fund introduces two new funds: NFOs are open for subscription

Two new funds have been launched by Bajaj Finserv Mutual Fund to serve different investment purposes. Let’s get into the specifics of each new fund offering (NFO) to find out about its objective, where it puts its money, who manages it as well as what other funds like this perform like.

1. Bajaj Finserv Multi Asset Allocation Fund

Bajaj Finserv Multi Asset Allocation Fund is a new open-ended hybrid mutual fund launched by Bajaj Finserv Mutual Fund on May 13, 2024. The fund aims to generate income through fixed-income instruments and capital appreciation by investing in equities, derivatives, gold and silver ETFs, commodity derivatives, and units of REITs and InvITs. The offer period closes on May 27, 2024. There is no entry load, but an exit load of 1% applies if more than 30% of units are redeemed within one year of allotment. The minimum investment amount is ₹500.

The investment objective of the Bajaj Finserv Multi Asset Allocation Fund is to generate income from fixed-income instruments and generate capital appreciation for investors by investing in equity and equity-related securities including derivatives, Gold ETFs, Silver ETFs, exchange-traded commodity derivatives, and in units of REITs & InvITs. However, there is no assurance that the investment objective of the Scheme will be achieved.

Benchmark

The fund house compares the performance of Bajaj Finserv Multi-Asset Allocation Fund to 65% weighted Nifty 50 TRI + 25% NIFTY Short Duration Debt Index + 10% domestic prices of Gold.

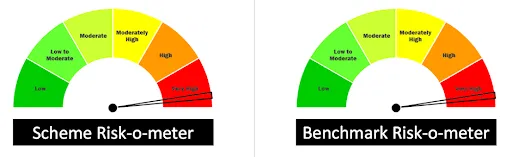

Risk-o-meter:

Funds Allocation

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Equity | Very High | 35% | 80% |

| Debt securities | Low to Moderate | 10% | 55% |

| Gold ETFs, Silver ETFs, Exchange Traded Commodity Derivatives (ETCDs) | Moderately High | 10% | 55% |

| REITs and InvITs | High | 10% | 0% |

Peer Schemes

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | Since Launch Ret (%) |

|---|---|---|---|---|

| ICICI Pru Multi Asset Fund | 39534.59 | 1.51 | 30.73 | 21.4 |

| SBI Multi Asset Allocation | 4677.36 | 1.52 | 27.22 | 9.36 |

| HDFC Multi Asset Fund | 2642.42 | 2 | 20.61 | 10.24 |

| Quant Multi Asset Fund | 2173.05 | 2.01 | 43.15 | 11.61 |

| UTI Multi Asset Allocation Fund | 1681.45 | 1.9 | 37.02 | 12.96 |

| Axis Multi Asset Allocation Fund | 1202.42 | 2.13 | 16.34 | 9.48 |

Who should invest in this scheme?

This NFO of Bajaj Finserv Multi Asset Allocation Fund is suitable for individuals who seek earnings through fixed-income instruments. People who want income generation and long-term wealth creation/capital growth from investments in equities plus equity-related securities, gold ETFs or silver ETFs exchange-traded commodities derivatives (ETCD) or REITs & InvITs units.

Who Manages the Scheme?

Nimesh Chandan has spent 23 years in Indian Capital Markets honing his expertise in fund management for both domestic and foreign investors. His responsibilities in Canara Robeco and Birla Sunlife reveal his skill in portfolio management.

Sorbh Gupta, a Senior Fund Manager (Equity possesses) 16 years' worth of experience as well as CA Qualifications; he holds a CFA with BCOM qualifications too.

Siddharth Chaudhary (Senior Fixed Income Fund Manager) used to work for Sundaram Asset Management as well as Indian Bank hence he is quite experienced.

Vinay Bafna is a fund manager for commodities, with an MBA in Finance and specializes in commodities markets, utilizing knowledge from his previous positions at ICICI Securities and AMC.

2. Bajaj Finserv Nifty 1D Rate Liquid ETF

Bajaj Finserv Nifty 1D Rate Liquid ETF is an open-ended Exchange Traded Fund (ETF) launched by Bajaj Finserv Mutual Fund on May 13, 2024. It aims to provide current income with low risk and high liquidity by investing in tri-party repo on government securities, T-bills, and repo/reverse repo. The ETF tracks the Nifty 1D Rate Index, aiming to deliver similar returns (before expenses) with minimal tracking error. The New Fund Offer (NFO) is open for subscription until May 16, 2024, with a minimum investment of ₹5,000 and no entry load.

The investment objective of Bajaj Finserv Nifty 1D Rate Liquid ETF is to seek to provide current income, commensurate with low risk while providing a high level of liquidity through a portfolio of Tri-Party Repo on Government Securities or T-bills / Repo & Reverse Repo. The Scheme will provide returns that before expenses, closely correspond to the returns of the Nifty 1D Rate index, subject to tracking error. However, there can be no assurance or guarantee that the investment objective of the Scheme will be achieved.

Benchmark

The fund house compares the performance of Bajaj Finserv Nifty 1D Rate Liquid ETF to Nifty 1D Rate Liquid ETF.

Funds Allocation

| Types of Instruments | Risk Profile | Minimum Allocation | Maximum Allocation |

|---|---|---|---|

| Tri-Party Repos in Government Securities or Treasury Bills (TREPS) | Low | 95% | 100% |

| Units of Overnight/ Liquid schemes, Money Market Instruments, cash & cash equivalents. | Low to Moderate | 0% | 5% |

Peer Schemes

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) |

|---|---|---|---|

| Nippon India ETF Nifty 1D Rate Liquid BeES DAILY | 08-07-2003 | 11230.62 | 0.69 |

| HDFC Nifty 1D Rate Liquid ETF | 01-08-2023 | 44.74 | 0.5 |

| DSP NIFTY 1D Rate Liquid ETF IDCW Daily Reinvest | 08-03-2018 | 1154.75 | 0.4 |

| Kotak Nifty 1D Rate Liquid ETF | 24-01-2023 | 47.11 | 0.2 |

| ICICI Prudential S&P BSE Liquid Rate ETF | 05-09-2018 | 3259.53 | 0.25 |

| Mirae Asset Nifty 1D Rate Liquid ETF | 27-07-2023 | 381.51 | 0.27 |

Who should invest in this scheme?

This NFO of Bajaj Finserv Nifty 1D Rate Liquid ETF suits investors in need of short-term savings solutions and wants to earn some returns through low-risk, highly liquid securities issued under the Nifty 1D Rate Index.

Who Manages the Scheme?

The fund has been under the management of Mr. Siddharth Chaudhary who is a Senior Fund Manager-Fixed Income with Bajaj Finserv Mutual Fund since July 2012. He has 18 years’ experience in finance across which he worked at Sundaram Asset Management Co. Ltd as Head- Fixed Income Institutional Business.

To sum up, the latest funds launched by Bajaj Finserv suit varied investor expectations like income generation, capital growth and low-risk liquidity provision. These add-ons enhance the array of mutual funds and give buyers a range of choices for avoiding risks.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story