Market News

Weekly Wrap August 5 to 9: Key indices extend weekly losses amid global meltdown

.png)

5 min read | Updated on August 10, 2024, 17:17 IST

SUMMARY

On a weekly basis, SENSEX shed 1276 points or 1.64%, while NIFTY retreated 350 points or 1.48%. Among NIFTY stocks, Maruti Suzuki dropped the most by 8.5% this week. Hindalco, Tata Steel, Tata Motors and Grasim were also among the key losers.

Stock list

- SENSEX dropped 1.64%, while NIFTY retreated 1.48% on a weekly basis.

- Suzlon Energy shares rallied 12% this week, its market cap surpassed ₹1 lakh crore for the first time.

- Japanese markets witnessed their worst meltdown in decades on Monday. The Nikkei 225 index plunged over 12%.

- Investors lost more than ₹17 lakh crore on Monday.

Hi folks! We are back with a quick recap of all the actions in Indian stock markets this week. Indian benchmark indices experienced a roller coaster ride amid a global meltdown.

In the last five sessions, key indices hit a month’s low before recovering some ground at the end of the week. However, benchmark NIFTY50 and SENSEX registered second-week losses as US economic growth concerns, rate hike worries in Japan, and geopolitical tensions gripped markets globally.

SENSEX slid below the 79,000 mark while NIFTY fell below the crucial 24,000 level to hit their month’s low this week due to a global equity meltdown.

The United States recession fears and the rate hike by the Japanese central bank made investors jittery triggering heavy selling in global markets. Japanese markets witnessed their worst meltdown in decades, with the Nikkei 225 index plunging over 12% on Monday.

The Japanese markets made a spirited recovery of 10% the next day as the country’s central bank assuaged market fears.

The RBI Monetary Policy announced on Thursday offered little solace to nervous investors. The RBI governor kept the policy rates unchanged for a straight ninth time due to inflation worries. The governor highlighted that he cannot ignore stubbornly high food inflation, which can also push core inflation high.

However, a recovery in the US markets towards the end helped the key Indian stock indices recover some ground.

SENSEX, NIFTY on a roller coaster ride amid volatile global markets

Starting the week on a sombre note, stock markets on Monday saw their worst single-day fall since June 4, 2024. SENSEX and NIFTY crashed nearly 3% due to investors' across-the-board selling.

SENSEX plummeted 2,222.55 points, or 2.74%, to close below the 79,000 level. NIFTY tumbled more than 3% intra-day to slide below the 23,000 level for the first time in the past month. The index closed at 24,055.60, still down by 662.1 points, or 2.68%. Smallcap and midcap indices also declined up to 4%.

Stock markets attempted to recover from deep losses on Tuesday, but still closed lower due to FII selling and high valuation concerns.

Key indices snapped the losing run on Wednesday in line with a recovery in global markets. SENSEX rebounded 874.94 points or 1.11%, and NIFTY bounced back 345.15 points, or 1.43%, to close above the 24,300 level.

Stocks lost steam on Thursday as the RBI governor's hawkish comments triggered selling in real estate, metal, energy, and IT shares. The SENSEX dropped to 78,000, and the NIFTY dropped 0.74% to settle at 24,117.

Indian benchmarks staged a smart recovery on Friday, gaining 1% each, as global markets closed higher. Buying in blue chips like Reliance and Infosys helped NIFTY close the week at 24,367.50, up by 250.5 points. SENSEX closed at 79,705.91, up by 819.69 points, or 1.04%.

On a weekly basis, SENSEX shed 1276 points or 1.64%, while NIFTY retreated 350 points or 1.48%.

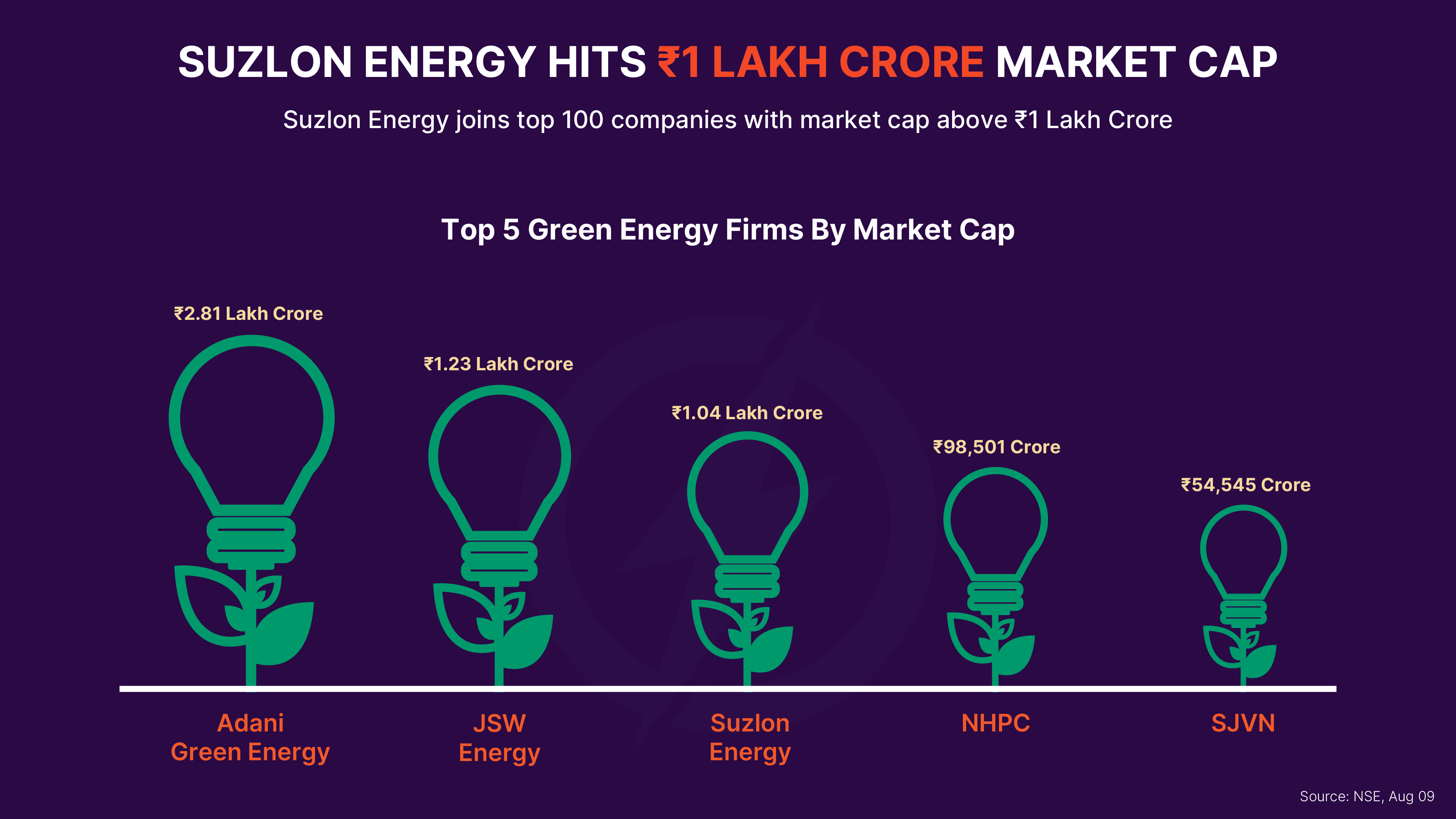

Suzlon Energy hits ₹1 lakh crore market capitalisation

Suzlon Energy shares rallied 12% this week, taking its market valuation to more than ₹ 1 lakh crore. The renewable energy player joined the coveted club of the top 100 companies on the NSE with a market cap above ₹1 lakh crore. The company also figures among the top five green energy firms by market cap.

Investors lose over ₹15 lakh crore in a single day amid crash

Investors lost more than ₹15 lakh crore on Monday as stock markets tanked around 3% due to global factors. The market valuation of BSE-listed firms declined by ₹15.32 lakh crore to ₹441.84 lakh crore ($5.27 trillion) on Monday. The market valuation fell further to ₹439.59 lakh crore ($5.24 trillion) on Tuesday, wiping out ₹22 lakh crore of investor money in a three-day crash since Friday. The market cap recovered to ₹450.24 lakh crore ($5.36 trillion) on Friday following the fag-end rebound.

NIFTY Metal PSU Bank major sectoral losers

NIFTY Metal, PSU Bank, IT, Financial Services and Private Bank were among the major sectoral indices losers this week. NIFTY Metal and PSU Bank declined 3% each, and NIFTY IT, Fin Services and Private Bank by 2% each. NIFTY Pharma and FMCG bucked the trend, gaining 1% each.

The week ahead

In a truncated week due to the market holiday on account of Independence Day, investors will watch macroeconomic data and the remaining Q1 results. The July inflation data is expected on August 12. The Index of Industrial Production (IIP) data and trade data, scheduled to be released next week, may also define market trends. Among other global factors, the US consumer price index (CPI) inflation data is also likely to affect investor sentiment.

About The Author

Next Story