Market News

Weekly wrap: Markets extend gains ahead of Budget 2024

.png)

4 min read | Updated on July 20, 2024, 12:50 IST

SUMMARY

Budget 2024 will be the biggest market mover next week. Stock markets have been expecting the Modi 3.0 government's first budget to include pro-growth and pro-consumption measures.

Stock list

- SENSEX and NIFTY scaled the lifetime highs for the fourth day in a row on Thursday, July 18.

- The NIFTY FMCG index breached the record 61,000 mark on July 18.

- Budget 2024 will be the biggest market mover next week.

Hey there! We are back with a quick recap of an action-packed week on D-street, during which benchmark indices hit record highs ahead of Budget 2024.

Ahead of Budget 2024, benchmark indices NIFTY and SENSEX settled marginally higher in a holiday-shortened week. IT, FMCG, and PSU bank shares helped the key indices extend their winning run for the seventh week in a row.

SENSEX and NIFTY previously closed with losses on a weekly basis, during May 27 to May 31 period, ahead of the announcement of general election results.

SENSEX scaled the 81,000 level for the first time before closing the week to July 19, marginally up by 85 points, or 0.01%, at 80,604.65. NIFTY also scaled the 24,800 level for the first time but closed the week marginally up by 28.75 points, or 0.01%, at the 24,530.9 level.

IT majors TCS and Infosys' strong financial results and positive outlook about the current fiscal year helped technology shares rebound this week.

Global factors like easing US bond yields, growing expectations of US Fed rate cut by September and FII inflows also supported the Indian stock markets this week.

Continuing the winning momentum, NIFTY and SENSEX closed at lifetime highs on Monday following gains in PSU banks and oil shares. NIFTY closed at 24,586 and SENSEX at 80,665 points.

Buying in telecom, FMCG and IT shares helped the indices close at lifetime high levels for the third straight day on Tuesday as well. The dovish comments of US Federal Chair Jerome Powell on inflation raised hopes of a rate cut by September. NIFTY scaled the 24,600 mark for the first time and closed at 24,613 on Tuesday.

Stock markets were closed on Wednesday for Muharram.

SENSEX and NIFTY resumed trading on Thursday in an upbeat mode and scaled lifetime highs for the fourth straight day.

SENSEX breached the 81,000 mark for the first time, while NIFTY scaled the 24,800 peak on the back of gains in FMCG, oil and IT shares.

Stock markets witnessed profit-taking on Friday, reaching record highs ahead of the presentation of the Union budget on July 23.

SENSEX and NIFTY dropped more than 1% each due to profit taking in metal, oil, financial, and tech shares. A global sell-off triggered by operating system issues that caused devices to crash worldwide also hit market sentiment.

FMCG, IT index lead gains; Metal, media top losers

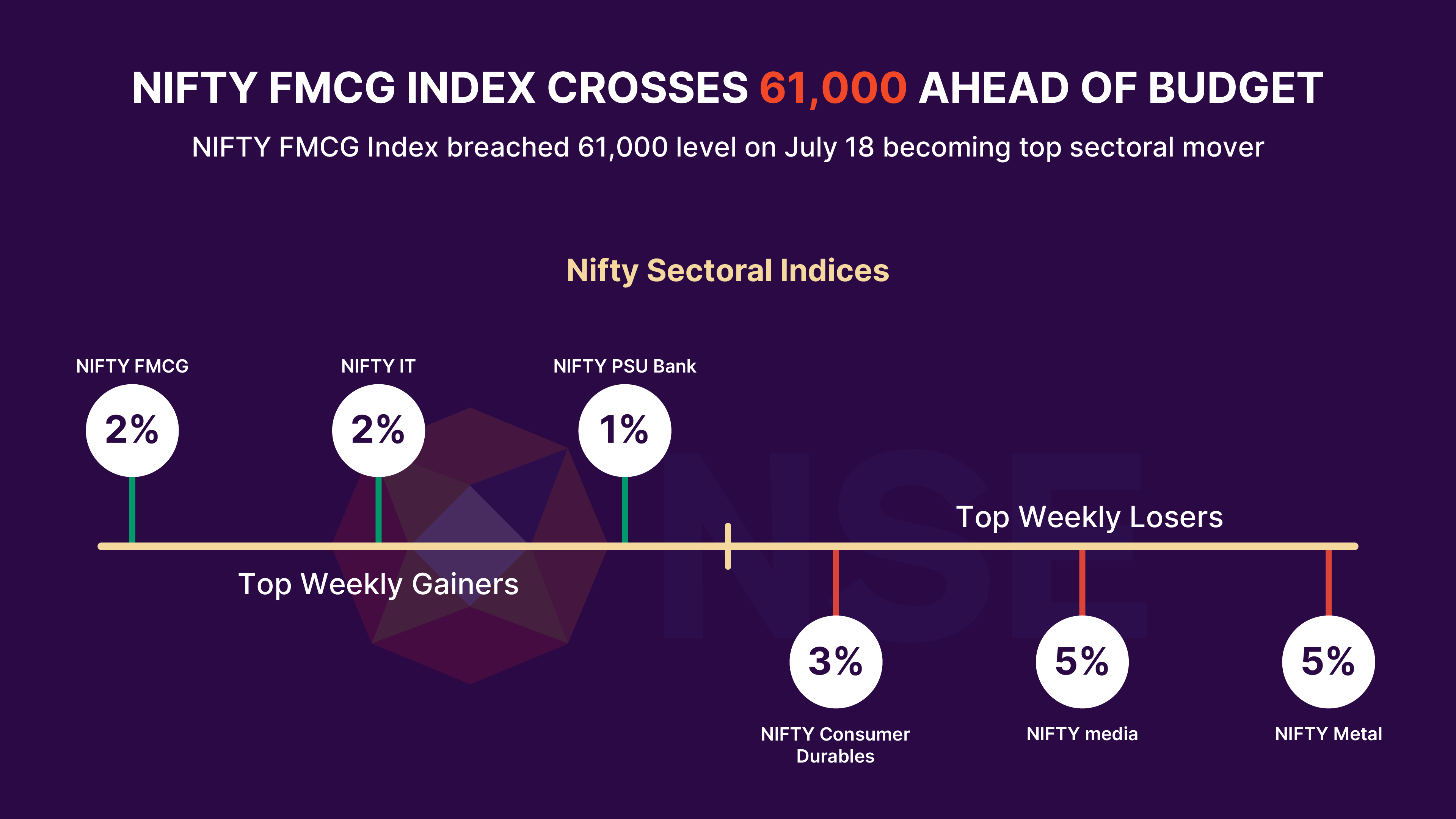

NIFTY FMCG, IT, and PSU Bank indices were the lead gainers among sectoral indices this week. NIFTY FMCG and IT indices rose by 2% each, while NIFTY PSU Bank gained 1%. Metal and Media indices dropped sharply by 5% each, followed by consumer durables.

NIFTY FMCG breach record 61,000 mark

NIFTY FMCG index breached the record 61,000 mark on Thursday following its nine-day rally since July 5. FMCG shares were on the rise following a revival in rural demand, positive business updates by corporates and the government's focus on rural development. Active monsoon and kharif sowing patterns also boosted FMCG shares. ITC and Britannia Industries were lead gainers among NIFTY FMCG shares this week.

Broader markets lag benchmark ahead of Budget

The broader market lagged benchmark indices this week as investors shifted bets ahead of the Union Budget for FY 2024-25. NIFTY Midcap indices dropped 2%, while NIFTY Smallcap indices retreated 3% this week due to profit-taking.

What lies ahead?

Budget 2024 will be the biggest market mover next week. Stock markets have been expecting the Modi 3.0 government's first budget to include pro-growth and pro-consumption measures. Investors will also watch quarterly corporate results for further direction.

About The Author

Next Story