Market News

Week ahead: US tariffs, Q3 earnings and FIIs activity among key market triggers to watch

.png)

4 min read | Updated on January 18, 2026, 14:14 IST

SUMMARY

IT stocks drew attention this week as Infosys and HCL Tech reported strong Q3FY26 results and positive guidance. Their performance lifted sector sentiment amid signs of demand stabilisation. The results spurred early Nifty IT gains, though profit-booking tempered moves.

Stock list

Eternal, Interglobe Aviation, DLF, Hindustan Zinc, Persistent Systems among key companies to announced Q3 earnings this week. | Image: Shutterstock

Indian markets ended the volatile, truncated week largely unchanged. The NIFTY50 index ended the week at 25,694, while SENSEX ended the week at 83,570. The trading was choppy and influenced by US tariff threats, mixed third quarter earnings and continuous foreign institutional investor (FII) selling. Additionally, the rupee weakened to 90.86, reflecting dollar strength.

The broader markets consolidated alongside the benchmarks, with the Nifty Midcap 150 index closing at 21,975 and the Smallcap 250 index closing at 16,207. This reflects a cautious stance following the sharp correction of the previous week. Sectoral trends diverged sharply with Nifty PSU Bank (+4.8%) and Metals (+4.5%) led the gains amid renewed buying. Nifty Consumer Durables (-2.8%), Realty (-2.4%) and Pharma (-2.3%) faced profit-taking and weak demand amid global volatility.

Meanwhile, the Bureau of Economic Analysis releases its key personal consumption expenditures price index alongside the final Q4 GDP growth estimate on Thursday. Markets will focus on PCE inflation trends to validate the Fed's projected rate-cut trajectory for 2026.

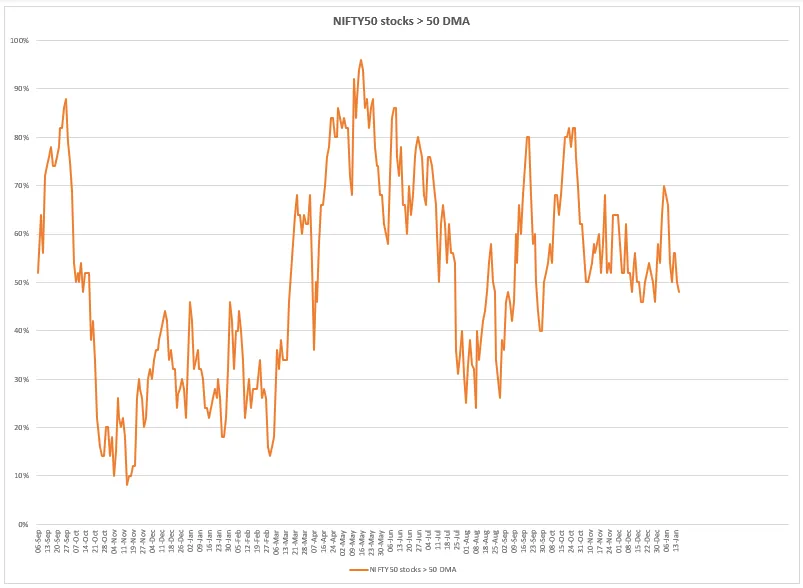

Market breadth

This week, NIFTY’s market breadth weakened, with the percentage of NIFTY50 stocks trading above their 50-day moving average falling from the recent 70% zone to below 50% range. This sharp pullback suggests that the earlier expansion in market breadth was not sustainable, as many stocks that had moved above key averages gave up their gains. This suggests cooling participation and early consolidation after a sharp pullback. In the upcoming sessions, the 50% level will be important. A sustained reading below would suggest weakness.

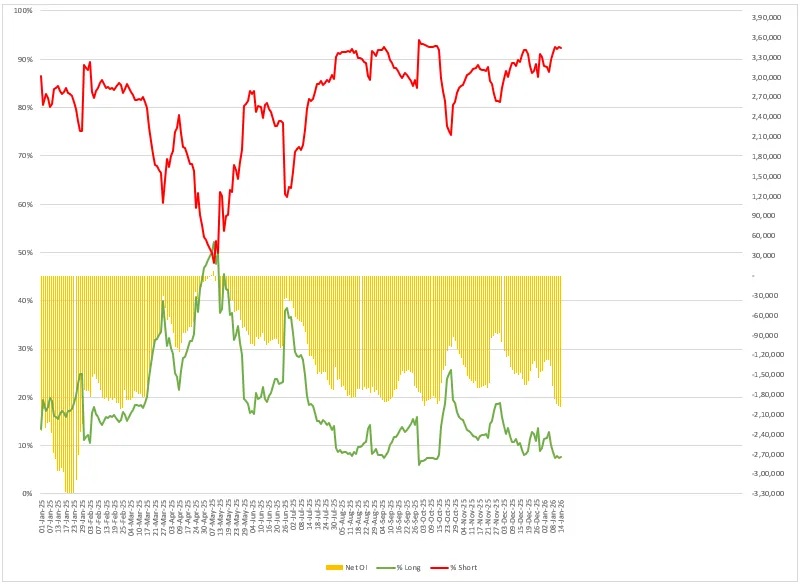

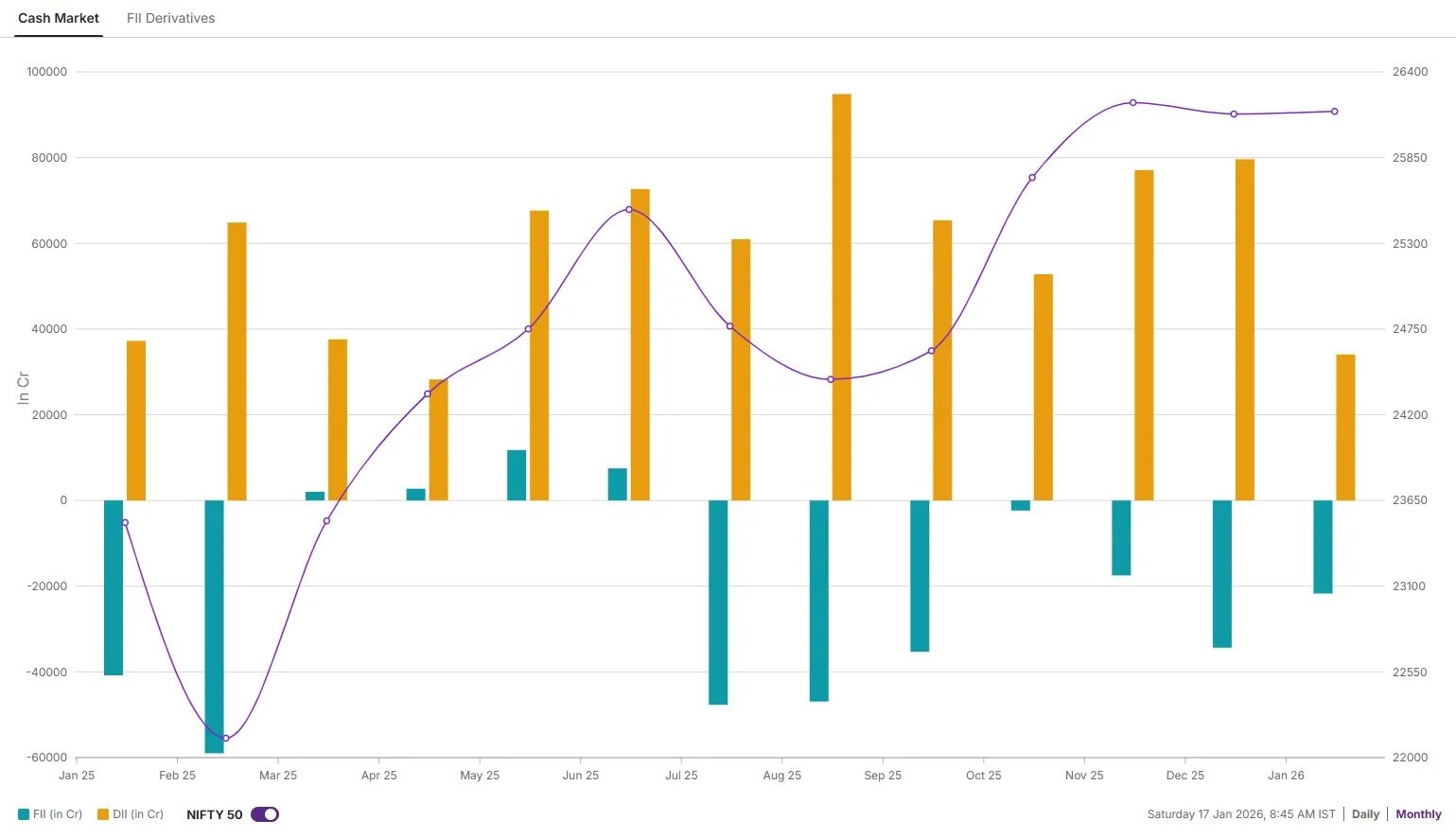

FIIs cash market and derivatives

Foreign Investors (FIIs) remained firmly defensive this week, with short positions continuing to dominate index futures. The share of short contracts stayed elevated near the 90%+ zone, while long exposure remained limited, indicating a lack of conviction on the upside despite the index holding near highs. Net open interest stayed deeply negative and edged lower through the week, suggesting that FIIs added to their hedges and increased short exposure during recent sessions.

In the cash market, FIIs started 2026 on a weak note, selling shares worth ₹21,000 crore and continuing their bearish outlook on Indian equities. In contrast, domestic investors remained net buyers, supporting the markets by purchasing shares worth ₹34,000 crore.

NIFTY50 outlook

NIFTY has formed a ‘pause candle’ (doji) on the weekly chart, reflecting clear indecision after the recent sharp down move. This pattern suggests that the market is at a balance point, where neither buyers nor sellers have been able to assert dominance. The next directional move is likely to be determined by a decisive daily close above or below the doji’s range, which will indicate whether buyers are regaining control or sellers are stepping in. With the Union Budget approaching, traders should closely monitor these key levels, as a breakout on either side could set the tone for the market’s next phase.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story