Market News

Week ahead: US-India tariff deadlock, Nvidia earnings, GDP figures and auto stocks in focus

.png)

7 min read | Updated on August 24, 2025, 13:27 IST

SUMMARY

This week, the market focus centers on the ongoing U.S.-India tariff dispute, Nvidia's earnings, new GDP data and the flows in auto stocks. Investors are closely monitoring trade negotiations and the impact of tariffs. From the technical standpoint, the NIFTY50 index is oscillating between 25,200 and 24,700. A break of this range will provide further clues.

After several weeks of weakness, the breadth of the NIFTY50 index showed signs of improvement. | Image: Shutterstock

Indian markets extended their winning streak for a second consecutive week, fuelled by optimism surrounding new GST measures, favourable monsoon conditions and falling crude oil prices. However, volatility emerged late in the week due to profit-taking ahead of the 27 August U.S. tariff deadline.

Against this backdrop, the NIFTY index rose by 0.9% to close at 24,870, while the SENSEX advanced by 0.8% to settle at 81,306. Both benchmarks sustained their uptrend, marking two consecutive weeks of gains. Meanwhile, the broader markets also participated in this trend, with the NIFTY Midcap 150 rising 2.0% and the Smallcap 250 gaining 2.6%.

Market breadth was largely positive across sectors, with the exception of Defence (-1.1%) and PSU Banks (-0.3%), which saw some profit-taking. Automobiles (+5.0%), Consumer Durables (+3.9%) and Real Estate (+3.4%) led the gains on hopes of GST slab rationalisation, boosting sentiment in consumption-linked and housing related sectors.

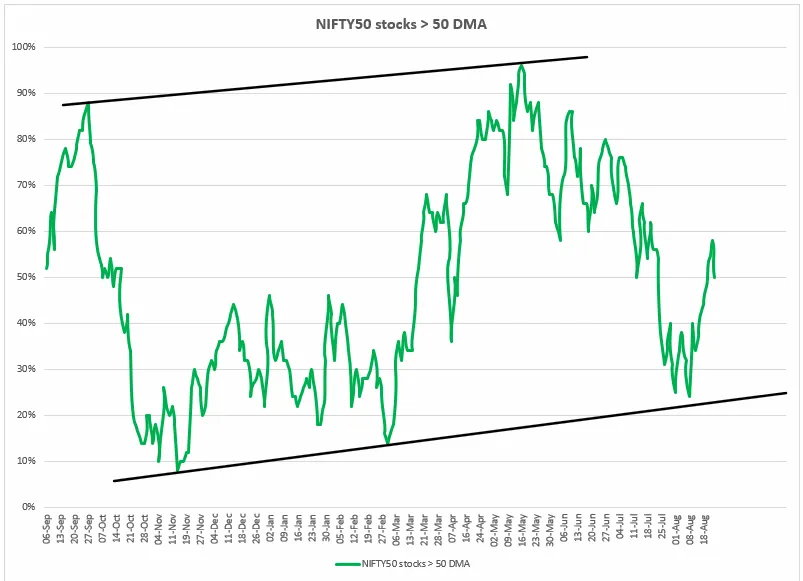

Index breadth

After several weeks of weakness, the breadth of the NIFTY50 index showed signs of improvement. The percentage of NIFTY50 stocks trading above their respective 50-day moving averages (DMAs) increased significantly from recent lows, although it remains below the highs seen in early May.

After falling sharply to almost 24% in late July, breadth has climbed back above 50%, indicating short-term strength across a wider range of stocks in the index. However, the current level remains well below the peak readings seen in April and May. This highlights that, although momentum is improving, the rally has yet to become widespread. If the NIFTY50 moves and stays above the 50% threshold, this could signal further stabilisation and lasting strength.

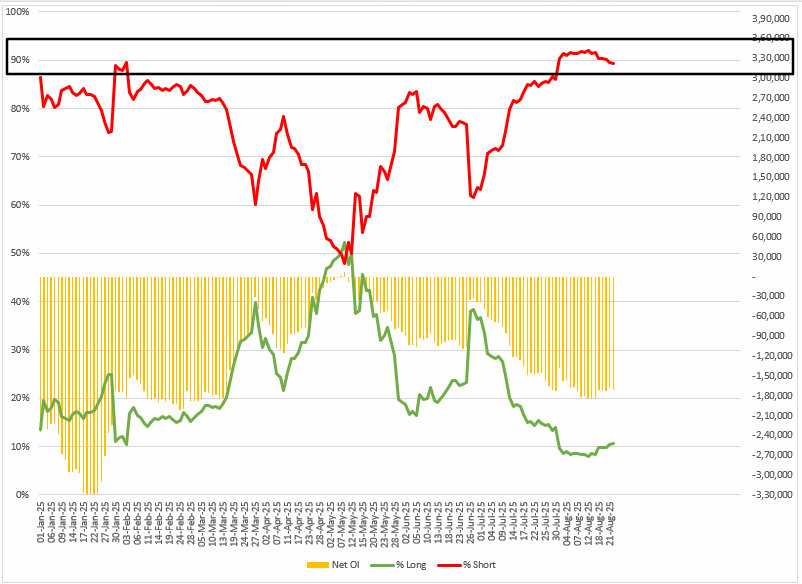

FIIs positioning in the index

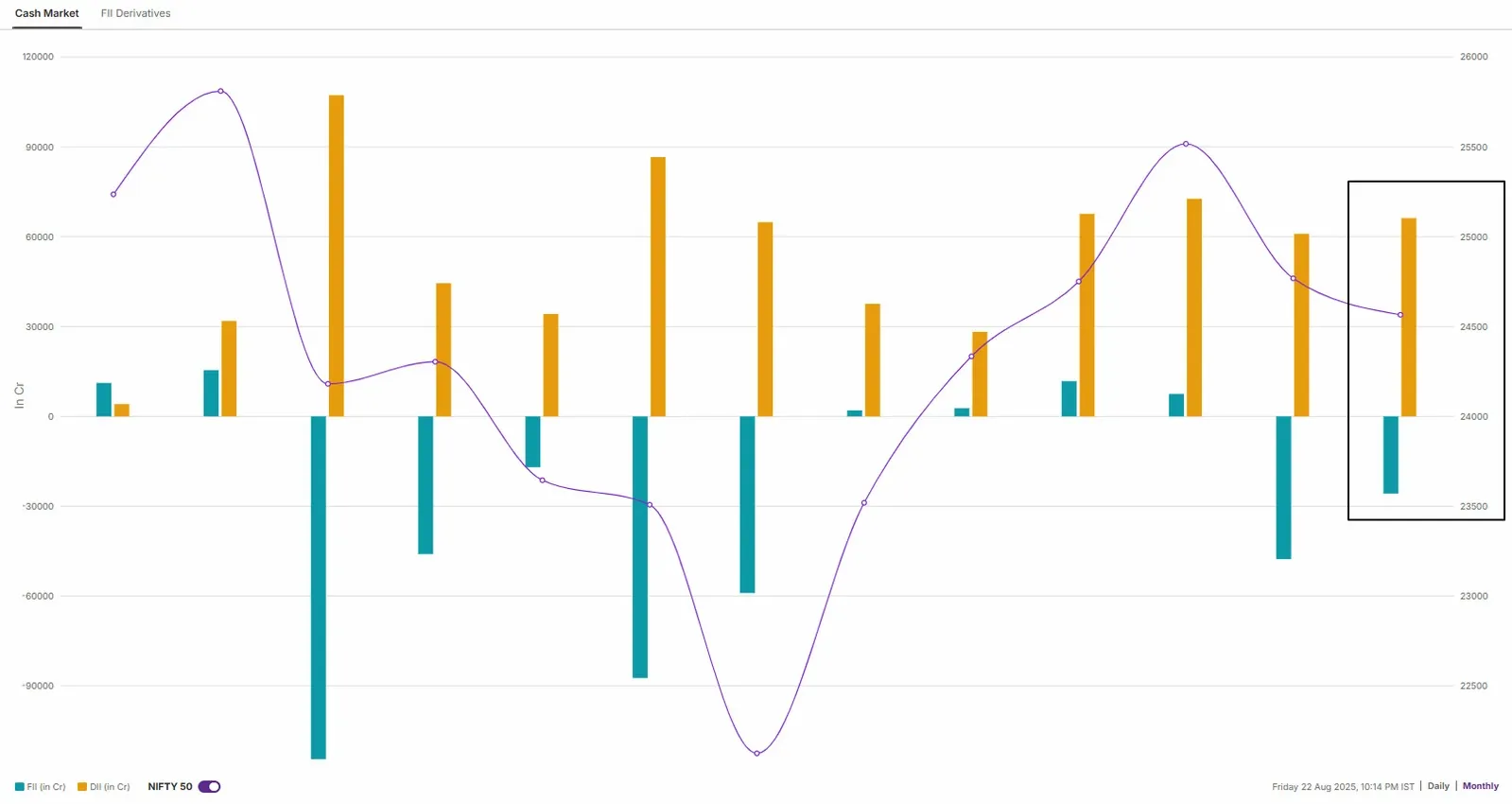

This week, Foreign Institutional Investors (FIIs) remained net sellers in both the cash and derivatives segments, intensifying their bearish stance. They maintained a long-to-short ratio in index futures above 10:90, resulting in a net open interest of -1.71 lakh contracts, a clear indication of sustained negative positioning.

FIIs maintained their bearish positions in index futures for over a month, with short bets accounting for more than 90% of their total net open interest. This is the first time in recent history that such high levels of bearish positioning have persisted. Historically, extreme readings like these often signal potential for a reversal as sentiment becomes overly negative. However, throughout the August series, FIIs continued to resist shifting their stance. As a result, the NIFTY50 came under consistent selling pressure at higher levels and struggled to retain its gains.

Meanwhile, in the cash market, FIIs have offloaded shares of over ₹25,700 crore so far, which is nearly half of the July figure. Conversely, the Domestic Institutional Investors aggressively supported the markets and have bought equities worth ₹66,183 crore.

NIFTY50 index

The technical structure of the NIFTY50 index shifted from sideways to bearish after the confirmation of the hanging man candlestick pattern on the daily chart. On 21 August, the index formed a hanging man, which is a classic bearish reversal signal at the top of an uptrend. This signal was confirmed when the subsequent candle closed below the low of the reversal pattern.

For the upcoming sessions, the index has key resistance zones around 25,300 and 25,150. Unless the index reclaims the immediate resistance zone of 25,150 on a closing basis, it will not negate the bearish reversal pattern. On the flip side, the immediate support for the index is around 24,850 and 24,600 zones. A break below these zones on a closing basis will provide further clues.

Additionally, reports of a positive outlook for the festive season and favourable monsoon conditions have bolstered investor confidence. Against this backdrop, the week's biggest gainers were Maruti Suzuki (+10.9%), TVS Motor (+9.1%), Ashok Leyland (+7.6%), MRF (+6.5%) and Hero MotoCorp (+6.2%).

In the U.S., attention will shift on July's personal income and spending data, as well as the closely watched Personal Consumption Expenditures (PCE) price index, the Federal Reserve's preferred measure of inflation. The second estimate of Q2 GDP and durable goods orders will offer further insight into the state of the economy. Meanwhile, Nvidia’s earnings report on Wednesday will be a key event for tech investors, offering clues about demand in the AI and semiconductor sectors.

In India, markets are awaiting the release of Q2 GDP data, which is expected to shed light on the country’s growth momentum amid ongoing global uncertainties. Apart from the economic calendar, markets are closely monitoring the potential impact of the looming U.S. tariff deadline on 27 August. The U.S. plans to impose an additional 25% tariff on Indian goods, effectively doubling the existing 25% tariff to bring the total tariff on most exports to 50%. This escalation is in response to India’s continued import of Russian oil. Although trade negotiations are ongoing, the impending tariff increase poses a significant risk to market sentiment.

Related News

About The Author

Next Story