Market News

Week ahead: US GDP data, crude oil prices, FIIs activity among key market triggers to watch

.png)

6 min read | Updated on December 21, 2025, 13:25 IST

SUMMARY

Markets are heading into a holiday-shortened week, with NIFTY still in a prolonged consolidation phase. Trading activity is expected to remain subdued due to low liquidity and muted global cues. While the index remains within the 25,700–26,250 range, traders are likely to exercise caution and focus on individual stock opportunities. Overall, the tone remains stable but indecisive.

Stock list

NIFTY IT index made a strong comeback boosted by a combination of positive global and stock-specific news. | Image: Shutterstock

Indian markets extended their losing streak, with the NIFTY index posting a third consecutive weekly decline, even though trading remained confined to the narrowest ranges observed since October. The benchmark slipped by around 0.3% to close at 25,966, while the Sensex fell by around 0.4% to 84,929. Overall, the move felt more like a pause following the significant rally than a sharp reversal.

Broader markets also witnessed weakness during the week but ended the week on a flat note. Both the NIFTY Midcap 150 index and Smallcap 250 index closed at 22,146 and 16,407 respectively. The rupee, which had hit a fresh record low above 91 against the U.S. dollar earlier in the month, recovered this week to finish closer to 89.6–89.7, reducing some pressure on sentiment.

The picture was mixed across sectors. While banks, automobile and defence stocks were weak, IT, FMCG and select PSU banks, as well as a few metal and consumption-linked stocks, performed better. This mixed performance across sectors indicates consolidation in the market.

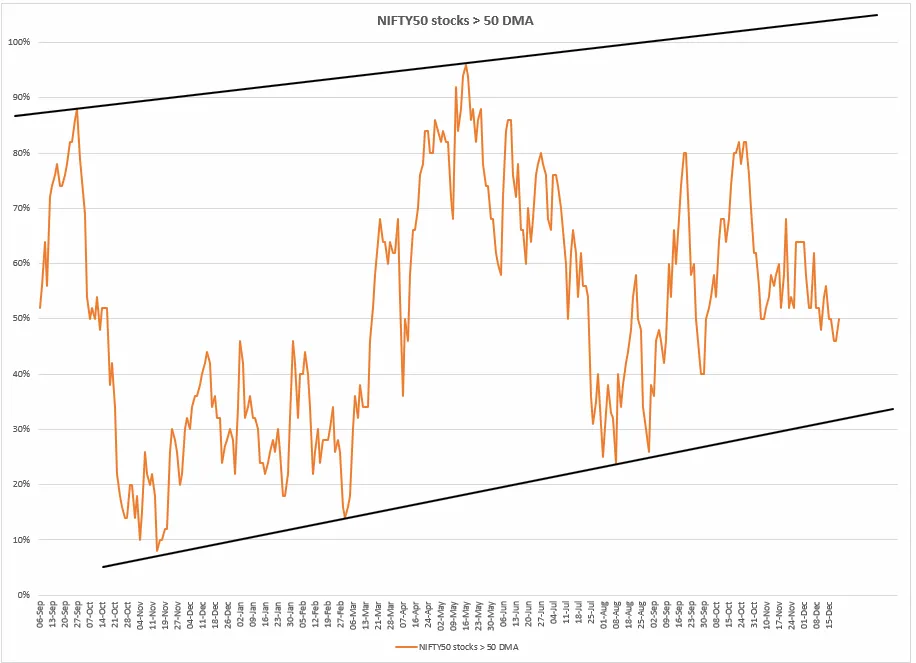

Index breadth

NIFTY’s breadth weakened further this week, with the percentage of NIFTY50 stocks trading above their 50-DMA briefly slipped into the mid-40% zone, signalling narrowing participation. Even though the overall rising trend in breadth is still intact, the recent pullback from higher levels shows that momentum is tiring. Until breadth improves clearly above the 60% mark, the market is likely to remain selective, making stock-specific movement more effective than aggressive index positioning.

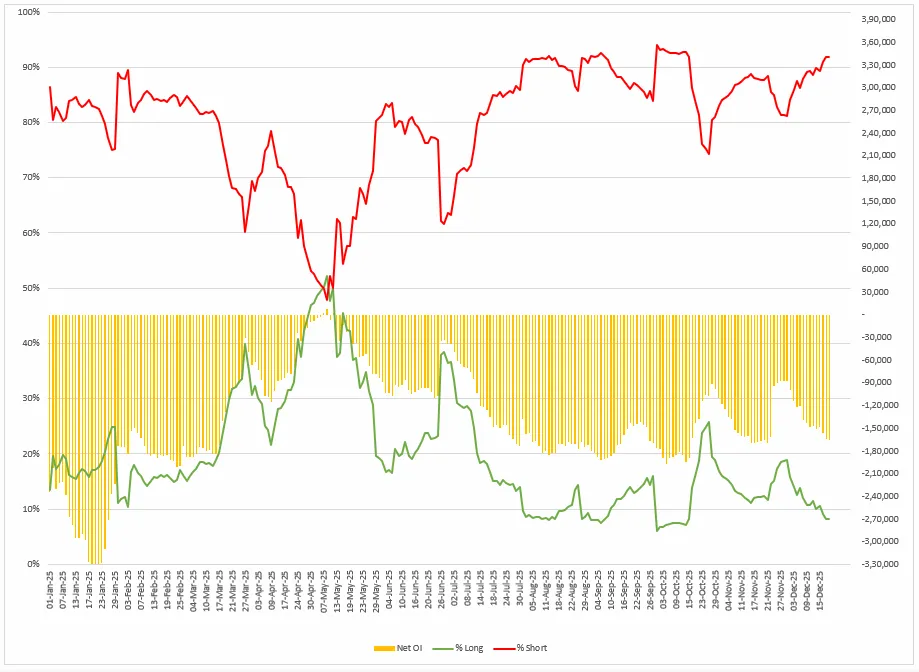

FIIs positioning equity and derivatives

This week’s data shows the Foreign Institutional Investors (FIIs) index futures turned more cautious, with long positions easing further to 8% of long-to-short ratio and short positions getting elevated to 92%. Net open interest also remained firmly negative, reinforcing the view that risk appetite is still subdued. Overall, the current situation indicates defensive positioning and a lack of conviction, suggesting that the market is still in a consolidation phase and waiting for a clear trigger before there is a significant change in sentiment.

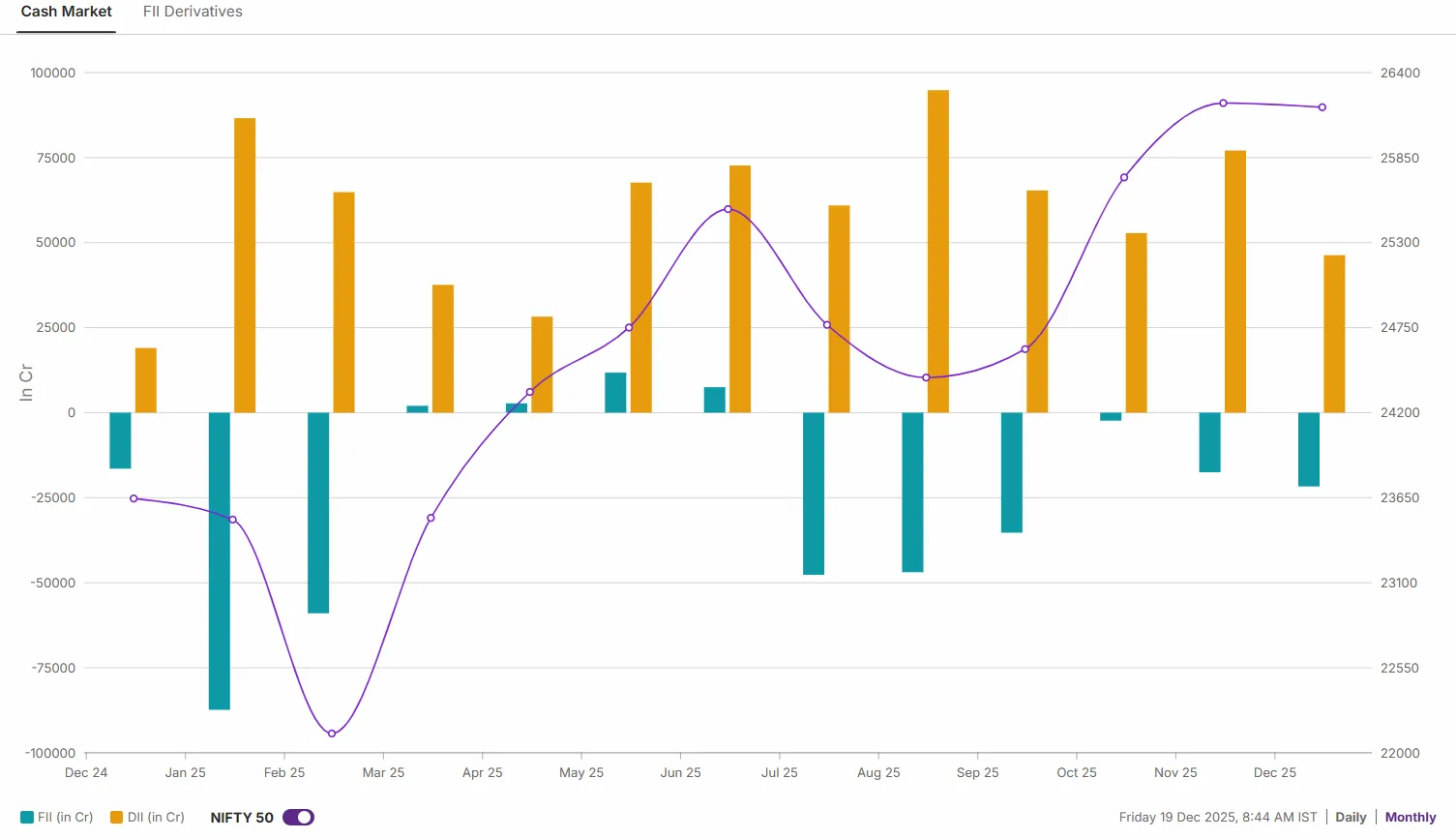

Meanwhile, in the cash market, FIIs have sold shares worth ₹19,857 crore so far in December, extending their bearish streak to a sixth consecutive month. In contrast, domestic institutional investors (DIIs) continue to lend support at higher levels, having bought shares worth ₹52,032 crore during the month, helping cushion the impact of persistent foreign selling.

NIFTY 50 index

The NIFTY50 index extended the consolidation for the 27th session in a row with the index struggling to generate sustained buying interest near record highs. The immediate resistance for the index stands at 26,250 and only a sustained breakout above this level is likely to pave the way for the next phase of the rally. On the downside, the 25,700–25,800 area remains an important support level, and falling below this could invite short-term selling pressure. Overall, the broader trend remains positive, but a decisive breakout above the 26,250 zone will rebuild the momentum.

.webp)

.webp)

Alongside the GDP figures, US markets will also monitor weekly jobless claims for further indications of the state of the labour market. Meanwhile, the trading environment is expected to remain subdued due to the Christmas holiday, with major global exchanges closed on 25 December and typically lower liquidity in the sessions around the break. In India, no major domestic data releases are scheduled for the week, and the equity markets will be closed on Thursday 25 December for Christmas.

About The Author

Next Story