Market News

Week ahead: Q4 results, FIIs activity, global cues among key market triggers to watch out

.png)

5 min read | Updated on May 18, 2025, 13:24 IST

SUMMARY

Market trends are likely to be shaped by Q4 results this week. The India-U.S. trade deal and foreign fund flows are other key triggers. The index's technical structure remains bullish, with immediate support around the 24,500 zone.

Stock list

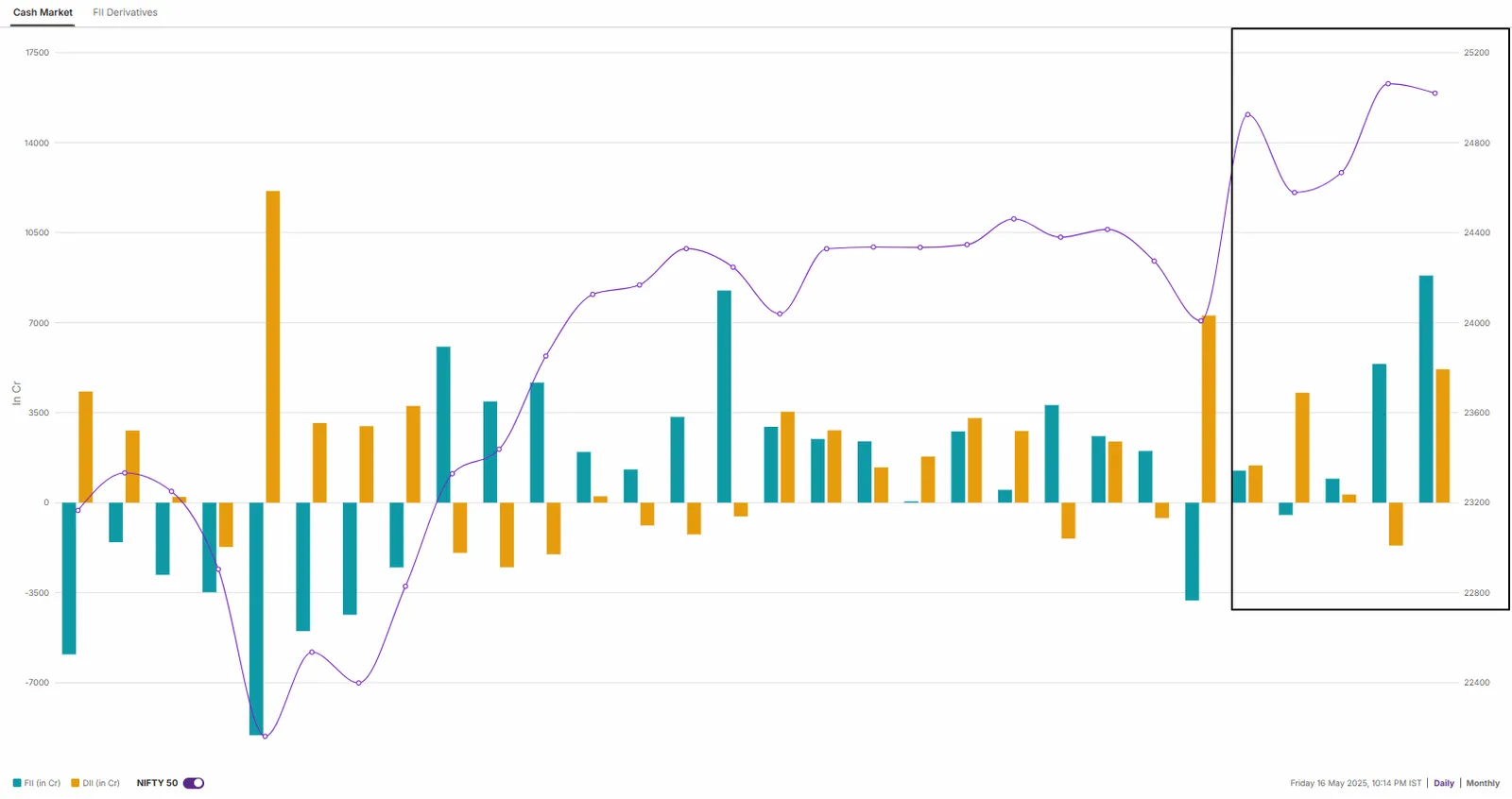

In the cash market, the FIIs remained net buyers and purchased shares worth ₹3,295 crore last week. | Image: Shutterstock

Indian markets resumed its bullish momentum following the de-escalation of geopolitical tensions between India and Pakistan, as well as the easing of tariff issues globally. This positive sentiment was further supported by lower crude oil prices and sustained buying by foreign investors in domestic equities. As a result, the NIFTY50 index surged over 4%, closing the week just above the 25,000 mark.

Broader markets truly stood out, with the NIFTY Midcap 100 index soaring 7%-its strongest weekly performance in two months. On the other hand, the NIFTY Smallcap 100 index outpaced even that, rallying an impressive 9%.

The rally was supported by broad-based buying across sectors with Defence (+17%), Real-Estate (+10%) and Metal (+9%) indices advancing the most.

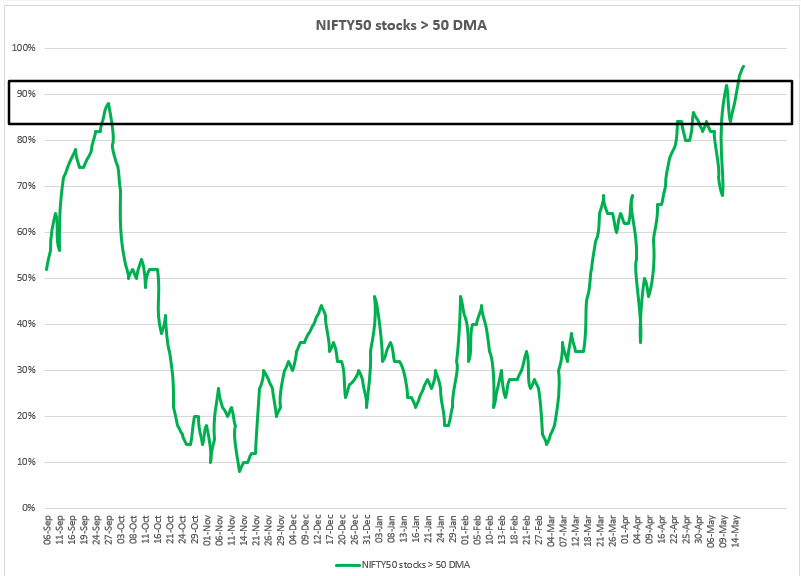

Index breadth

The NIFTY50 index maintained strong breadth throughout the week, with over 90% of its constituents trading above their 50-day moving average. While this broad participation underscores the market’s underlying strength, such elevated readings often precede phases of profit booking or consolidation, as seen during a similar episode in September 2024 when the index subsequently experienced a sharp pullback.

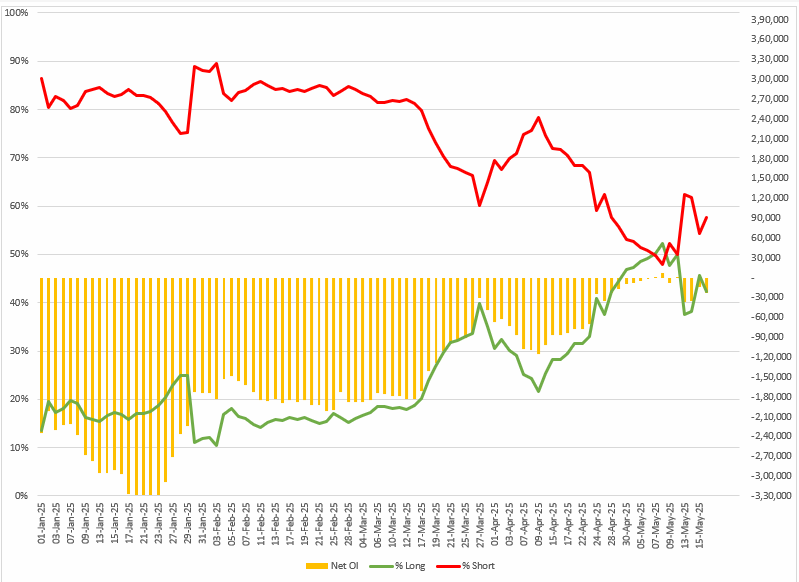

FIIs positioning in the index

Throughout the week, Foreign Institutional Investors (FIIs) displayed a mixed and indecisive approach, frequently shifting between initiating and covering short positions. They started the series on neutral long-to-short ratio of 50:50 and favoured short positioning of 38:62.

In the cash market, the FIIs remained net buyers and purchased shares worth ₹3,295 crore last week. The Domestic Institutional Investors (DIIs) also supported the markets and bought shares worth ₹11,647 crore.

NIFTY50 outlook

The NIFTY50 index decisively reversed last week’s bearish engulfing pattern, surging more than 4% and forming a strong bullish candle on the weekly chart. Notably, it closed above the highs of the previous three weeks, signaling renewed upward momentum. For the upcoming sessions, the immediate support for the index is around 24,500 and 24,400 zone. Unless the index breaks this zone on a closing basis, the trend may remain bullish. Meanwhile, the immediate resistance for the index is around 25,300 zone.

Meanwhile, from a technical standpoint, the FMCG (Fast-Moving Consumer Goods) index stands at a crucial juncture. After January 2025, the index reclaimed its 21-week and 50-week exponential moving averages, indicating support-based buying from lower levels. Among the index constituents, Colgate-Palmolive, Radico Khaitan, Tata Consumer Products and Godrej Consumer Products have risen by more than 5%.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story