Market News

Week ahead: NIFTY50 struggles below 200 DMA, Auto sales and Q3 updates in focus amid low volatility

.png)

5 min read | Updated on December 30, 2024, 09:44 IST

SUMMARY

Auto sales data, Q3 earnings updates and foreign fund inflows are expected to shape market trends this week. The broader trend of the NIFTY50 remains range-bound with immediate support around 23,500.

Week ahead: NIFTY50 struggles below 200 DMA, Auto sales and Q3 updates in focus amid low volatility

Index breadth

Markets traded in a narrow range followed by a sharp correction in the week before, ending the truncated week with marginal gains. The NIFTY50 index sustained below the 200-day moving average (DMA), psychologically crucial support amid subdued trading, foreign fund outflows and depreciating rupee.

Sectorally, Automobiles (+2.3%) and Pharmaceuticals (+2.2%) were the top gainers for the week, while Metals(-1.0%) and Media (-1.8%) were the top laggards. Meanwhile, the sentiment in the broader markets also remained subdued. The NIFTY Midcap 100 index rose 0.1%, while Small cap 100 index advanced 0.2%.

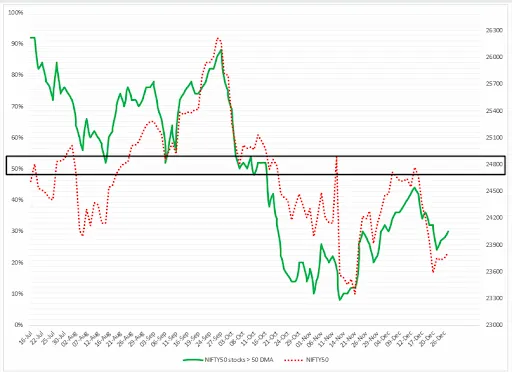

Index breadth

The breadth of the NIFTY50 index remained lackluster over the past week, with an average of only 27% of its constituents trading above their 50-day moving average (DMA). As illustrated in the chart below, the index has struggled to surpass the 50% threshold over the past two months, signaling underlying weakness.

Typically, a breadth reading between 50% and 70% indicates consolidation with a positive bias. However, in the last two months, the index has faced consistent selling pressure whenever it approached the 50% mark. In this context, unless the index reclaims a reading above 50%, broader market breadth is likely to remain subdued.

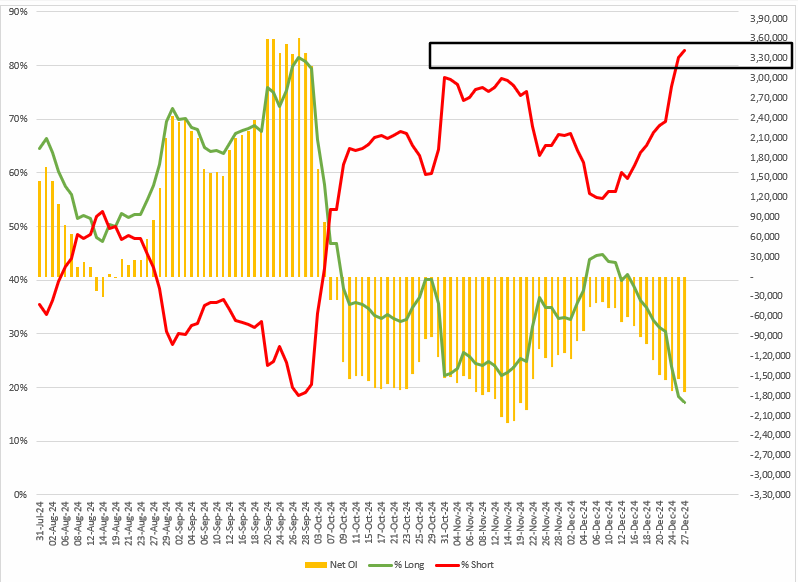

FIIs positioning in the index

After sustaining the net short position on index futures throughout the December series, the Foreign Institutional Investors (FIIs) started the January series on a negative note. The FIIs have started the January series with the long-to-short ratio of 17:83 on index futures with the net short open interest (OI) standing at -1.74 lac contracts, highest since 21 November.

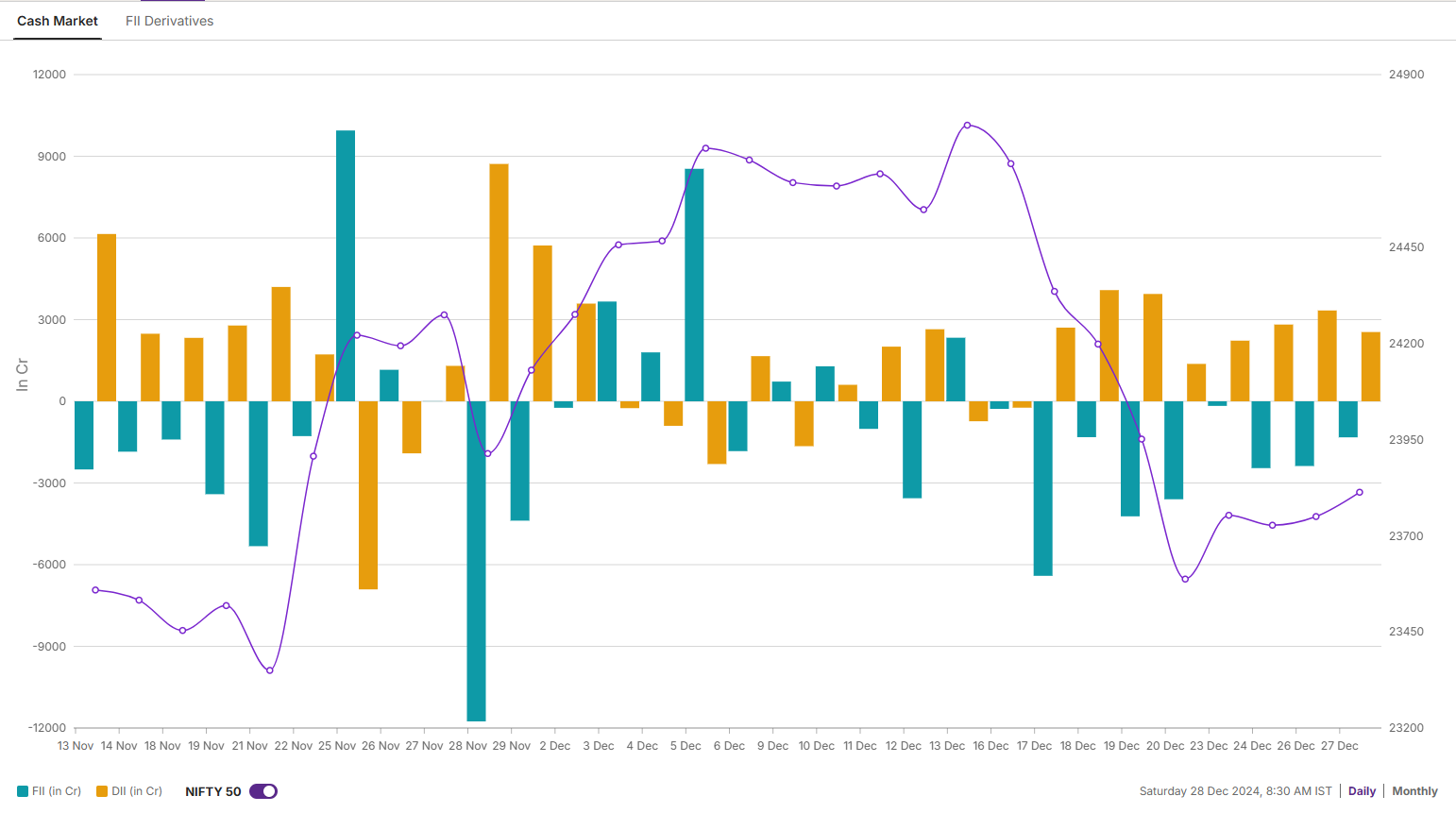

In the cash market, the FIIs remained net sellers for the third consecutive week and sold shares worth ₹6,322 crore. On the other hand, the Domestic Institutional Investors supported the markets and purchased shares worth ₹10,927 crore.

NIFTY50 outlook

The NIFTY50 index consolidated in a range of less than 300 points during the week after a sharp drop of over 4% in the week before. The index ended the week with marginal gains and remained confined between weekly 20 and 50 exponential moving average (EMA).

For the upcoming week, traders can monitor the range of 24,250 and 23,400, which aligns with the weekly 20 and 50 EMA. Unless the index breaches this range on a closing basis on the daily chart, the trend may remain range-bound. A breach of this range may provide further directional clues.

SENSEX outlook

The SENSEX also remained range-bound and traded within the range of 1%. After surrendering weekly 20 EMA previous week, the index is currently placed between 20 and 50 weekly exponential moving average. For the upcoming week, traders can monitor this trading range as a close above or below these levels on daily chart will provide further clues.

For the upcoming week, traders can focus on the range of 24,200 and 23,400, which aligns with the weekly 21 and 50 EMAs. Unless these levels are breached on a closing basis, the trend may remain range-bound.

For intraday range updates and any revisions to these levels, visit our daily morning trade setup blog, published at 8 AM before the market opens.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story