Market News

Week ahead: HUL, Kotak Bank earnings, NIFTY BANK record high, US inflation, FIIs activity among key market triggers to watch

.png)

6 min read | Updated on October 19, 2025, 13:47 IST

SUMMARY

In the coming week, markets will be influenced by key earnings announcements from major companies such as Hindustan Unilever and Kotak Mahindra Bank. Meanwhile, Bank NIFTY hit a new all-time high, driven by strong momentum around earnings. As the NIFTY approaches the important technical resistance zone of 26,000, the subsequent price movement will be crucial in confirming the sustainability of this bullish trend.

Stock list

Markets will be closed on October 22 for Diwali festival, while special Muhurat trading will take place on October 21 between 1:45 and 2:45 pm.

Indian markets posted their biggest weekly gain in four months, marking a third consecutive week of positive closing. The rally was fuelled by renewed buying from foreign investors, sustained inflows from domestic investors and falling crude oil prices. Adding to the positive sentiment, the Indian rupee saw its strongest weekly recovery since June, rebounding by almost 1% against the US dollar, at around 87.97.

The NIFTY50 advanced 1.7% to close at 25,709, while the Sensex climbed 1.7% to end at 83,952, marking a robust close to the week’s trade. In the broader market, the Midcap 150 index remained steady and Smallcap 250 index dipped 0.2% due to selective profit-booking.

Sectorally, Real Estate (+4.1%), FMCG (+3.0%) and Automobiles (+1.9%) advanced the most, while IT (-1.8%), PSU Banks (-0.7%) and Metals (-0.6%) faced selling pressure.

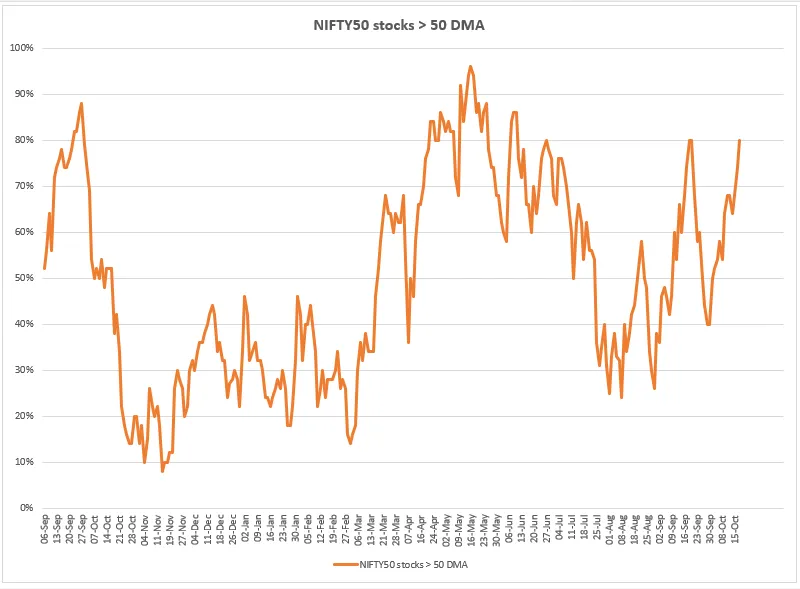

Market breadth

This week's market breadth chart shows a notable improvement, with 80% of NIFTY50 stocks currently trading above their 50-day moving average. This represents a sharp increase on last week's figure of 65%. This strong increase in breadth indicates robust and widespread participation in the ongoing rally, with the majority of index stocks comfortably above key technical benchmarks. While market breadth remains above 50%, the outlook is positive, suggesting sustained bullish momentum and depth in the rebound, which could lead to further gains in the near future.

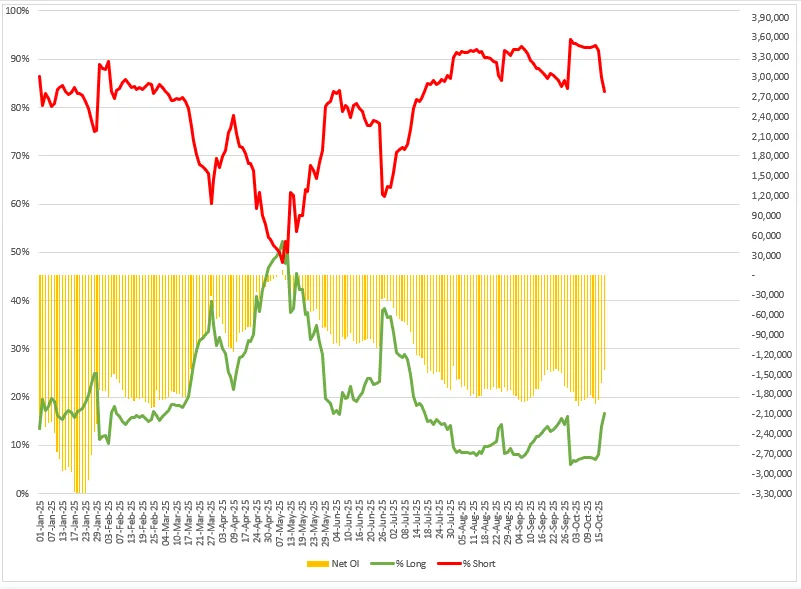

FIIs positioning in the index

The positioning of foreign investors (FIIs) in derivatives has shown a notable shift. There has been significant short-covering activity in index futures, with the long-to-short ratio improving from last week's 8:92 to 18:82. The proportion of long contracts held by FIIs has almost doubled as short positions have decreased considerably. This unwinding of bearish bets marks the first meaningful reversal in FIIs sentiment within the October series. Although shorts still outnumber longs, this positive momentum requires monitoring, as FIIs adjust their exposure in response to the recent price action.

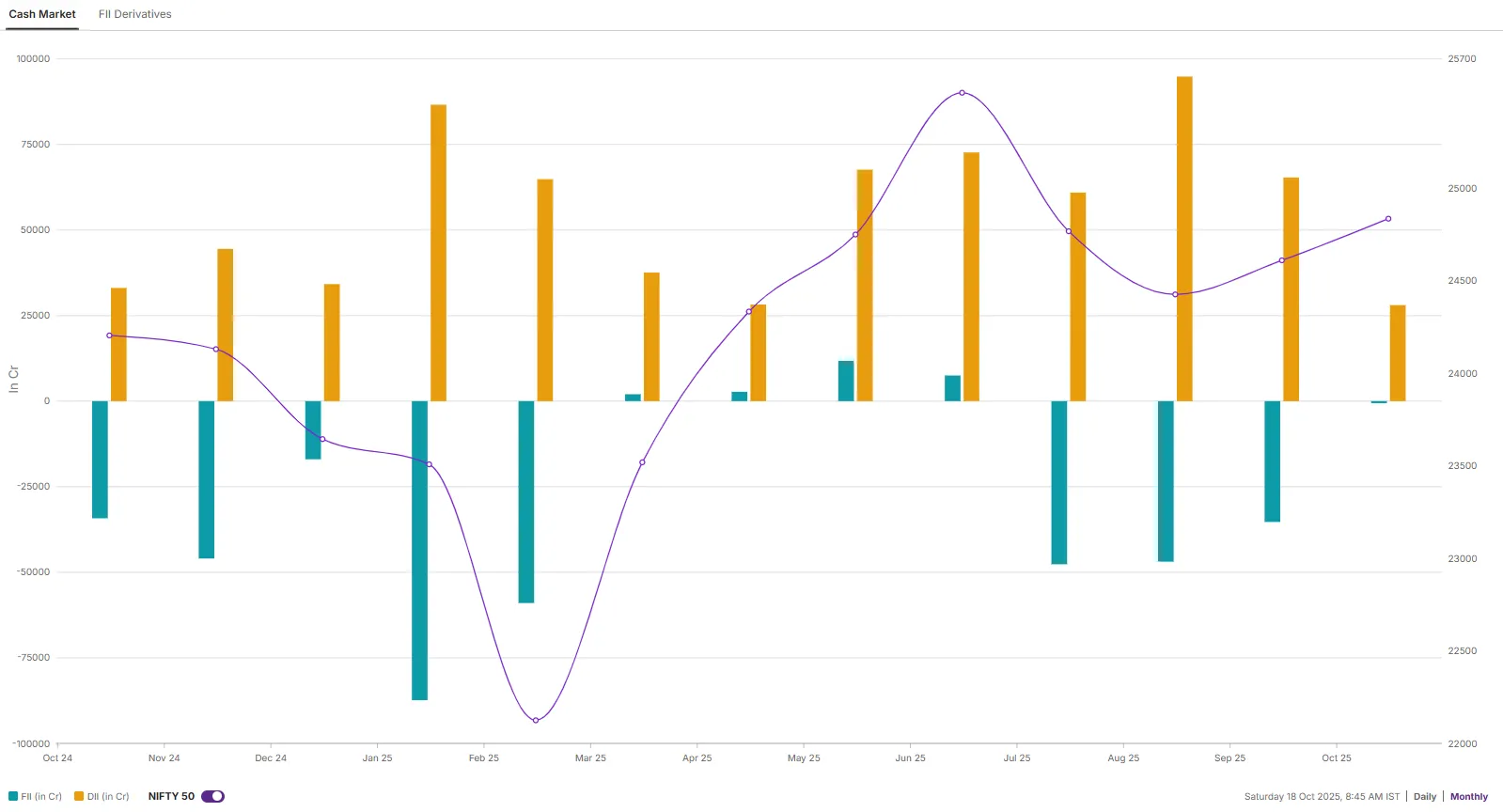

Meanwhile, in the cash market FIIs continued to slow their selling spree. They have not turned net buyers and their total outflows for October so far stand at ₹586 crore, lower compared to previous months. However, support from domestic investors have added over ₹28,000 crore in equities this month, helping underpin market stability and resilience. The coming weeks will be crucial to see if FIIs sustain this low-exit pattern or if selling resumes on a larger scale.

NIFTY 50 index

The NIFTY50 index saw robust bullish momentum, closing above 25,700 for the first time in over a year and reaching a new 52-week high. This decisive breakout above the critical resistance zone of 25,400–25,500 suggests continuation of the higher high–higher low pattern on the daily chart. Technical indicators continue to favour the bulls, with immediate support at around 25,500–25,400. As long as NIFTY remains above 25,400 in the upcoming sessions, the path appears open for a further rally towards the psychological level of 26,000.

HDFC Bank's second-quarter net profit increased by 11% in comparison with last year, reaching ₹18,641 crore, supported by stable asset quality and consistent growth in core operations. The bank’s gross non-performing asset (GNPA) ratio improved to 1.24%, reflecting robust asset quality management. The result was driven by healthy growth in loans and deposits, improving net interest margins, and controlled credit costs.

About The Author

Next Story