Market News

Trade Setup for Sept 6: NIFTY50 eyes weekly close above 25,300 to sustain bullish momentum

.png)

4 min read | Updated on September 06, 2024, 07:42 IST

SUMMARY

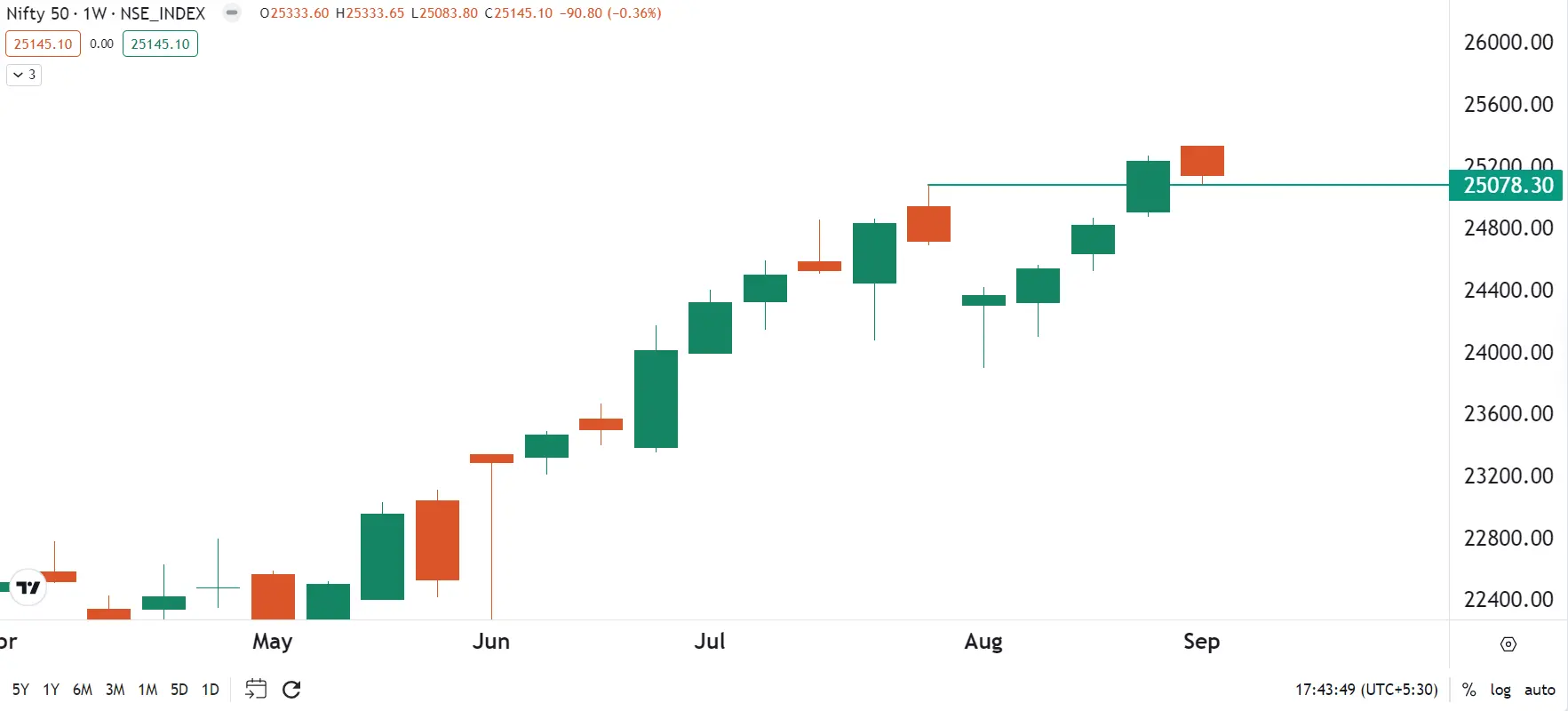

The NIFTY50 has extended its bullish momentum over the past three weeks, closing positive and above last week's high, signalling strong buying interest at lower levels. Traders should keep a close eye on the 25,250 level, as a close above it would confirm the continuation of the bullish trend.

Stock list

On the daily chart, the broader structure of the NIFTY50 remains positive.

Asian markets update at 7 am

GIFT NIFTY is down 0.4%, signaling a weak start for the Indian equities today. Most Asian markets are trading flat, with Japan's Nikkei 225 unchanged, and Hong Kong markets closed due to a holiday.

U.S. market update

- Dow Jones: 40,755 (▼0.5%)

- S&P 500: 5,503 (▼0.3%)

- Nasdaq Composite: 17,127 (▲0.2%)

U.S. market ended the Thursday’s session a mixed note ahead of the release of U.S. jobs report of August. The consensus estimate calls for an increase of 1,60,000 nonfarm payrolls, while the unemployment rate is expected to edge down to 4.2%, from 4.3%.

Meanwhile, the August jobs report will be closely scrutinised by Federal Reserve officials, as it represents the final employment data before their upcoming meeting on September 17-18. The central bank is widely expected to lower interest rates for the first time in over four years during this meeting. Fed Funds futures currently suggest a 59% probability of a 0.25% rate cut and a 41% chance of a more substantial 0.5% reduction.

NIFTY50

- September Futures: 25,236 (▼0.0%)

- Open Interest: 5,95,390 (▼2.3%)

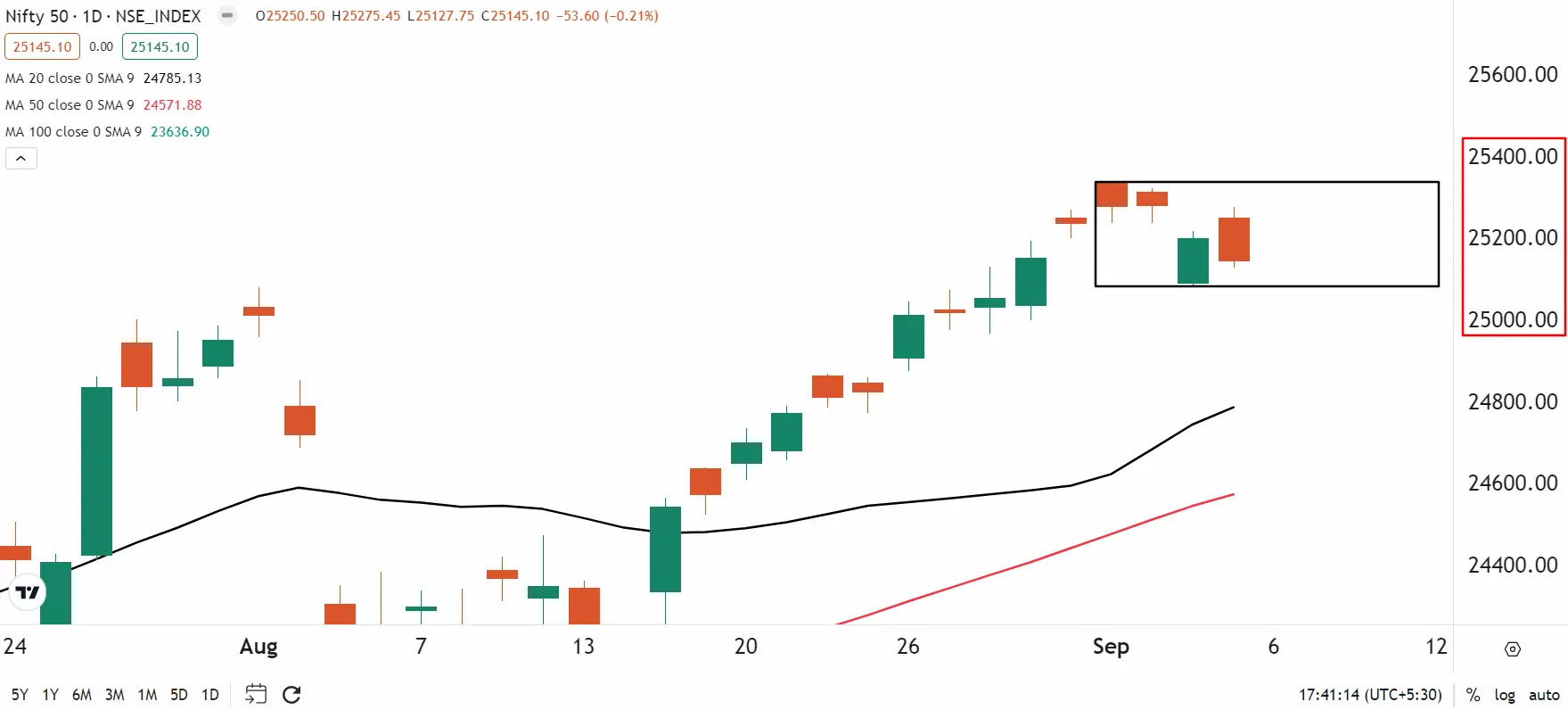

The NIFTY50 extended the losing streak for the second day in a row and failed to sustain its opening gains above the 25,200 mark. The index formed a negative candle on the daily chart and traded in a narrow range on the expiry of its weekly options contracts.

On the daily chart, the broader structure of the NIFTY50 remains positive. The index is currently consolidating between 25,350 and 25,000 range. A decisive break or a close above or below this range will provide traders further directional clues. Meanwhile, the index has crucial support around 24,800 zone. A break of this support will weakness in the current trend.

On the weekly chart, the index is currently forming a negative candle. Traders can keep an eye on the weekly close of NIFTY50 as a close above 25,300 will signal continuation of the trend, while a close below 25,300 will imply short-term consolidation.

BANK NIFTY

- September Futures: 51,727 (▲0.2%)

- Open Interest: 1,57,918(▼1.6%)

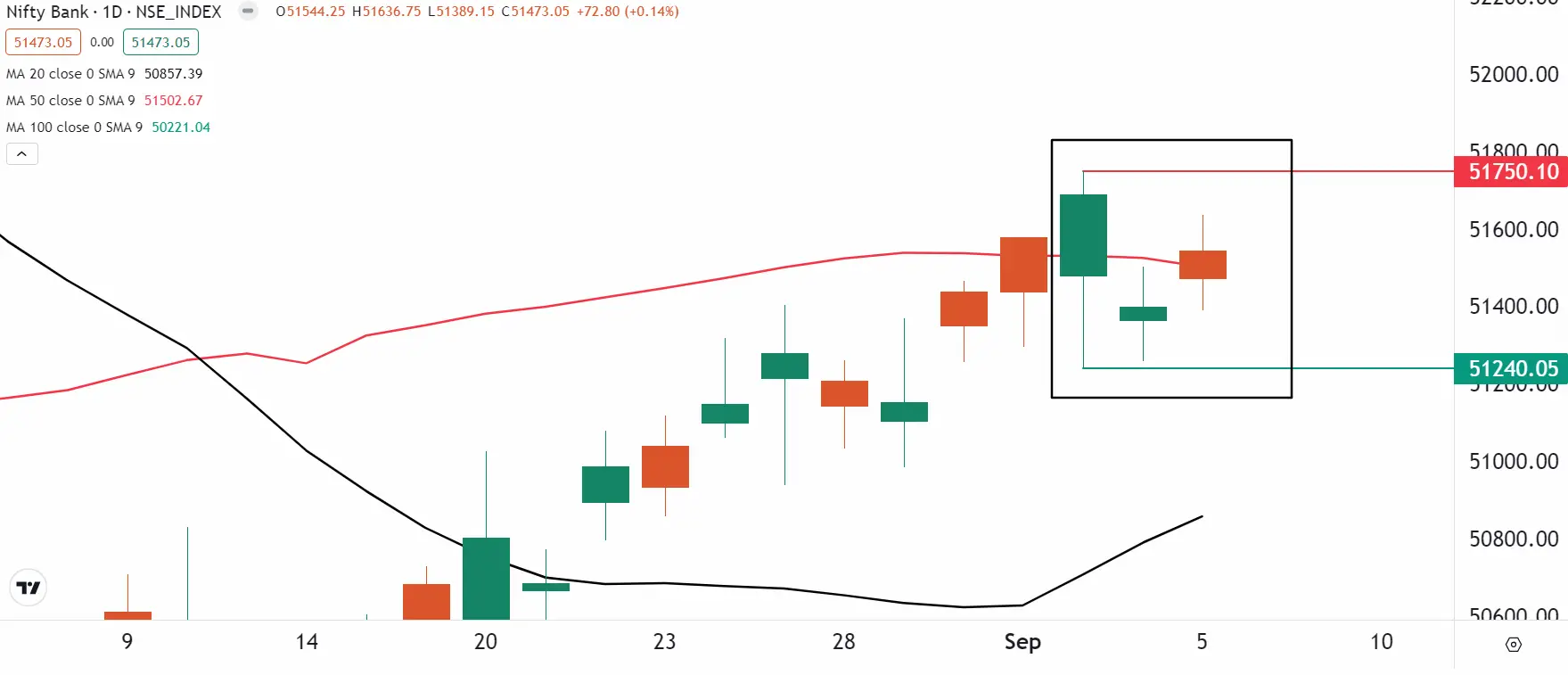

The BANK NIFTY index displayed strength and ended the day in green. However, the index once again faced resistance around its 50-day moving average and failed to capture it on closing basis.

The index traded within the range of 3 September candle, forming a second consecutive inside candle on the daily chart. In such a scearion, traders can monitor the high and low of the 3 September close. A break above or below on closing basis will provide directional insights to traders.

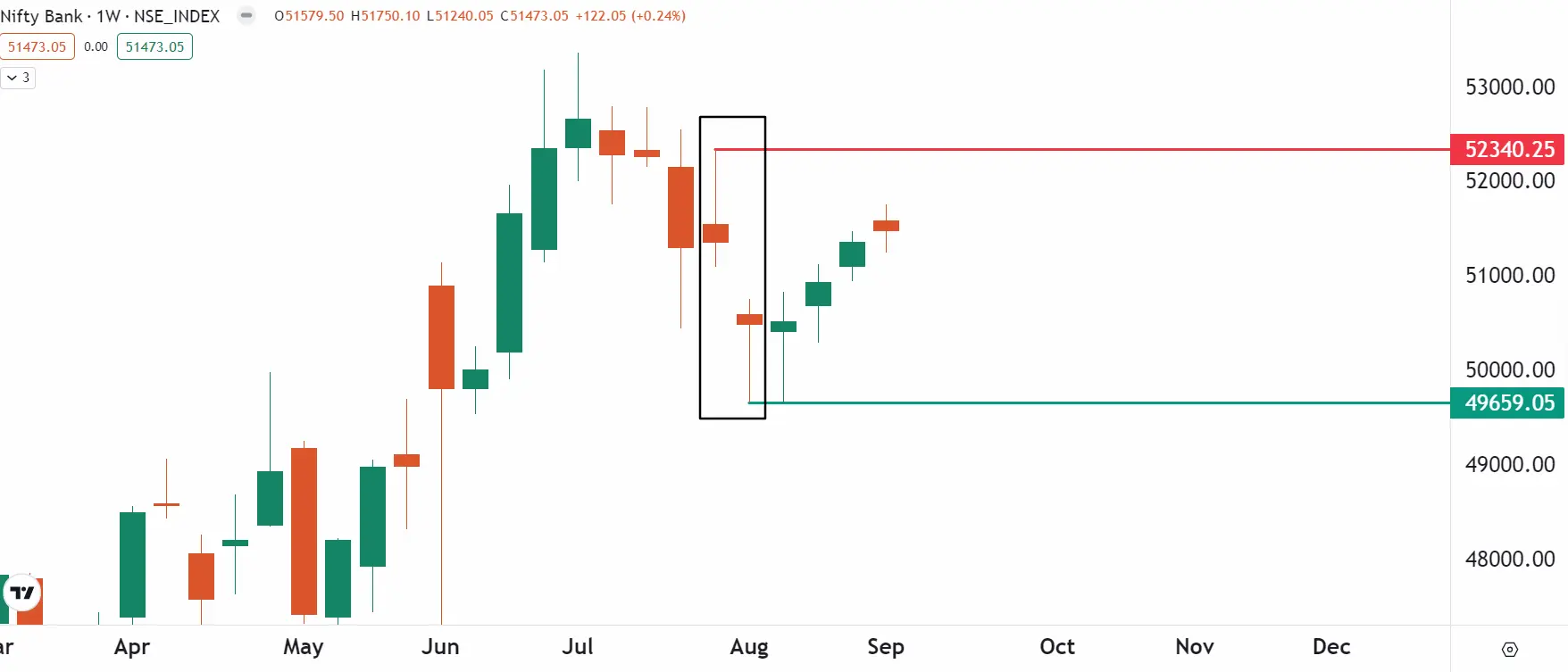

However, the weekly chart of the BANK NIFTY still projects a range-bound structure. The index is broadly trading between 52,30 and 49,600 zone. Until this range is broken, the index may consolidate within this zone and can witness sharp bouts of volatility.

FII-DII activity

Stock scanner

Under F&O ban: Aditya Birla Fashion and Retail, Balrampur Chini Mills, Bandhan Bank, Biocon, Chambal Fertilisers, Hindustan Copper and RBL Bank

Added under F&O ban: Bandhan Bank, Biocon and Chambal Fertilisers

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story