Market News

Trade Setup for Sept 26: NIFTY50 breaks 26,000 barrier– Will it sustain the key level on expiry?

.png)

4 min read | Updated on September 26, 2024, 07:47 IST

SUMMARY

Monthly options data for the NIFTY50 shows significant put accumulation at the 25,900 and 25,700 strikes, suggesting support for the index around these levels. Conversely, the call base is established at the 26,000 and 26,200 strikes. The index may encounter resistance around this area.

GIFT Nifty indicates a positive start for Indian markets on Thursday.

Asian markets update at 7 am

All the major Asian indies are trading positive with gains up to 2.4% on Thursday morning. The Japanese Nikkei index is leading the pack with 2.4% gains as semiconductor related stocks gain on upbeat quarterly earnings by leading chip manufacturer Micron Technology. In addition, a softer yen also boosted investor sentiments in Japan on Thursday.

The Hong Kong’s Hang Seng and Korea’s Kospi index too followed the trend with 1.3% and 2.0% gains on Thursday morning.

The GIFT NIFTY is trading at 26,047 up by 57 points, indicating a positive start for Indian market on Thursday.

U.S. market update

Dow Jones: 41,914 (▼0.7%) S&P 500: 5,722 (▼0.1%) Nasdaq Composite: 18,082 (▲0.0%)

U.S. indices ended the Wednesday’s session on a mixed note, with Dow Jones and S&P 500 retreating from their record highs. Except for technology stocks, nine out of eleven sectors on the S&P 500 ended the day in the red.

Weighing on Dow Jones , General Motors, Ford and Amgen fell in the range of 4 to 5%, while Visa slipped over 1% after decline 5% on Tuesday after the Justice Department said it was suing the company for antitrust violations.

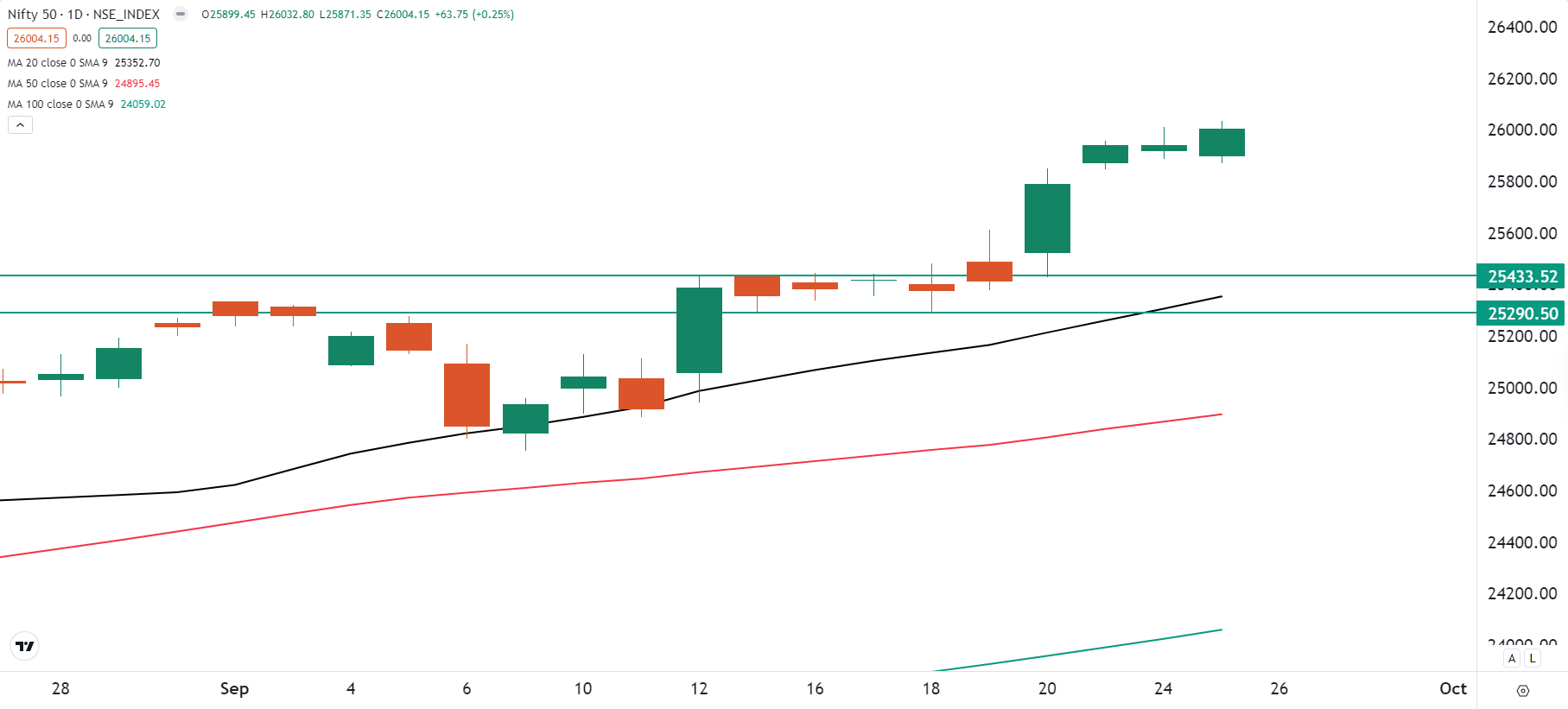

NIFTY50

October Futures: 26,126 (▲0.1%) Open Interest: 4,57,897 (▲22.1%)

The NIFTY50 closed in green for the fifth consecutive day, closing above the psychological 26,000 level for the first time. The index traded in a tight range during the first half of the session and saw buying momentum in the second half.

As you can see on the chart below, the index closed above the doji, a neutral candlestick pattern formed on 24 September, indicating the continuation of the bullish momentum. The broader trend of the index remains positive with crucial support around the 25,500 zone.

In the 15-minute time frame, the index has found multiple supports in the 25,800-25,850 region. As you can see on the chart below, this zone will act as a crucial support for today's expiry. Meanwhile, the index has cleared the immediate resistance zone of 25,950-26,000. Unless there is a break below this area, there is potential for a consolidation of gains at higher levels.

The open interest data for today’s expiry has a significant put base buildup at 25,900 to 25,700, pointing to support for the index around these levels. Conversely, the call base was seen at 26,000 and 26,200 strikes, indicating resistance in these zones.

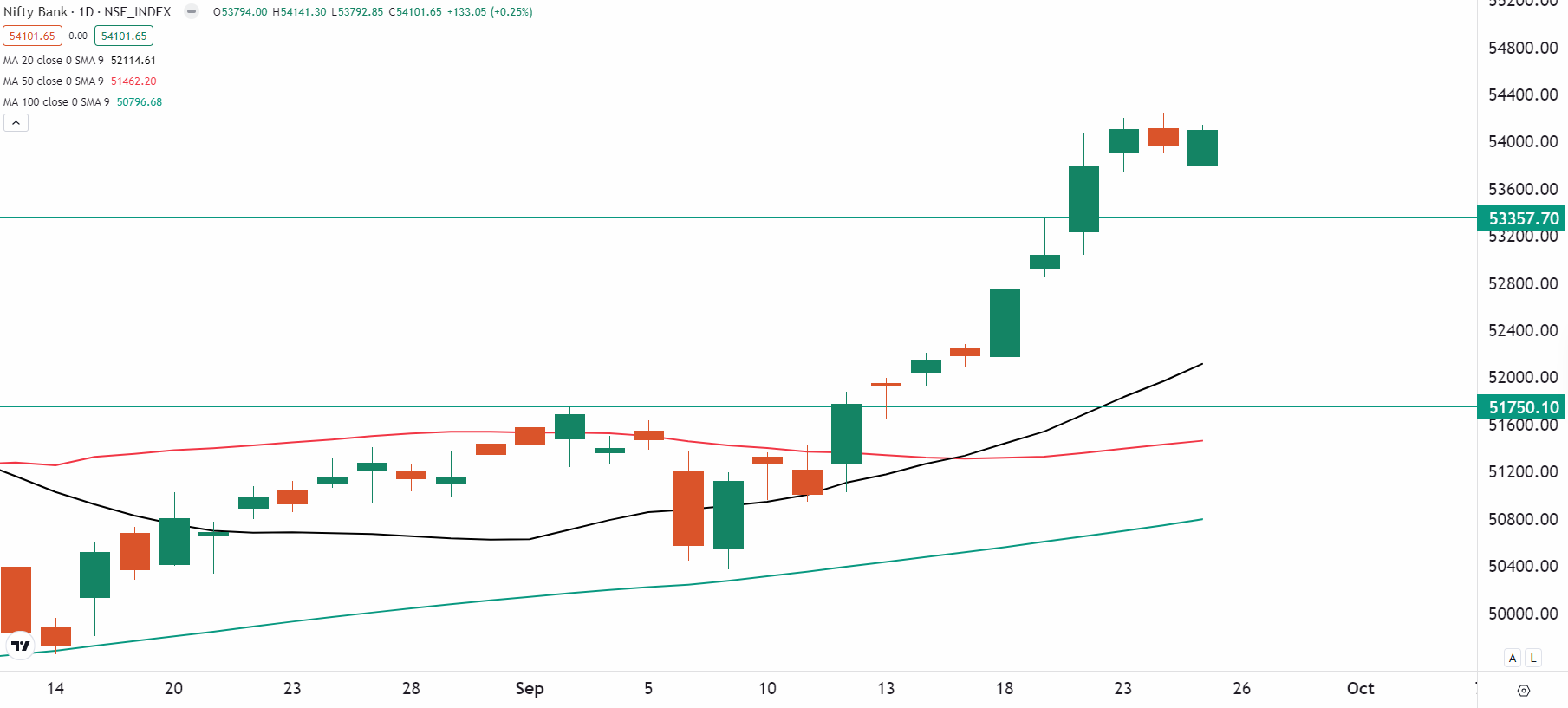

BANK NIFTY

September Futures: 54,335 (▲0.0%) Open Interest: 1,20,726 (▲25.6%)

The BANK NIFTY index consolidated its gains at higher level on monthly expiry of its futures and options contracts and remained rage-bound. The index saw entry of fresh buyers from lower levels as the it briefly dipped towards 53,700 zone, indicaiting continuation of the positive momentum.

The technical structure of the BANK NIFTY still remains bullish as the index is currently consolidating its gains and protecting previous sessions low on closing basis. However, traders should only plan fresh long positions once the index breaks 24 Septemeber high and captures it on closing basis. The immediate support for the index is aroun 53,350 zone, it previous all-time high. Unless the index closes below this zone on closing basis, the trend may remain bullish.

FII-DII activity

Stock scanner

Long build-up: Power Grid and Muthoot Finance

Short build-up: Dabur, Oracle Financial Services Software, LIC Housing Finance, Tech Mahindra and Balkrishna Indsutries

Under F&O ban: Aditya Birla Fashion and Retail, Granules India, Hindustan Copper, Vodafone-Idea and Indian Energy Exchange

Out of F&O ban: N/A

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story