Market News

Trade Setup for Sept 24: BANK NIFTY climbs for eighth day in a row, breaks 54,000 barrier

.png)

5 min read | Updated on September 24, 2024, 07:34 IST

SUMMARY

Open interest data of BANK NIFTY’s 25 September expiry saw a significant call and put buildup at 54,000 strike, indicating consolidation at current levels.

Stock list

The broader trend of the BANK NIFTY remains bullish as the index has rallied almost 5% without any significant retracement since the breakout on September 12.

Asian markets update at 7 am

The GIFT NIFTY is up 0.1%, indicating a flat to positive start for the NIFTY50 today. Meanwhile, Asian markets are trading firmly in the green. Japan's Nikkei 225 is up 1.2% and Hong Kong's Hang Seng rose 2.1%.

U.S. market update

- Dow Jones: 42,124 (▲0.1%)

- S&P 500: 5,718 (▲0.2%)

- Nasdaq Composite: 17,974 (▲0.1%)

U.S. indices started the week on a positive note, with the Dow Jones and S&P 500 closing at record highs on Monday. The moves come after the Federal Reserve's first interest rate cut of 50 basis points last week.

In the coming sessions, investors will be closely watching Friday's reading of the PCE index, the Fed's preferred measure of inflation, as well as Thursday's second quarter GDP print for further clues.

NIFTY50

- September Futures: 25,917 (▲0.5%)

- Open Interest: 4,56,246 (▼17.1%)

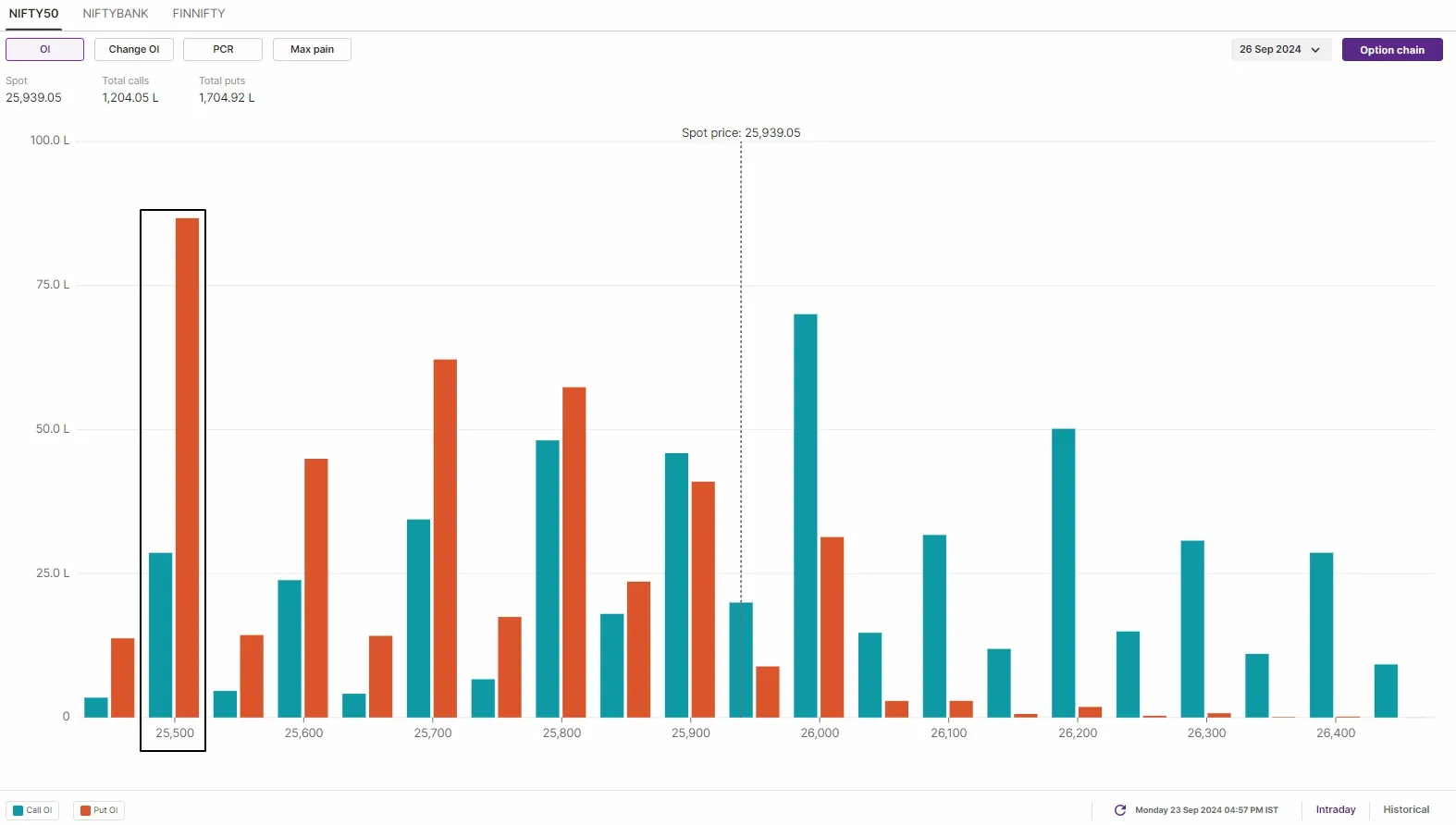

The NIFTY50 continued its winning streak for the third day in a row, closing at a record high, driven by broad-based buying across all sectors except technology. The index closed tad below the psychological 26,000 mark, ending the day 0.5% higher.

The technical structure of the NIFTY50 index remains bullish, as indicated by the formation of higher highs and higher lows on the daily chart. With the index closing above the previous session's high, the trend continues to favour the bulls. Immediate support is seen around the 25,800 level, with stronger support near the 25,500 zone. As long as the index stays above these key levels, the bullish momentum is expected to continue.

Meanwhile, the open interest date for the 26 September expiry has highest put base around 25,000 and 25,500 strikes, pointing at support around these levels. On the flip side, the call base was established at 26,000 strike, indicating resistance around this zone.

BANK NIFTY

- September Futures: 54,072 (▲0.9%)

- Open Interest: 98,648 (▼16.1%)

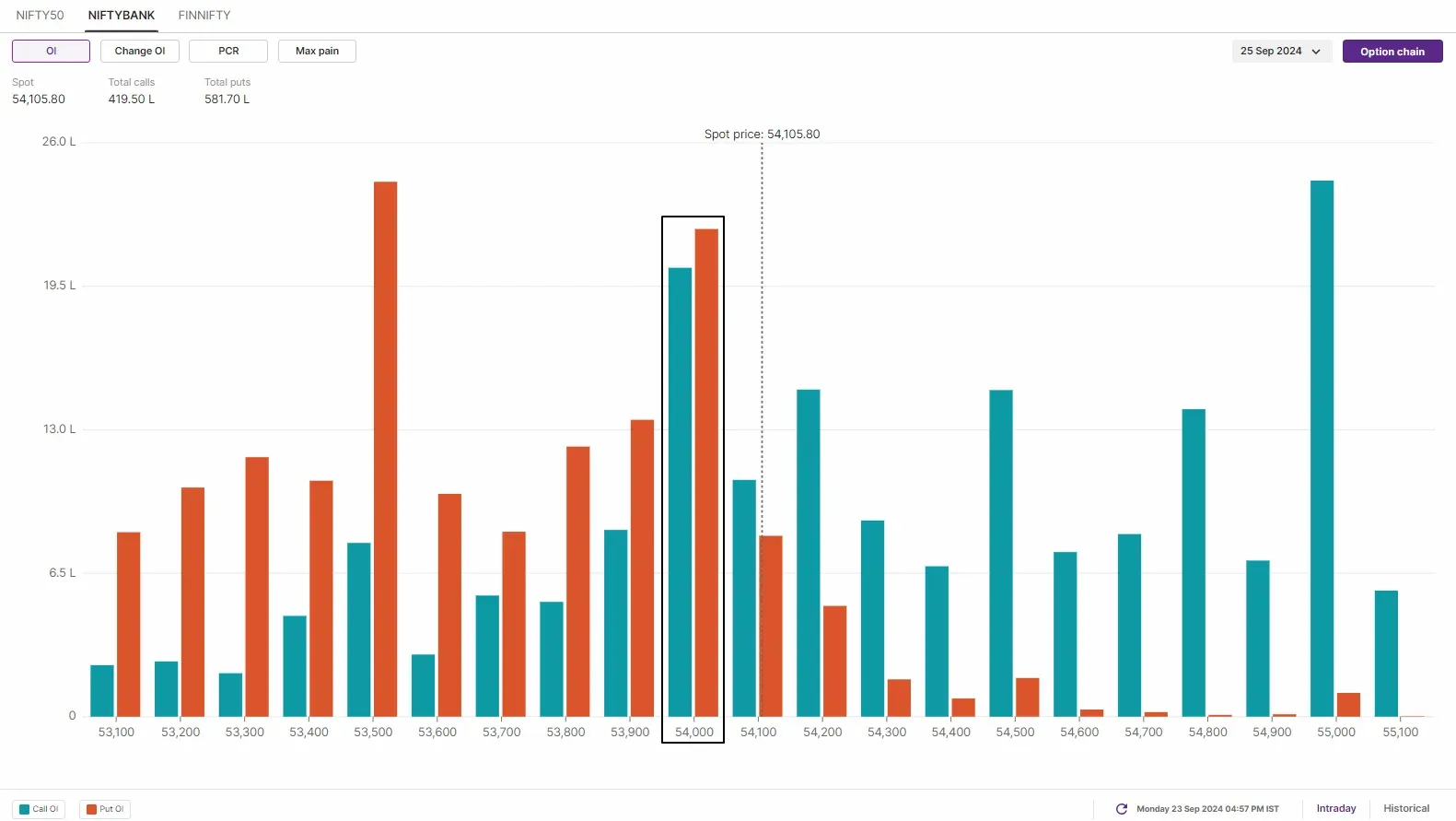

The BANK NIFTY index extended the winning momentum for the eighth day consecutive day and ended the day above the 54,000 mark. The index formed a bullish candle on the daily chart, indicating continiutaion of the current trend.

The broader trend of the BANK NIFTY remains bullish as the index has rallied almost 5% without any significant retracement since the breakout on 12 September. Immediate support is around the previous all-time high zone of 53,350, while critical support is near the 51,800 level.

Experts believe that the index could further extend its gains after the breakout and possibly consolidate around the 54,000 level. However, traders looking to enter new long positions should be cautious as the risk/reward has become less favourable. In the event of a retracement, traders are advised to monitor price action around key support areas and plan strategies accordingly.

Open interest data for the 25 September expiry shows a significant put base spread between the 53,000 and 54,000 strike prices, signaling strong bullish momentum and support at these levels. On the other hand, the highest call base is concentrated at the 55,000 strike, indicating potential resistance around this level.

FII-DII activity

Stock scanner

Short build-up: Alkem Laboratories and Eicher Motors

Under F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Biocon, Chambal Fertilisers, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, Vodafone Idea LIC Housing Finance, National Aluminium, Oracle Financial Services Software, Punjab National Bank and Steel Authority of India

Out of F&O ban: RBL Bank

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story