Market News

Trade Setup for Sept 13: Will NIFTY50 invalidate bearish engulfing on weekly chart?

.png)

4 min read | Updated on September 13, 2024, 07:45 IST

SUMMARY

On the weekly chart of NIFTY50, a close above 25,333, its previous all-time high, would invalidate last week’s bearish engulfing pattern. Even if the index doesn’t close above that level, it would still form a bullish piercing pattern, which is a bullish reversal signal.

Stock list

If the BANK NIFTY closes above the 51,750 level, it could extend its gains towards the 52,300 level.

Asian markets update at 7 am

The GIFT NIFTY is trading marginally lower, suggest a flat to negative start for Indian stock exchanges. Asian markets are trading mixed, with Japan's Nikkei 225 down 0.4% and Hong Kong's Hang Seng index rising 1.5%.

U.S. market update

- Dow Jones: 41,096 (▲0.5%)

- S&P 500: 5,595 (▲0.7%)

- Nasdaq Composite: 17,569 (▲1.0%)

U.S. indices extended gains for the second day in a row as the Producer Price Index for August provided further evidence of cooling inflation. Wholesale prices rose 0.2% month-on-month, slightly above expectations. However, the annualised reading of 1.7% was in line with expectations as July's reading was revised lower.

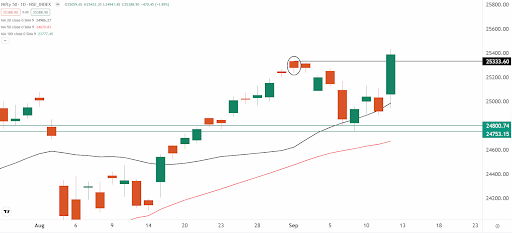

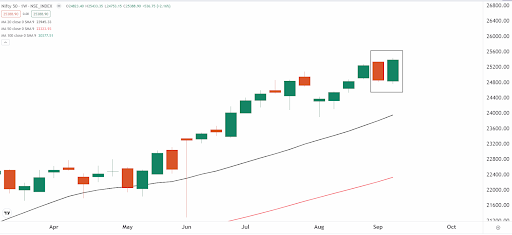

NIFTY50

- September Futures: 25,356 (▲1.6%)

- Open Interest: 5,85,346 (▲9.9%)

The NIFTY50 index broke out of its short-term consolidation, reaching a new all-time high on expiry of weekly options. A strong bullish candle formed on the daily chart, engulfing the highs of the previous eight sessions. The sharp rally was driven by broad-based buying across sectors, with metals and automobiles leading the charge.

The index closed above its previous all-time high, signalling a continuation of bullish momentum for the coming sessions. It is also trading above all key daily moving averages (DMAs) such as 20 and 50, establishing them as immediate support levels.

On the weekly chart, a close above 25,333, its previous all-time high, would invalidate last week’s bearish engulfing pattern. Even if the index doesn’t close above that level, it would still form a bullish piercing pattern, which is a bullish reversal signal.

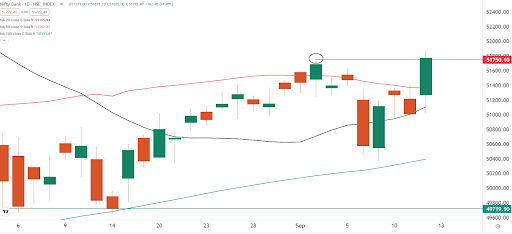

BANK NIFTY

- September Futures: 51,759

- Open Interest: 1,45,664 (▼11.3%)

The BANK NIFTY broke out of its consolidation between its 50 and 20 day moving averages (DMAs) and regained its 50 DMA by the close. The index formed a bullish candle on the daily chart, closing above the highs of the previous seven sessions.

As shown in the chart below, the index successfully broke out of its consolidation and closed above the recent swing high of 51,750. Traders should monitor the price action around this area during today's session. If the BANK NIFTY closes above the 51,750 level, it could extend its gains towards the 52,300 level. On the other hand, a close below this level could push the index back into the consolidation range between 51,750 and 49,700.

We advised our readers to look for a breakout of the highlighted area on the 15 minute chart of the BANK NIFTY. The index has broken this range to the upside, surpassing the 51,700 level. Going forward, this breakout area should act as immediate support. However, if the index falls below this zone, it could revert to a range-bound pattern.

FII-DII activity

Stock scanner

Short build-up: Granules India

Under F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Balrampur Chini Mills, Bandhan Bank, Chambal Fertilisers, Granules India, Hindustan Copper and RBL Bank

Added under F&O ban: Granules India

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

Related News

About The Author

Next Story