Market News

Trade Setup for Oct 16: Is BANK NIFTY sustaining momentum above the 50 DMA?

.png)

4 min read | Updated on October 16, 2024, 07:14 IST

SUMMARY

Options data for the BANK NIFTY shows significant additions to both call and put contracts at the 51,800 and 51,900 strikes, suggesting that the index may consolidate around these levels in the near term.

Stock list

The BANK NIFTY Index outperformed its benchmark for the second consecutive session, closing in positive territory.

Asian markets update

The GIFT NIFTY is down 0.2%, suggesting a weak opening for the NIFTY50 today. Other major Asian indices are also in the negative territory, with Japan’s Nikkei 225 falling 1.7%, while Hong Kong’s Hang Seng index slipping 0.7%, reflecting weakness across the region.

U.S. market update

- Dow Jones: 42,740 (▼0.7%)

- S&P 500: 5,815 (▼0.7%)

- Nasdaq Composite: 18,315 (▼1.0%)

U.S. stocks ended Tuesday's session in the red as investors reacted to earnings from ASML Holding, a leading semiconductor supplier. The company's shares fell 15% after it issued a disappointing sales outlook for FY25. Nvidia and AMD were also dragged down, each falling 5%.

Meanwhile, investors also assessed results of Goldman Sachs. The company’s net profit jumped 45% YoY to $2.99 billion in the third quarter of FY25 , led by investment banking and stock trading operations.

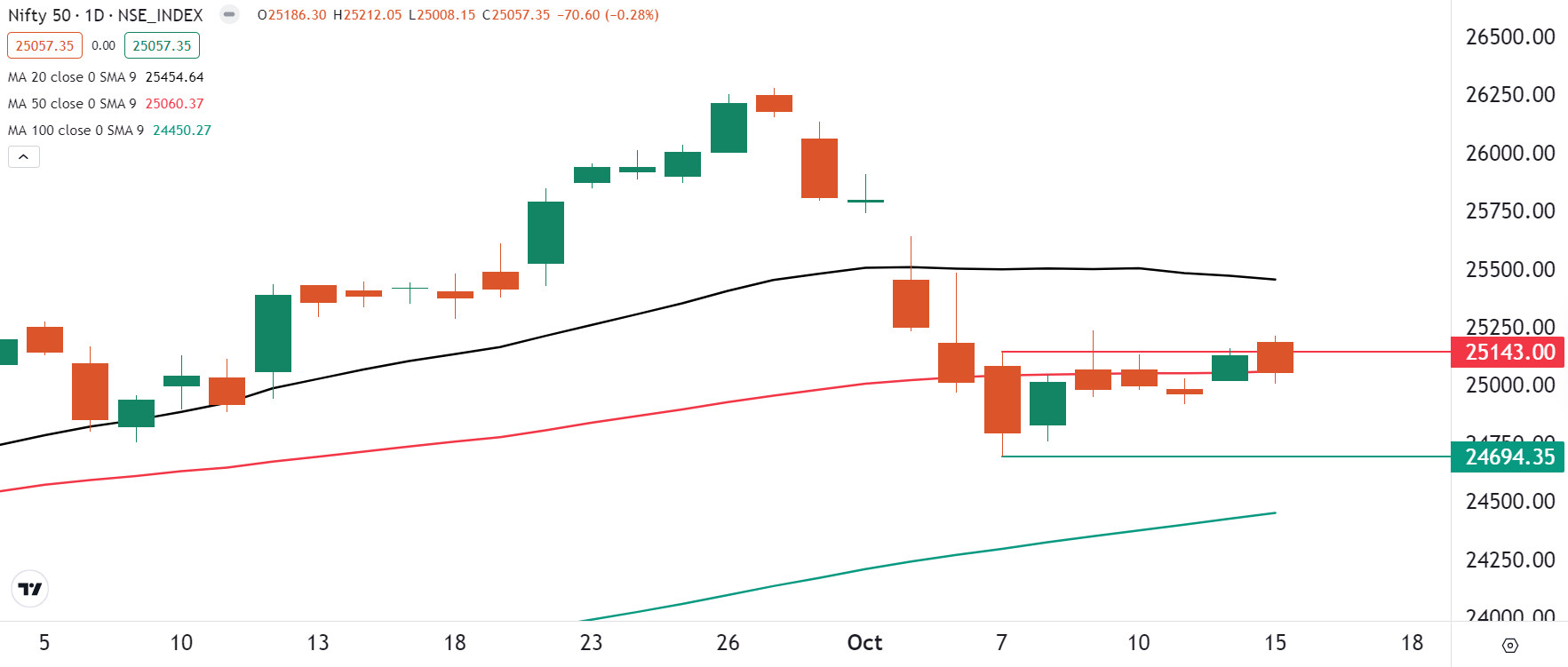

NIFTY50

- October Futures: 25,117 (▼0.3%)

- Open Interest: 5,44,190 (▲0.8%)

The NIFTY50 index failed to sustain its opening gains and witnessed profit booking at higher levels. The index surrendered previous day’s gains and formed a negative candle on the daily chart.

On the daily chart, the index failed to close above the key swing high of the 7 October and was rejected at higher levels. However, the broader structure of the index remains range bound between the 20 and 100 day moving averages. Unless the index breaks this range on a closing basis, the trend may remain range-bound.

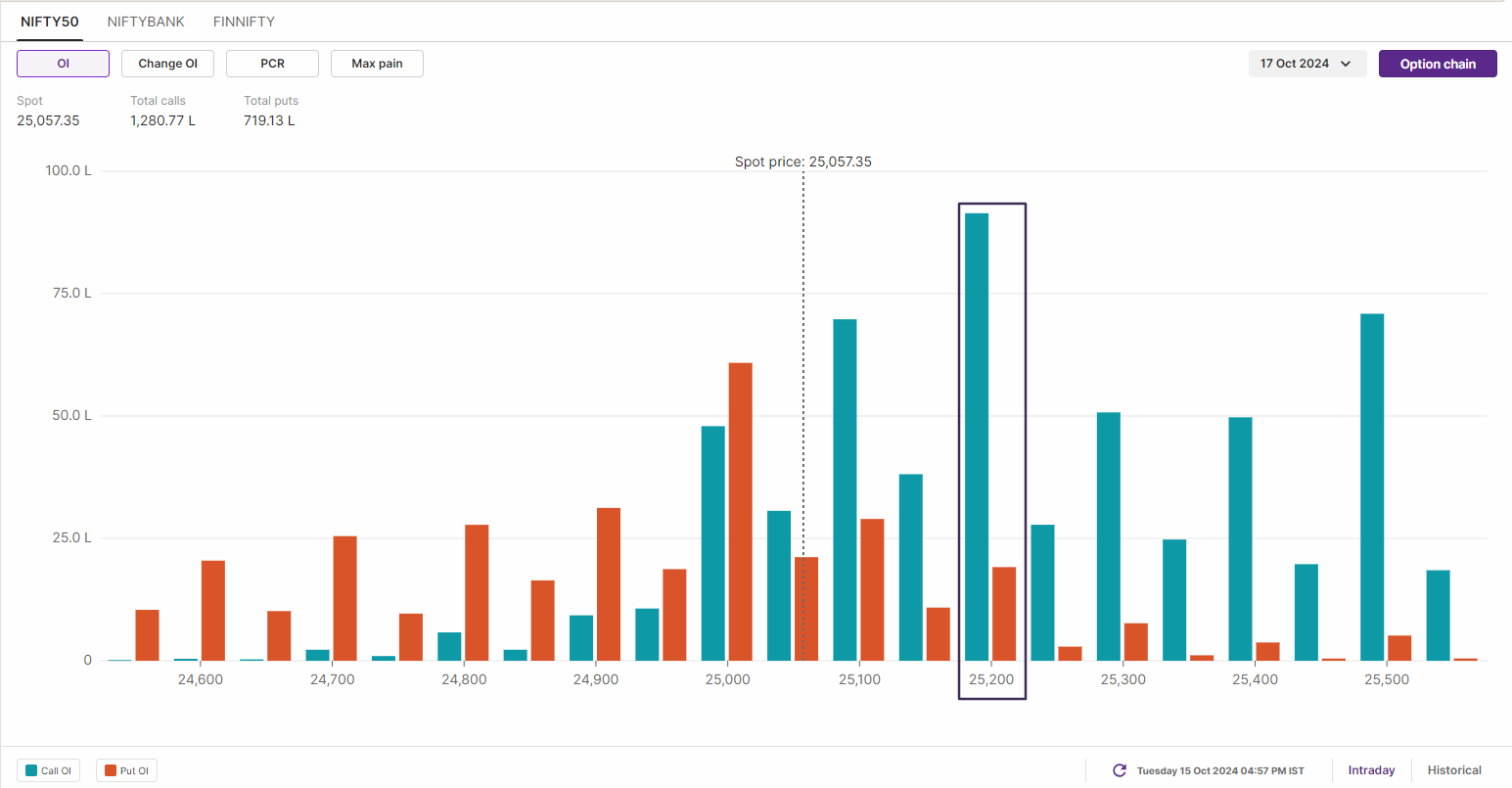

Open interest data for the 17 October expiry saw significant emergence of call writers at 25,200 strike, indicating resistance around this zone. Conversely, the highest put base remained at 25,000 strike, indicating support around this area.

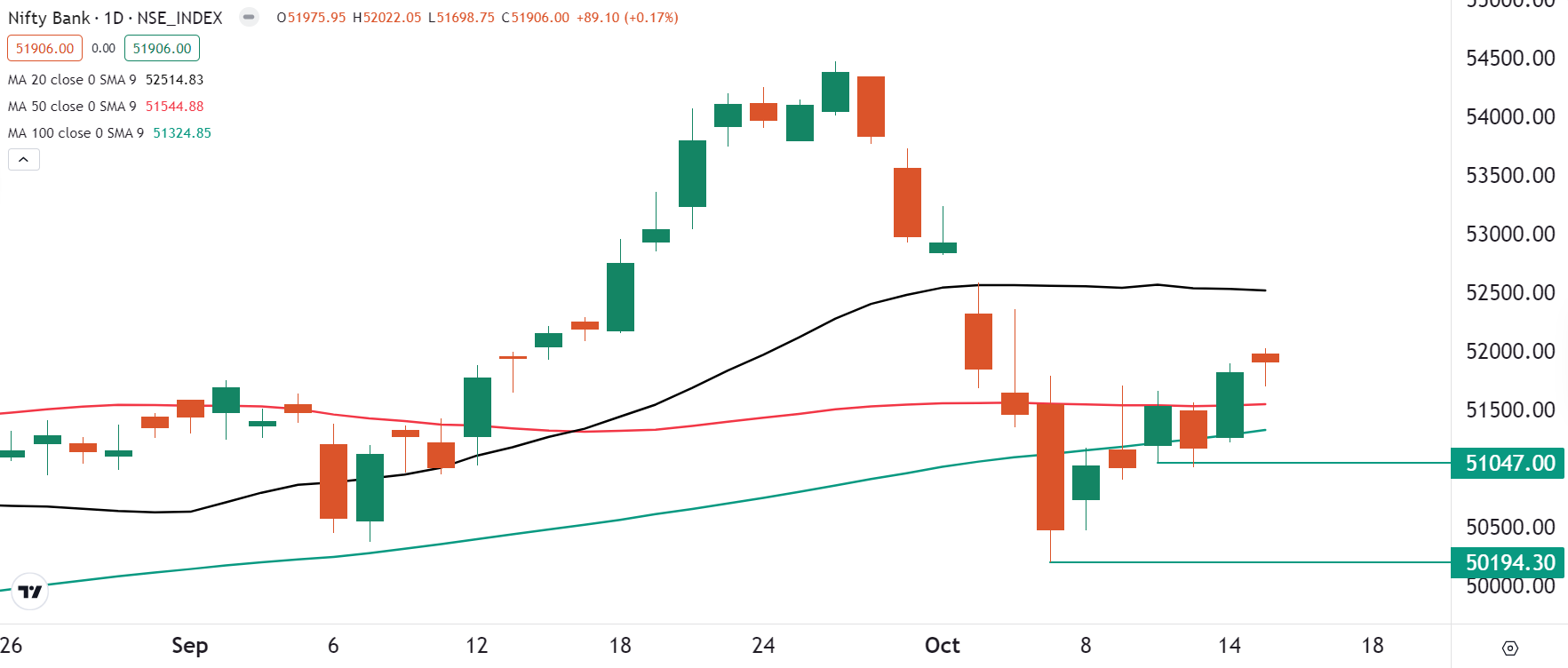

BANK NIFTY

- October Futures: 52,106 (▲0.2%)

- Open Interest: 1,93,965 (▲0.1%)

The BANK NIFTY Index outperformed its benchmark for the second consecutive session, closing in positive territory. The index maintained its upward momentum, remaining above both its 50-day and 100-day moving averages.

The index also closed above the key 51,800 level, which marked the swing high of 7 October, signaling continued strength in the near term. The immediate support for the index is around 51,250, while the resistance was seen at 52,600 zone.

Open interest data for the BANK NIFTY shows a significant call build-up at the 52,000 and 52,500 strikes, suggesting that the index may encounter resistance at these levels. On the downside, there is strong put support at the 51,000 and 51,500 strikes. In addition, notable call and put accumulations at the 51,800 and 51,900 strikes indicate potential consolidation around these levels, with the index likely to remain range-bound in the near term.

FII-DII activity

Stock scanner

Short build-up: Reliance Industries, Jindal Steel, Wipro, Bajaj-Auto and Bandhan Bank

Under F&O ban: Bandhan Bank, Chambal Fertilisers, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, Hindustan Copper, IDFC First Bank, IEX, L&T Finance Manappuram Finance, National Aluminium, Punjab National Bank, RBL Bank, Steel Authority of India and Tata Chemicals

Out of F&O ban: NIL

Added under F&O ban: Bandhan Bank and L&T Finance

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story