Market News

Trade Setup for Nov 25: NIFTY50 rebounds from 200 EMA—Sustained recovery or short-term bounce?

.png)

4 min read | Updated on November 25, 2024, 07:14 IST

SUMMARY

In a strong short-covering rally on Friday, the NIFTY50 index rallied over 2% and formed a bullish candle on the daily chart. In the upcoming sessions, traders should monitor the price action of the index around 21 and 50 EMA. A close above or rejection from these levels will provide further directional clues.

Stock list

The NIFTY50 index witnessed a sharp short-covering rally on Friday.

Asian markets @ 7 am

- GIFT NIFTY: 24,323 (+ 1.17%)

- Nikkei 225: 38,928 (+ 1.68%)

- Hang Seng: 19,274 (+ 0.22%)

U.S. market update

- Dow Jones: 44,296 (▲0.9%)

- S&P 500: 5,969 (▲0.3%)

- Nasdaq Composite: 19,003 (▲0.3%)

U.S. indices ended the Friday’s session on a positive note, extending the winning momentum for the fifth consecutive day. U.S. economic activity gained momentum in November, as indicated by S&P’s purchasing managers indexes, which recorded their fastest expansion since April 2022, driven by a stronger-than-anticipated performance in the services sector.

NIFTY50

- November Futures: 23,886 (▲2.8%)

- Open Interest: 4,00,387 (▼10.8%)

The NIFTY50 index witnessed a sharp short-covering rally on Friday, driven by buying across sectors. The index zoomed past its immediate resistance zone of 23,800 and captured the crucial level on closing basis.

As the index steps out of the oversold territory, the short-term trend has turned positive due to the technical bounce. The index can the rally towards the immediate resistance zones of 21 and 50 day exponential moving averages (EMAs) which are around 24,000 and 24,400 levels. The trend will only change in favour of bulls if the index surpasses 50 EMA on closing basis. On the flip side, the immediate support for the index is at its 200 EMA, which is around 23,500 zone.

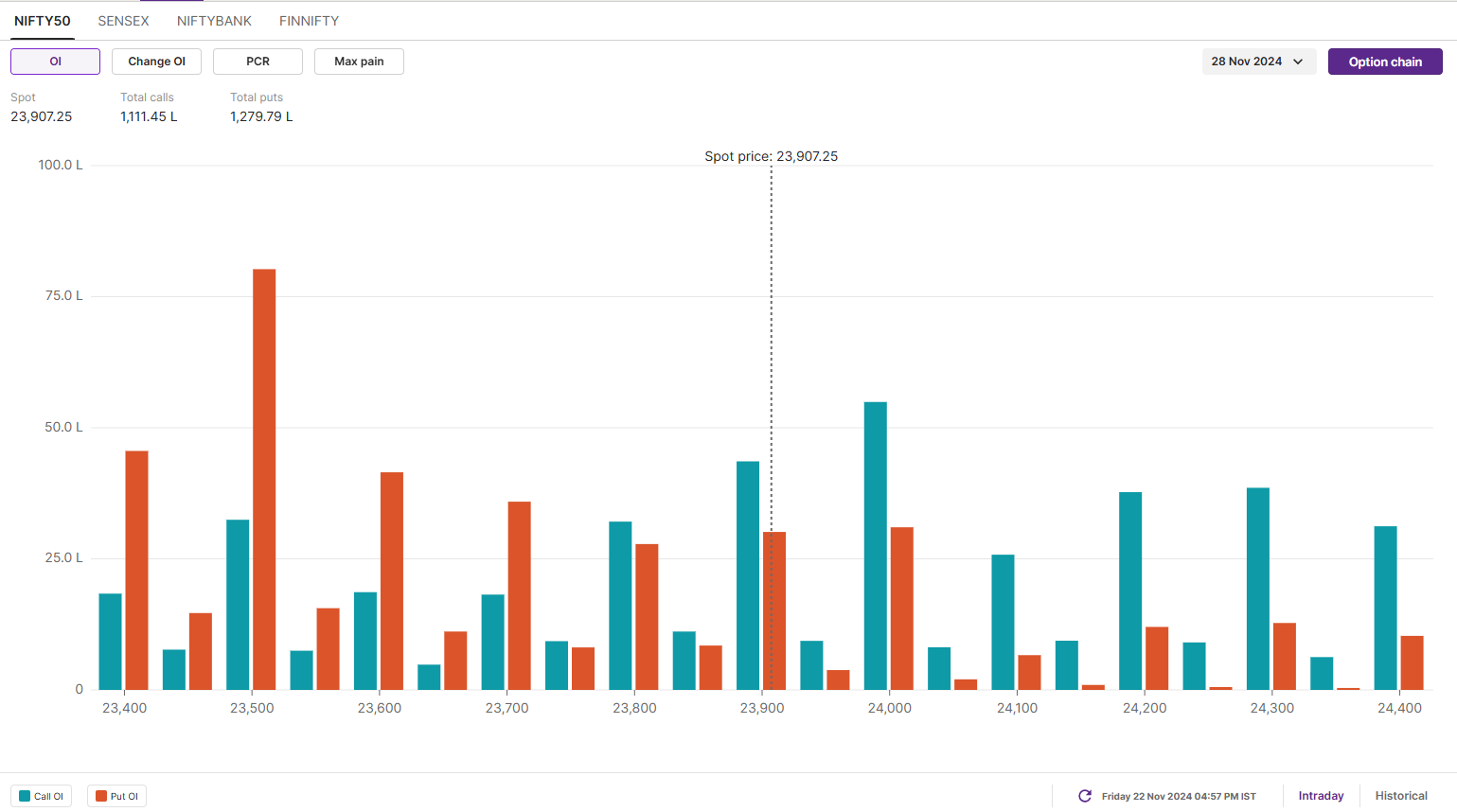

The open interest data for the 28 November expiry saw significant put base at 23,500 strikes, suggesting support for the index around this zone. Meanwhile, the call base was seen at 24,000 and 24,500 strikes, indicating that the index may face resistance around these zones.

SENSEX:

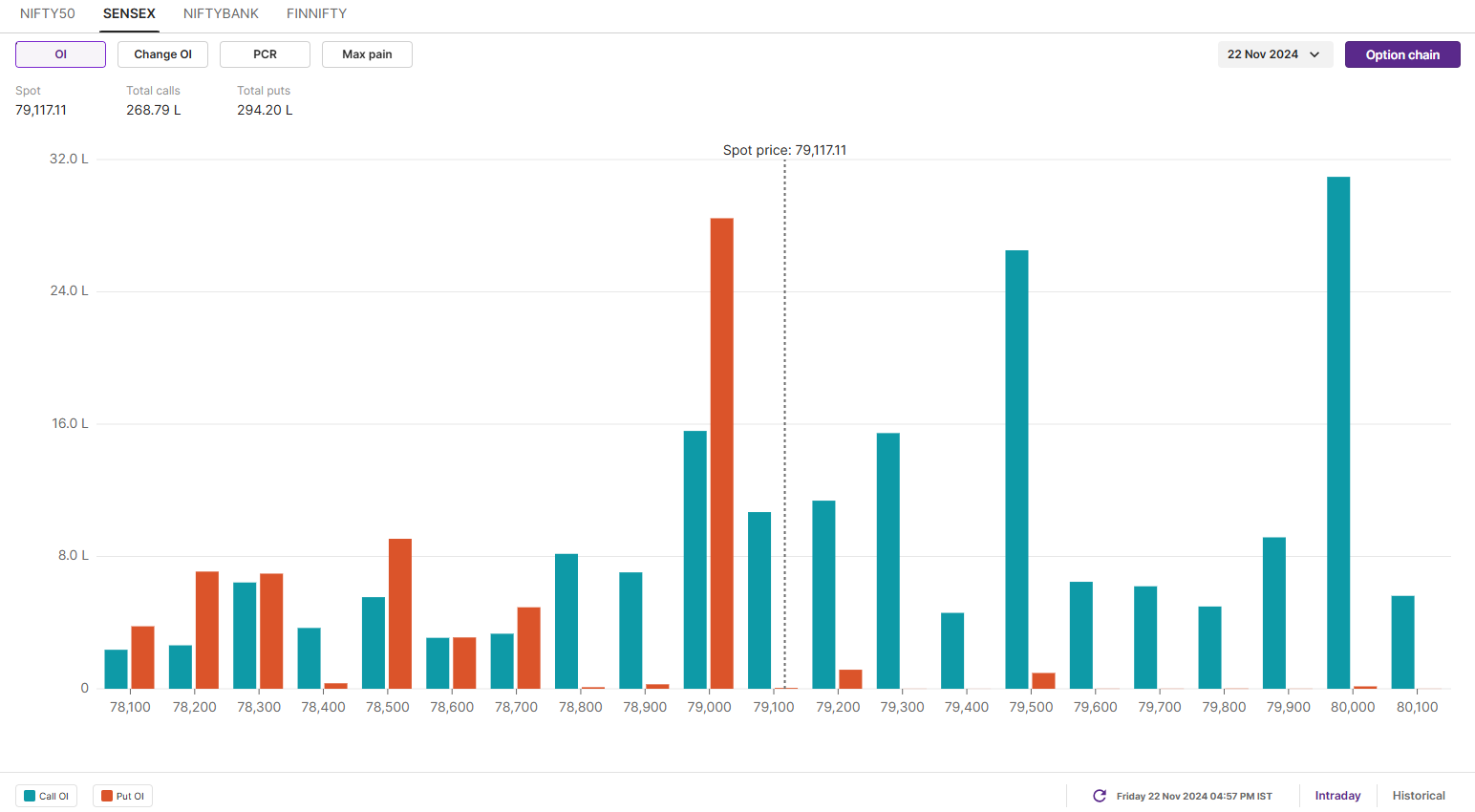

- Max call OI: 79,500

- Max put OI: 79,000

The SENSEX also rebounded from the crucial support zone of 200 EMA and formed a bullish candle on the daily chart, confirming the bullish hammer, which is reversal pattern formed on 21 November.

On the daily chart, the index zoomed past the immediate hurdle of 78,300 and tested the crucial resistance zone of 21 EMA on the daily chart. As per the price action, the currrent structure after the short-term bounce looks positive with next hurdle around 50 EMA (80,100). If the index sustains above this level on closing basis then it can extend the momentum upto 81,500 zone. However, a rejecetion from this zone may lead to further weakness. Meanwhile, the immediate support for the index is around 76,700 zone.

The open interest data for the 29 November expiry remains scattered with the highest put base around 79,000 and call base around 80,000 strike. Traders should monitor the addition and further build-up of open interest in the coming sessions and plan the stratgies accordingly.

FII-DII activity

Stock scanner

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story